Bitcoin (BTC)

Bitcoin (BTC)

-3.35% 24H

- 66Індекс соціальних настроїв (SSI)-7.77% (24h)

- #87Рейтинг пульсу ринку (MPR)-72

- 1,63024-годинні згадки в соціальних мережах-14.58% (24h)

- 55%24-годинний коефіцієнт бичачого настрою KOL577 Активних KOL

- Підсумок

- Бичачі сигнали

- Ведмежі сигнали

Індекс соціальних настроїв (SSI)

- Загальні дані66SSI

- Тенденція SSI (7 днів)Ціна (7 днів)Розподіл настроївНадзвичайно бичачий (19%)Бичачий (36%)Нейтральні (14%)Ведмежий (25%)Надзвичайно ведмежий (6%)Аналітика SSI

Рейтинг пульсу ринку (MPR)

- Аналітика сповіщень

Дописи з платформи X

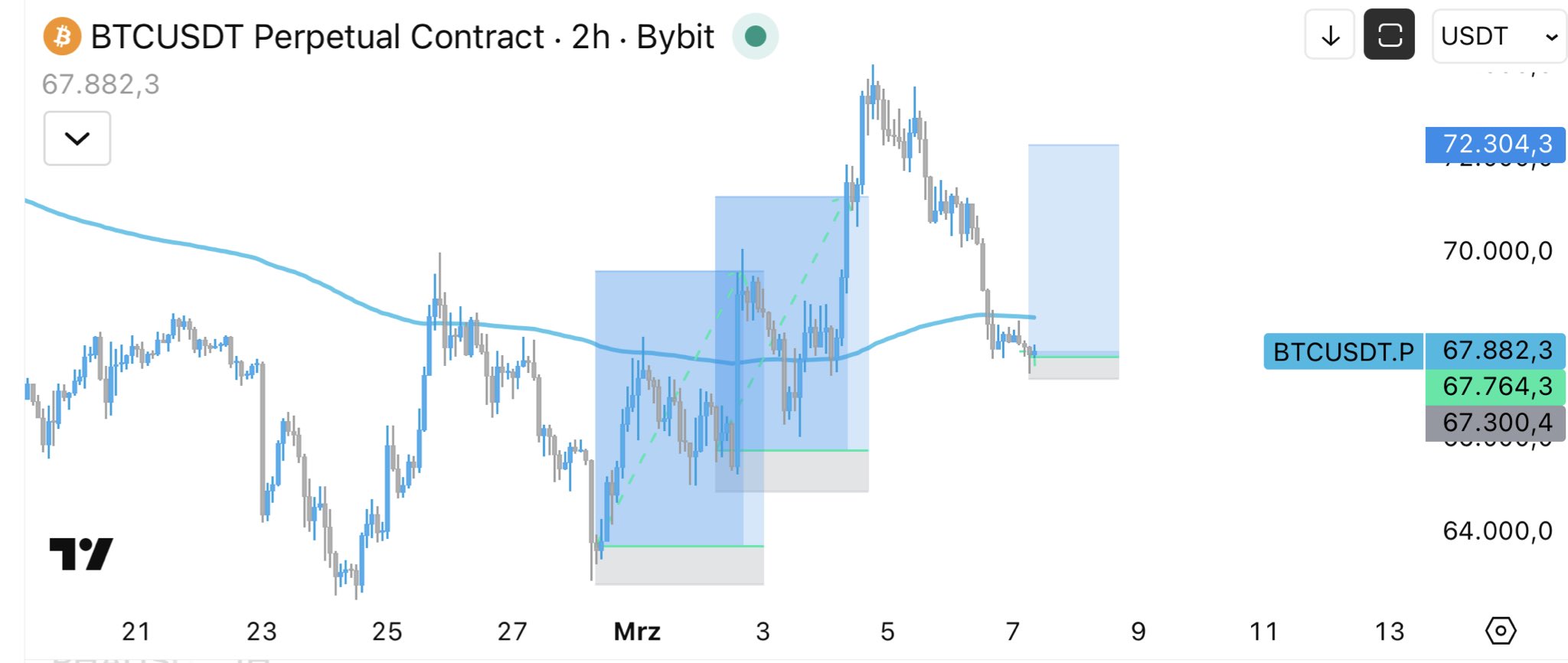

Muro TA_Analyst Trader C405.27K @MuroCrypto

Muro TA_Analyst Trader C405.27K @MuroCrypto

Muro TA_Analyst Trader C405.27K @MuroCrypto

Muro TA_Analyst Trader C405.27K @MuroCrypto 3 1 545 Оригінал >Тенденція BTC після випускуБичачий

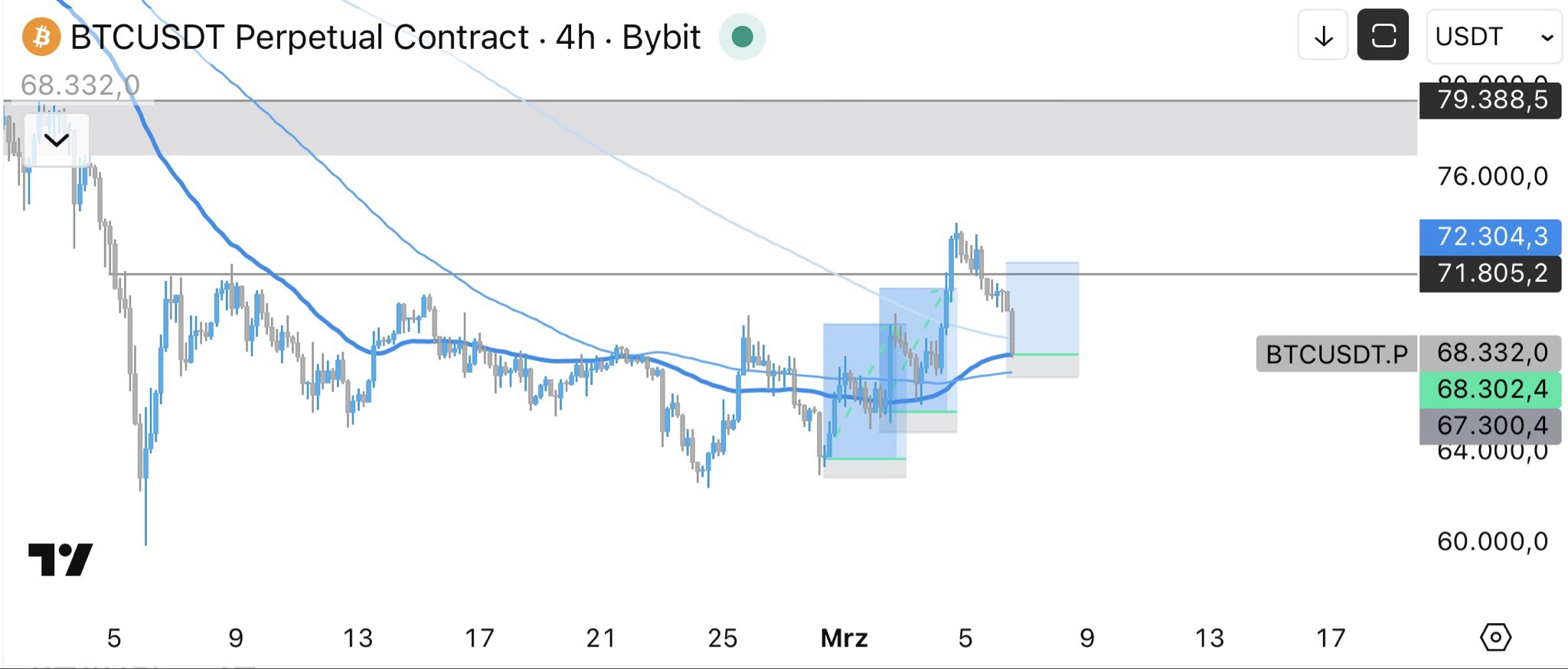

3 1 545 Оригінал >Тенденція BTC після випускуБичачий Quinten | 048.eth TA_Analyst FA_Analyst C223.85K @QuintenFrancois

Quinten | 048.eth TA_Analyst FA_Analyst C223.85K @QuintenFrancois Super฿ro TA_Analyst Educator S23.81K @SuperBitcoinBro

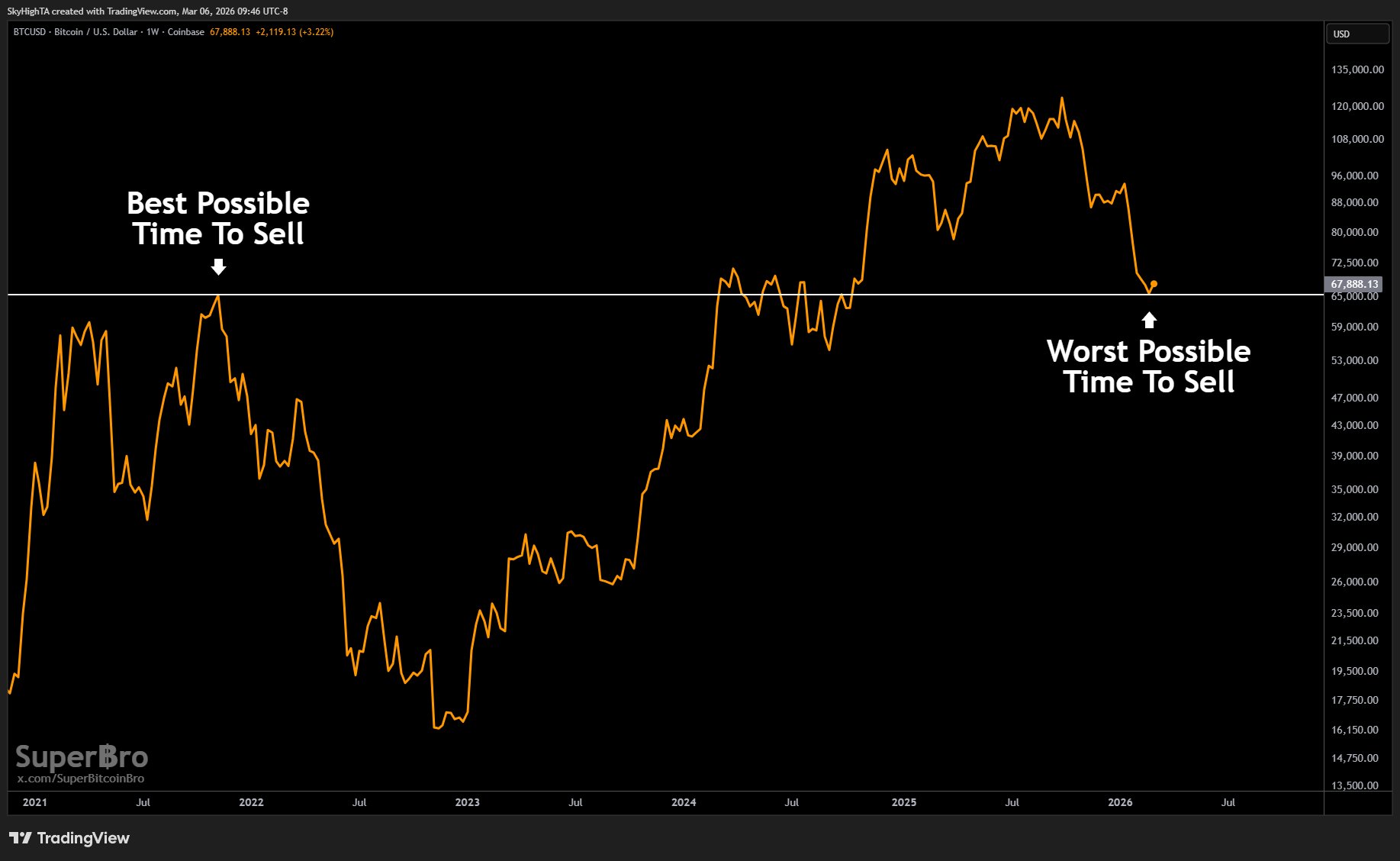

Super฿ro TA_Analyst Educator S23.81K @SuperBitcoinBro 9 3 349 Оригінал >Тенденція BTC після випускуНадзвичайно бичачий

9 3 349 Оригінал >Тенденція BTC після випускуНадзвичайно бичачий- Тенденція BTC після випускуВедмежий

- Тенденція BTC після випускуНадзвичайно бичачий

- Тенденція BTC після випускуВедмежий

- Тенденція BTC після випускуБичачий

- Тенденція BTC після випускуБичачий

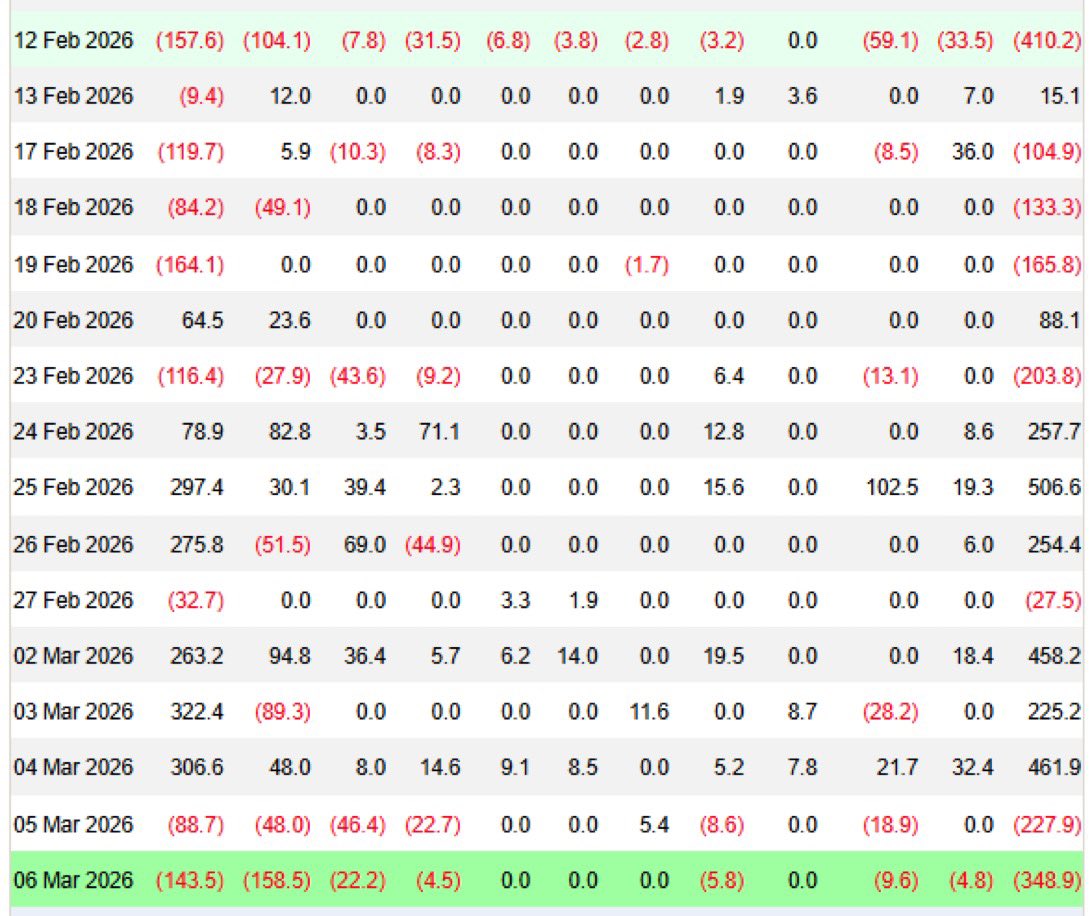

Michael Egorov Founder DeFi_Expert B42.28K @newmichwill

Michael Egorov Founder DeFi_Expert B42.28K @newmichwill Jacob King FA_Analyst Media B528.19K @JacobKinge

Jacob King FA_Analyst Media B528.19K @JacobKinge 0 0 113 Оригінал >Тенденція BTC після випускуНадзвичайно ведмежий

0 0 113 Оригінал >Тенденція BTC після випускуНадзвичайно ведмежий- Тенденція BTC після випускуНейтральні

- Тенденція BTC після випускуБичачий