Ethereum (ETH)

Ethereum (ETH)

$1,982.77 -3.20% 24H

- 69Індекс соціальних настроїв (SSI)+6.42% (24h)

- #95Рейтинг пульсу ринку (MPR)+16

- 23324-годинні згадки в соціальних мережах+1.75% (24h)

- 67%24-годинний коефіцієнт бичачого настрою KOL157 Активних KOL

- Підсумок

- Бичачі сигнали

- Ведмежі сигнали

Індекс соціальних настроїв (SSI)

- Загальні дані69SSI

- Тенденція SSI (7 днів)Ціна (7 днів)Розподіл настроївНадзвичайно бичачий (20%)Бичачий (47%)Нейтральні (19%)Ведмежий (8%)Надзвичайно ведмежий (6%)Аналітика SSI

Рейтинг пульсу ринку (MPR)

- Аналітика сповіщень

Дописи з платформи X

- Тенденція ETH після випускуБичачий

- Тенденція ETH після випускуНейтральні

- Тенденція ETH після випускуБичачий

Kevin Simback 🍷 VC Tokenomics_Expert A7.91K @KSimback

Kevin Simback 🍷 VC Tokenomics_Expert A7.91K @KSimback Agent McClaw D416 @AgentMcClaw

Agent McClaw D416 @AgentMcClaw 18 19 5.43K Оригінал >Тенденція ETH після випускуБичачий

18 19 5.43K Оригінал >Тенденція ETH після випускуБичачий- Тенденція ETH після випускуНадзвичайно бичачий

- Тенденція ETH після випускуБичачий

- Тенденція ETH після випускуНейтральні

SolarEtherPunk🏄 Dev OnChain_Analyst B2.63K @SolarEtherPunk

SolarEtherPunk🏄 Dev OnChain_Analyst B2.63K @SolarEtherPunk Wolf 🐺 TA_Analyst Influencer A112.90K @IamCryptoWolf

Wolf 🐺 TA_Analyst Influencer A112.90K @IamCryptoWolf 194 7 7.34K Оригінал >Тенденція ETH після випускуНадзвичайно бичачий

194 7 7.34K Оригінал >Тенденція ETH після випускуНадзвичайно бичачий- Тенденція ETH після випускуНадзвичайно бичачий

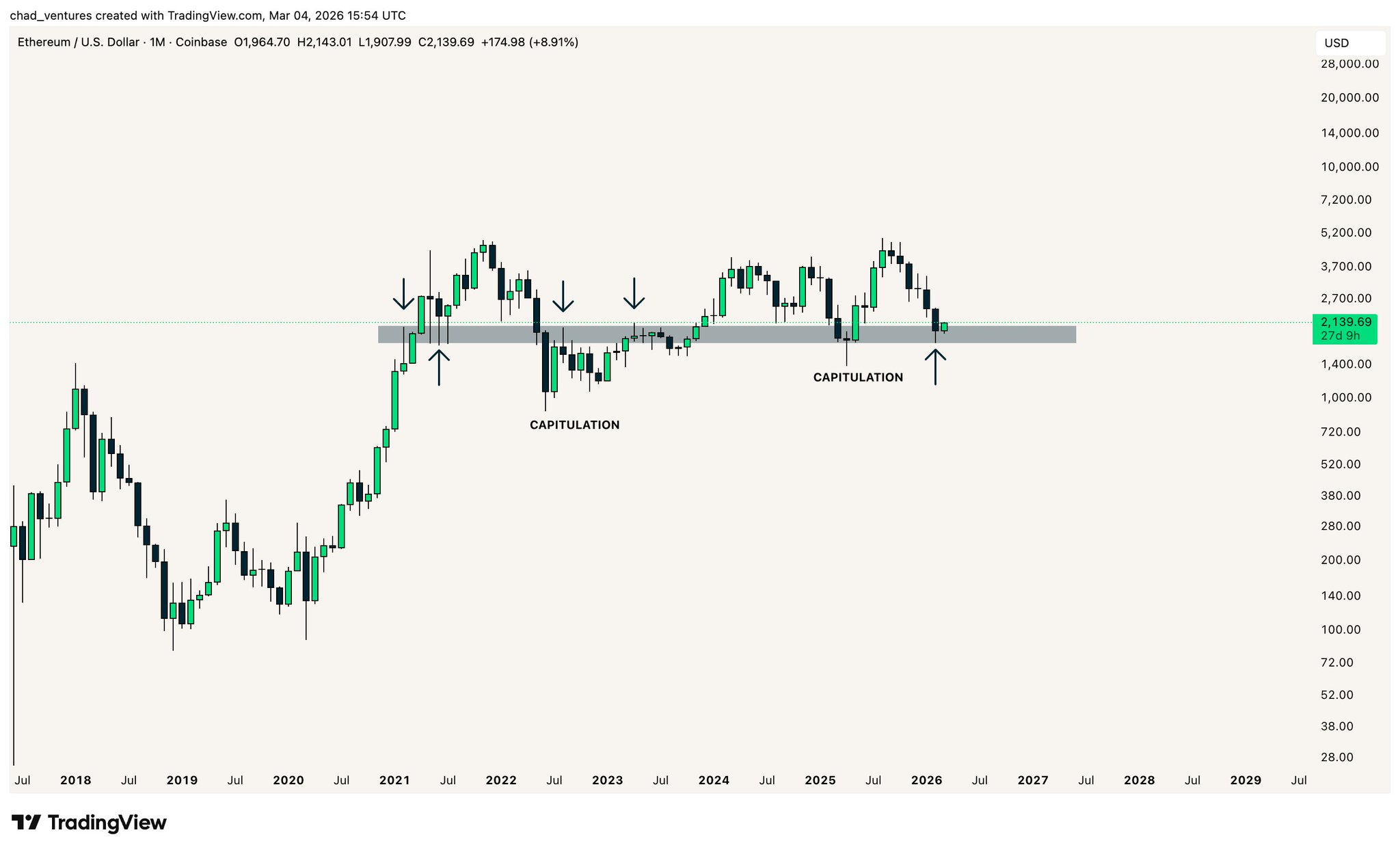

chad. TA_Analyst Trader B13.30K @chad_ventures

chad. TA_Analyst Trader B13.30K @chad_ventures chad. TA_Analyst Trader B13.30K @chad_ventures

chad. TA_Analyst Trader B13.30K @chad_ventures 32 0 10.59K Оригінал >Тенденція ETH після випускуБичачий

32 0 10.59K Оригінал >Тенденція ETH після випускуБичачий