Sei Network (SEI)

Sei Network (SEI)

$0.0660 -3.51% 24H

- 40Індекс соціальних настроїв (SSI)-35.99% (24h)

- #117Рейтинг пульсу ринку (MPR)-71

- 524-годинні згадки в соціальних мережах-44.44% (24h)

- 80%24-годинний коефіцієнт бичачого настрою KOL5 Активних KOL

- Підсумок

- Бичачі сигнали

- Ведмежі сигнали

Індекс соціальних настроїв (SSI)

- Загальні дані40SSI

- Тенденція SSI (7 днів)Ціна (7 днів)Розподіл настроївБичачий (80%)Ведмежий (20%)Аналітика SSI

Рейтинг пульсу ринку (MPR)

- Аналітика сповіщень

Дописи з платформи X

- Тенденція SEI після випускуНадзвичайно бичачий

StakingCabin Dev OnChain_Analyst C2.70K @stakingcabin

StakingCabin Dev OnChain_Analyst C2.70K @stakingcabin Sei Media Community_Lead C780.45K @SeiNetwork

Sei Media Community_Lead C780.45K @SeiNetwork 357 42 12.83K Оригінал >Тенденція SEI після випускуБичачий

357 42 12.83K Оригінал >Тенденція SEI після випускуБичачий- Тенденція SEI після випускуБичачий

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey 44 23 3.06K Оригінал >Тенденція SEI після випускуВедмежий

44 23 3.06K Оригінал >Тенденція SEI після випускуВедмежий Sei Media Community_Lead C780.45K @SeiNetwork

Sei Media Community_Lead C780.45K @SeiNetwork Sei Media Community_Lead C780.45K @SeiNetwork

Sei Media Community_Lead C780.45K @SeiNetwork 357 42 12.83K Оригінал >Тенденція SEI після випускуБичачий

357 42 12.83K Оригінал >Тенденція SEI після випускуБичачий Block_Diversity v.8 ™️ TA_Analyst Trader A26.50K @i_bot404

Block_Diversity v.8 ™️ TA_Analyst Trader A26.50K @i_bot404 Rektlife D78 @Rektlife_27 8 2.72K Оригінал >Тенденція SEI після випускуБичачий

Rektlife D78 @Rektlife_27 8 2.72K Оригінал >Тенденція SEI після випускуБичачий- Тенденція SEI після випускуБичачий

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

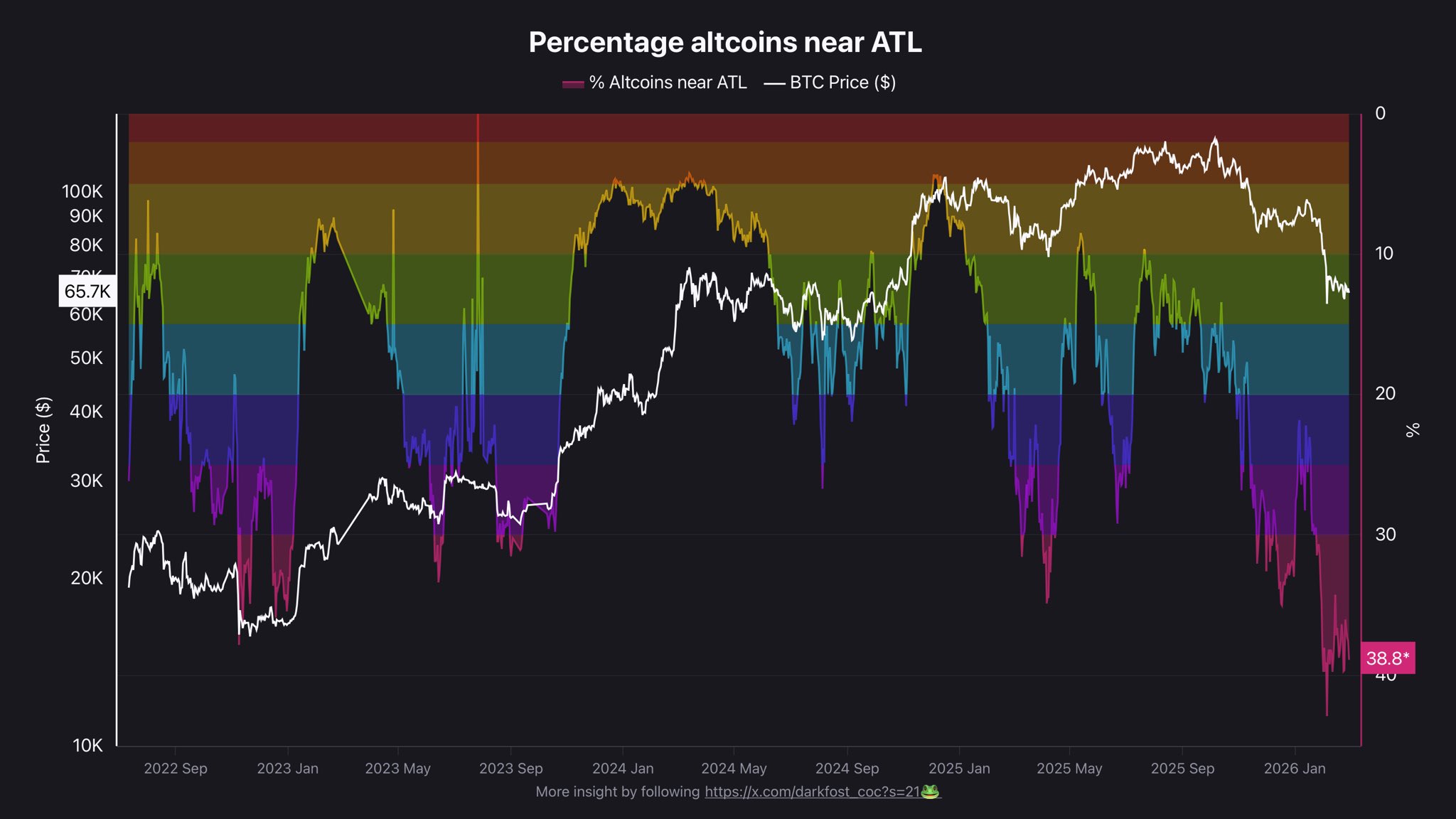

Darkfost OnChain_Analyst TA_Analyst S8.43K @Darkfost_Coc

Darkfost OnChain_Analyst TA_Analyst S8.43K @Darkfost_Coc 44 23 3.06K Оригінал >Тенденція SEI після випускуБичачий

44 23 3.06K Оригінал >Тенденція SEI після випускуБичачий Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2 Sei Media Community_Lead C780.45K @SeiNetwork

Sei Media Community_Lead C780.45K @SeiNetwork 666 61 41.89K Оригінал >Тенденція SEI після випускуНадзвичайно бичачий

666 61 41.89K Оригінал >Тенденція SEI після випускуНадзвичайно бичачий- Тенденція SEI після випускуБичачий