CVX (CVX)

CVX (CVX)

$2.127 +6.14% 24H

- 73Chỉ số cảm xúc xã hội (SSI)- (24h)

- #5Xếp hạng nhịp đập thị trường (MPR)0

- 1Đề cập trên mạng xã hội 24h- (24h)

- 100%Tỷ lệ tăng KOL 24h1 KOL đang hoạt động

- Tóm tắt

- Tín hiệu tăng giá

- Tín hiệu giảm giá

Chỉ số cảm xúc xã hội (SSI)

- Tổng quan dữ liệu73SSI

- Xu hướng SSI (7 ngày)Giá (7 ngày)Phân bổ cảm xúcCực kỳ lạc quan (100%)Thông tin chuyên sâu SSI

Xếp hạng nhịp đập thị trường (MPR)

- Thông tin chuyên sâu về cảnh báo

Bài đăng trên X

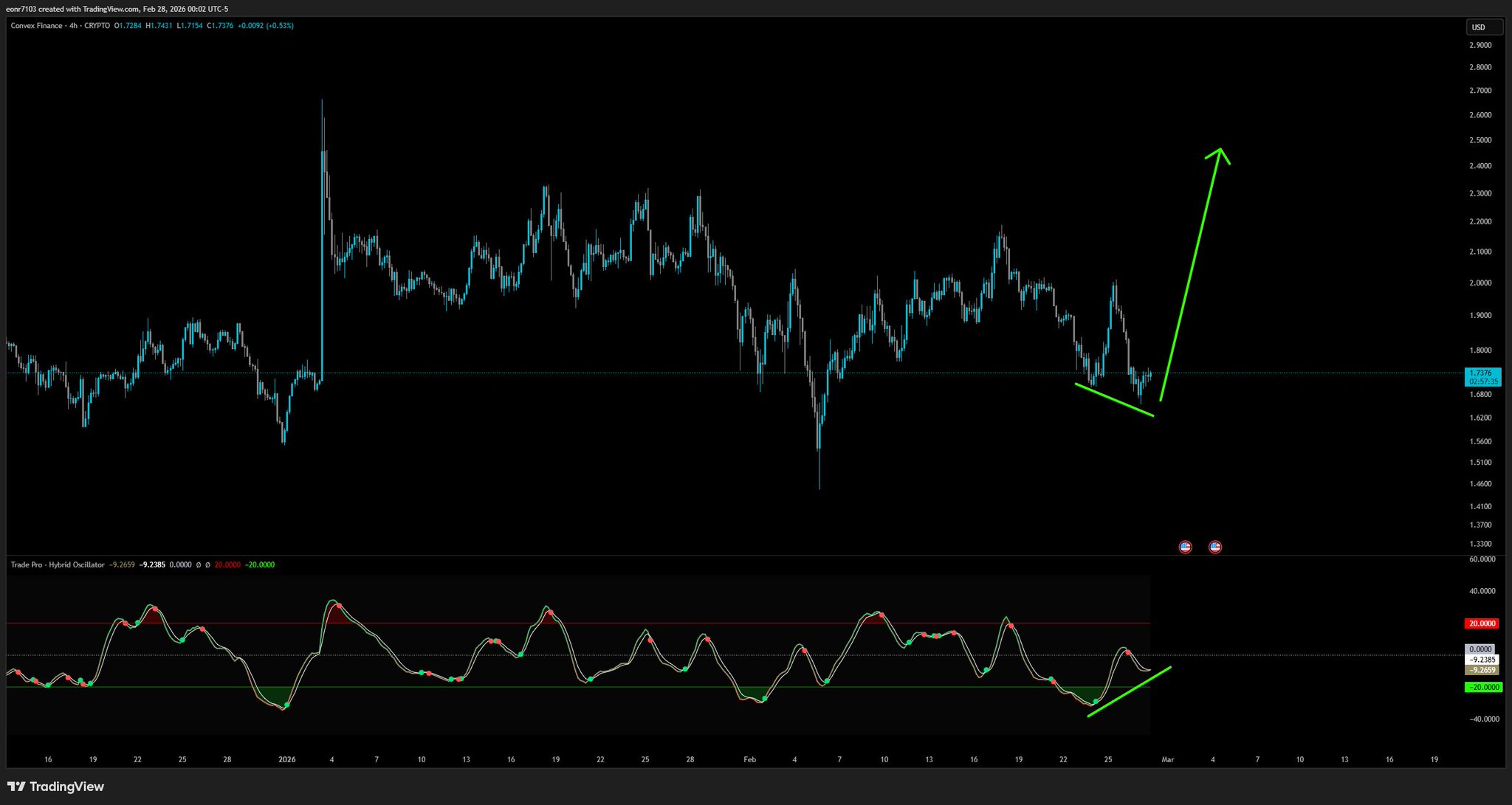

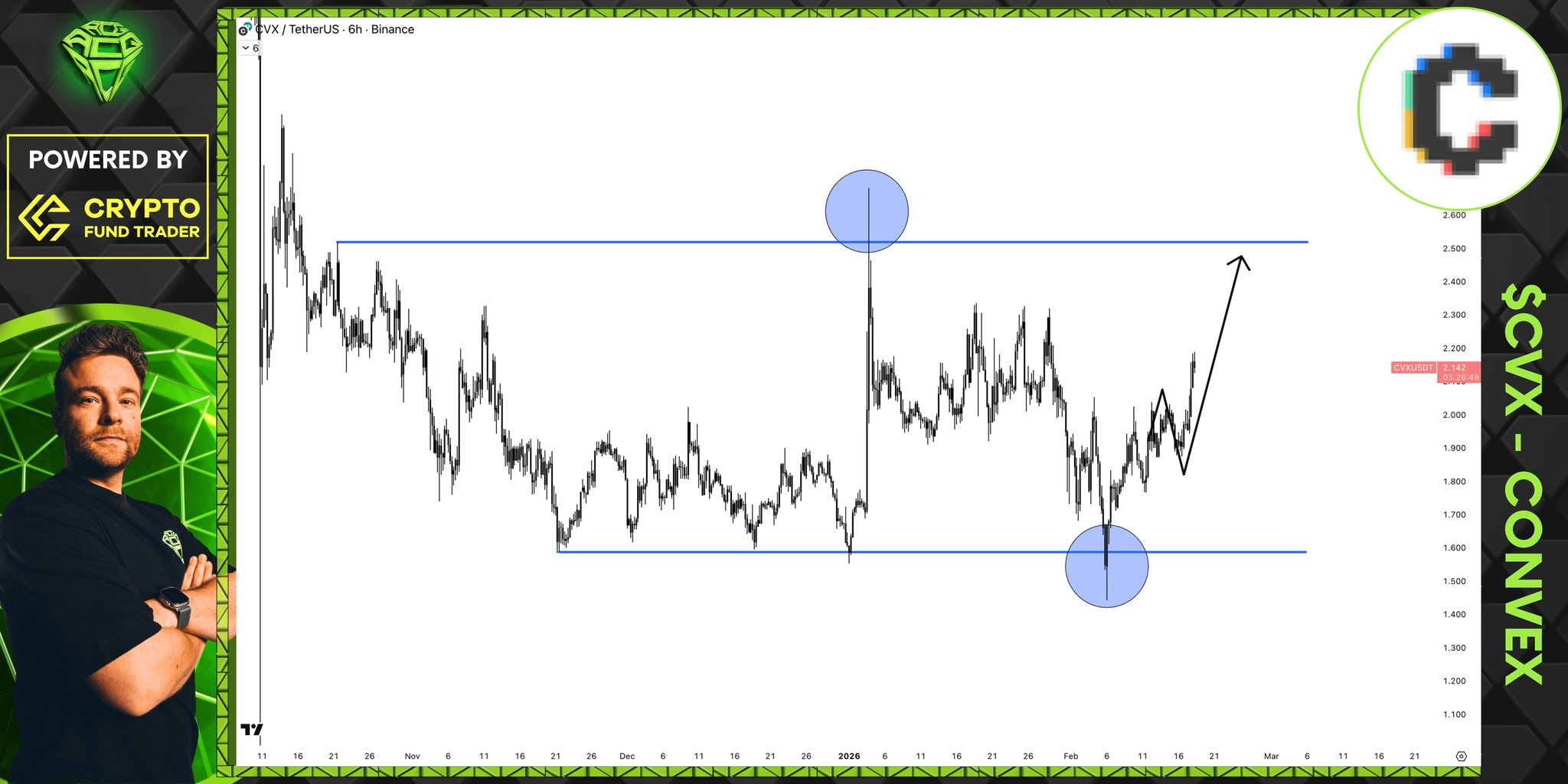

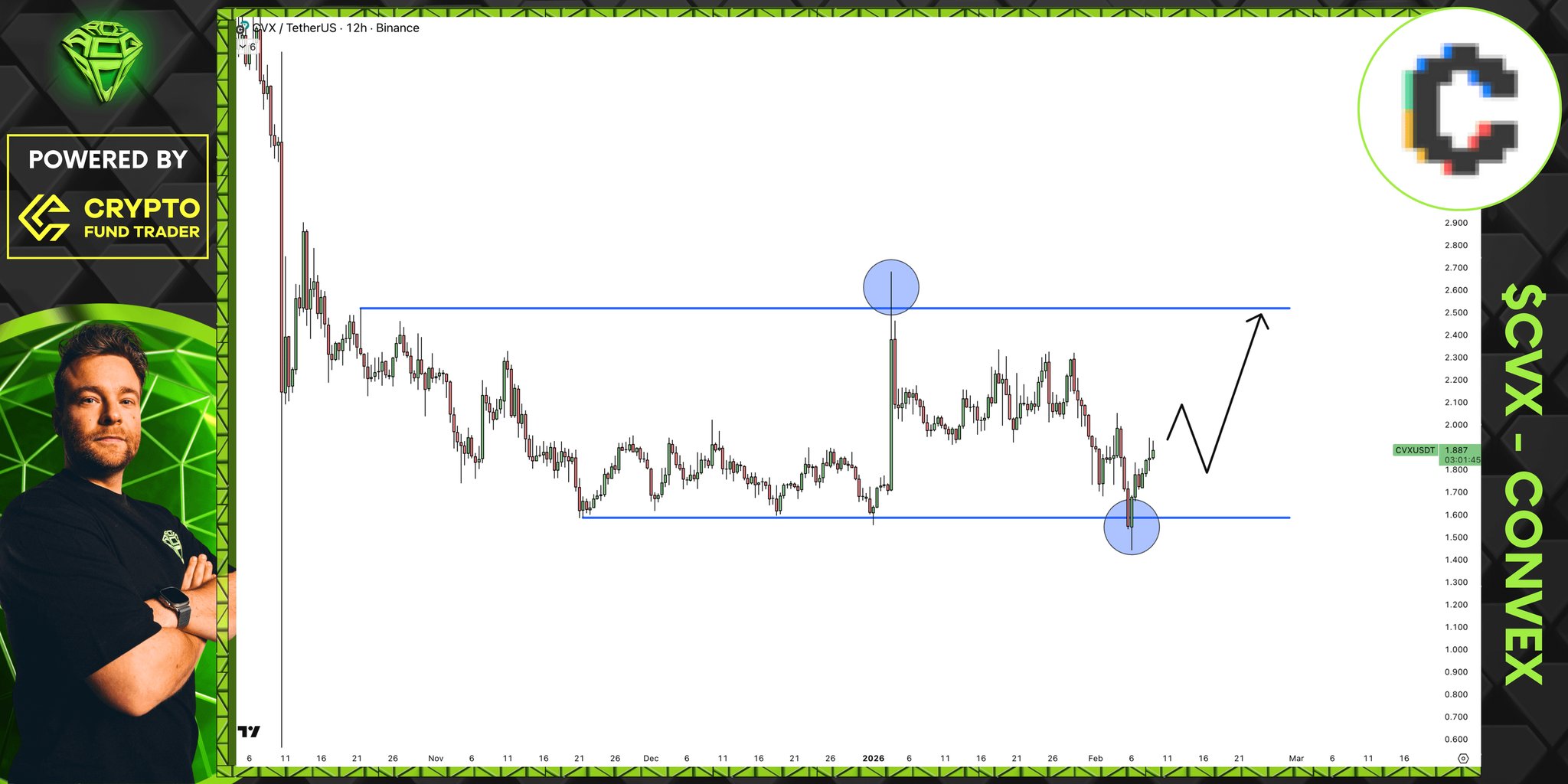

Trade Pro TA_Analyst Trader A2.03K @TradePro16

Trade Pro TA_Analyst Trader A2.03K @TradePro16

Trade Pro TA_Analyst Trader A2.03K @TradePro16

Trade Pro TA_Analyst Trader A2.03K @TradePro16

7 0 255 Gốc >Xu hướng của CVX sau khi phát hànhCực kỳ lạc quan

7 0 255 Gốc >Xu hướng của CVX sau khi phát hànhCực kỳ lạc quan- Xu hướng của CVX sau khi phát hànhCực kỳ lạc quan

CrediBULL Crypto TA_Analyst Educator B485.18K @CredibleCrypto

CrediBULL Crypto TA_Analyst Educator B485.18K @CredibleCrypto Ivan Livinskiy D666 @ilivinskiy

Ivan Livinskiy D666 @ilivinskiy 267 25 57.30K Gốc >Xu hướng của CVX sau khi phát hànhCực kỳ lạc quan

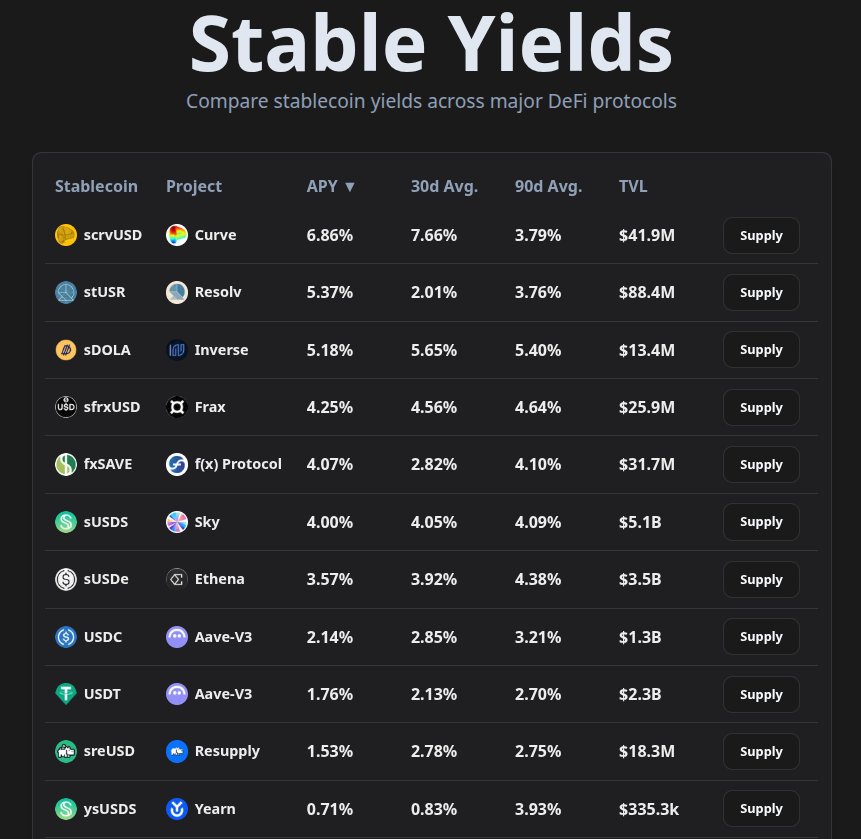

267 25 57.30K Gốc >Xu hướng của CVX sau khi phát hànhCực kỳ lạc quan Zh0u 🧬 OnChain_Analyst DeFi_Expert B8.72K @Crypto_Zh0u

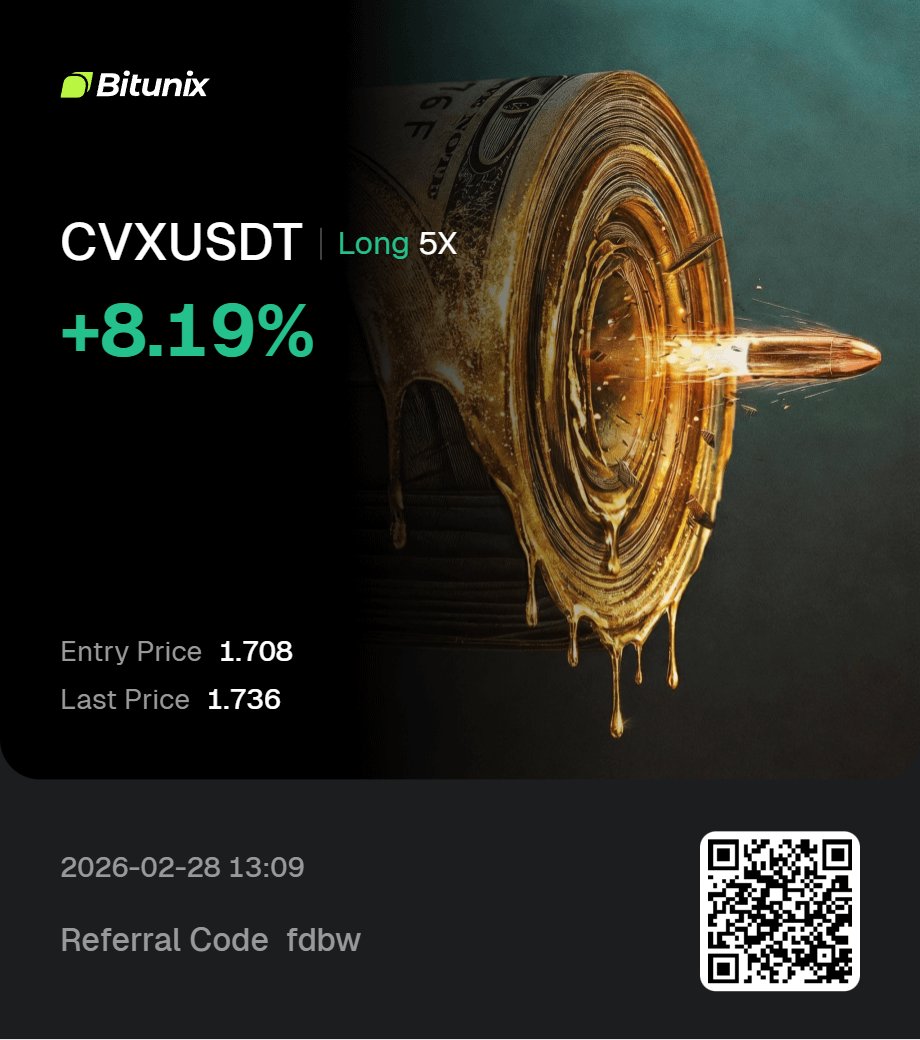

Zh0u 🧬 OnChain_Analyst DeFi_Expert B8.72K @Crypto_Zh0u Zh0u 🧬 OnChain_Analyst DeFi_Expert B8.72K @Crypto_Zh0u7 3 1.10K Gốc >Xu hướng của CVX sau khi phát hànhTăng giá

Zh0u 🧬 OnChain_Analyst DeFi_Expert B8.72K @Crypto_Zh0u7 3 1.10K Gốc >Xu hướng của CVX sau khi phát hànhTăng giá Maelius TA_Analyst Trader S9.28K @MaeliusCrypto

Maelius TA_Analyst Trader S9.28K @MaeliusCrypto Maelius TA_Analyst Trader S9.28K @MaeliusCrypto

Maelius TA_Analyst Trader S9.28K @MaeliusCrypto 114 8 20.28K Gốc >Xu hướng của CVX sau khi phát hànhTăng giá

114 8 20.28K Gốc >Xu hướng của CVX sau khi phát hànhTăng giá- Xu hướng của CVX sau khi phát hànhTăng giá

EliZ TA_Analyst Trader B603.25K @eliz883

EliZ TA_Analyst Trader B603.25K @eliz883

EliZ TA_Analyst Trader B603.25K @eliz883

EliZ TA_Analyst Trader B603.25K @eliz883 230 38 34.49K Gốc >Xu hướng của CVX sau khi phát hànhCực kỳ lạc quan

230 38 34.49K Gốc >Xu hướng của CVX sau khi phát hànhCực kỳ lạc quan Sjuul | AltCryptoGems TA_Analyst Trader C479.87K @AltCryptoGems

Sjuul | AltCryptoGems TA_Analyst Trader C479.87K @AltCryptoGems

Sjuul | AltCryptoGems TA_Analyst Trader C479.87K @AltCryptoGems

Sjuul | AltCryptoGems TA_Analyst Trader C479.87K @AltCryptoGems 495 24 26.07K Gốc >Xu hướng của CVX sau khi phát hànhTăng giá

495 24 26.07K Gốc >Xu hướng của CVX sau khi phát hànhTăng giá- Xu hướng của CVX sau khi phát hànhTăng giá

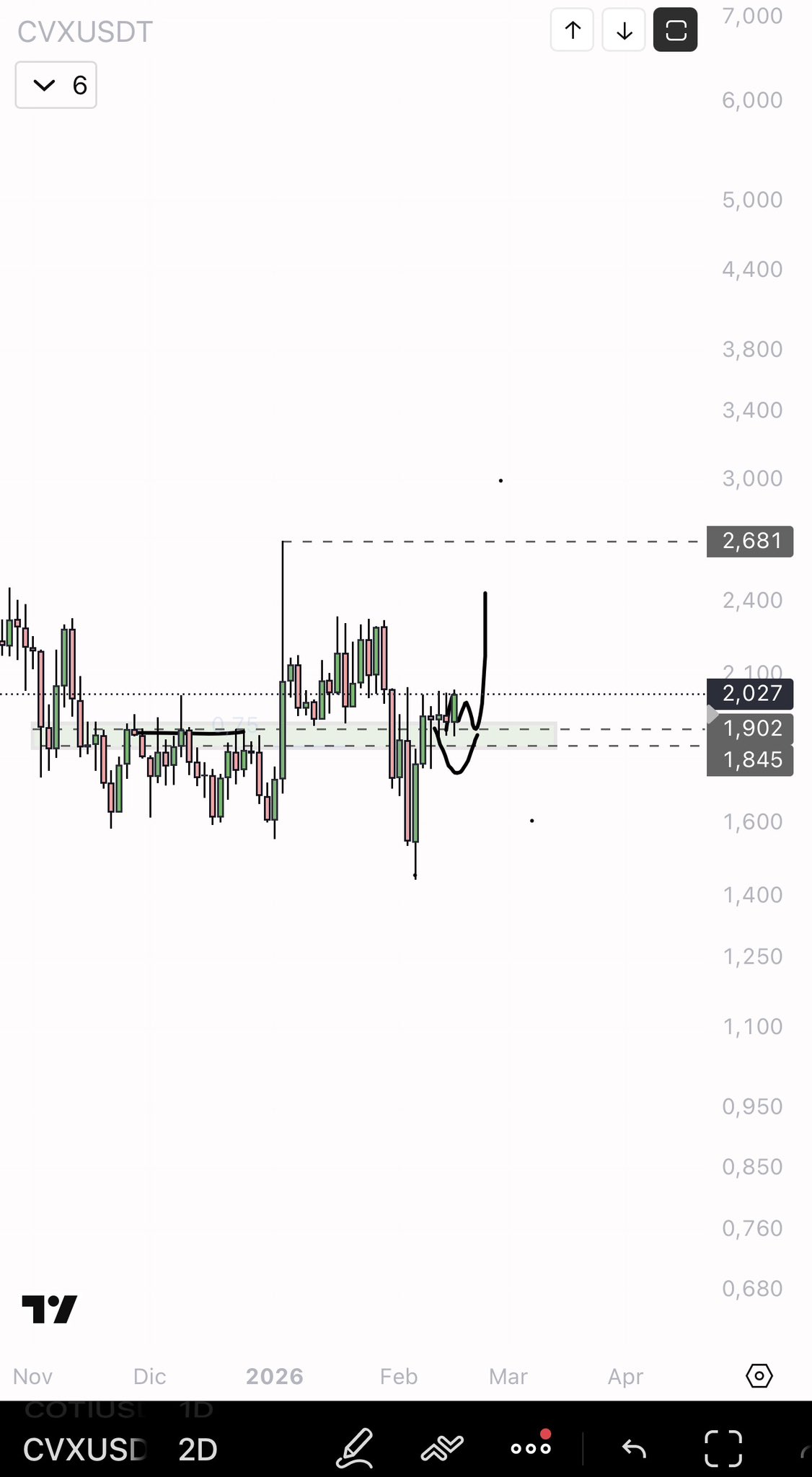

TraderJB TA_Analyst Trader A2.35K @TraderJBx

TraderJB TA_Analyst Trader A2.35K @TraderJBx

TraderJB TA_Analyst Trader A2.35K @TraderJBx105 18 15.35K Gốc >Xu hướng của CVX sau khi phát hànhCực kỳ lạc quan

TraderJB TA_Analyst Trader A2.35K @TraderJBx105 18 15.35K Gốc >Xu hướng của CVX sau khi phát hànhCực kỳ lạc quan