Sei Network (SEI)

Sei Network (SEI)

$0.0648 -2.70% 24H

- 75Chỉ số cảm xúc xã hội (SSI)-1.74% (24h)

- #54Xếp hạng nhịp đập thị trường (MPR)-32

- 12Đề cập trên mạng xã hội 24h+71.43% (24h)

- 92%Tỷ lệ tăng KOL 24h9 KOL đang hoạt động

- Tóm tắt

- Tín hiệu tăng giá

- Tín hiệu giảm giá

Chỉ số cảm xúc xã hội (SSI)

- Tổng quan dữ liệu75SSI

- Xu hướng SSI (7 ngày)Giá (7 ngày)Phân bổ cảm xúcCực kỳ lạc quan (25%)Tăng giá (67%)Trung tính (8%)Thông tin chuyên sâu SSI

Xếp hạng nhịp đập thị trường (MPR)

- Thông tin chuyên sâu về cảnh báo

Bài đăng trên X

- Xu hướng của SEI sau khi phát hànhTăng giá

- Xu hướng của SEI sau khi phát hànhTrung tính

Block_Diversity v.8 ™️ TA_Analyst Trader A26.50K @i_bot404

Block_Diversity v.8 ™️ TA_Analyst Trader A26.50K @i_bot404

Block_Diversity v.8 ™️ TA_Analyst Trader A26.50K @i_bot40423 2 2.24K Gốc >Xu hướng của SEI sau khi phát hànhTăng giá

Block_Diversity v.8 ™️ TA_Analyst Trader A26.50K @i_bot40423 2 2.24K Gốc >Xu hướng của SEI sau khi phát hànhTăng giá- Xu hướng của SEI sau khi phát hànhTăng giá

Block_Diversity v.8 ™️ TA_Analyst Trader A26.50K @i_bot404

Block_Diversity v.8 ™️ TA_Analyst Trader A26.50K @i_bot404 Rektlife D78 @Rektlife_17 3 1.77K Gốc >Xu hướng của SEI sau khi phát hànhTăng giá

Rektlife D78 @Rektlife_17 3 1.77K Gốc >Xu hướng của SEI sau khi phát hànhTăng giá StakingCabin Dev OnChain_Analyst C2.70K @stakingcabin

StakingCabin Dev OnChain_Analyst C2.70K @stakingcabin Sei Media Community_Lead C780.45K @SeiNetwork

Sei Media Community_Lead C780.45K @SeiNetwork 1 1 28 Gốc >Xu hướng của SEI sau khi phát hànhCực kỳ lạc quan

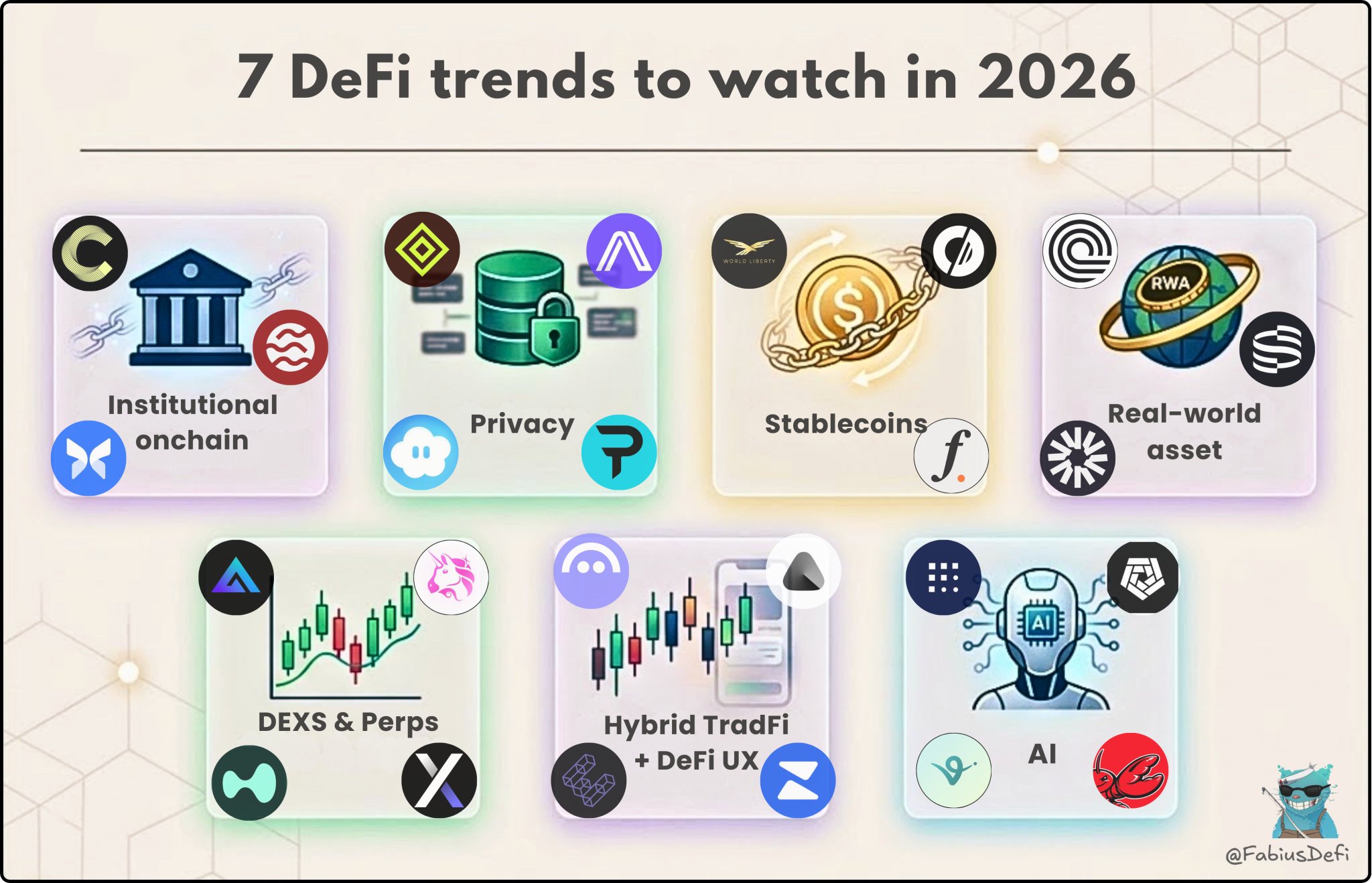

1 1 28 Gốc >Xu hướng của SEI sau khi phát hànhCực kỳ lạc quan Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi

Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi

Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi 131 53 4.79K Gốc >Xu hướng của SEI sau khi phát hànhTăng giá

131 53 4.79K Gốc >Xu hướng của SEI sau khi phát hànhTăng giá Sei Media Community_Lead C780.45K @SeiNetwork

Sei Media Community_Lead C780.45K @SeiNetwork Sei Media Community_Lead C780.45K @SeiNetwork

Sei Media Community_Lead C780.45K @SeiNetwork 594 56 34.01K Gốc >Xu hướng của SEI sau khi phát hànhTăng giá

594 56 34.01K Gốc >Xu hướng của SEI sau khi phát hànhTăng giá- Xu hướng của SEI sau khi phát hànhCực kỳ lạc quan

nbdieu.sei 🔴💨 Community_Lead Media B3.69K @nbdieu

nbdieu.sei 🔴💨 Community_Lead Media B3.69K @nbdieu Sei Media Community_Lead C780.45K @SeiNetwork

Sei Media Community_Lead C780.45K @SeiNetwork 594 56 34.01K Gốc >Xu hướng của SEI sau khi phát hànhTăng giá

594 56 34.01K Gốc >Xu hướng của SEI sau khi phát hànhTăng giá