Aave (AAVE)

Aave (AAVE)

$190.65 -2.88% 24H

- 69社交熱度指數(SSI)-24.52% (24h)

- #109市場預警排名(MPR)-39

- 2224小時社交提及量-33.33% (24h)

- 72%24小時KOL看好比例19位活躍KOL

- 概要

- 看漲訊號

- 看跌訊號

社交熱度指數(SSI)

- 總體資料69SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (27%)看漲 (45%)中性 (5%)看跌 (23%)社交熱度洞察

市場預警排名(MPR)

- 預警解讀

相關推文

Richard Fetyko Founder TA_Analyst B1.16K @FetykoRichard

Richard Fetyko Founder TA_Analyst B1.16K @FetykoRichard altFINS_altcoins D13.05K @AltfinsA

altFINS_altcoins D13.05K @AltfinsA 4 0 106 閱讀原文 >釋出後AAVE走勢極度看漲

4 0 106 閱讀原文 >釋出後AAVE走勢極度看漲- 釋出後AAVE走勢中性

- 釋出後AAVE走勢極度看漲

Stani.eth Founder DeFi_Expert C278.56K @StaniKulechov

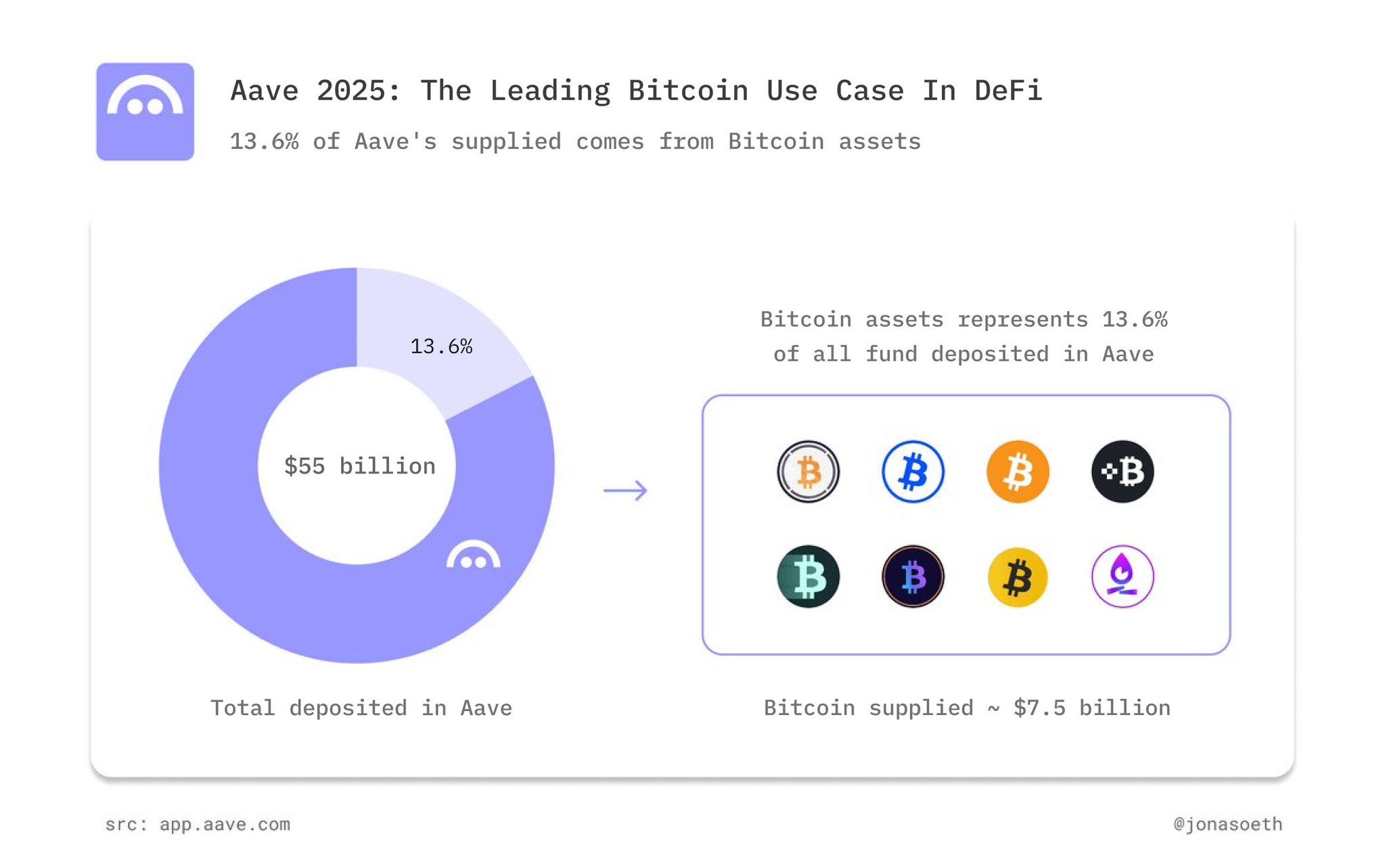

Stani.eth Founder DeFi_Expert C278.56K @StaniKulechov Jonaso D4.77K @Jonasoeth

Jonaso D4.77K @Jonasoeth 160 15 10.73K 閱讀原文 >釋出後AAVE走勢極度看漲

160 15 10.73K 閱讀原文 >釋出後AAVE走勢極度看漲- 釋出後AAVE走勢看漲

- 釋出後AAVE走勢看跌

- 釋出後AAVE走勢看跌

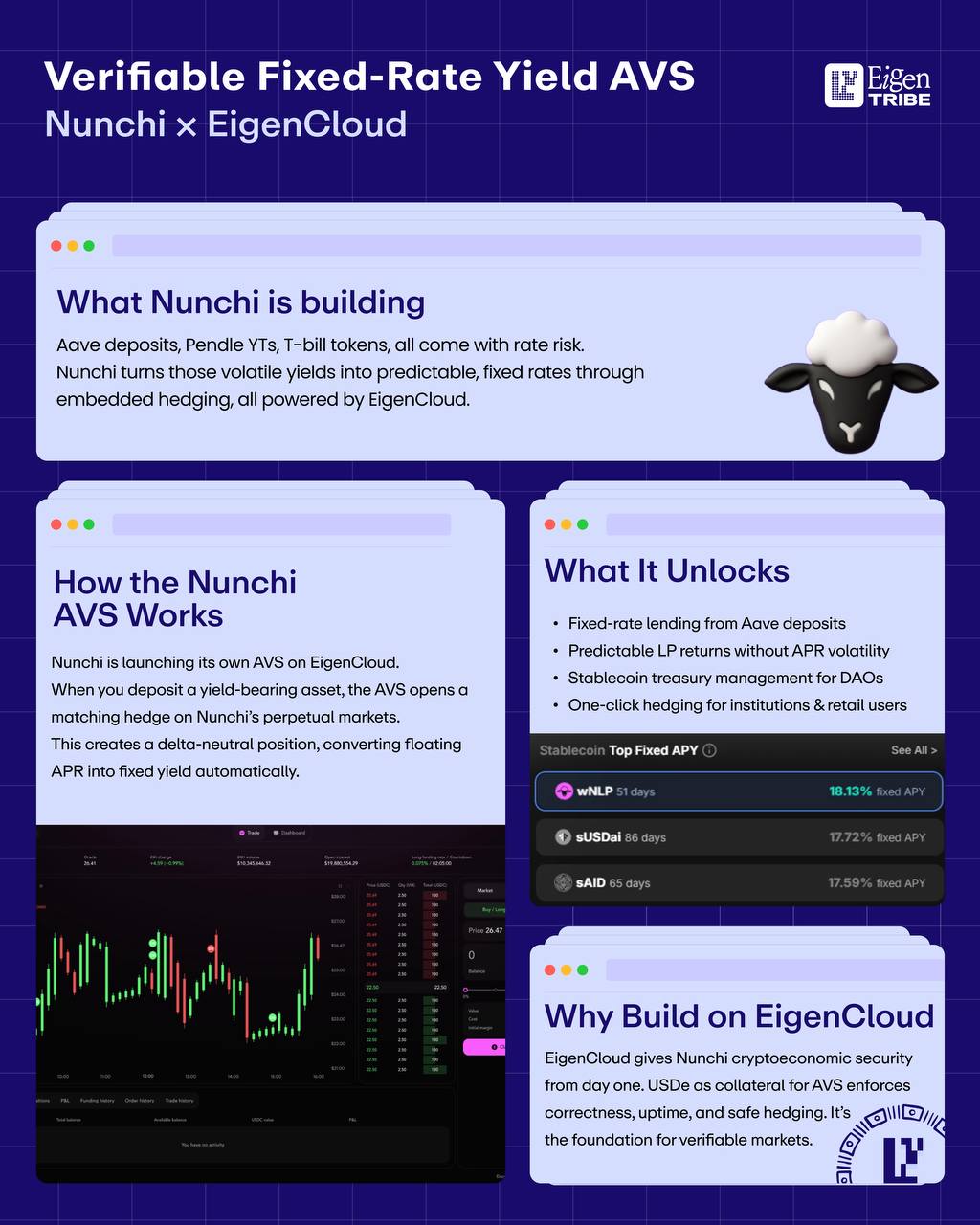

EigenCloud Dev Security_Expert C317.59K @eigencloud

EigenCloud Dev Security_Expert C317.59K @eigencloud EigenTribe D1.03K @eigentribe

EigenTribe D1.03K @eigentribe 34 2 3.46K 閱讀原文 >釋出後AAVE走勢極度看漲

34 2 3.46K 閱讀原文 >釋出後AAVE走勢極度看漲- 釋出後AAVE走勢看漲

Eldar DeFi_Expert FA_Analyst A2.00K @eldarcap

Eldar DeFi_Expert FA_Analyst A2.00K @eldarcap PaperImperium D8.54K @ImperiumPaper

PaperImperium D8.54K @ImperiumPaper 50 5 7.95K 閱讀原文 >釋出後AAVE走勢看跌

50 5 7.95K 閱讀原文 >釋出後AAVE走勢看跌