DeAgentAI (AIA)

DeAgentAI (AIA)

- 51社交熱度指數(SSI)- (24h)

- #136市場預警排名(MPR)0

- 124小時社交提及量- (24h)

- 0%24小時KOL看好比例1位活躍KOL

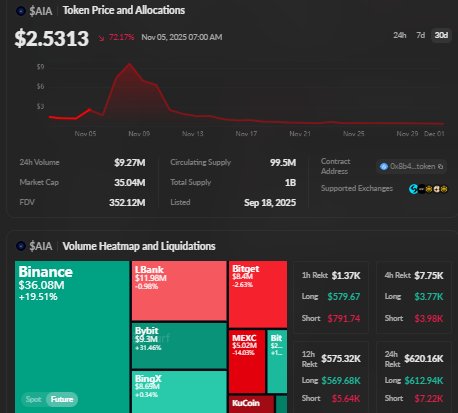

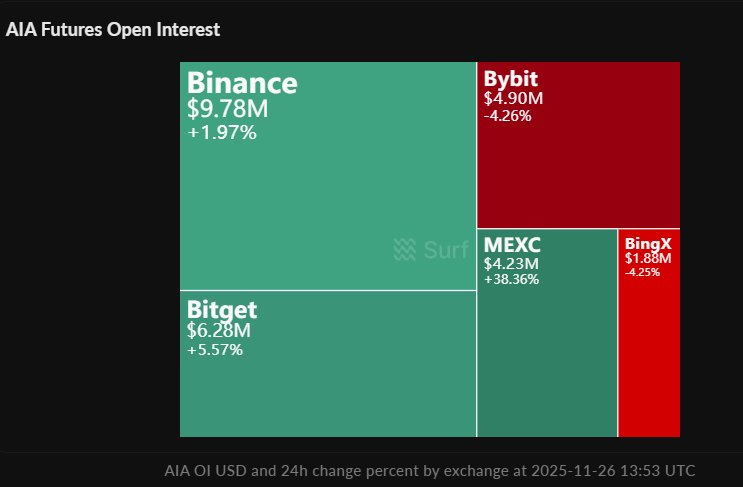

- 概要AIA up 10.9% in 24h, volume $11.6M, Oi +6.6%, but positions are highly concentrated and have previously experienced a sharp crash.

- 看漲訊號

- Price up 10.9%

- Volume $11.6M

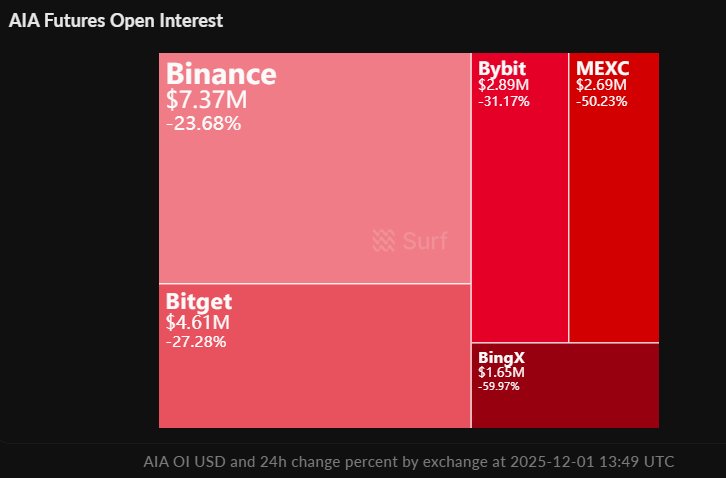

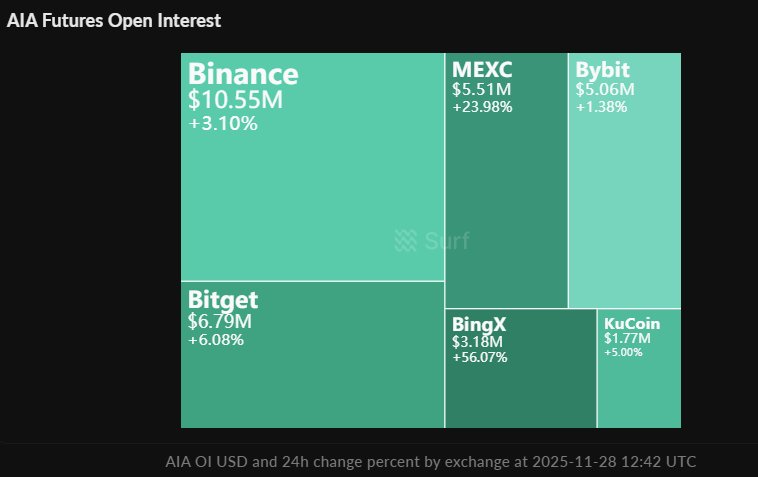

- Open interest up 6.6%

- Positions have not seen significant sell-off

- Backing funds and technical support

- 看跌訊號

- Supply 83% held by top 10 wallets

- Historically, after an 11k% rise, 99% crashed

- Discord was breached

- 30-day decline 71%

- High volatility risk

社交熱度指數(SSI)

- 總體資料51SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈中性 (100%)社交熱度洞察AIA social heat moderate (51/100, unchanged), activity 28/40, sentiment positive 20/30, driven by 10.9% price increase and $11.6M volume, no notable KOL uplift yet.

市場預警排名(MPR)

- 預警解讀AIA warning rank #136, social anomaly 70.41/100 high, sentiment polarization 0, KOL shift 0, corresponding to potential risks of concentrated positions and Discord breach.

相關推文

Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX

Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX#DeAgentAI: The AI Token That Pumped 11,000%… Then Imploded 99% #DeAgentAI launched with strong credentials — $6M seed backing (Valkyrie, PANONY, https://t.co/SLJe2k6Drr Ventures), 17M users, 192M+ txs, and a working AI infra stack (AlphaX, zkTLS oracles, multi-chain deployment on BSC/Sui/opBNB). But beneath the clean fundamentals is one of the strangest volatility profiles of any AI token this year. 1. Key On-Chain Signals > 83% of circulating supply sits in the top 10 wallets. Most appear vested/locked, not whales but concentration this high means any unlock window becomes systemic risk. > No meaningful whale exits despite a -71% 30D drawdown -> holder conviction remains surprisingly strong. > 24h trading volume still at $11.6M, mostly on Binance perp markets, where OI increased +6.6% — traders are positioning, not capitulating. 2. Why Price Collapsed > The November +11,000% run to $28.44 ATH likely triggered reflexive speculation typical of new AI tokens. > Discord was compromised on Dec 3 — no on-chain risk, but sentiment shock accelerated the fall. 3. Why It’s Not Dead > Oversold RSI (38–40) + positive MACD divergence → setup for stabilization. > Two upcoming products (CorrAI + Truesights) expand beyond prediction engines and reinforce real infra use cases. Narrative Setup: If AI-infra rotates again, AIA is one of the few with actual users but the concentration risk is a double-edged sword.

0 0 50 閱讀原文 >釋出後AIA走勢中性AIA surged then plunged 99%, technicals now show stabilization signs, but concentration risk remains high.

0 0 50 閱讀原文 >釋出後AIA走勢中性AIA surged then plunged 99%, technicals now show stabilization signs, but concentration risk remains high. Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX

Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX🚨 #AIA COLLAPSES 98.8% BUT ON-CHAIN DATA REVEALS A TWIST FEW EXPECTED #DeAgentAI (#AIA) just printed one of the harshest drawdowns in the AI-crypto sector down 98.8% from $28.44 ATH to ~$0.33. But unlike typical collapse patterns, AIA shows structurally unusual signals beneath the surface. 1. Ultra-Low Float + Extreme Lockup Only 9.95% of supply is circulating. ~87% remains locked until Sep 2026, with linear unlocks stretching to 2029. This creates temporary manipulation resistance but amplifies volatility with even small order flow. 2. Heavy Usage Despite Price Implosion AIA processed 192M+ transactions and onboarded 17M+ users across Sui, BSC, and opBNB in just two months — an anomaly for a collapsing token. 3. No Major Whale Exits Top wallets show zero large outflows, with whales accumulating ~1.1M AIA during the crash, signaling conviction rather than capitulation. 4. Derivatives Say “Not Dead Yet” OI remains high at $15.9M, funding near neutral, and liquidations lean short-heavy, a setup historically preceding relief squeezes. 5. Sentiment Split But No Scam Flags Narratives cite volatility and hype exhaustion, but no rug-pull evidence. Engagement is coordinated but not fraudulent. TL;DR: #AIA is a paradox: catastrophic price action paired with unusually strong on-chain fundamentals. High risk but not a dead project.

3 0 358 閱讀原文 >釋出後AIA走勢中性AIA token price plummeted 98.8% but on-chain data shows strong fundamentals, not a dead coin, with high-risk rebound potential.

3 0 358 閱讀原文 >釋出後AIA走勢中性AIA token price plummeted 98.8% but on-chain data shows strong fundamentals, not a dead coin, with high-risk rebound potential. Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX

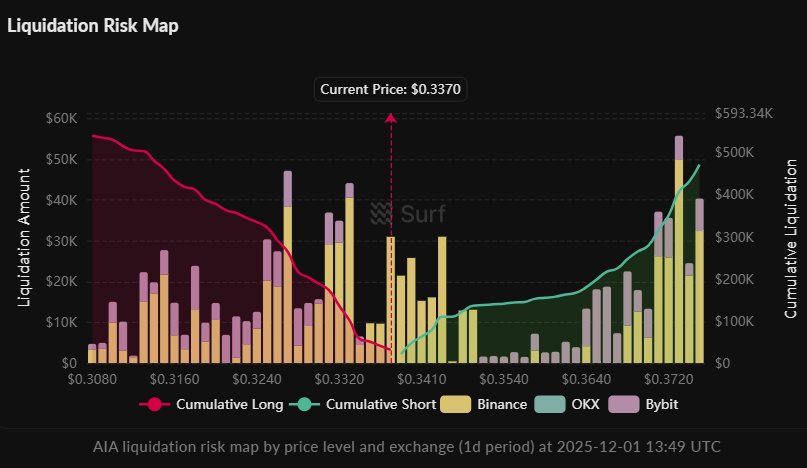

Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX#DeAgentAI ( $AIA ) Crash Alert! –22% in 24h #DeAgentAI ( $AIA ) tanks 22% to $0.34, under pressure after 98.8% crash from ATH ($28.44). The BSC based AI agent infrastructure project boasts 401K DAU on AlphaX, $6M funding, and multi chain deployment (Sui, BSC, Bitcoin), but faces extreme token concentration (97.5% in top 10 wallets) and oversold conditions. Key Levels: Support $0.305 | Resistance $0.420 Derivatives: $20.5M OI, funding rates favor shorts, liquidation risk $539K at $0.308. Watch: Oversold RSI hints at a bounce, but heavy whale dominance and bearish structure suggest caution. Technical relief possible toward $0.42 if support holds

5 0 148 閱讀原文 >釋出後AIA走勢極度看跌AIA token plunged 22%, facing high concentration and bearish structure, beware of downside risk.

5 0 148 閱讀原文 >釋出後AIA走勢極度看跌AIA token plunged 22%, facing high concentration and bearish structure, beware of downside risk. Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX

Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX🚨 #DeAgentAI (#AIA) – Innovation on Top, Chaos Underneath? 🚨 #DeAgentAI is one of the most confusing AI tokens on BSC right now, powerful tech, but wrapped in major structural red flags. Key insights: > Supply numbers don’t match anywhere. BSC shows 200M total supply, while exchanges report 99.5M–129M. This creates real valuation uncertainty and destroys TA reliability. > Whales run the show. Top 5 holders control 68% of supply. One wallet alone holds 31.5M AIA, meaning any single move can nuke liquidity. > High activity, weak liquidity. AIA printed 38,356 transactions and $6.4M volume in 24h, but liquidity sits mostly on PancakeSwap V3, where big orders face dangerous slippage. Retail is active, but depth is thin. > Technical picture is still bearish. RSI oversold (1h & 4h ~25). Price sits below all EMAs. Longs are getting squeezed: $613K long liqs vs $7K shorts. > Narrative remains strong. Partnerships with HyperGPT, zkTLS, and Hyra keep the “AI agent infrastructure” narrative alive, the one thing preventing a full sentiment collapse. $AIA is high-tech, high-risk. Until supply discrepancies and whale concentration are addressed, the token trades like a speculative volatility engine.

6 0 457 閱讀原文 >釋出後AIA走勢極度看跌AIA因供应不匹配、鲸鱼控盘、流动性差及技术看跌,风险极高。

6 0 457 閱讀原文 >釋出後AIA走勢極度看跌AIA因供应不匹配、鲸鱼控盘、流动性差及技术看跌,风险极高。 Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX

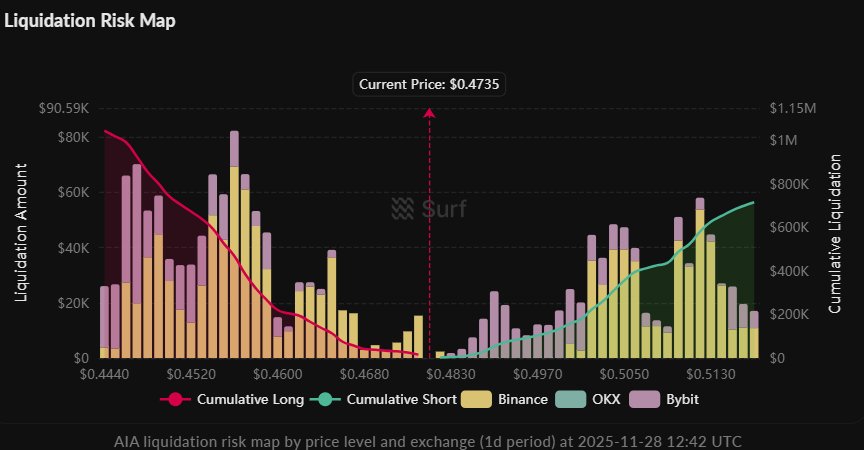

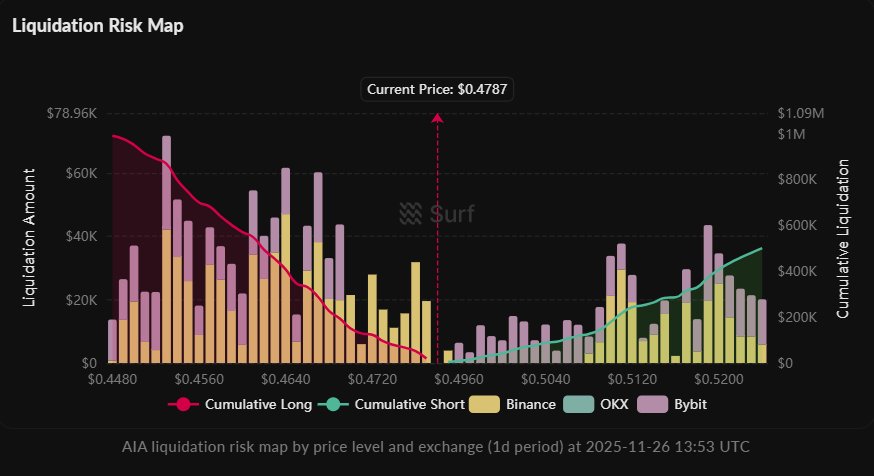

Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX#DeAgentAI ( $AIA ) Crashes 98%, Is the AI Dream Over? $AIA plunged 98% from $28.44 ATH to $0.48 ($47M cap) after Pieverse hype faded. Built for decentralized AI agents with zkTLS Oracles & Memory NFTs, the project boasts $6M seed backing but top 5 wallets control 75% of supply, signaling extreme concentration risk. Why Watch: Multi chain AI infrastructure: Sui, BSC, BTC ecosystems Real world utility via invoice verification & staking Liquidity thin; derivatives show long liquidation risk below $0.47 Technicals bearish; resistance at $0.487, support $0.466 $AIA : high tech AI promise + extreme volatility + whale risk. Only a volume driven bounce above $0.487 could reignite bullish momentum.

7 1 950 閱讀原文 >釋出後AIA走勢極度看跌After AIA's 98% crash, the technical outlook is bearish, liquidity is poor, and there is a long liquidation risk.

7 1 950 閱讀原文 >釋出後AIA走勢極度看跌After AIA's 98% crash, the technical outlook is bearish, liquidity is poor, and there is a long liquidation risk. Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX

Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX⚡️ #DeAgentAI ( $AIA ): 900% Pump, 90% Crash, Extreme Volatility Alert! Price: $0.47 | Market Cap: $47M | Top 5 Holders: 75% #DeAgentAI, a cross chain AI agent infrastructure, surged 900% to $28 after the Pieverse partnership, then plummeted 90%, showing extreme volatility despite real utility. Tech & Utility: zkTLS AI Oracles, Memory NFTs, AI DAO incentives. Tokenomics: Highly concentrated; whale risk & large 2026 unlocks. On Chain: Mostly PancakeSwap, low institutional access, 1.25x 30 day turnover. TA: Bearish trend; support $0.465 to $0.485, resistance $0.499 to $0.532. Sentiment: Mixed, cautious post crash; utility still acknowledged. Bottom Line: Real tech, speculative price swings, whale dominance high risk, high reward play.

8 0 770 閱讀原文 >釋出後AIA走勢看跌AIA experienced a 900% surge followed by a 90% drop, currently in a bear market trend, with significant whale risk.

8 0 770 閱讀原文 >釋出後AIA走勢看跌AIA experienced a 900% surge followed by a 90% drop, currently in a bear market trend, with significant whale risk. Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto🟩🟩 AIA LONG TRADE 🟩🟩 $AIA is making a clean double bottom after its downtrend. Same pattern as BLESS and CC Trying a long now. ENTRY: 0.5 STOP-LOSS: 0.421 TAKE PROFITS: Take 50% out at 0.621, then 50% at 0.774 Leverage: 6X

66 18 12.20K 閱讀原文 >釋出後AIA走勢看漲AIA forms a double bottom and recommends a long trade, target prices 0.621 and 0.774.

66 18 12.20K 閱讀原文 >釋出後AIA走勢看漲AIA forms a double bottom and recommends a long trade, target prices 0.621 and 0.774. Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto

Tryrex Trader TA_Analyst S21.29K @TryrexcryptoGood morning Despite the big win we had on $AIA, I took a loss on $TRUST (-0.9R) and $RESOLV (-1R) Trading is both ups and downs. We keep going today

95 32 6.08K 閱讀原文 >釋出後AIA走勢中性AIA profit, small losses on TRUST and RESOLV, holding positions. CoinMarketCal Media Researcher D111.09K @CoinMarketCal

CoinMarketCal Media Researcher D111.09K @CoinMarketCal$AIA (@deagentai) was a top gainer in the last 24 hours with a significant recent event: 21 Nov 2025 Bitrue Alpha Listing 👉 https://t.co/mh2ipF3gGx More highlights 👉 https://t.co/ihlcRHO7QZ https://t.co/ouDHQk1ZB7

4 3 1.87K 閱讀原文 >釋出後AIA走勢中性The AIA token will be listed on Bitrue Alpha, but AI analysis believes its price impact will be limited.

4 3 1.87K 閱讀原文 >釋出後AIA走勢中性The AIA token will be listed on Bitrue Alpha, but AI analysis believes its price impact will be limited. Ifeanyi🛡 DeFi_Expert Educator B14.15K @Ifeanyi_gmi

Ifeanyi🛡 DeFi_Expert Educator B14.15K @Ifeanyi_gmiSo many cr!mes happening daily onchain. One of your main aim should be how to be involved! GN https://t.co/4NTxxUIWp2

28 10 1.68K 閱讀原文 >釋出後AIA走勢中性The tweet warns of on-chain risks, encourages market participation, and showcases extreme volatility of coin price swings.

28 10 1.68K 閱讀原文 >釋出後AIA走勢中性The tweet warns of on-chain risks, encourages market participation, and showcases extreme volatility of coin price swings.