Arbitrum (ARB)

Arbitrum (ARB)

$0.0992 -4.06% 24H

- 62社交熱度指數(SSI)+6.83% (24h)

- #49市場預警排名(MPR)+53

- 1924小時社交提及量+72.73% (24h)

- 53%24小時KOL看好比例5位活躍KOL

- 概要

- 看漲訊號

- 看跌訊號

社交熱度指數(SSI)

- 總體資料62SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (16%)看漲 (37%)中性 (47%)社交熱度洞察

市場預警排名(MPR)

- 預警解讀

相關推文

- 釋出後ARB走勢看跌

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA19 2 354 閱讀原文 >釋出後ARB走勢看跌

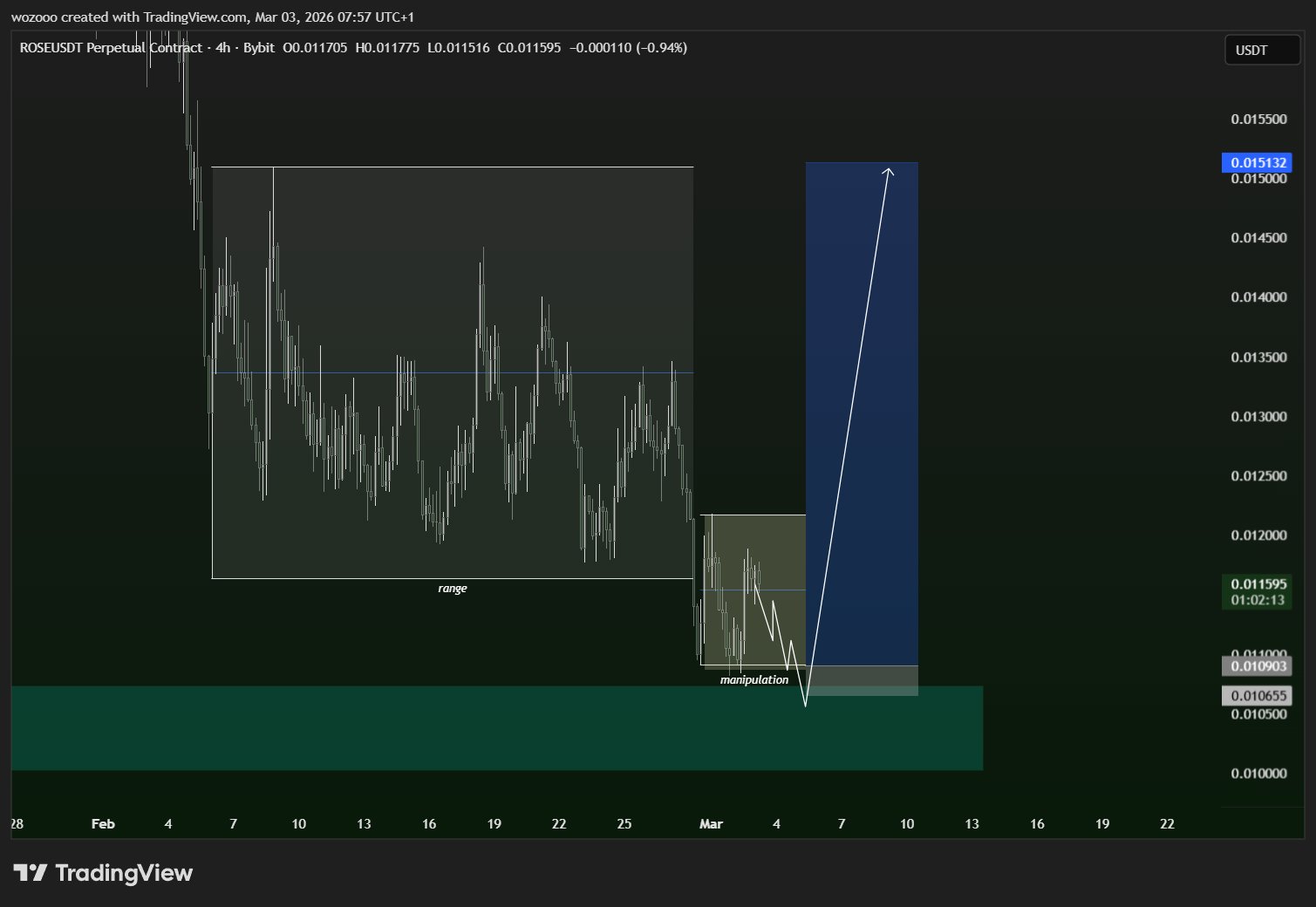

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA19 2 354 閱讀原文 >釋出後ARB走勢看跌 wozo TA_Analyst Trader A2.12K @wozo_capital

wozo TA_Analyst Trader A2.12K @wozo_capital

wozo TA_Analyst Trader A2.12K @wozo_capital

wozo TA_Analyst Trader A2.12K @wozo_capital

63 4 2.37K 閱讀原文 >釋出後ARB走勢看漲

63 4 2.37K 閱讀原文 >釋出後ARB走勢看漲- 釋出後ARB走勢看漲

MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth

MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth crypto.news Media Influencer D111.77K @cryptodotnews

crypto.news Media Influencer D111.77K @cryptodotnews 161 12 6.42K 閱讀原文 >釋出後ARB走勢看漲

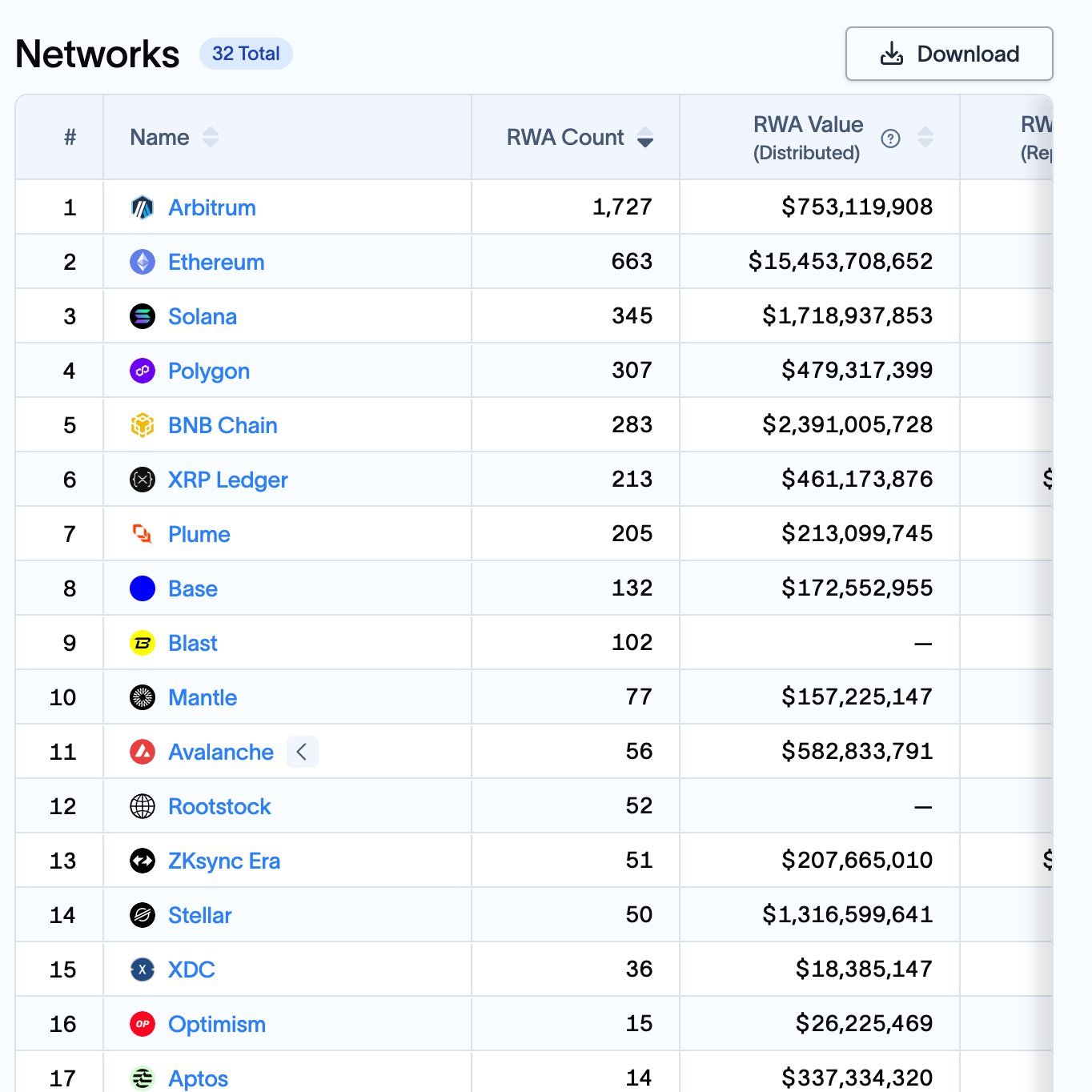

161 12 6.42K 閱讀原文 >釋出後ARB走勢看漲 Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA

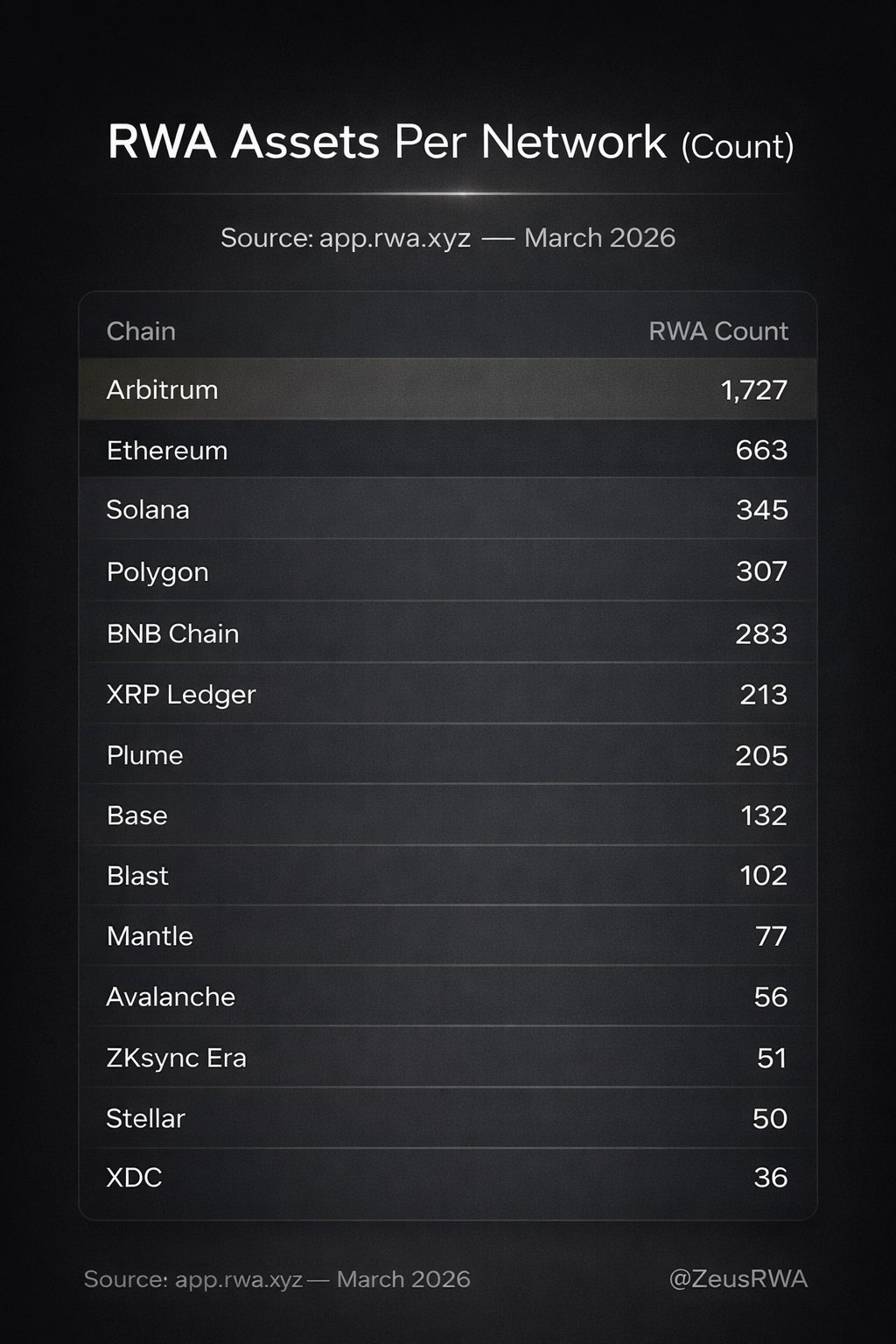

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA 64 10 5.51K 閱讀原文 >釋出後ARB走勢中性

64 10 5.51K 閱讀原文 >釋出後ARB走勢中性 Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA50 20 3.19K 閱讀原文 >釋出後ARB走勢中性

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA50 20 3.19K 閱讀原文 >釋出後ARB走勢中性- 釋出後ARB走勢看漲

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA50 20 3.19K 閱讀原文 >釋出後ARB走勢中性

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA50 20 3.19K 閱讀原文 >釋出後ARB走勢中性 Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA 64 10 5.51K 閱讀原文 >釋出後ARB走勢中性

64 10 5.51K 閱讀原文 >釋出後ARB走勢中性