Circle xStock (CRCLX)

Circle xStock (CRCLX)

- 71社交熱度指數(SSI)- (24h)

- #33市場預警排名(MPR)0

- 124小時社交提及量- (24h)

- 100%24小時KOL看好比例1位活躍KOL

- 概要Kraken acquires BackedFi, xStocks trading volume high, Binance Wallet integration, DeFi collateral attempts, price up 8.6%.

- 看漲訊號

- Kraken acquisition boosts attention

- Binance Wallet integration

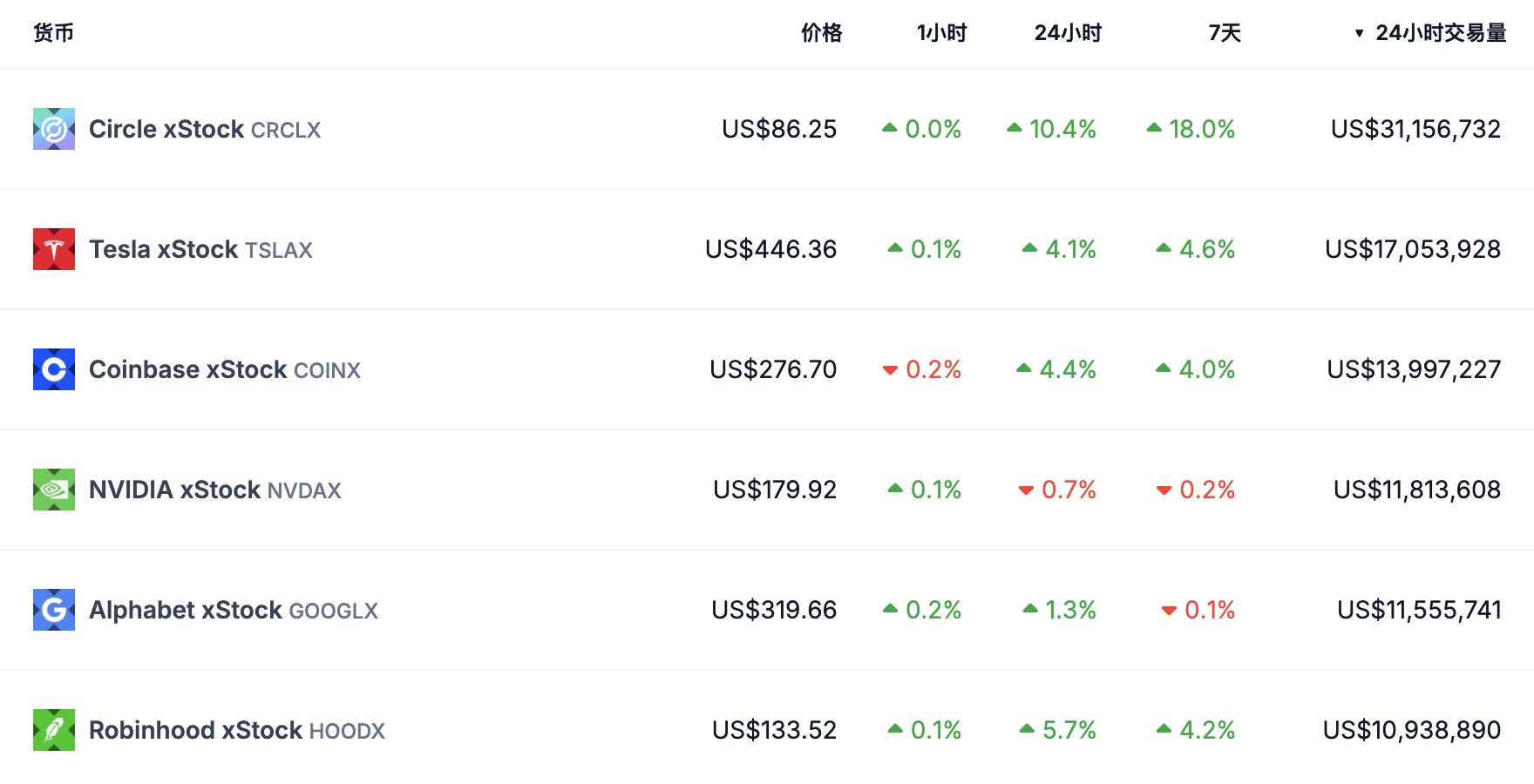

- Trading volume reaches $400 million

- xStocks can be used as collateral

- Price up 8.58% in 24h

- 看跌訊號

- Holding attractiveness declines

- Hyperliquid competition perpetual

- Market expectations not met

- DeFi size remains small

- Relying only on trade&hold

社交熱度指數(SSI)

- 總體資料71SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈看漲 (100%)社交熱度洞察CRCLX social heat is high (70.5/100) with activity score full 40/40, sentiment positive 27.5/30, driven by Kraken's acquisition of BackedFi and Binance Wallet integration, price up 8.6%.

市場預警排名(MPR)

- 預警解讀CRCLX warning rank #33, social abnormality 100/100 (highest), sentiment polarization 50/100, caused by Kraken's acquisition of BackedFi and other hot topics leading to abrupt changes in social behavior.

相關推文

CM FA_Analyst DeFi_Expert A54.05K @cmdefi

CM FA_Analyst DeFi_Expert A54.05K @cmdefiKraken acquires BackedFi (xStocks) and takes another look at the tokenized stock market situation: Several popular stocks have daily trading volumes of $10M‑$30M, such as TSLAx, NVDAx, CRCLx. On-chain cumulative trading volume is $400 million, with CEX volume even higher. Recently Binance Wallet has integrated them, so incremental volume should increase. At present, pure trade‑and‑hold appeal is modest, and with Perps entering the space, a new outlet should be sought. Attention should return to DeFi portfolios. In the past few months, market expectations for this track were very high, but the current state clearly falls short of expectations. Moreover, Hyperliquid HIP3 has started offering perpetual contracts for US equities, further eroding the attractiveness of simply holding and trading tokenized stocks. Building around DeFi should receive more attention from project teams in the future. Currently, xStocks can be used as collateral for borrowing on Kamino, achieving an initial DeFi composability. Although the scale is modest, I consider this a good start and experiment. The xStocks solution is fully backed 1:1 by real stocks, with underlying assets verified via Chainlink PoR, permissionless and freely transferable, providing essential groundwork for DeFi integration. In many other solutions, users cannot move tokens to public blockchains outside the platform, confining them to a trade‑and‑hold niche, which greatly limits those solutions. xStocks’ openness offers an advantage here and could be a breakthrough for the future of tokenized stocks.

Backed D27.79K @BackedFi

Backed D27.79K @BackedFiToday, we are announcing that Backed will become part of @krakenfx. For us, this moment represents the culmination of a long and demanding journey, one shaped by a clear vision, guided by discipline, and driven by a small group of people who believed that equities deserved an open, global, onchain future. Backed was founded in 2021 with an ambitious idea: if the internet has a native currency, it should also have native capital markets. At the time, the space for onchain equities barely existed, and yet the direction was clear to us. Just as stablecoins transformed how money moves online, tokenized equities would one day transform how people access markets. We built Backed around this conviction. Over the years, this small but mighty team has always punched above its weight. Across engineering, operations, marketing, compliance, and product, this group designed and built a tokenization engine adopted by leading exchanges, wallets, and protocols. The work required navigating regulation that was and is still

49 21 9.95K 閱讀原文 >釋出後CRCLX走勢看漲Kraken acquires BackedFi, and the tokenized stock market is seeking new growth through DeFi.

49 21 9.95K 閱讀原文 >釋出後CRCLX走勢看漲Kraken acquires BackedFi, and the tokenized stock market is seeking new growth through DeFi. Jupiter (🐱, 🐐) DeFi_Expert Dev C600.81K @JupiterExchange

Jupiter (🐱, 🐐) DeFi_Expert Dev C600.81K @JupiterExchange Jupiter Uplink D49.62K @jup_uplink

Jupiter Uplink D49.62K @jup_uplinkTrading stocks on this bad boy >>> https://t.co/vGSc33EaKc

137 33 12.18K 閱讀原文 >釋出後CRCLX走勢極度看漲Jupiter demonstrates an innovative way to trade tokenized stocks using vintage watch devices.

137 33 12.18K 閱讀原文 >釋出後CRCLX走勢極度看漲Jupiter demonstrates an innovative way to trade tokenized stocks using vintage watch devices.