Morpho (MORPHO)

Morpho (MORPHO)

$1.80454 -3.15% 24H

- 35社交熱度指數(SSI)-7.01% (24h)

- #66市場預警排名(MPR)+7

- 224小時社交提及量0% (24h)

- 100%24小時KOL看好比例2位活躍KOL

- 概要

- 看漲訊號

- 看跌訊號

社交熱度指數(SSI)

- 總體資料35SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (50%)看漲 (50%)社交熱度洞察

市場預警排名(MPR)

- 預警解讀

相關推文

- 釋出後MORPHO走勢看漲

- 釋出後MORPHO走勢極度看漲

CBduck 🛡️ Influencer Media B14.66K @CoinbaseDuck

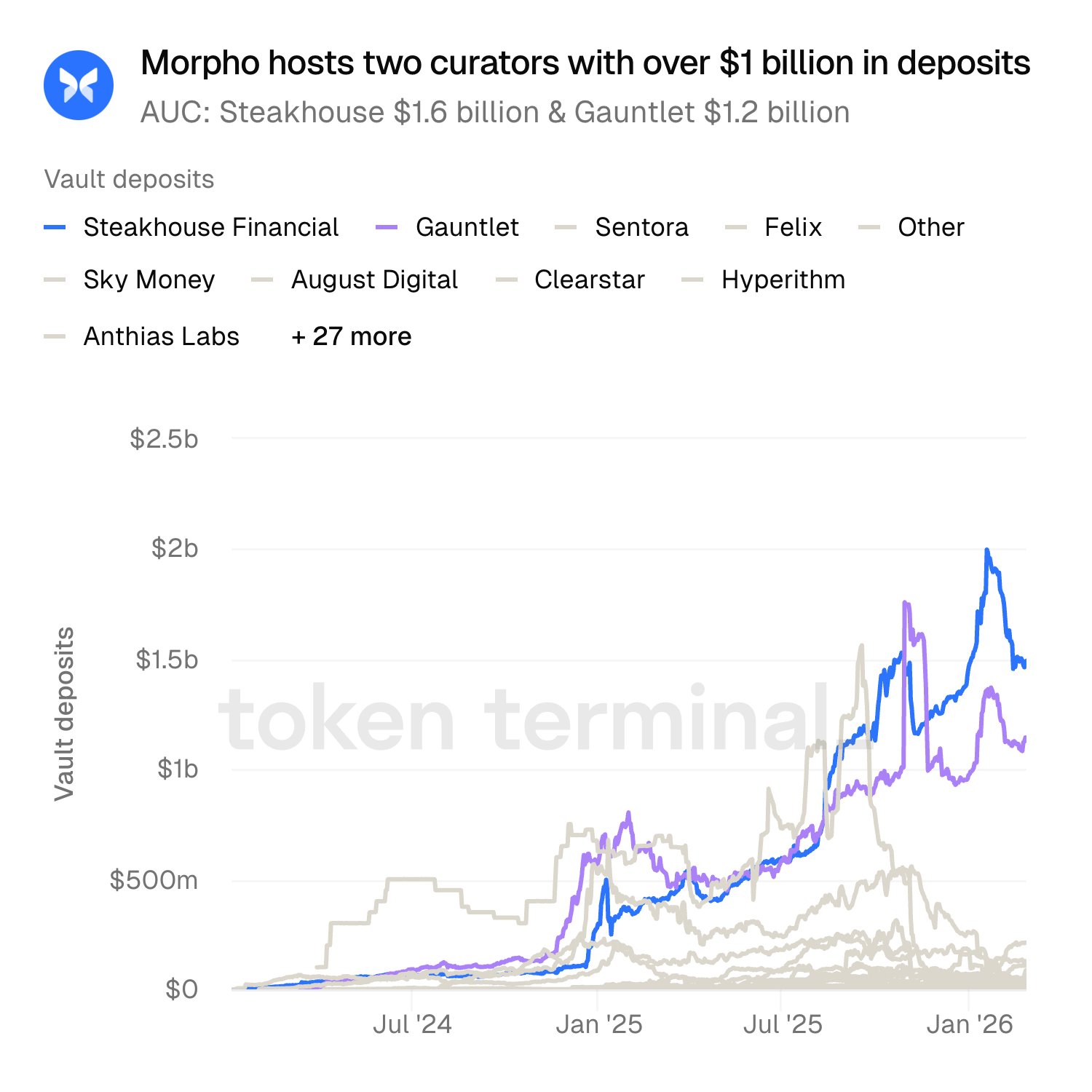

CBduck 🛡️ Influencer Media B14.66K @CoinbaseDuck Token Terminal 📊 D155.17K @tokenterminal

Token Terminal 📊 D155.17K @tokenterminal 25 5 3.28K 閱讀原文 >釋出後MORPHO走勢極度看漲

25 5 3.28K 閱讀原文 >釋出後MORPHO走勢極度看漲 Sjuul | AltCryptoGems TA_Analyst Trader C479.87K @AltCryptoGems

Sjuul | AltCryptoGems TA_Analyst Trader C479.87K @AltCryptoGems

Sjuul | AltCryptoGems TA_Analyst Trader C479.87K @AltCryptoGems

Sjuul | AltCryptoGems TA_Analyst Trader C479.87K @AltCryptoGems 416 13 23.88K 閱讀原文 >釋出後MORPHO走勢極度看漲

416 13 23.88K 閱讀原文 >釋出後MORPHO走勢極度看漲- 釋出後MORPHO走勢看漲

- 釋出後MORPHO走勢極度看漲

Al Bert OnChain_Analyst Tokenomics_Expert B5.64K @Albert_TheVoid

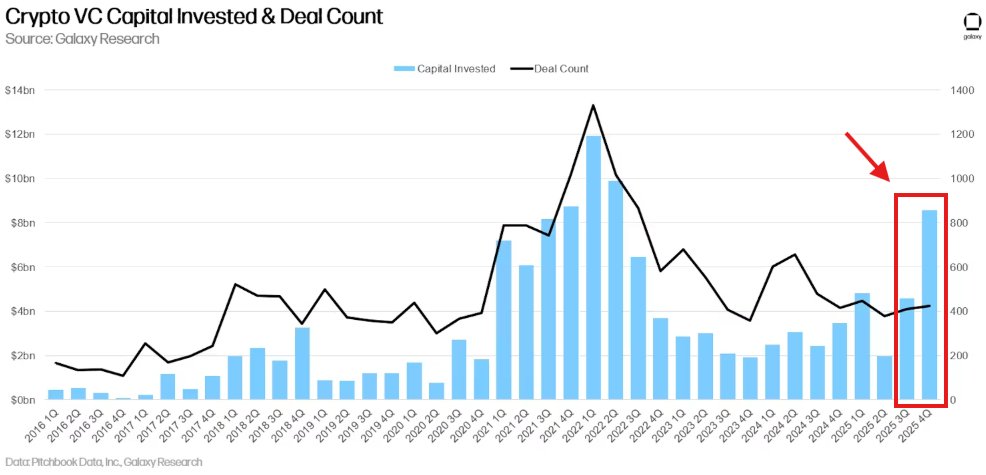

Al Bert OnChain_Analyst Tokenomics_Expert B5.64K @Albert_TheVoid The Kobeissi Letter Media Researcher A1.27M @KobeissiLetter

The Kobeissi Letter Media Researcher A1.27M @KobeissiLetter 1.41K 120 180.05K 閱讀原文 >釋出後MORPHO走勢極度看漲

1.41K 120 180.05K 閱讀原文 >釋出後MORPHO走勢極度看漲- 釋出後MORPHO走勢看跌

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.95K @Freki_OG

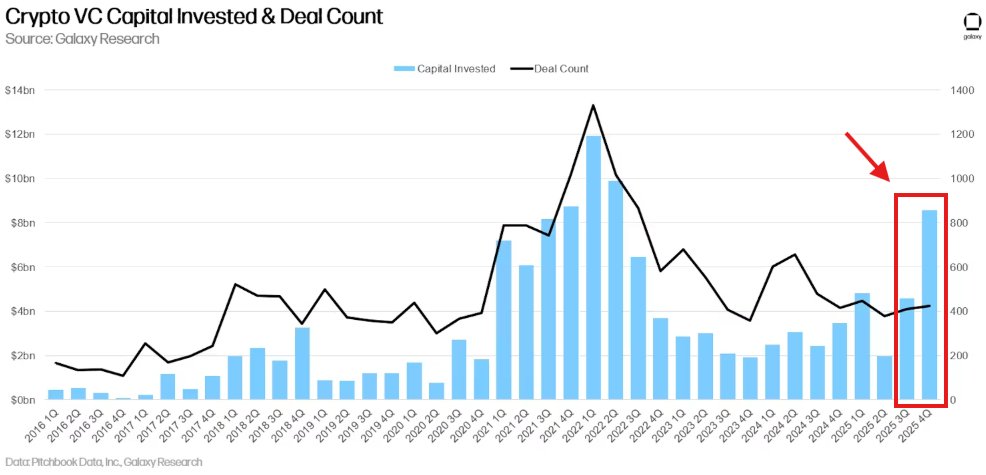

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.95K @Freki_OG The Kobeissi Letter Media Researcher A1.27M @KobeissiLetter

The Kobeissi Letter Media Researcher A1.27M @KobeissiLetter 1.41K 120 180.05K 閱讀原文 >釋出後MORPHO走勢極度看漲

1.41K 120 180.05K 閱讀原文 >釋出後MORPHO走勢極度看漲 Crypto Psychanalyse TA_Analyst Trader B1.66K @CryptoPsycha

Crypto Psychanalyse TA_Analyst Trader B1.66K @CryptoPsycha Trump Fact News 🇺🇸 D193.79K @Trump_Fact_News

Trump Fact News 🇺🇸 D193.79K @Trump_Fact_News

1 0 125 閱讀原文 >釋出後MORPHO走勢極度看漲

1 0 125 閱讀原文 >釋出後MORPHO走勢極度看漲