OPEN (OPEN)

OPEN (OPEN)

- 61社交熱度指數(SSI)-20.96% (24h)

- #80市場預警排名(MPR)-48

- 524小時社交提及量-16.67% (24h)

- 80%24小時KOL看好比例3位活躍KOL

- 概要OPEN received a 5M token corporate buyback and micro reward launch; technical support sits on the Ichimoku cloud; price down 4.73%, social heat down 20.96%.

- 看漲訊號

- 5M corporate buyback

- Micro reward on-chain

- Treasury buyback support

- Ichimoku support

- Breakout of $7.30 expectation

- 看跌訊號

- Price down 4.73%

- Social heat down 20.96%

- High transaction fees

- Low trading sentiment

- Narrow pressure zone

社交熱度指數(SSI)

- 總體資料61SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (40%)看漲 (40%)看跌 (20%)社交熱度洞察OPEN social heat is moderate (60.67/100, -21%), social activity down 27% & sentiment down 22% leading to cooling, KOL attention up 12% affected by 5M buyback and micro reward launch.

市場預警排名(MPR)

- 預警解讀OPEN warning rank fell to #80 (down 48), social anomaly remains high (96.8/100) but sentiment polarization dropped sharply (‑52%), KOL attention shifted to 0, corresponding to a price drop of 4.73% and a sharp fall in social heat.

相關推文

alliseeisW TA_Analyst Trader A6.25K @alliseeis_W

alliseeisW TA_Analyst Trader A6.25K @alliseeis_W$OPEN are you ready for the next leg up? https://t.co/InsqT0hFFv

10 0 480 閱讀原文 >釋出後OPEN走勢看漲Opendoor Technologies (OPEN) shares rose 2.95%, the tweet hints at the next rally.

10 0 480 閱讀原文 >釋出後OPEN走勢看漲Opendoor Technologies (OPEN) shares rose 2.95%, the tweet hints at the next rally. alliseeisW TA_Analyst Trader A6.25K @alliseeis_W

alliseeisW TA_Analyst Trader A6.25K @alliseeis_W$OPEN is fighting right on top of the Ichimoku cloud support again. A breakout over $7.30–$7.35 would flip the structure bullish and open the path toward $7.80+. Tight range… pressure building. One good catalyst and this thing pops. https://t.co/mOA7C4jyO6

6 0 358 閱讀原文 >釋出後OPEN走勢看漲OPEN is consolidating above the Ichimoku cloud support, and a breakout above $7.30-$7.35 could trigger a rise to $7.80+.

6 0 358 閱讀原文 >釋出後OPEN走勢看漲OPEN is consolidating above the Ichimoku cloud support, and a breakout above $7.30-$7.35 could trigger a rise to $7.80+. Vogue Merry DeFi_Expert Researcher C1.39K @MerryGaming

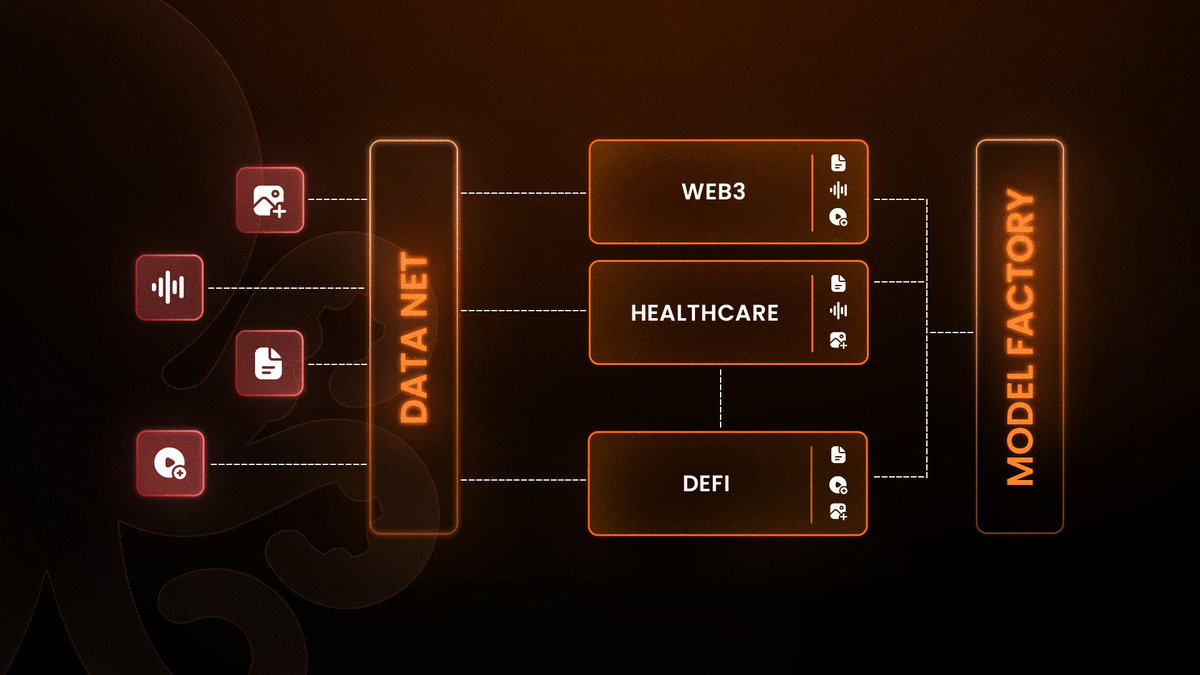

Vogue Merry DeFi_Expert Researcher C1.39K @MerryGaminggm this reads like the first onchain data hustle that isn’t charity minute-scale $OPEN micropays + enterprise-funded buybacks into 0x453243D085E73f1ed471E87cc4cDc7F42AfB9780 makes contributor yield believable my niche datanet: fps hitmarker false positives, controller drift traces, anti‑cheat noise, aim curves, recoil patterns, labeled VOD segments → hash + license → PoA → resubmit on disputes → farm flow on @OpenledgerHQ verifiable attribution + treasury-backed repurchases, who’s shipping gamer sets next

Power.Ranger (Ø,G)🔥 D1.02K @mooon_1123

Power.Ranger (Ø,G)🔥 D1.02K @mooon_1123gm lowkey tried a Datanet on @OpenledgerHQ before coffee. uploaded ~200 labeled clips, locked the hash + license, routed it through PoA, got credited, hit a tiny dispute, resubmitted with better labels, and minutes later small $OPEN micropays pinged my wallet. felt like a real side hustle that buys breakfast, not a one‑time tip then peeped the 5M $OPEN enterprise-funded buyback routing into accumulation wallet 0x453243D085E73f1ed471E87cc4cDc7F42AfB9780 (aiming ~4.5% of supply) verifiable attribution + treasury-backed repurchases actually makes contributor yield believable, not pipe dream 🚀 what odd niche datanet would you ship to farm real yield on #OpenLedger #AI #DataEconomy?

15 5 124 閱讀原文 >釋出後OPEN走勢極度看漲OpenLedger micro‑payments and the 5M $OPEN corporate buyback make contributor yield real and trustworthy.

15 5 124 閱讀原文 >釋出後OPEN走勢極度看漲OpenLedger micro‑payments and the 5M $OPEN corporate buyback make contributor yield real and trustworthy. belk.btc 🟧 FA_Analyst OnChain_Analyst B1.85K @belk3_95

belk.btc 🟧 FA_Analyst OnChain_Analyst B1.85K @belk3_95Tried an end-to-end run on Open Mainnet this morning uploaded a tiny labeled dataset, kicked off a fine-tune, and watched PoA receipts land on-chain like receipts you can actually audit ✅ Every model call, lineage hash, and micropayment was visible thanks to @OpenledgerHQ $OPEN micro-rewards trickled in and the whole flow felt composable and real 🐙 Seeing the 5M $OPEN buyback funded by enterprise revenue makes this more than theory it’s an economic loop: verifiable data → agentic actions → on-chain payouts Who’s building revenue-sharing agents or datanets I can plug into next, and what’s your first micro-reward target?

20 9 134 閱讀原文 >釋出後OPEN走勢極度看漲Openledger mainnet ran successfully, a 5M $OPEN buyback and micro-rewards validate its economic model.

20 9 134 閱讀原文 >釋出後OPEN走勢極度看漲Openledger mainnet ran successfully, a 5M $OPEN buyback and micro-rewards validate its economic model. belk.btc 🟧 FA_Analyst OnChain_Analyst B1.85K @belk3_95

belk.btc 🟧 FA_Analyst OnChain_Analyst B1.85K @belk3_95 lanxing |蓝鸟会🔆 D21.62K @lanxing4

lanxing |蓝鸟会🔆 D21.62K @lanxing4I suggest my friends check how much they've paid in trading fees over the past three months. Here's how: Tap the assets icon at the bottom right, then on the overview screen the contract menu is on the right side; tap Contracts, then tap the small arrow next to today's realized loss. Then look at the funding fees and trading fees. My three‑month trading fees are almost $9,200—scary, it's equivalent to the one‑year salary my wife sent to my sister. https://t.co/mrR0ar5H30

55 34 1.79K 閱讀原文 >釋出後OPEN走勢看跌The author was shocked that his trading fees over the past three months amounted to $9,200.

55 34 1.79K 閱讀原文 >釋出後OPEN走勢看跌The author was shocked that his trading fees over the past three months amounted to $9,200. P|.edge🦭 Researcher DeFi_Expert B2.21K @eth2828

P|.edge🦭 Researcher DeFi_Expert B2.21K @eth2828Real PoA rails on @OpenledgerHQ hitting instant non-custodial micropayments back to source is actually insane. Data streams flipping from extractive blackbox to liquid provenance feels like the moment AI economics stops robbing contributors in broad daylight. $OPEN isn’t a claim—it’s full settlement rails. DeAI is gonna vaporize the Web2 leech model.

WanXiao 🌊 RIVER|.edge🦭 D1.04K @0xWANXIAO

WanXiao 🌊 RIVER|.edge🦭 D1.04K @0xWANXIAOThe next trillion-dollar question isn’t *if* AI agents will dominate, but *who* gets paid when they do 🧐 The old Web2 way? Data feeds black boxes, centralized extraction, contributors get zero. The new DeAI way? Accountable, transparent, and rewarding. I spent time mapping out the workflow on @OpenledgerHQ mainnet and the accountability layer is what blows my mind It’s not just a claim about agentic revenue sharing it’s an actual, verifiable rail system > Data Contributor uploads to Datanet > PoA attribution tracks lineage data → model → execution output > Agent action triggers immediate, non-custodial micropayments back to the contributor This stack provides real liquidity for intelligence, securing true provenance. It’s what transforms data from an asset that can be stolen into a stream that generates automated $OPEN rewards. This feels like the first time AI economics is actually built to empower the source, not just the middleman. Are you setting up your data streams yet #DeAI #ProofOfAttribution #A

7 3 94 閱讀原文 >釋出後OPEN走勢看漲OPEN achieves instant non-custodial micro‑payments, empowering data contributors egoego⚡💵 Community_Lead Influencer B2.86K @egoegodifi

egoego⚡💵 Community_Lead Influencer B2.86K @egoegodifi egoego⚡💵 Community_Lead Influencer B2.86K @egoegodifi

egoego⚡💵 Community_Lead Influencer B2.86K @egoegodifiI have been a believer of what @OpenledgerHQ is building. I am going to do a daily price update of $OPEN until we get back to a reasonable price of $0.5 to $1. The team had started another wave of buybacks from enterprise income, I believe this buybacks will be very important to sustain Proof of Attribution long term. Current price : $0.227 ATH : $1.82 ATL : $0.209 C. Supply: 215.5M

19 15 364 閱讀原文 >釋出後OPEN走勢看漲The author is bullish that OPEN will rebound to $0.5–1, and the team is conducting buybacks.

19 15 364 閱讀原文 >釋出後OPEN走勢看漲The author is bullish that OPEN will rebound to $0.5–1, and the team is conducting buybacks. egoego⚡💵 Community_Lead Influencer B2.86K @egoegodifi

egoego⚡💵 Community_Lead Influencer B2.86K @egoegodifiI have been a believer of what @OpenledgerHQ is building. I am going to do a daily price update of $OPEN until we get back to a reasonable price of $0.5 to $1. The team had started another wave of buybacks from enterprise income, I believe this buybacks will be very important to sustain Proof of Attribution long term. Current price : $0.227 ATH : $1.82 ATL : $0.209 C. Supply: 215.5M

19 15 364 閱讀原文 >釋出後OPEN走勢看漲The author is bullish that OPEN will rebound to $0.5–1, and the team is conducting buybacks.

19 15 364 閱讀原文 >釋出後OPEN走勢看漲The author is bullish that OPEN will rebound to $0.5–1, and the team is conducting buybacks. deathmage.x .edge🦭 DeFi_Expert Researcher B2.27K @phanthanguss

deathmage.x .edge🦭 DeFi_Expert Researcher B2.27K @phanthangussJust tested this pipeline on @OpenledgerHQ dropped a niche video dataset into Datanets: hash + license + timestamp chained, Proof-of-Attribution pings my address instantly, influence score shifts smooth; forked a lightweight model via ModelFactory + OpenLoRA, handed it to OPEN Agent for a natural language run. OpenGradient's TEE+ZKML spits back encrypted receipts, fully replayable on-chain, micro $OPEN inflows hit based on proofs, no luck needed, just credentials damn, it's clicking Mainnet's humming, contributions to settlements locked in tight, leaderboard's no joke. Backed by enterprise revenue, that 5M $OPEN buyback rolls on, pure cash flywheel no inventory BS, got me stacking harder. Layer on @miranetwork $MIRA's identity + rep stack, agent chats flip from you who? to prove it game changer for verifiable econ Next move: chaining a cross-domain intent agent to stress-test multi-modal convergence, or dumping ancient archive scans for cultural proof flows? Who's running what first let's see those zero-know receipts stack #OnchainAI #Datanets #AgentEcon #OpenLedger

LyLy.eth(小林)💥 D1.24K @jack36363366

LyLy.eth(小林)💥 D1.24K @jack36363366Last night I tossed a niche video dataset into @OpenledgerHQ's Datanets: hash + license + timestamp on-chain, Proof‑of‑Attribution returned to my address in seconds, influence score shifted a bit; then used ModelFactory + OpenLoRA to fork a lightweight model, gave it to OPEN Agent to execute a small action from a natural language command. Throughout, OpenGradient's TEE+ZKML sent me encrypted receipts, the kind that can be replayed on-chain, micro $OPEN inflows came in not by luck but by proof, pretty interesting. Even better, the mainnet is live, contributions → settlements are flowing smoothly, the leaderboard isn’t just for show. Plus, the 5M $OPEN buyback backed by enterprise revenue continues, no inventory tricks, this hard‑cash‑driven flywheel makes me more confident to double down. Adding @miranetwork $MIRA’s identity and reputation layer, communication and execution between agents no longer rely on “Do I know you?” but on “Can you prove it?” #OnchainAI #Datanets #AgentEcon #OpenLedger What data will you upload next, or which agent will you put on-chain to test this verifiable pipeline?

2 3 28 閱讀原文 >釋出後OPEN走勢極度看漲The OpenledgerHQ ecosystem performs excellently, $OPEN has enterprise revenue support and buyback, the author is extremely bullish.

2 3 28 閱讀原文 >釋出後OPEN走勢極度看漲The OpenledgerHQ ecosystem performs excellently, $OPEN has enterprise revenue support and buyback, the author is extremely bullish. belk.btc 🟧 FA_Analyst OnChain_Analyst B1.85K @belk3_95

belk.btc 🟧 FA_Analyst OnChain_Analyst B1.85K @belk3_95GM CT! played with @OpenledgerHQ mainnet uploaded a niche dataset, locked it to a datanet, watched provenance flow onchain 😌 poa stamped my handle → dataset → OpenLoRA bump zk-style attest kept me private but rewards fair set agent splits, agent ran, micropays landed in $OPEN saw $5M rev-funded buyback shrinking supply + clear post‑TGE window Nov12→Feb12 2026 not hype felt like real liquidity for contributors curious how datanets scale provenance across datasets & models while keeping attestation tight? anyone else farming verifiable yield on #DeAI #OpenLedger $OPEN gOpenLedger🐙

NotVitalik.eth 👑🪐 D1.03K @KtownSexyindian

NotVitalik.eth 👑🪐 D1.03K @KtownSexyindianGM CT! woke up poking at @OpenledgerHQ mainnet and ran a tiny play uploaded a niche dataset, locked it to a Datanet, and watched provenance actually flow onchain 😌 1) PoA stamped my handle → dataset → OpenLoRA model bump 2) zk-style attest kept my identity private but rewards fair 3) set agent splits, agent executed, micropayments landed in $OPEN 4) saw the economics: $5M buyback (revenue-funded) shrinking supply + clear post‑TGE window Nov 12 → Feb 12 2026 Not hype felt like real liquidity for contributors. Anyone else running datanets this morning to farm verifiable yield on #DeAI #OpenLedger #DataEconomy #Web3 #AI $OPEN gOpenLedger🐙?

8 4 140 閱讀原文 >釋出後OPEN走勢看漲OPEN's returns are real, buybacks shrink supply, anticipating long-term gains