Sei Network (SEI)

Sei Network (SEI)

$0.0657 -4.37% 24H

- 67社交熱度指數(SSI)-9.44% (24h)

- #21市場預警排名(MPR)0

- 824小時社交提及量+14.29% (24h)

- 100%24小時KOL看好比例7位活躍KOL

- 概要

- 看漲訊號

- 看跌訊號

社交熱度指數(SSI)

- 總體資料67SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (50%)看漲 (50%)社交熱度洞察

市場預警排名(MPR)

- 預警解讀

相關推文

StakingCabin Dev OnChain_Analyst C2.70K @stakingcabin

StakingCabin Dev OnChain_Analyst C2.70K @stakingcabin Sei Media Community_Lead C780.45K @SeiNetwork

Sei Media Community_Lead C780.45K @SeiNetwork 1 1 18 閱讀原文 >釋出後SEI走勢極度看漲

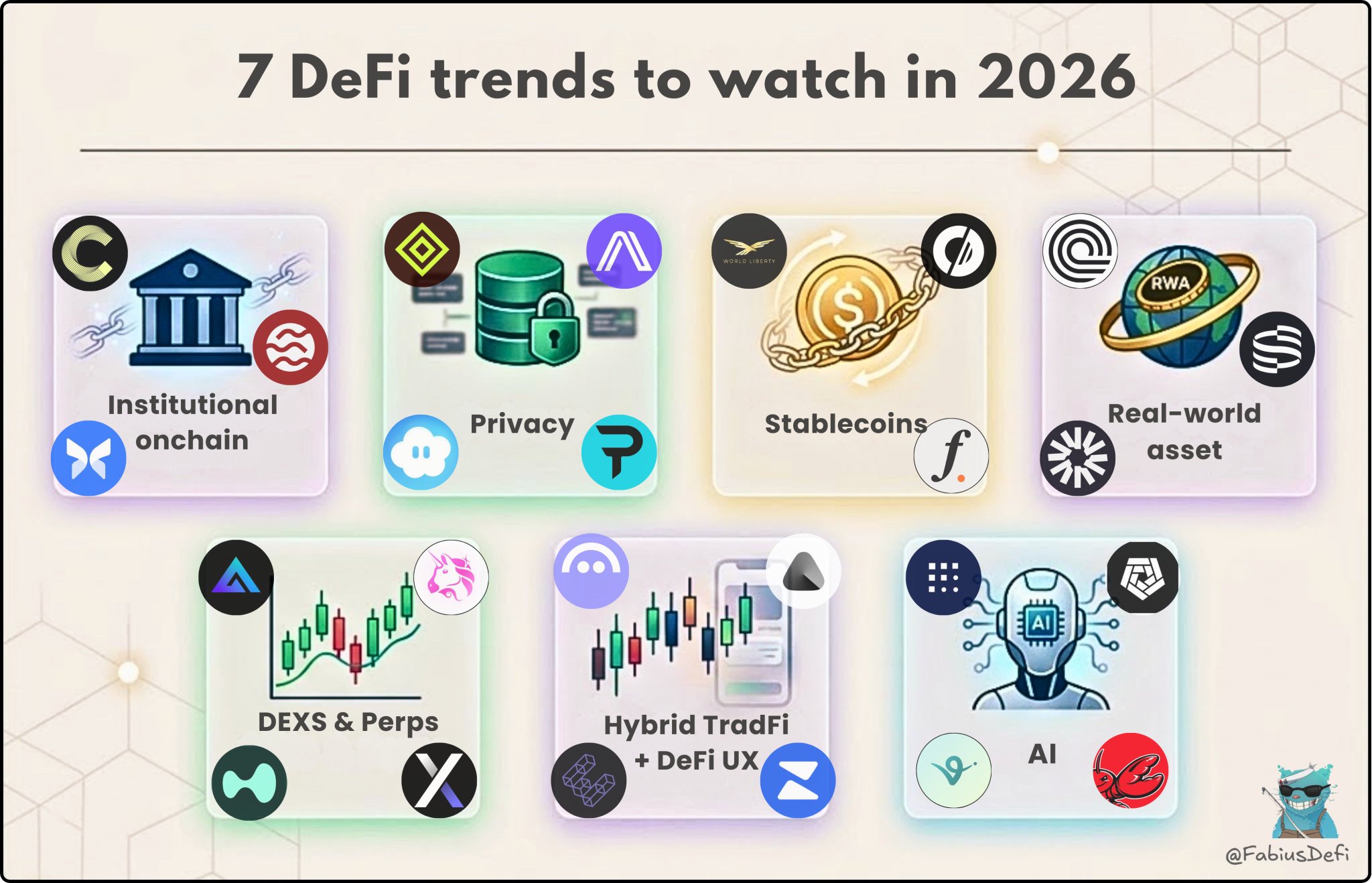

1 1 18 閱讀原文 >釋出後SEI走勢極度看漲 Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi

Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi

Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi 131 53 4.72K 閱讀原文 >釋出後SEI走勢看漲

131 53 4.72K 閱讀原文 >釋出後SEI走勢看漲 Sei Media Community_Lead C780.45K @SeiNetwork

Sei Media Community_Lead C780.45K @SeiNetwork Sei Media Community_Lead C780.45K @SeiNetwork

Sei Media Community_Lead C780.45K @SeiNetwork 535 52 29.09K 閱讀原文 >釋出後SEI走勢看漲

535 52 29.09K 閱讀原文 >釋出後SEI走勢看漲- 釋出後SEI走勢極度看漲

nbdieu.sei 🔴💨 Community_Lead Media B3.69K @nbdieu

nbdieu.sei 🔴💨 Community_Lead Media B3.69K @nbdieu Sei Media Community_Lead C780.45K @SeiNetwork

Sei Media Community_Lead C780.45K @SeiNetwork 535 52 29.09K 閱讀原文 >釋出後SEI走勢看漲

535 52 29.09K 閱讀原文 >釋出後SEI走勢看漲 Campbell | now replaceable with Claude Media Influencer B5.02K @CampbellEaston

Campbell | now replaceable with Claude Media Influencer B5.02K @CampbellEaston Jay ($/acc) D26.48K @jayendra_jog66 9 2.22K 閱讀原文 >釋出後SEI走勢看漲

Jay ($/acc) D26.48K @jayendra_jog66 9 2.22K 閱讀原文 >釋出後SEI走勢看漲- 釋出後SEI走勢極度看漲

Gilmo FA_Analyst OnChain_Analyst B15.30K @0xgilllee

Gilmo FA_Analyst OnChain_Analyst B15.30K @0xgilllee

Token Relations 📊 D11.82K @TokenRelations80 31 3.78K 閱讀原文 >釋出後SEI走勢極度看漲

Token Relations 📊 D11.82K @TokenRelations80 31 3.78K 閱讀原文 >釋出後SEI走勢極度看漲- 釋出後SEI走勢看漲

Sei Media Community_Lead C780.45K @SeiNetwork

Sei Media Community_Lead C780.45K @SeiNetwork Sei Media Community_Lead C780.45K @SeiNetwork337 30 16.66K 閱讀原文 >釋出後SEI走勢看漲

Sei Media Community_Lead C780.45K @SeiNetwork337 30 16.66K 閱讀原文 >釋出後SEI走勢看漲