Bittensor (TAO)

Bittensor (TAO)

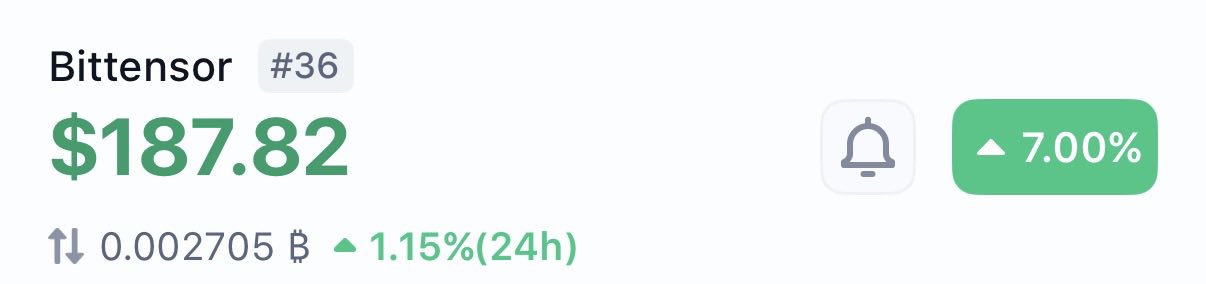

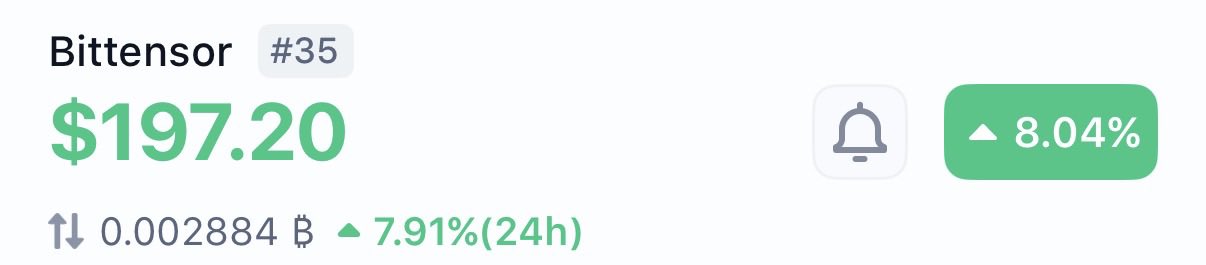

$178.94 -2.52% 24H

- 76社交熱度指數(SSI)+10.75% (24h)

- #68市場預警排名(MPR)+20

- 4224小時社交提及量+68.00% (24h)

- 89%24小時KOL看好比例23位活躍KOL

- 概要

- 看漲訊號

- 看跌訊號

社交熱度指數(SSI)

- 總體資料76SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (29%)看漲 (60%)中性 (10%)看跌 (1%)社交熱度洞察

市場預警排名(MPR)

- 預警解讀

相關推文

- 釋出後TAO走勢中性

Connor On-Chain FA_Analyst OnChain_Analyst B8.43K @ConnorOnChain

Connor On-Chain FA_Analyst OnChain_Analyst B8.43K @ConnorOnChain Millie D1.59K @AltcoinMillie

Millie D1.59K @AltcoinMillie 5 0 233 閱讀原文 >釋出後TAO走勢看漲

5 0 233 閱讀原文 >釋出後TAO走勢看漲 Connor On-Chain FA_Analyst OnChain_Analyst B8.43K @ConnorOnChain

Connor On-Chain FA_Analyst OnChain_Analyst B8.43K @ConnorOnChain Shizzy D11.82K @ShizzyUnchained13 1 621 閱讀原文 >釋出後TAO走勢看漲

Shizzy D11.82K @ShizzyUnchained13 1 621 閱讀原文 >釋出後TAO走勢看漲 Mariuszek FA_Analyst Community_Lead S4.03K @sobczak_mariusz

Mariuszek FA_Analyst Community_Lead S4.03K @sobczak_mariusz Zeus | SN 18 D1.98K @zeussubnet10 1 586 閱讀原文 >釋出後TAO走勢看漲

Zeus | SN 18 D1.98K @zeussubnet10 1 586 閱讀原文 >釋出後TAO走勢看漲 Robin τ Tokenomics_Expert OnChain_Analyst B10.29K @Robin_T100

Robin τ Tokenomics_Expert OnChain_Analyst B10.29K @Robin_T100 Robin τ Tokenomics_Expert OnChain_Analyst B10.29K @Robin_T10012 0 461 閱讀原文 >釋出後TAO走勢看漲

Robin τ Tokenomics_Expert OnChain_Analyst B10.29K @Robin_T10012 0 461 閱讀原文 >釋出後TAO走勢看漲 Tseu Tseu - τao OnChain_Analyst Tokenomics_Expert S5.26K @tseutseutao

Tseu Tseu - τao OnChain_Analyst Tokenomics_Expert S5.26K @tseutseutao Openτensor Foundaτion D167.63K @opentensor77 0 2.80K 閱讀原文 >釋出後TAO走勢看漲

Openτensor Foundaτion D167.63K @opentensor77 0 2.80K 閱讀原文 >釋出後TAO走勢看漲 Alpha co Derivatives_Expert Trader C36.30K @alpha_co

Alpha co Derivatives_Expert Trader C36.30K @alpha_co

Alpha co Derivatives_Expert Trader C36.30K @alpha_co

Alpha co Derivatives_Expert Trader C36.30K @alpha_co 17 2 930 閱讀原文 >釋出後TAO走勢極度看漲

17 2 930 閱讀原文 >釋出後TAO走勢極度看漲- 釋出後TAO走勢看漲

- 釋出後TAO走勢中性

- 釋出後TAO走勢極度看漲