Velvet (VELVET)

Velvet (VELVET)

- 38社交熱度指數(SSI)-19.50% (24h)

- #159市場預警排名(MPR)-19

- 124小時社交提及量-50.00% (24h)

- 100%24小時KOL看好比例1位活躍KOL

- 概要VELVET has risen 295% since issuance, features real AI+DeFi usage and has received KOL praise, with a 24h price drop of 1.1% and social hype down 19.5%.

- 看漲訊號

- Up 295% since issuance

- Real AI+DeFi usage

- Multiple KOLs give positive feedback

- Smooth UI product launched

- AI DeFi growth potential

- 看跌訊號

- 24h price down 1.1%

- Social hype down 19.5%

- Overall new token down 70%

- Possible profit-taking

- Risk of sentiment decline

社交熱度指數(SSI)

- 總體資料38SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈看漲 (100%)社交熱度洞察VELVET social hype is moderate to low (37.8/100, -19.5%), activity fell 46.7% to 9.33/40, positive sentiment remains high (27.5/30) but KOL attention has halved, mainly due to the 24h price pullback and the decline in new token hype.

市場預警排名(MPR)

- 預警解讀VELVET warning rank fell to #159 (down 19), social anomaly score is 0/100 and has disappeared, sentiment polarization remains at 50/100, KOL attention shift decreased, overall abnormal signals are weak, reflecting the regular fluctuation of a slight recent price pullback.

相關推文

Mookie Founder Influencer B152.06K @MookieNFT

Mookie Founder Influencer B152.06K @MookieNFTChecking @Velvet_Capital today and the numbers look really impressive $VELVET is up almost +295% since launch… Meanwhile most new tokens this year are down 70% or more And honestly $VELVET still feels underrated for what it offers Here’s why I think Velvet stands out: > Real usage, not just hype > Working AI + DeFi tools > Smooth UI and clean execution > People actually trade and build portfolios on it Many new AI + DeFi tools are launching but Velvet is still ahead with real products and real traction. If AI DeFi keeps growing $VELVET could go much higher. NFA just my honest view 🫡

203 103 14.71K 閱讀原文 >釋出後VELVET走勢看漲VELVET has risen nearly 295% since issuance, and the author is bullish on its AI+DeFi potential.

203 103 14.71K 閱讀原文 >釋出後VELVET走勢看漲VELVET has risen nearly 295% since issuance, and the author is bullish on its AI+DeFi potential. Fablo Educator Researcher B8.39K @0xfablo

Fablo Educator Researcher B8.39K @0xfabloHere's my take on the @Velvet Capital streak system. Seems like @soliieth is enjoying the boosted rewards for consistent use. I wonder how many ppl are actually using these types of loyalty programs in DeFi. 🤔 Does anyone else find that daily reward systems actually keep you engaged with a protocol, or is it more of a chore?

Soli D2.87K @soliieth

Soli D2.87K @soliiethSo now that I've hit a 23 day streak, I get 2x Gems on any volume on @Velvet_Capital also curious, if I miss a day, does the streak reset completely to zero or do I just lose a day? 36M $VELVET remaining in the pool. playing the long game here. https://t.co/Jd3fVRK5yI

9 8 115 閱讀原文 >釋出後VELVET走勢看漲User participates in Velvet Capital streak challenge, receives high multiplier rewards, and is bullish on $VELVET long-term value.

9 8 115 閱讀原文 >釋出後VELVET走勢看漲User participates in Velvet Capital streak challenge, receives high multiplier rewards, and is bullish on $VELVET long-term value. OCT Gems FA_Analyst Influencer S11.25K @oct_gems

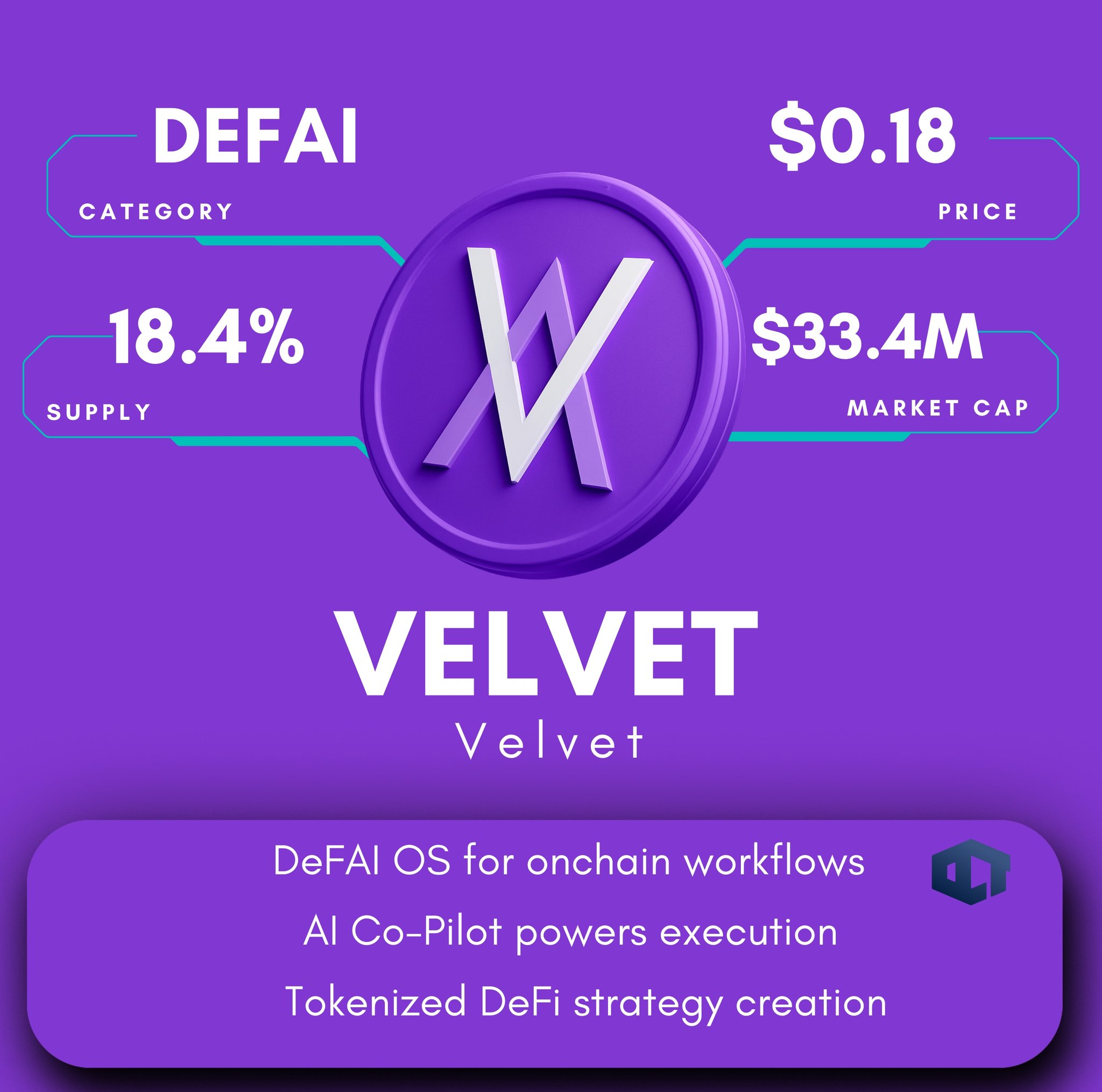

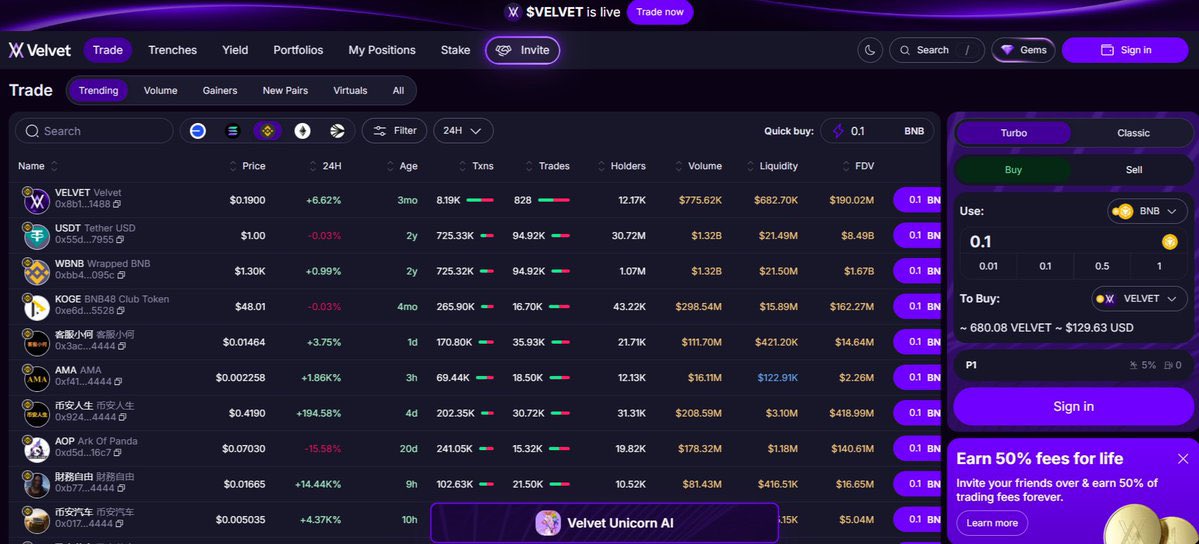

OCT Gems FA_Analyst Influencer S11.25K @oct_gems🚨 𝐆𝐞𝐦 𝐀𝐥𝐞𝐫𝐭 🚨 💎 $VELVET 💎 @Velvet_Capital 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰 : 👉 Velvet is a DeFAI Operating System streamlining onchain research, trading & portfolio management. 👉 It's multi-agent Al Co-Pilot integrated into the app to help discover, analyze & execute new opportunities using natural language. 👉 Velvet infrastructure also allows others to create tokenized DeFi strategies & manage them via UI or APIs. 🪙 𝐓𝐨𝐤𝐞𝐧𝐨𝐦𝐢𝐜𝐬 : 🔺 Token Ticker: $VELVET 🔺 Current price: $0.18 🔺Market cap: $33.44M 🔺Circulation supply: 184.44 million 🔺Total Supply: 1 billion Always take whatever you read on the internet with a pinch of salt, do your own research, NFA

16 3 398 閱讀原文 >釋出後VELVET走勢看漲VELVET is a DeFAI operating system with an AI Co-Pilot feature, current price $0.18.

16 3 398 閱讀原文 >釋出後VELVET走勢看漲VELVET is a DeFAI operating system with an AI Co-Pilot feature, current price $0.18. icefrog.◎ 🇻🇳 | 🎒 OnChain_Analyst Trader B6.29K @icefrog_sol

icefrog.◎ 🇻🇳 | 🎒 OnChain_Analyst Trader B6.29K @icefrog_solQuick guide if you hold $VELVET and want it to work for you Stake in Falcon’s Staking Vaults → keep $VELVET exposure → earn $USDf APR range sits around 20 35%, 180d lockup, 3d cooldown, 50M cap on @BNBCHAIN It’s non-custodial and the flow via @Velvet_Capital feels like an OS: clear steps, risk shown upfront, no maze of clicks Inter‑protocol staking means you tap Falcon’s infra while staying inside the Velvet ecosystem I locked mine today aiming for the upper band, treating it as productive collateral Who else is parking $VELVET for $USDf rewards right now #DeFi #staking #BNBChain

23 14 233 閱讀原文 >釋出後VELVET走勢極度看漲推荐质押VELVET获取20-35% APR的USDf收益,作者已参与。

23 14 233 閱讀原文 >釋出後VELVET走勢極度看漲推荐质押VELVET获取20-35% APR的USDf收益,作者已参与。 DWF Labs VC DeFi_Expert C125.62K @DWFLabs

DWF Labs VC DeFi_Expert C125.62K @DWFLabs Falcon Finance 🦅🟠 D111.77K @falconfinance

Falcon Finance 🦅🟠 D111.77K @falconfinance$VELVET staking just landed on Falcon’s Staking Vaults. Stake VELVET, keep your exposure, earn $USDf. The VELVET Vault comes with a range of 20–35% estimated APR, 180d lockup, 3d cooldown, and a 50M cap on @BNBCHAIN. This gives VELVET holders a new way to turn an ecosystem token into productive collateral, powered by Falcon’s infrastructure. Big nod to @Velvet_Capital for making this possible!

140 72 8.86K 閱讀原文 >釋出後VELVET走勢看漲VELVET has launched a staking vault on Falcon, offering 20-35% APR, enhancing its collateral value within the BNBCHAIN ecosystem.

140 72 8.86K 閱讀原文 >釋出後VELVET走勢看漲VELVET has launched a staking vault on Falcon, offering 20-35% APR, enhancing its collateral value within the BNBCHAIN ecosystem. Nofuturistic.eth 👻 Founder Influencer C12.91K @nofuture

Nofuturistic.eth 👻 Founder Influencer C12.91K @nofutureYou can now stake @Velvet_Capital $VELVET on Falcon Finance's Vaults and earn up to 35% APR in USDf. There is an 180 days lock up and a 3 day cooldown before you can withdraw. I love to see more ways to earn yield on $VELVET! https://t.co/3RwOO2IckF

22 19 301 閱讀原文 >釋出後VELVET走勢看漲VELVET代币现可在Falcon Finance质押,提供高达35%年化收益。

22 19 301 閱讀原文 >釋出後VELVET走勢看漲VELVET代币现可在Falcon Finance质押,提供高达35%年化收益。 Nofuturistic.eth 👻 Founder Influencer C12.91K @nofuture

Nofuturistic.eth 👻 Founder Influencer C12.91K @nofutureThe 208k of $VELVET in rewards for the @Velvet_Capital Wallchain campaign is pretty attractive especially if you stake your rewards to earn gems in their trading Epochs. They have 40 epochs planned with 1 million VELVET up for grabs each epoch. Stake to earn is real https://t.co/J1cMApscGV

19 14 225 閱讀原文 >釋出後VELVET走勢看漲Velvet Capital offers generous rewards; staking VELVET can earn you more.

19 14 225 閱讀原文 >釋出後VELVET走勢看漲Velvet Capital offers generous rewards; staking VELVET can earn you more. Chanimal 🍌 $APE 🦍 Noya NFT_Expert DeFi_Expert C24.29K @JaysonCrypto

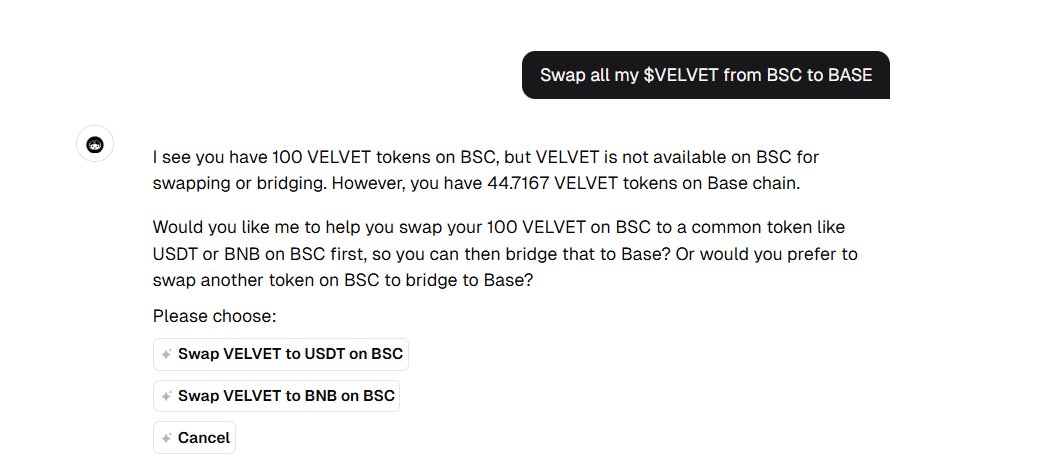

Chanimal 🍌 $APE 🦍 Noya NFT_Expert DeFi_Expert C24.29K @JaysonCryptoAll systems have room for improvement & Elsa is no different. I finally came across something that was not 1 step on Elsa today. I asked @HeyElsaAI to swap all my $VELVET, the native token from @Velvet_Capital on BSC to Base as they do both exists. However, Elsa was not able to do it but offer me a solution for 2 steps of swapping it to USDT or USDC then bridge to Base. The underlying issue is the bridge provider used the Elsa cannot support it.

60 35 672 閱讀原文 >釋出後VELVET走勢中性Elsa AI cannot directly perform the cross-chain swap of VELVET from BSC to Base; it needs to be done in two steps.

60 35 672 閱讀原文 >釋出後VELVET走勢中性Elsa AI cannot directly perform the cross-chain swap of VELVET from BSC to Base; it needs to be done in two steps. THEDEFIGURU OnChain_Analyst DeFi_Expert B58.62K @TheDeFiGuru_

THEDEFIGURU OnChain_Analyst DeFi_Expert B58.62K @TheDeFiGuru_VELVET: TURNING DEFI INTO A SELF-DRIVING MONEY MACHINE DeFi’s eternal curse? Killer strategies trapped in spreadsheets, weekends lost to manual rebalances, and portfolios nuked by one bad move while you sleep. @Velvet_Capital is torching that mess with an AI-powered onchain terminal that turns your wallet into something much closer to a self-driving fund. At the core is their DeFAI OS an adaptive intelligence layer that plugs into your wallet, learns your risk profile, reads onchain data in real time, and adjusts as markets shift. No more “set it and forget it” fairy tale, just systems that actually respond. What it unlocks 👇 🔹 Adaptive Vaults that rotate across protocols using live APY forecasts, dodging rugs and hunting yield without constant clicking 🔹 AI Portfolio Sentinel that flags MEV risk, predicts drawdowns, and helps hedge before the dump hits the timeline 🔹 One-Click Strategy Forge where you describe “max yield on stables under 5% vol” and get a verifiable onchain strategy instead of a PDF 🔹 Cross-Chain Orchestrator that bridges, swaps, and farms across EVMs without leaving dust bags everywhere 🔹 Security-first stack audited by PeckShield, Spearbit, ShellBoxes and more, plus Forta, OpenZeppelin tools, and live bug bounties watching the rails On top of that, their terminal has become my favorite way to actually look at markets: RSI, MACD, Bollinger, OBV, liquidity, market cap all on a single screen. Data → interpretation → decision. DYOR, but faster and cleaner. This isn’t another “AI dashboard with lipstick.” It’s closer to a DeFi cockpit that can fly itself, while still letting you eject or override whenever you want. ✍️ Conclusion: When retail finally realizes their strategies can run on autopilot without giving up control, this is the kind of interface they’ll look for first. @Velvet_Capital feels less like a tool and more like the infrastructure layer for how onchain portfolios will actually be managed.

45 28 1.22K 閱讀原文 >釋出後VELVET走勢看漲Velvet Capital launches AI-driven DeFi platform, empowering VELVET.

45 28 1.22K 閱讀原文 >釋出後VELVET走勢看漲Velvet Capital launches AI-driven DeFi platform, empowering VELVET. icefrog.◎ 🇻🇳 | 🎒 OnChain_Analyst Trader B6.29K @icefrog_sol

icefrog.◎ 🇻🇳 | 🎒 OnChain_Analyst Trader B6.29K @icefrog_solI turned @Velvet_Capital into a weekly habit a short DeFAI audit I start by checking exposure which networks I’m leaning on and whether my long term allocations still make sense Then I switch to the Unicorn Ask about a token and it breaks the picture down liquidity shifts narrative cycles cross chain behavior holder flow it pushes back on bias and keeps me honest I open the Gems dashboard the weekly accrual shows if I’m truly active not just busy If the market shifts I hit rebalance Velvet bundles swaps routes through the best aggregators and handles bridging in one flow Tiny fixes add up closing unnecessary risk freeing room for a new Trench or reinforcing what’s compounding Simple routine big edge #DeFAI #VelvetUnicorn $VELVET Who else is running this every week?

16 10 175 閱讀原文 >釋出後VELVET走勢極度看漲The author recommends using Velvet Capital to manage crypto assets weekly, saying it offers huge advantages.

16 10 175 閱讀原文 >釋出後VELVET走勢極度看漲The author recommends using Velvet Capital to manage crypto assets weekly, saying it offers huge advantages.