Cartesi 實時價格數據

今日Cartesi的實時價格為$ 0.029 (CTSI/USD), 當前市值為 $ 27.07M USD。 24小時的成交量為 $ 4.47M USD。 過去24小時內漲跌幅為 +0.00%, 流通量為 902.79M CTSI。

Cartesi CTSI 價格歷史 USD

跟蹤 Cartesi 的今日價格、7天、30天和90天價格

週期

漲跌

漲跌幅 (%)

今日

0

0.00%

7日

--

--

30日

--

--

90日

0

-25.00%

Cartesi 市場信息

$ 0.019 24小時價格浮動區間 $ 0.029

歷史最高

$ 0.039

歷史最低

$ 0.019

24小時漲跌幅

0.00%

24小時交易量

$ 4,473,326.92

流通供給

0.90B

CTSI

市值

$ 27.07M

最大供給

1.00B

CTSI

完全稀釋的市值

$ 29.98M

交易 CTSI

Cartesi 社交媒體動態

CTSI entered Stage 2, decentralized governance affirmed.

Cartesi has raised the bar for L2s.

At Stage 2 maturity, Cartesi ensures a decentralized and permissionless environment where code is law. This architecture guarantees that users, not founders, remain in control.

Watch @felipeargento discuss this milestone on @CryptoCoinShow ↓ https://t.co/KrIVkPbClX

8 日 前

發佈後CTSI走勢

無數據

看漲

CTSI entered Stage 2, decentralized governance affirmed.

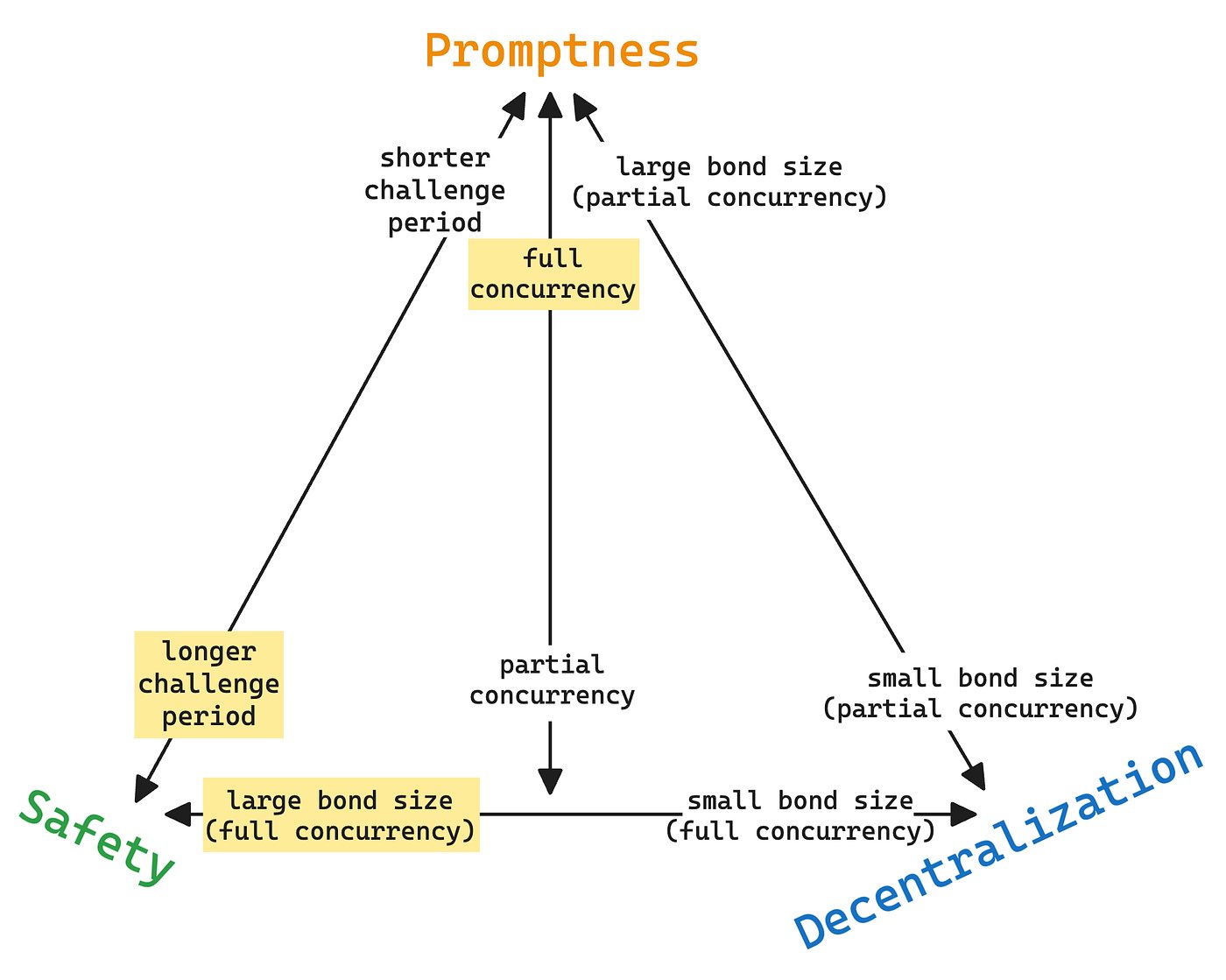

Analyzing ZK/fraud proofs, advocating Layer-2 hybrid architecture to optimize performance.

In a recent thread, @joaopdgarcia a Cartesi developer explained the difference between fraud proofs and ZK proofs in rollups.

He described fraud proofs as a way to “reveal lies” by re-executing disputed steps, and ZK proofs as mathematical statements asserting correctness without re-execution.

That distinction is useful and I quite agree with him .

ZK proofs are impressive as they compress a computation into a tiny proof that anyone can verify quickly.

But this power comes with trade‑offs.

Surveys like the 2025 SoK on zk‑SNARKs point out that scaling these proofs for real‑world, Turing‑complete computations is challenging.

Circuits can become extremely complex, proving requires significant memory and hardware, and only a few actors can generate proofs efficiently.

Studies comparing SNARKs, STARKs, and Bulletproofs confirm that even seemingly simple computations can be orders of magnitude more costly to prove than to execute.

So while ZK proofs promise instant validity, the practical costs, both computational and economic, are non‑trivial.

Fraud proofs, on the other hand, remain surprisingly powerful in practice.

The idea is simple: assume computations are correct unless challenged.

If a dispute arises, only the specific step in question is re‑executed and verified.

Research on optimistic rollups, including recent 2024–2025 studies, shows that fraud proofs not only ensure correctness, but also preserve decentralization, sequencer honesty, and economic security.

Because anyone can verify a dispute cheaply, there’s no natural bottleneck or centralization risk.

They also allow for full Turing‑complete off‑chain computation, something current ZK circuits cannot reliably handle due to expressiveness limits.

The other dimension is hybrid designs, which combine the strengths of both approaches.

By using ZK proofs where computation is tractable and fraud proofs as a fallback for complex or edge‑case logic, hybrid rollups can reduce prover centralization, maintain high throughput, and strengthen security guarantees.

Recent research from 2025 shows that hybrid architectures can balance finality speed, computational expressiveness, and decentralization in ways that pure ZK or pure fraud‑proof systems cannot.

They also provide better transparency for MEV management, since fraud proofs allow visibility during the challenge window, while ZK proofs compress it.

Looking at all the evidence, my take agrees with Joao.

The debate isn’t about choosing one over the other;

it’s about understanding the trade‑offs and designing systems that leverage the strengths of both.

For anyone building Layer‑2 rollups today, this means using fraud proofs for complex logic, applying ZK proofs where proving costs are manageable, and considering hybrid architectures to maximize security, throughput, and decentralization.

Make sure to read the entire thread here 👇

The role of fraud-proofs in a ZK World

Throughout @EFDevcon, the Stage 2 Rollups stand kept the @cartesiproject team busy, walking builders through fraud proofs and zk proofs.

Let’s talk about validation mechanisms in Web3 and why fraud proofs still matter.

71 日 前

發佈後CTSI走勢

無數據

看漲

Analyzing ZK/fraud proofs, advocating Layer-2 hybrid architecture to optimize performance.

Fraud proofs remain a critical verification mechanism in ZK Rollup

The role of fraud-proofs in a ZK World

Throughout @EFDevcon, the Stage 2 Rollups stand kept the @cartesiproject team busy, walking builders through fraud proofs and zk proofs.

Let’s talk about validation mechanisms in Web3 and why fraud proofs still matter.

73 日 前

發佈後CTSI走勢

無數據

中性

Fraud proofs remain a critical verification mechanism in ZK Rollup

價格預測

什麼時候是購買CTSI的好時機?我應該現在買入還是賣出CTSI?

在判斷現在是否是買入或賣出 Cartesi (CTSI) 的合適時機時,首先需要結合自身的交易策略和風險承受能力。長期投資者與短期交易者對市場信號的解讀往往不同,因此建議根據個人交易計劃做出決策。 根據最新的 CTSI 4 小時技術分析,當前交易信號為持有。 根據最新的 CTSI 1 天技術分析,當前交易信號為持有。

Beacon預測

概率價格預測(未來24小時)crypto.loading

關於 Cartesi

Cartesi (CTSI) is a cryptocurrency launched in 2020and operates on the Ethereum platform. Cartesi has a current supply of 1,000,000,000 with 902,789,769.71116571 in circulation. The last known price of Cartesi is 0.02767016 USD and is up 1.33 over the last 24 hours. It is currently trading on 220 active market(s) with $2,617,492.89 traded over the last 24 hours. More information can be found at https://cartesi.io/.

查看更多

探索更多

BM發現

新上市

SOFION SoFi Technologies Ondo Tokenized

0 0.00%

ARMON Arm Holdings plc Ondo Tokenized

0 0.00%

IBMON IBM Ondo Tokenized

0 0.00%

ADBEON Adobe Ondo Tokenized

0 0.00%

NKEON Nike Ondo Tokenized

0 0.00%

TCU29 TCU29

0 0.00%

BIGTROUT The Big Trout

0 0.00%

RUNE THORChain

0 0.00%

GSON Goldman Sachs Ondo Tokenized

0 0.00%

SPOTON Spotify Ondo Tokenized

0 0.00%