⚡ Breaking News

⚙️ Immunefi drives proactive security in Web3

The infographic explains how @Immunefi reduces critical risks by coordinating ethical hackers and protocols before exploits.

⚡ Breaking News

⚙️ Immunefi drives proactive security in Web3

The infographic explains how @Immunefi reduces critical risks by coordinating ethical hackers and protocols before exploits.

🚩 The So-Called “ICO Season"

Here’s the performance of ICOs over the last 3 months:

• Monad raised at $2.5B FDV → listed at $2.4B FDV

• Trove raised at $40M FDV → listed at $500K FDV (-90%)

• Fogo planned to raise at $1B FDV (abandoned after backlash) → listed at $450M FDV

• Space raised at $69M FDV → expected to list below $40M FDV

• Solstice raised at $260M FDV → expected to list below $150M FDV

Other ICOs:

• IMU (-30%)

• TEN (-40%)

• VOOI (-30%)

• ALMANAK (-60%)

• Harmonix (-90%)

• Theoriq (-30%)

• Superform (-20%)

• Bitdealer (-25%)

• Anichess (-60%)

• PlayAI (-40%)

• Ranger (breakeven)

In 3 months, only 2–3 ICOs performed well at TGE:

• $WET

• $FIGHT

Upcoming T1 projects still pending:

• $MEGA

• $AI

• $ZAMA

• $AZTEC

This is why blindly trusting “ICO season” narratives is dangerous, Most launches are underwater at TGE.

DYOR.

Manage risk.

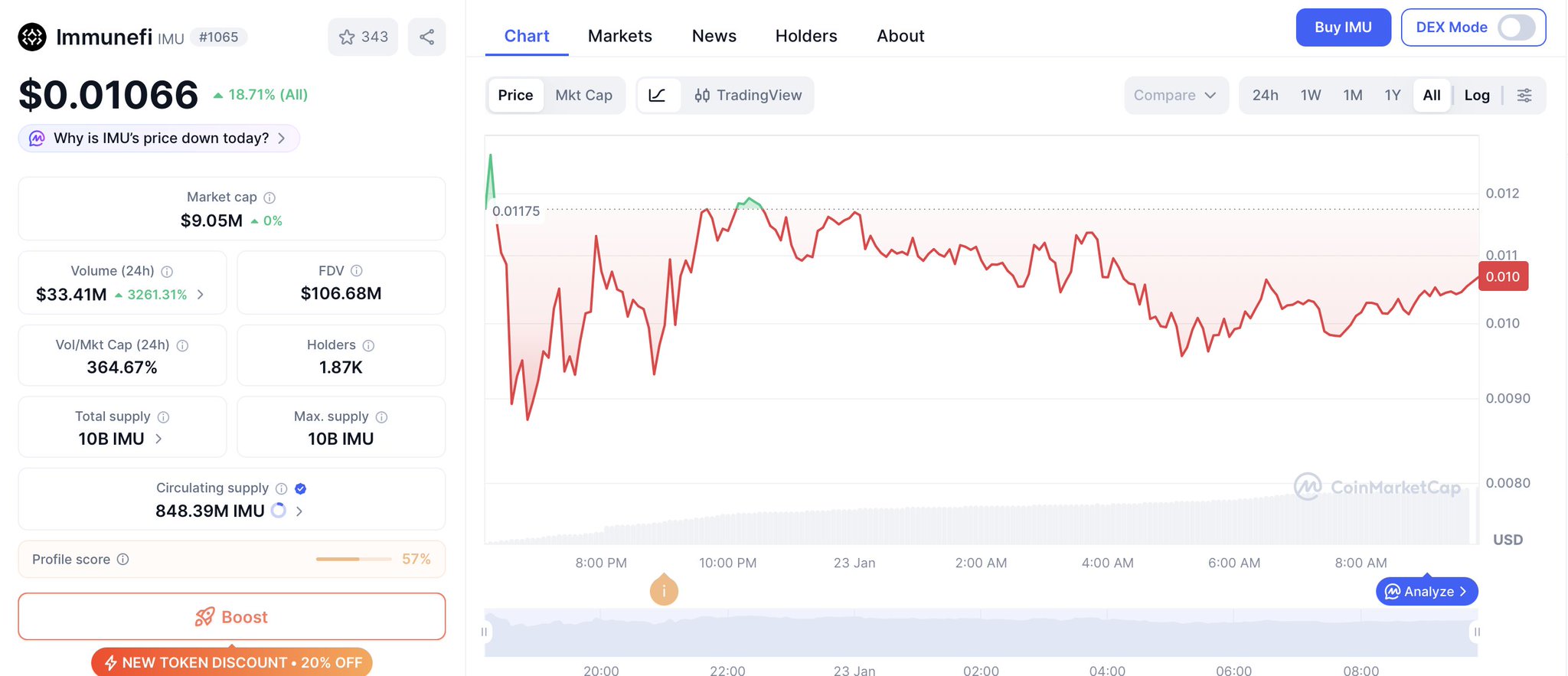

Imo, @immunefi at $100M FDV is very undervalued.

My thesis is that each time a new protocol is hacked, $IMU will pump (cause devs will start thinking about preventive measures, finally)

In fact, here's a ton of cryptos with zero value sitting at the same FDV, meanwhile $IMU has:

• $25B+ in losses prevented

• 300+ customers today (Aave, Chainlink, Arbitrum, Optimism, etc)

• 650+ protocols secured (Ethereum, Ripple, Polygon, Sky, etc)

• 60,000+ security researchers (the largest security community in crypto)

• $125m+ in onchain bounties paid

NFA ofc.