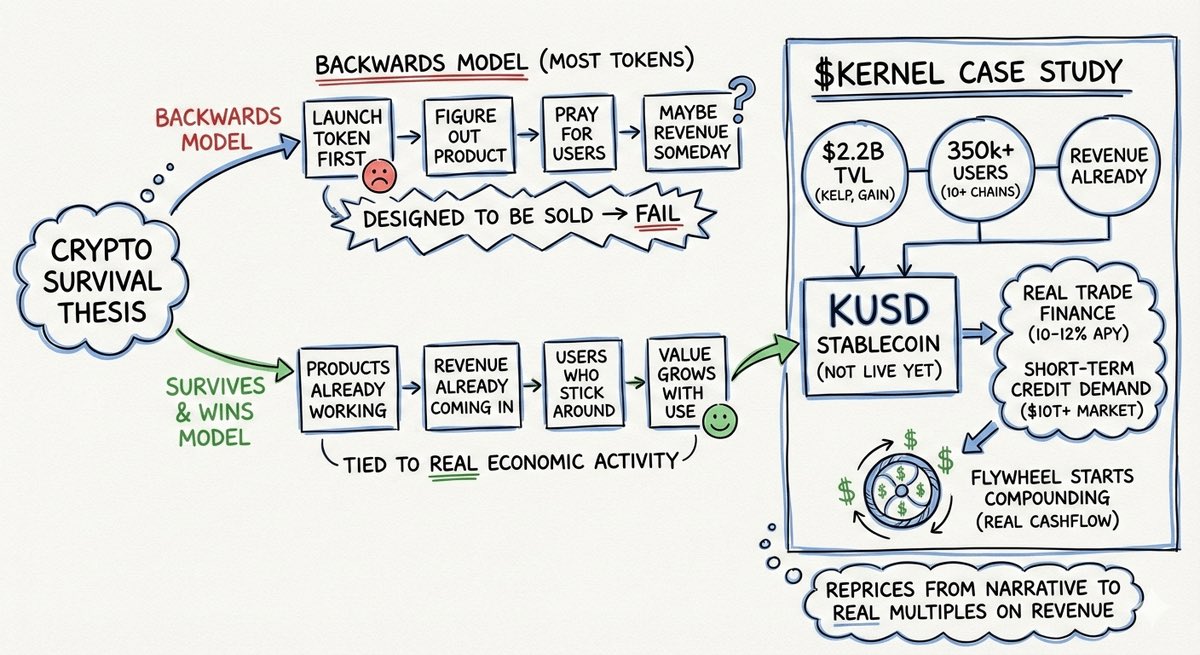

one pattern i keep seeing with most tokens is pretty obvious.

> the token comes first

> the business comes later… if at all

liquidity shows up for incentives and leaves right after and once hype fades, there’s nothing holding it together.

the few tokens that actually survive usually do it the other way around.

business first. revenue first. users first. token last.. that’s the lens i’m looking at @kernel_dao | $KERNEL through.

now zoom out to stablecoins for a second. rn you basically have 2 choices:

- safe but capped yields from treasury wrappers

- higher yields from funding rates or leverage that only work in good markets

what’s missing is obvious imo.

there’s no dominant stablecoin product that gives high yield, backed by real-world credit, that still works when markets go sideways.

meanwhile, in the real world, businesses already pay 10–15% annually just to manage payment delays, trade finance, and cross-border settlement gaps.

this demand exists regardless of crypto cycles. it’s massive and alw