Disclaimer:

Data from X (Twitter), Property of original creators. For reference only, not investment advice.

X Posts

JackTheRippler ©️ Influencer Media B439.03K @RippleXrpie

JackTheRippler ©️ Influencer Media B439.03K @RippleXrpie JackTheRippler ©️ Influencer Media B439.03K @RippleXrpie

JackTheRippler ©️ Influencer Media B439.03K @RippleXrpie 410 14 8.77K Original >Trend of XRP after releaseExtremely Bullish

410 14 8.77K Original >Trend of XRP after releaseExtremely Bullish- Trend of BTC after releaseBullish

Milk Road Educator Influencer D94.09K @MilkRoad

Milk Road Educator Influencer D94.09K @MilkRoad

Milk Road Educator Influencer D94.09K @MilkRoad

Milk Road Educator Influencer D94.09K @MilkRoad 2 1 123 Original >Trend of BTC after releaseBullish

2 1 123 Original >Trend of BTC after releaseBullish Ripple Bull Winkle | Crypto Researcher 🚀🚨 FA_Analyst Influencer D130.72K @RipBullWinkle1 0 37 Original >Trend of XRP after releaseBullish

Ripple Bull Winkle | Crypto Researcher 🚀🚨 FA_Analyst Influencer D130.72K @RipBullWinkle1 0 37 Original >Trend of XRP after releaseBullish Ripple Bull Winkle | Crypto Researcher 🚀🚨 FA_Analyst Influencer D130.72K @RipBullWinkle

Ripple Bull Winkle | Crypto Researcher 🚀🚨 FA_Analyst Influencer D130.72K @RipBullWinkle 0 0 55 Original >Trend of BTC after releaseBullish

0 0 55 Original >Trend of BTC after releaseBullish- Neutral

Angry Crypto Show Media Influencer B17.82K @angrycryptoshow

Angry Crypto Show Media Influencer B17.82K @angrycryptoshow Oscar Ramos D105.09K @realOscarRamos10 0 12 Original >Trend of ADA after releaseBullish

Oscar Ramos D105.09K @realOscarRamos10 0 12 Original >Trend of ADA after releaseBullish- Trend of ETH after releaseNeutral

TokenPulse BTC / 《海外の仮想通貨ニュースを最速で毎日お届け!》 Media OnChain_Analyst D20.57K @TokenPulseJP

TokenPulse BTC / 《海外の仮想通貨ニュースを最速で毎日お届け!》 Media OnChain_Analyst D20.57K @TokenPulseJP Cointelegraph Media Influencer C2.90M @Cointelegraph

Cointelegraph Media Influencer C2.90M @Cointelegraph

0 0 3 Original >Trend of BTC after releaseBearish

0 0 3 Original >Trend of BTC after releaseBearish kimcĦi.ℏ/acc Media Educator B3.99K @HederaKimchi

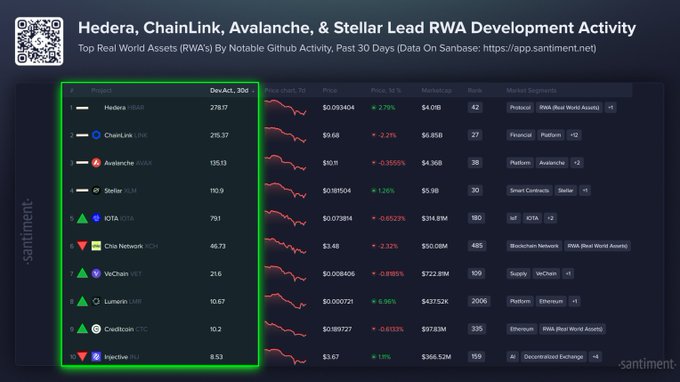

kimcĦi.ℏ/acc Media Educator B3.99K @HederaKimchi

kimcĦi.ℏ/acc Media Educator B3.99K @HederaKimchi

kimcĦi.ℏ/acc Media Educator B3.99K @HederaKimchi 0 0 9 Original >Trend of HBAR after releaseBullish

0 0 9 Original >Trend of HBAR after releaseBullish

24h Social Sentiment from X

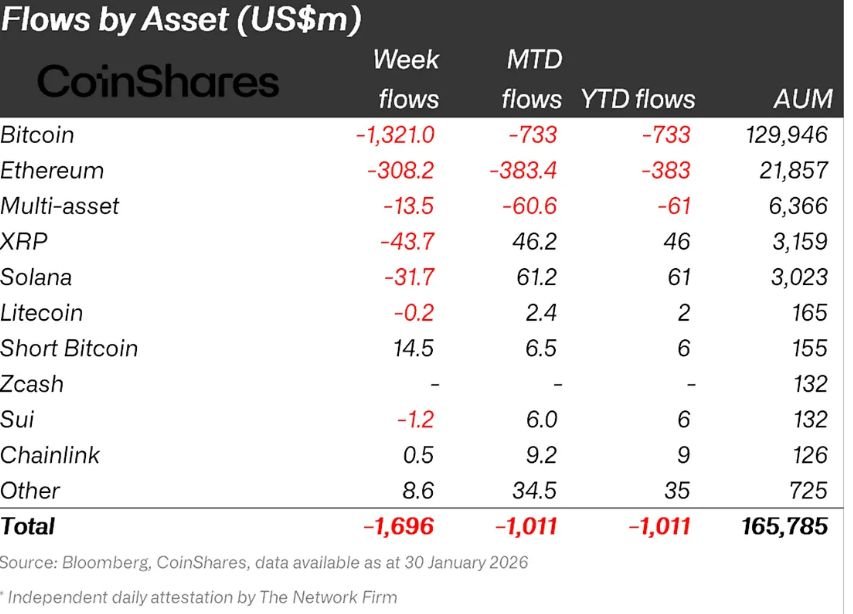

8,263Analyzed Posts+22.94%2,496Surveyed KOLs0%Market sentiment leans Bullish- CoinsSSIChangeSSI Insights

- CoinsMPRChange

W#1 Social mentions surge-

W#1 Social mentions surge- TURBO#2 Social mentions surged-

TURBO#2 Social mentions surged- FF#3 Social mentions surged-

FF#3 Social mentions surged- BTC#4 Sentiment polarization surge+11

BTC#4 Sentiment polarization surge+11 ETH#5 Social mentions surged+8

ETH#5 Social mentions surged+8

Alert Summary