Aave (AAVE)

Aave (AAVE)

$128.54 +2.64% 24H

- 65Social Sentiment Index (SSI)+53.76% (24h)

- #81Market Pulse Ranking (MPR)+9

- 1324h Social Mention+116.67% (24h)

- 38%24h KOL Bullish Ratio10 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall65SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (15%)Bullish (23%)Bearish (62%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov

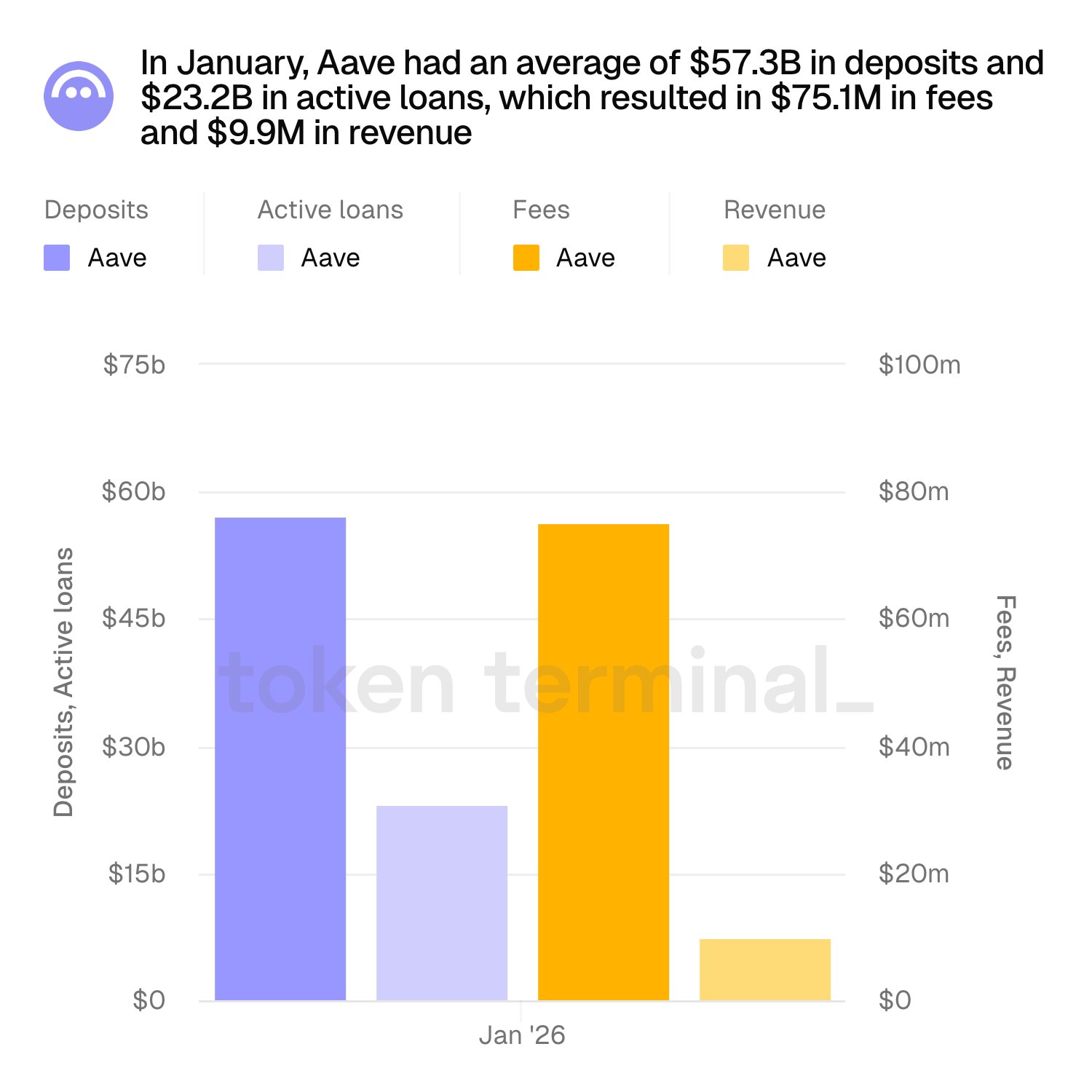

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov Token Terminal 📊 D155.17K @tokenterminal

Token Terminal 📊 D155.17K @tokenterminal 109 21 6.90K Original >Trend of AAVE after releaseExtremely Bullish

109 21 6.90K Original >Trend of AAVE after releaseExtremely Bullish chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda

chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda Marc ”七十 Billy” Zeller D105.30K @Marczeller396 42 24.35K Original >Trend of AAVE after releaseBearish

Marc ”七十 Billy” Zeller D105.30K @Marczeller396 42 24.35K Original >Trend of AAVE after releaseBearish SolarEtherPunk🏄 Dev OnChain_Analyst B2.63K @SolarEtherPunk

SolarEtherPunk🏄 Dev OnChain_Analyst B2.63K @SolarEtherPunk Marc ”七十 Billy” Zeller D105.30K @Marczeller396 42 24.35K Original >Trend of AAVE after releaseBearish

Marc ”七十 Billy” Zeller D105.30K @Marczeller396 42 24.35K Original >Trend of AAVE after releaseBearish Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov LlamaRisk D6.96K @LlamaRisk

LlamaRisk D6.96K @LlamaRisk 48 12 5.51K Original >Trend of AAVE after releaseBullish

48 12 5.51K Original >Trend of AAVE after releaseBullish Ignas | DeFi DeFi_Expert Tokenomics_Expert B158.49K @DefiIgnas

Ignas | DeFi DeFi_Expert Tokenomics_Expert B158.49K @DefiIgnas Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov 0 0 55 Original >Trend of AAVE after releaseBearish

0 0 55 Original >Trend of AAVE after releaseBearish- Trend of AAVE after releaseBearish

𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rd

𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rd Marc ”七十 Billy” Zeller D105.30K @Marczeller396 42 24.35K Original >Trend of AAVE after releaseBearish

Marc ”七十 Billy” Zeller D105.30K @Marczeller396 42 24.35K Original >Trend of AAVE after releaseBearish- Trend of AAVE after releaseBearish

Laura Shin Media Influencer C281.42K @laurashin

Laura Shin Media Influencer C281.42K @laurashin Marc ”七十 Billy” Zeller D105.30K @Marczeller396 42 24.35K Original >Trend of AAVE after releaseBearish

Marc ”七十 Billy” Zeller D105.30K @Marczeller396 42 24.35K Original >Trend of AAVE after releaseBearish Cointelegraph Media Influencer C2.90M @Cointelegraph

Cointelegraph Media Influencer C2.90M @Cointelegraph MSB Intel Media OnChain_Analyst A35.33K @MSBIntel

MSB Intel Media OnChain_Analyst A35.33K @MSBIntel

77 33 10.21K Original >Trend of AAVE after releaseBullish

77 33 10.21K Original >Trend of AAVE after releaseBullish