Arbitrum (ARB)

Arbitrum (ARB)

$0.1374 +0.59% 24H

- 46Social Sentiment Index (SSI)-46.00% (24h)

- #113Market Pulse Ranking (MPR)-98

- 724h Social Mention-58.82% (24h)

- 85%24h KOL Bullish Ratio5 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall46SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (14%)Bullish (71%)Bearish (15%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

f1go.eth FA_Analyst Tokenomics_Expert B6.73K @FigoETH

f1go.eth FA_Analyst Tokenomics_Expert B6.73K @FigoETH Steven Goldfeder D37.15K @sgoldfed173 23 18.63K Original >Trend of ARB after releaseBullish

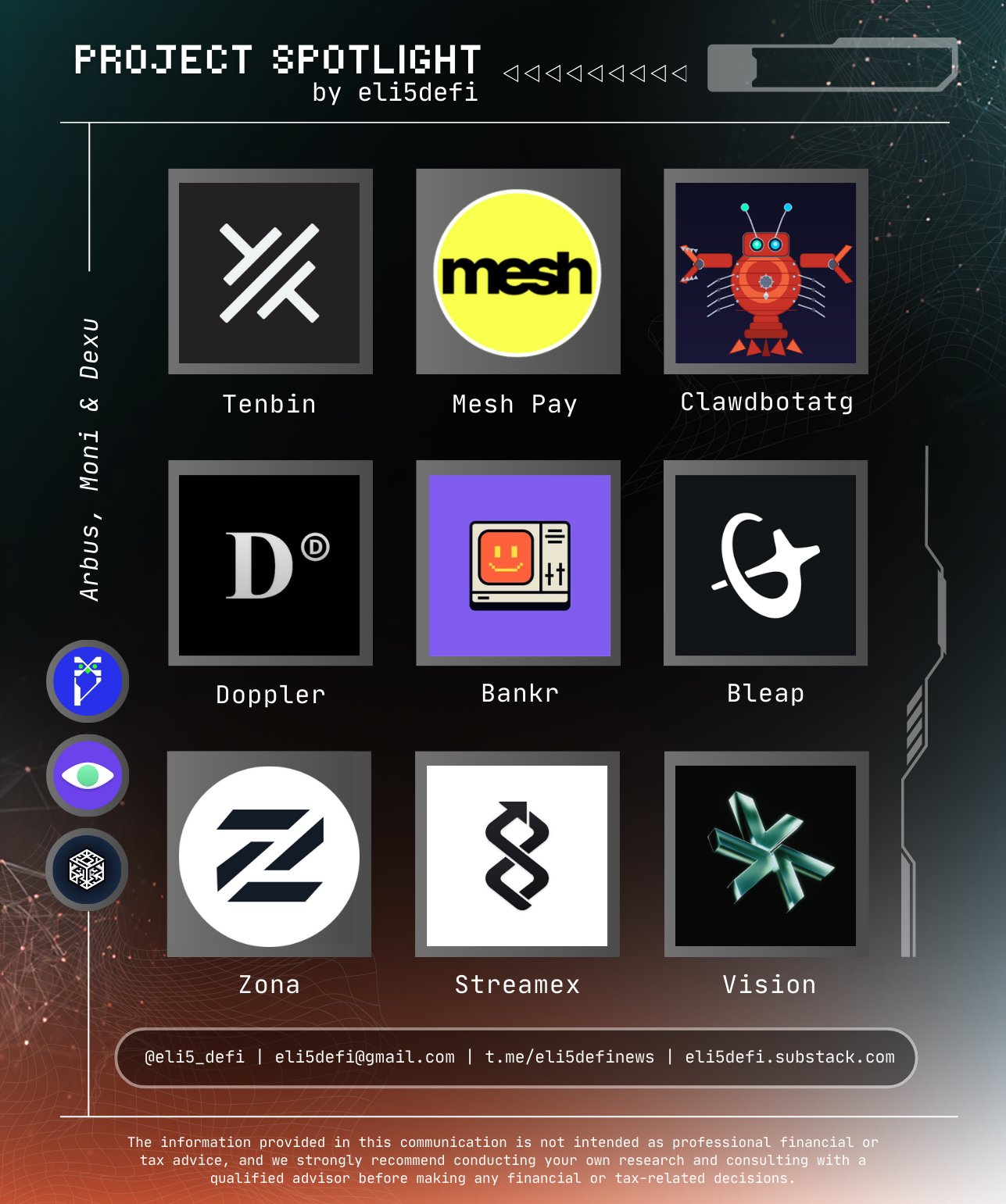

Steven Goldfeder D37.15K @sgoldfed173 23 18.63K Original >Trend of ARB after releaseBullish Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 98 28 5.14K Original >Trend of ARB after releaseBullish

98 28 5.14K Original >Trend of ARB after releaseBullish 𝗵𝘂𝗻𝘁𝗲𝗿 Media Community_Lead A15.75K @BFreshHB

𝗵𝘂𝗻𝘁𝗲𝗿 Media Community_Lead A15.75K @BFreshHB Steven Goldfeder D37.15K @sgoldfed173 23 18.63K Original >Trend of ARB after releaseBullish

Steven Goldfeder D37.15K @sgoldfed173 23 18.63K Original >Trend of ARB after releaseBullish 𝗵𝘂𝗻𝘁𝗲𝗿 Media Community_Lead A15.75K @BFreshHB

𝗵𝘂𝗻𝘁𝗲𝗿 Media Community_Lead A15.75K @BFreshHB David | www.usd.ai D14.35K @0xZergs67 8 6.50K Original >Trend of ARB after releaseBullish

David | www.usd.ai D14.35K @0xZergs67 8 6.50K Original >Trend of ARB after releaseBullish- Trend of ARB after releaseBullish

GigaEmmanuel Sei 🔴💨 Influencer Community_Lead C16.13K @EgsoncleCrypto

GigaEmmanuel Sei 🔴💨 Influencer Community_Lead C16.13K @EgsoncleCrypto GigaEmmanuel Sei 🔴💨 Influencer Community_Lead C16.13K @EgsoncleCrypto

GigaEmmanuel Sei 🔴💨 Influencer Community_Lead C16.13K @EgsoncleCrypto 37 28 681 Original >Trend of ARB after releaseExtremely Bullish

37 28 681 Original >Trend of ARB after releaseExtremely Bullish Genzo TA_Analyst Trader B252.40K @CryptoGenzo

Genzo TA_Analyst Trader B252.40K @CryptoGenzo Genzo TA_Analyst Trader B252.40K @CryptoGenzo

Genzo TA_Analyst Trader B252.40K @CryptoGenzo 366 68 82.67K Original >Trend of ARB after releaseBearish

366 68 82.67K Original >Trend of ARB after releaseBearish- Trend of ARB after releaseExtremely Bullish

Buuvei Community_Lead NFT_Expert C10.76K @i3uuve1

Buuvei Community_Lead NFT_Expert C10.76K @i3uuve1

Buuvei Community_Lead NFT_Expert C10.76K @i3uuve19 5 397 Original >Trend of ARB after releaseBullish

Buuvei Community_Lead NFT_Expert C10.76K @i3uuve19 5 397 Original >Trend of ARB after releaseBullish- Trend of ARB after releaseBullish