Hyperliquid (HYPE)

Hyperliquid (HYPE)

$33.722 +11.42% 24H

- 87Social Sentiment Index (SSI)+31.50% (24h)

- #45Market Pulse Ranking (MPR)+47

- 15124h Social Mention+104.05% (24h)

- 78%24h KOL Bullish Ratio95 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall87SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (26%)Bullish (52%)Neutral (13%)Bearish (9%)Extremely Bearish (0%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

Capital Flows FA_Analyst Trader B126.60K @Globalflows

Capital Flows FA_Analyst Trader B126.60K @Globalflows

Capital Flows FA_Analyst Trader B126.60K @Globalflows11 1 1.39K Original >Trend of HYPE after releaseExtremely Bullish

Capital Flows FA_Analyst Trader B126.60K @Globalflows11 1 1.39K Original >Trend of HYPE after releaseExtremely Bullish GLC OnChain_Analyst FA_Analyst B9.27K @GLC_Research

GLC OnChain_Analyst FA_Analyst B9.27K @GLC_Research GLC OnChain_Analyst FA_Analyst B9.27K @GLC_Research14 1 1.99K Original >Trend of HYPE after releaseBullish

GLC OnChain_Analyst FA_Analyst B9.27K @GLC_Research14 1 1.99K Original >Trend of HYPE after releaseBullish- Trend of HYPE after releaseExtremely Bullish

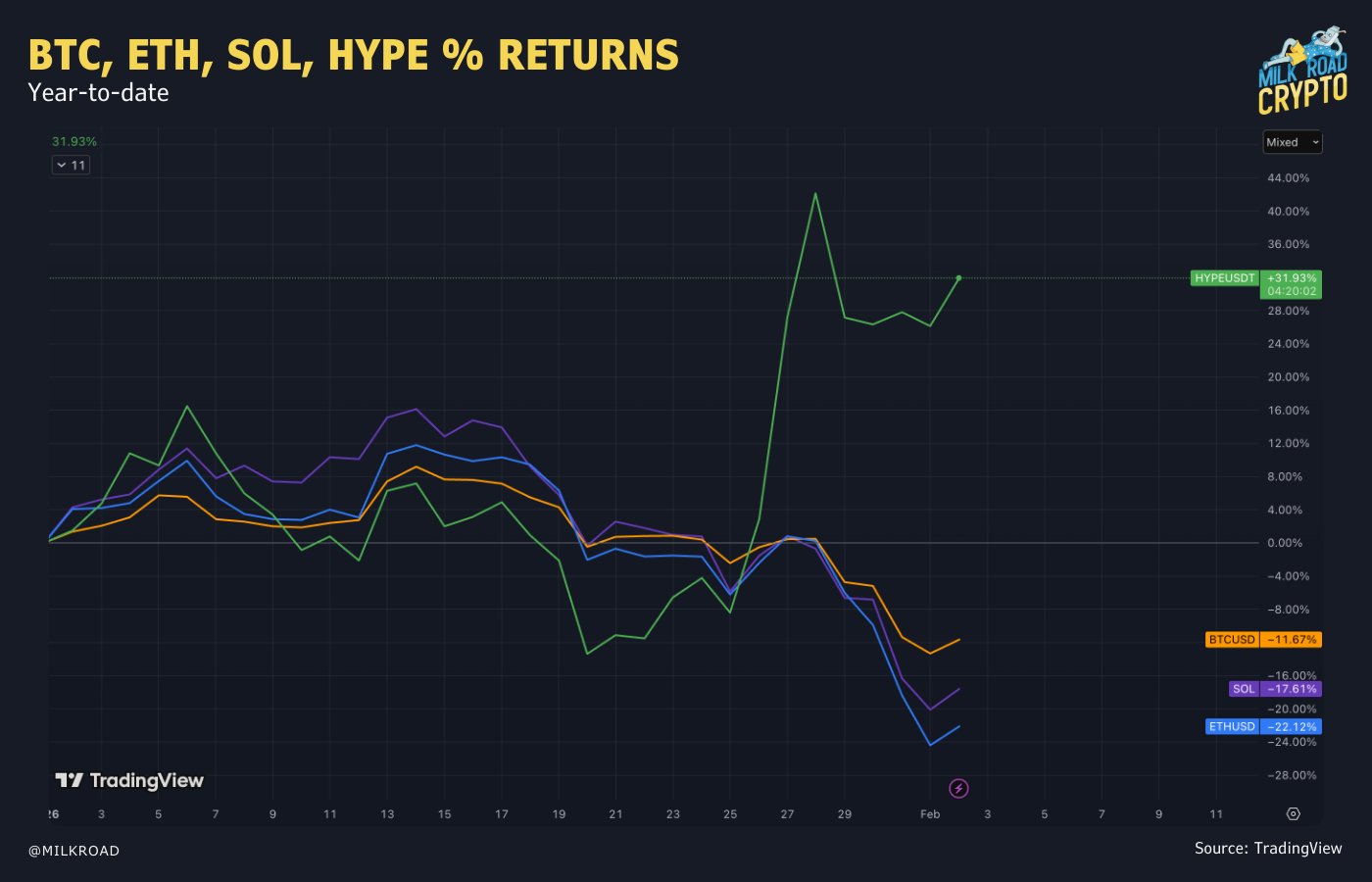

Milk Road Educator Influencer D94.09K @MilkRoad

Milk Road Educator Influencer D94.09K @MilkRoad

Milk Road Educator Influencer D94.09K @MilkRoad

Milk Road Educator Influencer D94.09K @MilkRoad 9 1 1.74K Original >Trend of HYPE after releaseExtremely Bullish

9 1 1.74K Original >Trend of HYPE after releaseExtremely Bullish- Trend of HYPE after releaseBullish

- Trend of HYPE after releaseBullish

- Trend of HYPE after releaseBullish

Base Case D FA_Analyst Trader A1.79K @CashflowingOptn

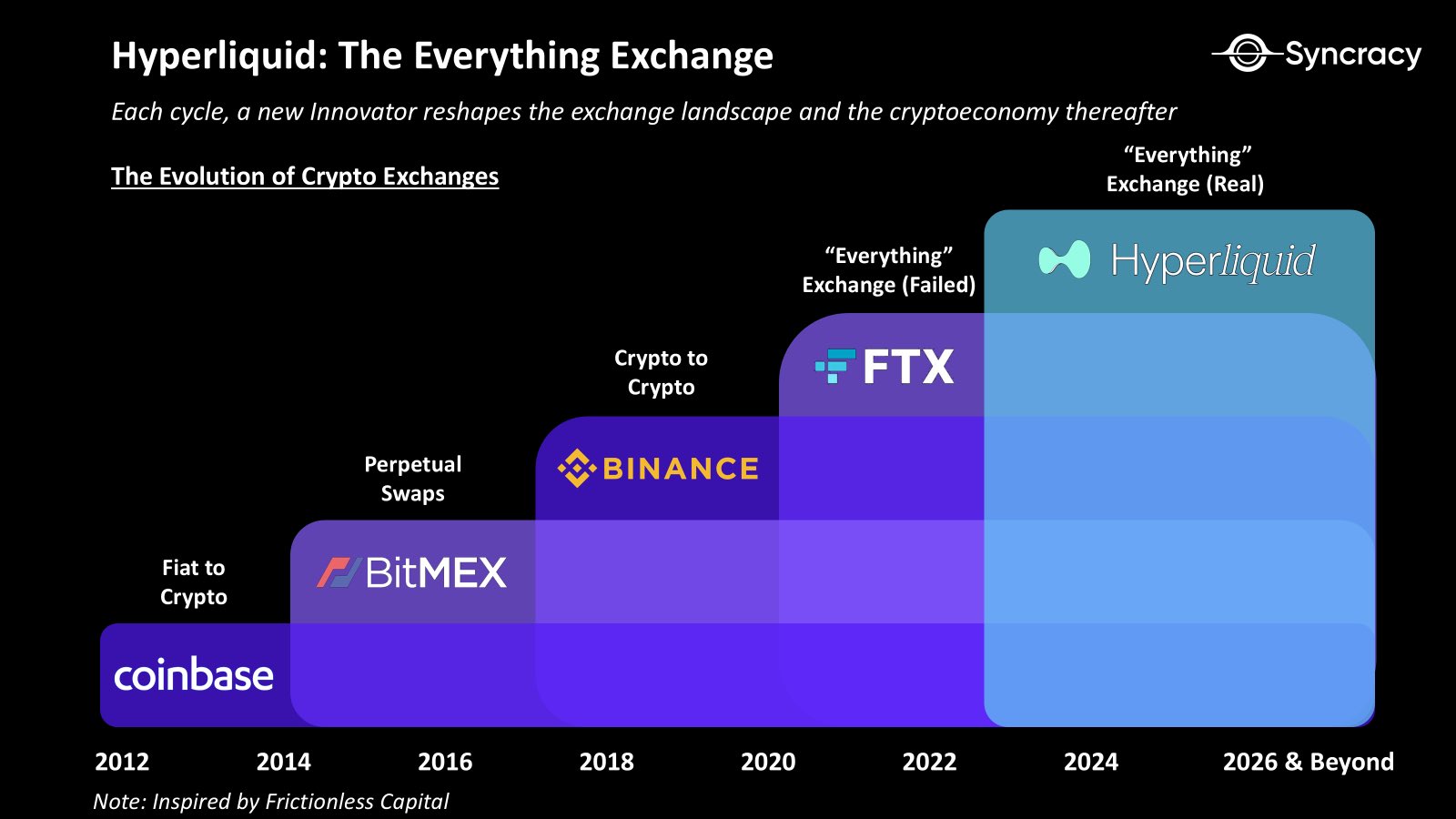

Base Case D FA_Analyst Trader A1.79K @CashflowingOptn Ryan Watkins D86.44K @RyanWatkins_

Ryan Watkins D86.44K @RyanWatkins_ 105 2 34.73K Original >Trend of HYPE after releaseExtremely Bullish

105 2 34.73K Original >Trend of HYPE after releaseExtremely Bullish Sir Joey DeFi_Expert Educator C11.59K @SirJoey

Sir Joey DeFi_Expert Educator C11.59K @SirJoey Sir Joey DeFi_Expert Educator C11.59K @SirJoey8 4 94 Original >Trend of HYPE after releaseNeutral

Sir Joey DeFi_Expert Educator C11.59K @SirJoey8 4 94 Original >Trend of HYPE after releaseNeutral- Trend of HYPE after releaseBullish