Kite AI (KITE)

Kite AI (KITE)

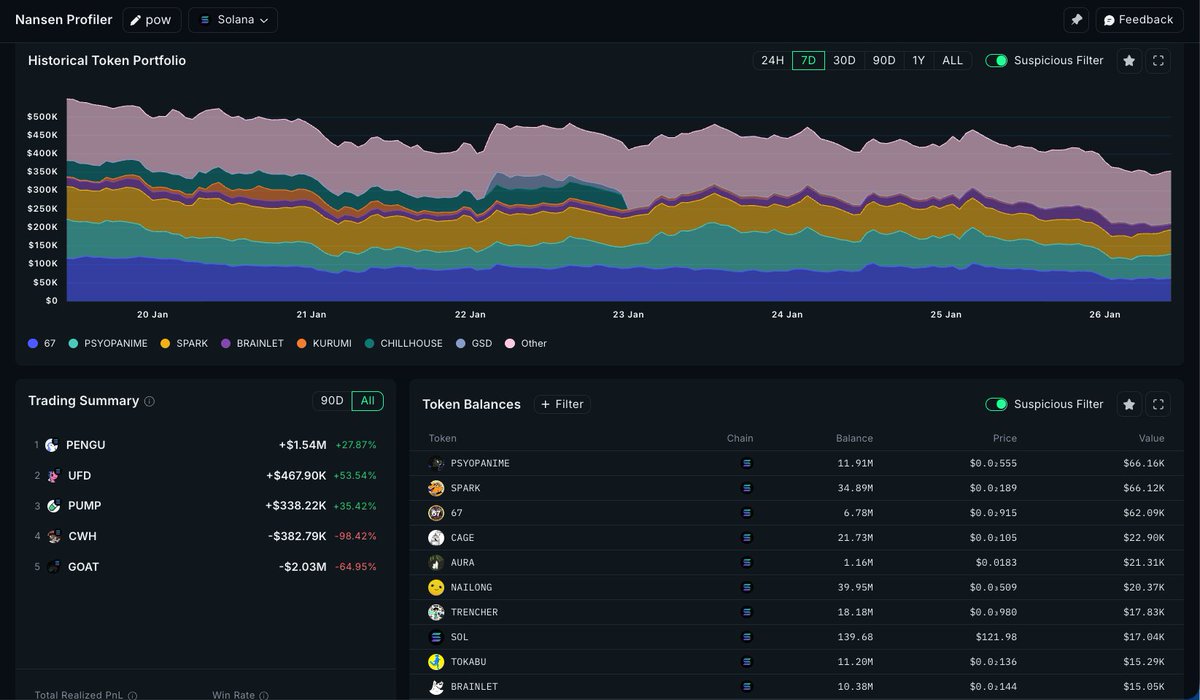

- 68Social Sentiment Index (SSI)-4.90% (24h)

- #63Market Pulse Ranking (MPR)-37

- 124h Social Mention-50.00% (24h)

- 100%24h KOL Bullish Ratio1 Active KOL

- SummaryKITE up 3.2%, new Reaction Lens shows slow-heat buyers accumulating during pullback, offering clear entry opportunities

- Bullish Signals

- Price up 3.2%

- Slow-heat group buying on pullback

- Reaction Lens provides margin

- Live trading captured 2.1% profit

- Market makers filtered out

- Bearish Signals

- Social heat down 4.9%

- Fast response group sell-off

- Oracle volatility causing pool drain

- Interaction count only 6

- Potential liquidity edge

Social Sentiment Index (SSI)

- Data Overall68SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionBullish (100%)SSI InsightsKITE social heat is medium (68/100, -4.9%), activity/mood unchanged, KOL attention dropped sharply by 87.5%, linked to the 3.2% rise and slow-heat buyers pulling back to accumulate.

Market Pulse Ranking (MPR)

- Alert InsightKITE warning rank fell to #63 (down 37), social anomalies remain high (89.2) but weakened, KOL attention shifted to 0.5, alerts triggered by fast sell-off and Oracle volatility.

X Posts

deathmage.x .edge🦭 DeFi_Expert OnChain_Analyst B2.46K @phanthanguss

deathmage.x .edge🦭 DeFi_Expert OnChain_Analyst B2.46K @phanthangussJust discovered a rarely mentioned perspective in @nansen_ai: Counterparty Reaction Lens (that's what I call it). It doesn't look at who is buying, but at “who reacts fastest, who is slow‑warm”, clustering labels by response latency, first‑move frequency, and follow‑up window. Looked at a small‑cap $KITE: - Fast‑reaction cohort (median latency ~6s) instantly exits the pool after oracle fluctuations. - Slow‑warm cohort (average follow‑up 6‑12h) steadily takes orders during price pull‑back. Conclusion: Within the same chain of actions, the tempo contrast can determine whether it’s a split‑second liquidity‑scraping cut or a later, slowly accumulated “clean” buying pressure. Playbook I ran: 1) Open Reaction Lens → filter label = market‑maker / grant / algo 2) Set threshold: first‑move latency <10s and follow‑ratio >0.6 as high‑tempo cohort alert 3) For the target, place three orders: first a very shallow maker (0.25%), set exchange‑inflow auto‑abort; rebuild the main position 50%/50% after the slow‑warm cohort kicks in 4) Attach the tempo alert to a shared Playbook for the team to vote on scaling up Live result: avoided a sudden pool‑clearing slippage, later captured an about 2.1% cleaner entry price in the slow‑warm entry window. Who is using response time / execution tempo to rhythmically adjust positions? Any latency thresholds you can share? #onchain #trading #risk

3 3 99 Original >Trend of KITE after releaseBullishIntroducing a new Nansen perspective, analyzing trader response speed, successfully applied to KITE to avoid slippage and earn 2.1% profit.

3 3 99 Original >Trend of KITE after releaseBullishIntroducing a new Nansen perspective, analyzing trader response speed, successfully applied to KITE to avoid slippage and earn 2.1% profit. BS Kol Club Media Influencer A12.33K @BSKolClub

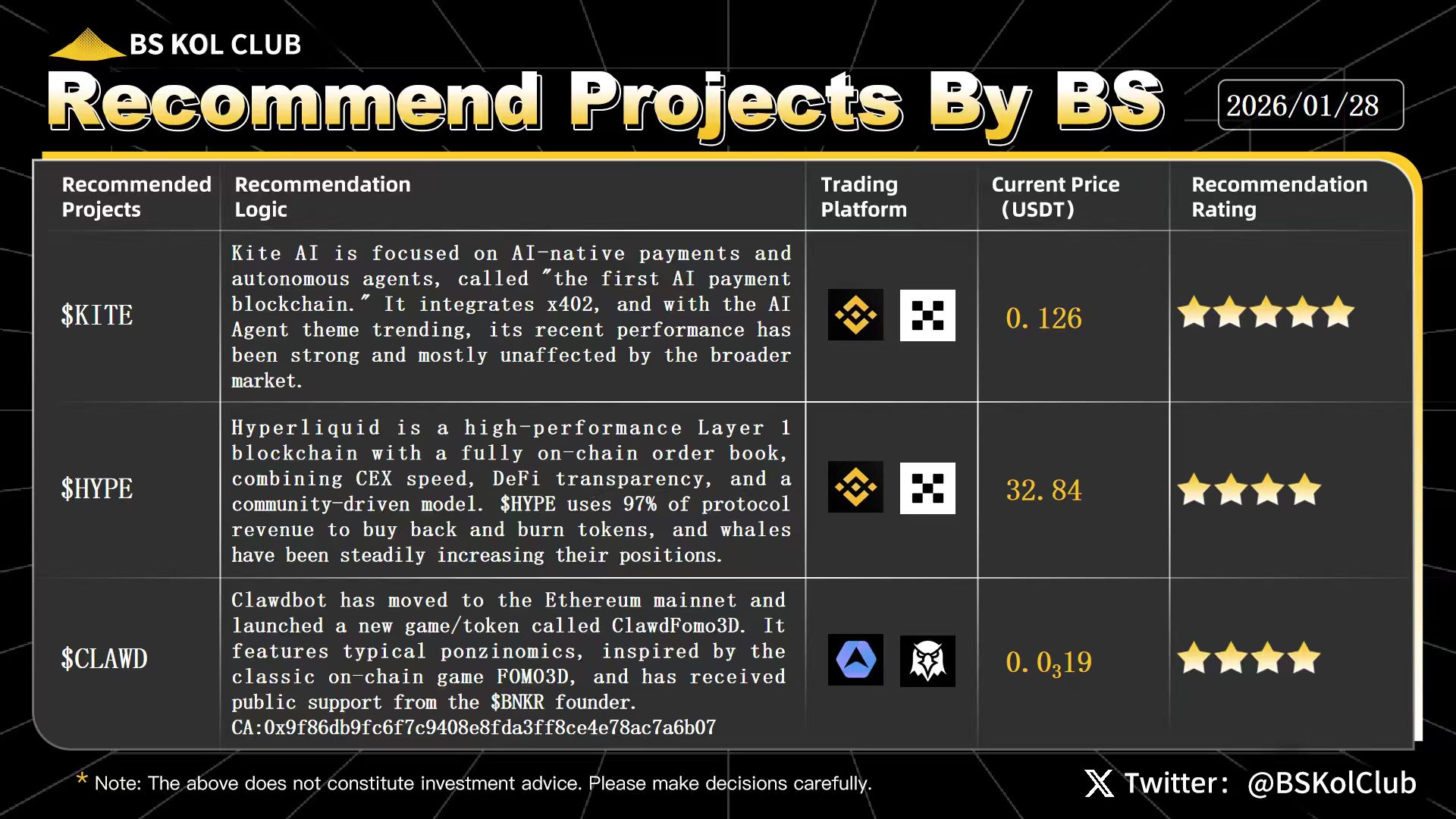

BS Kol Club Media Influencer A12.33K @BSKolClub✨ BS KOL Club Weekly Recommended Projects|#Issue91 This week’s picks: $KITE, $HYPE, $CLAWD Overnight and into this morning, the crypto market extended its rebound, with Bitcoin holding above USD 89,000 and Ethereum breaking past USD 3,000. U.S. equities were mixed: the Dow fell 0.83%, while the S&P 500 rose 0.41% and the Nasdaq gained 0.91%. Crypto-related stocks showed divergence—treasury-focused firms MSTR (+0.62%), BMNR (+5.5%), and ALTS (+10.05%) advanced, while sector companies COIN (-1.24%), GEMI (-4.88%), and CRCL (-1.33%) declined. On-chain data shows Bitcoin’s network hashrate plunged from 1.16 ZH/s to 690 EH/s, marking the largest drop on record, before beginning to recover. Analysts attribute this to the U.S. winter storm “Fernand,” where extreme cold and widespread power outages forced multiple mining pools offline, causing a temporary hashrate decline. On the macro front, Wall Street’s Rick Rieder is seen as a potential driver of more market-oriented Fed policy. He previously advocated a 50-basis-point rate cut last year and opposed forward guidance on future rates. Economists at Evercore ISI suggest he may support three rate cuts this year. While interest rate swaps currently price in fewer than two cuts, SOFR options indicate market bets on multiple cuts, potentially down to 1.5%. This week coincides with the Federal Reserve’s FOMC meeting. Analysts caution that FOMC weeks are often accompanied by heightened Bitcoin volatility and short-term downside risk. Even if markets remain optimistic ahead of the meeting due to rate-cut expectations, post-announcement price reactions are often bearish, underscoring the need for prudent position sizing and risk management. #cryptocurrency #AI #Kite #Hyperliquid #memes #L1

26 5 2.67K Original >Trend of KITE after releaseBullishBS KOL Club recommends KITE, HYPE, CLAWD, and warns of Bitcoin volatility risk during the FOMC meeting.

26 5 2.67K Original >Trend of KITE after releaseBullishBS KOL Club recommends KITE, HYPE, CLAWD, and warns of Bitcoin volatility risk during the FOMC meeting. EnHeng嗯哼🔸BNB Influencer Tokenomics_Expert B91.74K @EnHeng456

EnHeng嗯哼🔸BNB Influencer Tokenomics_Expert B91.74K @EnHeng456I've continuously been holding some $Kite, and before its listing sister jiayi kept telling me it's a good project and to keep a close watch. I noticed it's the PayPal prince, and the last time it faced FUD I even added a bit more, holding it till now. Kite remains so resilient largely because the whole team keeps building. I also see founder @ChiZhangData still working on the front lines, not opting to rest. Kite has never really topped the gainers list, yet it rose 70% over the past month.

jiayi 加一 D22.37K @mscryptojiayi

jiayi 加一 D22.37K @mscryptojiayiKite has never topped the gainers list, but it jumped 70% in a month. Who understands this even higher surge? https://t.co/nmScz5tOgL

59 42 10.20K Original >Trend of KITE after releaseBullishKITE up 70% this month, team continues building, recommend bullish holding OCT Gems FA_Analyst Influencer C11.47K @oct_gems

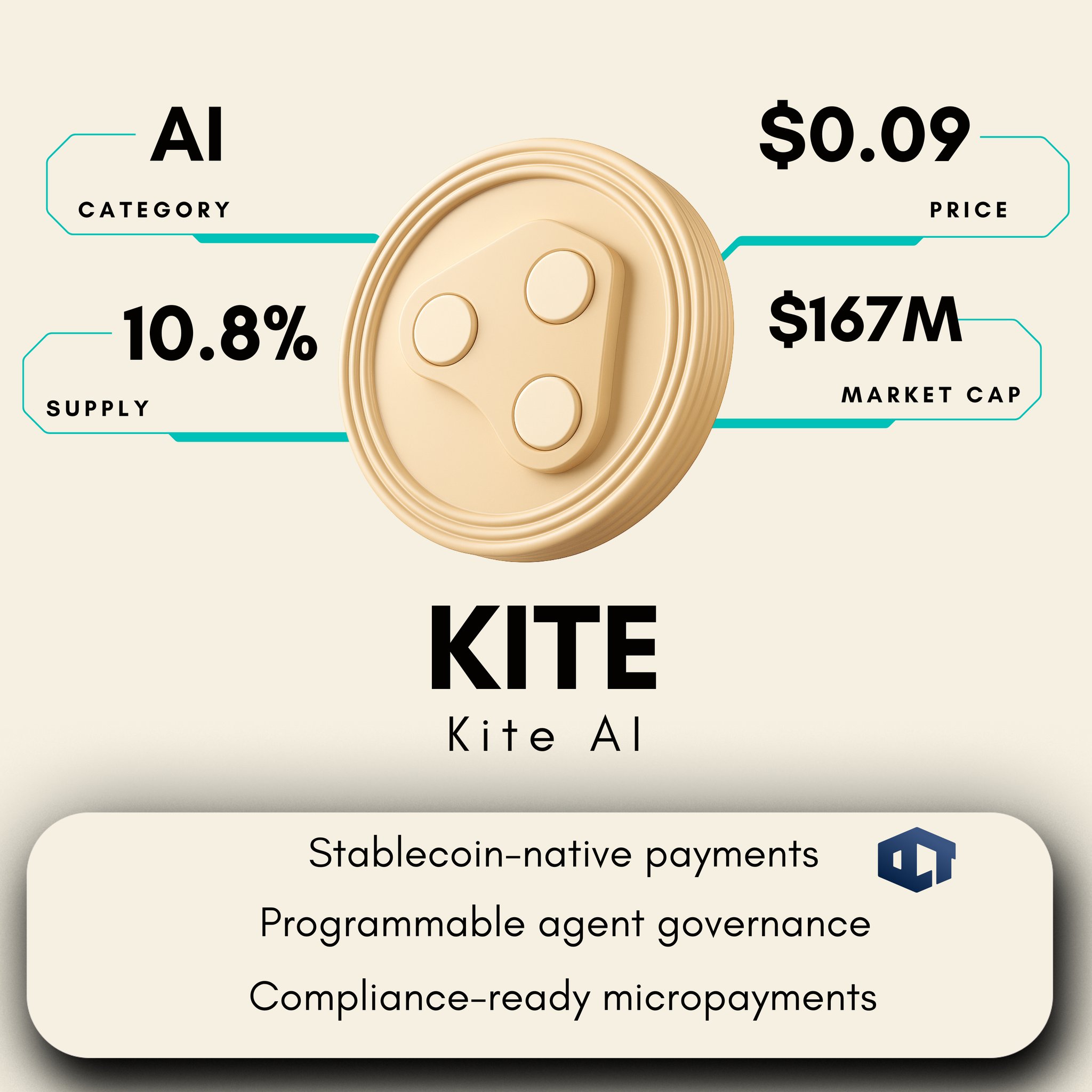

OCT Gems FA_Analyst Influencer C11.47K @oct_gems🚨 $KITE REVIEW: 1⃣ Introduction: • @GoKiteAI is the first AI payment blockchain, designed as a foundational Layer 1 infrastructure for the autonomous economy, enabling AI agents to discover, negotiate, and transact securely with cryptographic identities, programmable governance, and native stablecoin access. • It addresses limitations in agentic commerce by providing verifiable provenance, low-fee payments, and interoperability across chains, backed by investors like PayPal Ventures, General Catalyst, and Coinbase Ventures, with integrations for ecosystems like Avalanche and BNB Chain. • Kite AI pioneers x402 standards for modular security and agent-to-agent transactions, fostering an open, trustless environment for AI-driven payments and aiming to capture the multi-billion-dollar agent economy by 2030. 2⃣ How Does Kite AI Work? • Kite AI functions as a Proof of Artificial Intelligence (PoAI) Layer 1 blockchain, where agents receive cryptographic passports for identity verification, programmable rules for governance, and seamless stablecoin lanes for instant, low-cost transactions across protocols. • It supports autonomous operations through on-chain logging, ZK proofs for verifiability, and cross-chain bridges (e.g., via Stargate Finance), allowing agents to handle tasks like payments, collaborations, and executions without human intervention. Kite AI operates through a multi-component architecture: • The Chain Backbone: A PoAI consensus Layer 1 with 1-second block times and sub-$0.000001 fees for scalable AI operations. • The Identity Layer: Provides Agent Passports with ERC-8004-like cryptographic IDs for traceability and provenance. • The Governance Layer: Programmable constraints for permissions, spending limits, and behavior controls. • The Payment Layer: Native stablecoin rails with x402 for agentic, multi-protocol transactions. By structuring its operations in this way, Kite AI aims to provide a scalable, verifiable payment experience that minimizes trust issues and enhances autonomy for AI agents. 3⃣ Key Features: • Agentic Network: World's first platform for discovering and listing AI agents to perform autonomous tasks like e-commerce or services. • Verifiable Identity: Cryptographic passports ensuring traceability, provenance, and reputation for AI entities. • Programmable Governance: Custom rules for permissions, limits, and automated blocks on suspicious activities. • Instant Payments: Near-zero fee stablecoin transfers with x402 compatibility for cross-chain interoperability. 4⃣ Tokenomics: 𝑷𝒓𝒊𝒄𝒆: $0.09 𝑴𝒂𝒓𝒌𝒆𝒕 𝑪𝒂𝒑: $163 million 𝑪𝒊𝒓𝒄𝒖𝒍𝒂𝒕𝒊𝒐𝒏 𝒔𝒖𝒑𝒑𝒍𝒚: 1.8 billion 𝑴𝒂𝒙 𝒔𝒖𝒑𝒑𝒍𝒚 : 10 billion 5⃣ Conclusion: • Kite AI transforms payments for AI agents with a dedicated blockchain focused on security, scalability, and autonomy through x402 and PoAI. • Its layered architecture and ecosystem integrations position it as a leader in agentic commerce, with tools for identity, governance, and seamless transactions. • With strong backing, exchange listings, and utility in fees, staking, and governance, $KITE drives value in the emerging autonomous economy.

9 0 362 Original >Trend of KITE after releaseExtremely BullishKite AI, as an AI payment blockchain, its innovative technology and strong backing make it highly promising.

9 0 362 Original >Trend of KITE after releaseExtremely BullishKite AI, as an AI payment blockchain, its innovative technology and strong backing make it highly promising. OCT Gems FA_Analyst Influencer C11.47K @oct_gems

OCT Gems FA_Analyst Influencer C11.47K @oct_gems🚨 𝐆𝐞𝐦 𝐀𝐥𝐞𝐫𝐭 🚨 💎 $KITE 💎 @GoKiteAI 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰 : 👉 Kite is building a Al payment blockchain, a foundational infrastructure where autonomous Al agents can operate with verifiable identity and programmable governance, with native access to stablecoin payments. 👉 They present the SPACE framework as the complete solution: Stablecoin-native: Every transaction settles in stablecoins with predictable sub-cent fees. Programmable constraints: Spending rules enforced cryptographically, not through trust. Agent-first authentication: Hierarchical wallets with cryptographic principal binding. Compliance-ready: Immutable audit trails with privacy-preserving selective disclosure. Economically viable micropayments: True pay-per-request economics at global scale. 🪙 𝐓𝐨𝐤𝐞𝐧𝐨𝐦𝐢𝐜𝐬 : 🔺 𝑪𝒖𝒓𝒓𝒆𝒏𝒕 𝒑𝒓𝒊𝒄𝒆: $0.092 🔺𝑻𝒐𝒌𝒆𝒏 𝑻𝒊𝒄𝒌𝒆𝒓: $KITE 🔺𝑴𝒂𝒓𝒌𝒆𝒕 𝒄𝒂𝒑: $167M 🔺𝑪𝒊𝒓𝒄𝒖𝒍𝒂𝒕𝒊𝒐𝒏 𝒔𝒖𝒑𝒑𝒍𝒚: 1.8B 🔺𝑻𝒐𝒕𝒂𝒍 𝑺𝒖𝒑𝒑𝒍𝒚: 10B "Always take whatever you read on the internet with a pinch of salt, do your own research, NFA"

10 1 836 Original >Trend of KITE after releaseBullishKITE作为AI支付区块链潜力币被推荐。

10 1 836 Original >Trend of KITE after releaseBullishKITE作为AI支付区块链潜力币被推荐。- Trend of KITE after releaseNeutralOnly mentions KITE, no specific viewpoint or sentiment

Naveed Influencer Educator B23.67K @navex_eth

Naveed Influencer Educator B23.67K @navex_ethAI agents need a way to pay and transact @GoKiteAI is building a Layer 1 blockchain designed for agentic payments, where AI agents can operate with clear identity and rules. Kite separates users, agents, and sessions, making automation safer and more controlled $KITE #KITE https://t.co/514z4nTsS7

Naveed Influencer Educator B23.67K @navex_eth

Naveed Influencer Educator B23.67K @navex_ethThe network is EVM-compatible and built for real-time activity $KITE powers the ecosystem, starting with participation incentives and later adding staking, governance, and fees Built for AI-first economies #KITE

6 3 227 Original >Trend of KITE after releaseBullishKITE builds L1 blockchain payments for AI agents, with the token empowering the ecosystem. TerraNewsEN (TNEWS) Media Community_Lead B11.50K @TerraNewsEN

TerraNewsEN (TNEWS) Media Community_Lead B11.50K @TerraNewsENWill the expected surge in KITE, the first AI blockchain, materialize? KITE fundamentally solves the infrastructure crisis plaguing today's agent economy by enabling AI agents to perform autonomous transactions on a large scale with cryptographic security and native x402 compliance. The network's native token, $KITE, has a total supply of 10 billion units. With an initial circulating supply of 1.8 billion units, KITE's market capitalization has reached $160 million. Based on the total supply, we can say its market value is approximately $885 million. With the potential to reach a billion-dollar market capitalization during an altcoin bull run, expectations are high for $KITE... Are there any KITE investors here? #KİTE #KITE #Altcoins #Crypto #Analysis

9 0 599 Original >Trend of KITE after releaseBullishKITE, as the first AI blockchain, is expected to see its market cap surge in a bull market, solving AI agent infrastructure problems.

9 0 599 Original >Trend of KITE after releaseBullishKITE, as the first AI blockchain, is expected to see its market cap surge in a bull market, solving AI agent infrastructure problems. onchainschool.pro OnChain_Analyst Educator A6.03K @how2onchain

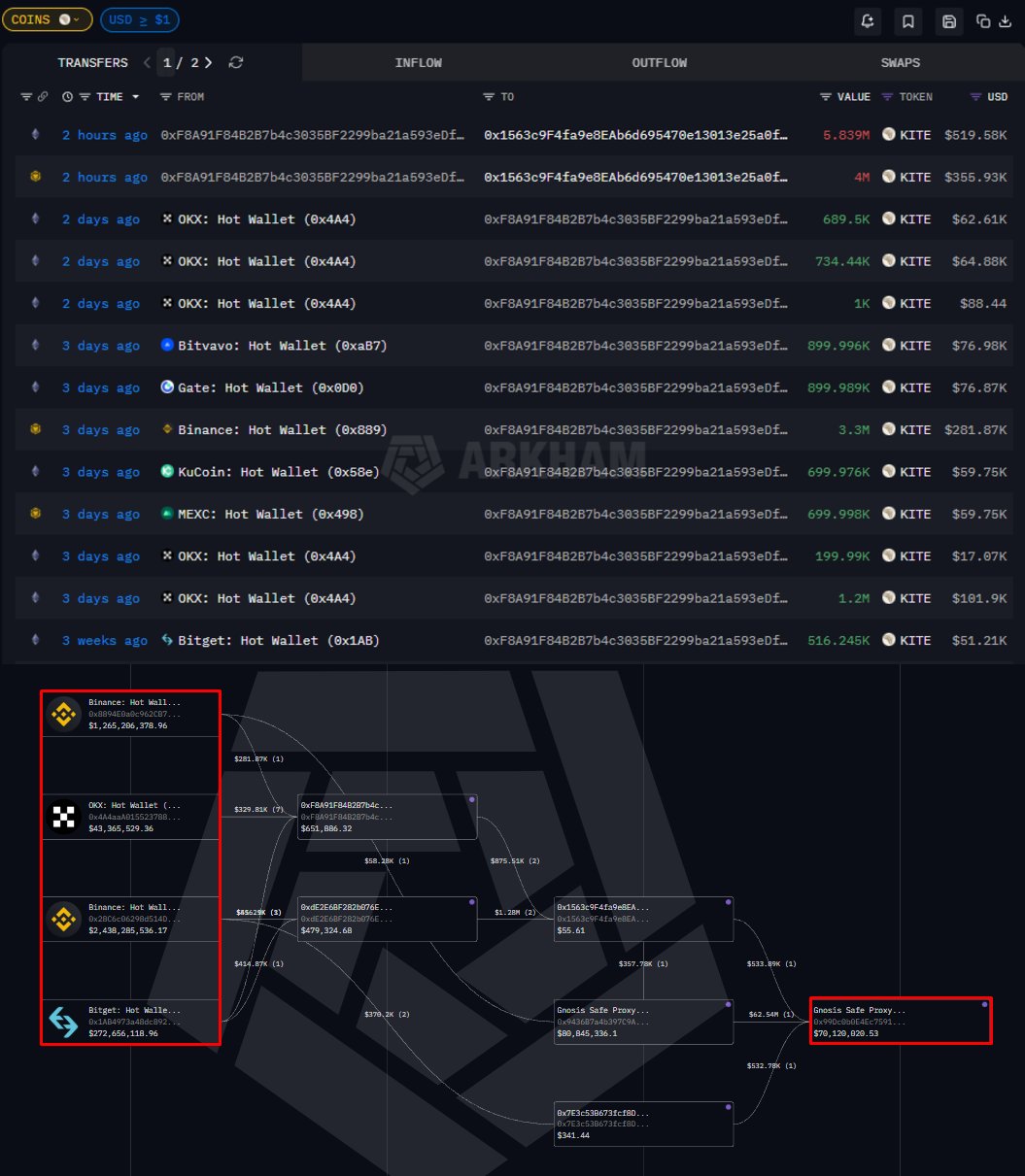

onchainschool.pro OnChain_Analyst Educator A6.03K @how2onchain$KITE MOVED TO TEAM WALLETS Over the last 2 hours, $KITE worth approximately $900K were transferred to two team wallets These tokens were withdrawn from multiple exchanges over the past 3 days and ultimately consolidated into the team wallets Additionally, 8 hours earlier, tokens worth $530K were transferred to a team wallet using the same flow Team wallets: 0x99Dc0b0E4Ec759159CA7412802684C48CD4bBB9a 0x9436B7a4b397C9A43A2fD2c75C41e826aceC0852

15 2 2.82K Original >Trend of KITE after releaseBearishThe KITE team moved tokens worth about $900K from exchanges to the team wallets.

15 2 2.82K Original >Trend of KITE after releaseBearishThe KITE team moved tokens worth about $900K from exchanges to the team wallets. Crypto Eagles FA_Analyst OnChain_Analyst B51.00K @CryptoProject6

Crypto Eagles FA_Analyst OnChain_Analyst B51.00K @CryptoProject6Most AI-focused chains talk about agent intelligence @GoKiteAI is actually building the rails these agents will transact on Their L1 introduces verifiable identity, programmable governance, and near-instant settlement - exactly what autonomous on-chain agents need to operate without friction The 3-layer identity design is a big deal: ✔ Users ✔ Agents ✔ Sessions Each isolated. Each auditable. Each secure. And with $KITE moving toward staking, governance, and fee mechanics, the network is aligning economic incentives with real agent activity If AI agents are the next major liquidity layer, #KITE is positioning itself as the chain they’ll rely on

70 81 711 Original >Trend of KITE after releaseExtremely BullishKITE is positioned as the infrastructure for AI agent trading, offering advantages such as verifiable identity and programmable governance.

70 81 711 Original >Trend of KITE after releaseExtremely BullishKITE is positioned as the infrastructure for AI agent trading, offering advantages such as verifiable identity and programmable governance.

- No Data