Pendle (PENDLE)

Pendle (PENDLE)

$1.5652 +0.14% 24H

- 71Social Sentiment Index (SSI)+111.94% (24h)

- #56Market Pulse Ranking (MPR)+45

- 524h Social Mention+400.00% (24h)

- 80%24h KOL Bullish Ratio4 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall71SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (20%)Bullish (60%)Neutral (20%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of PENDLE after releaseNeutral

- Trend of PENDLE after releaseBullish

- Trend of PENDLE after releaseBullish

- Trend of PENDLE after releaseBullish

區塊先生 🐡 ⚠️ (rock #58) Educator Influencer B99.31K @mrblock

區塊先生 🐡 ⚠️ (rock #58) Educator Influencer B99.31K @mrblock DeFi Andree D7.33K @DeFi_Andree

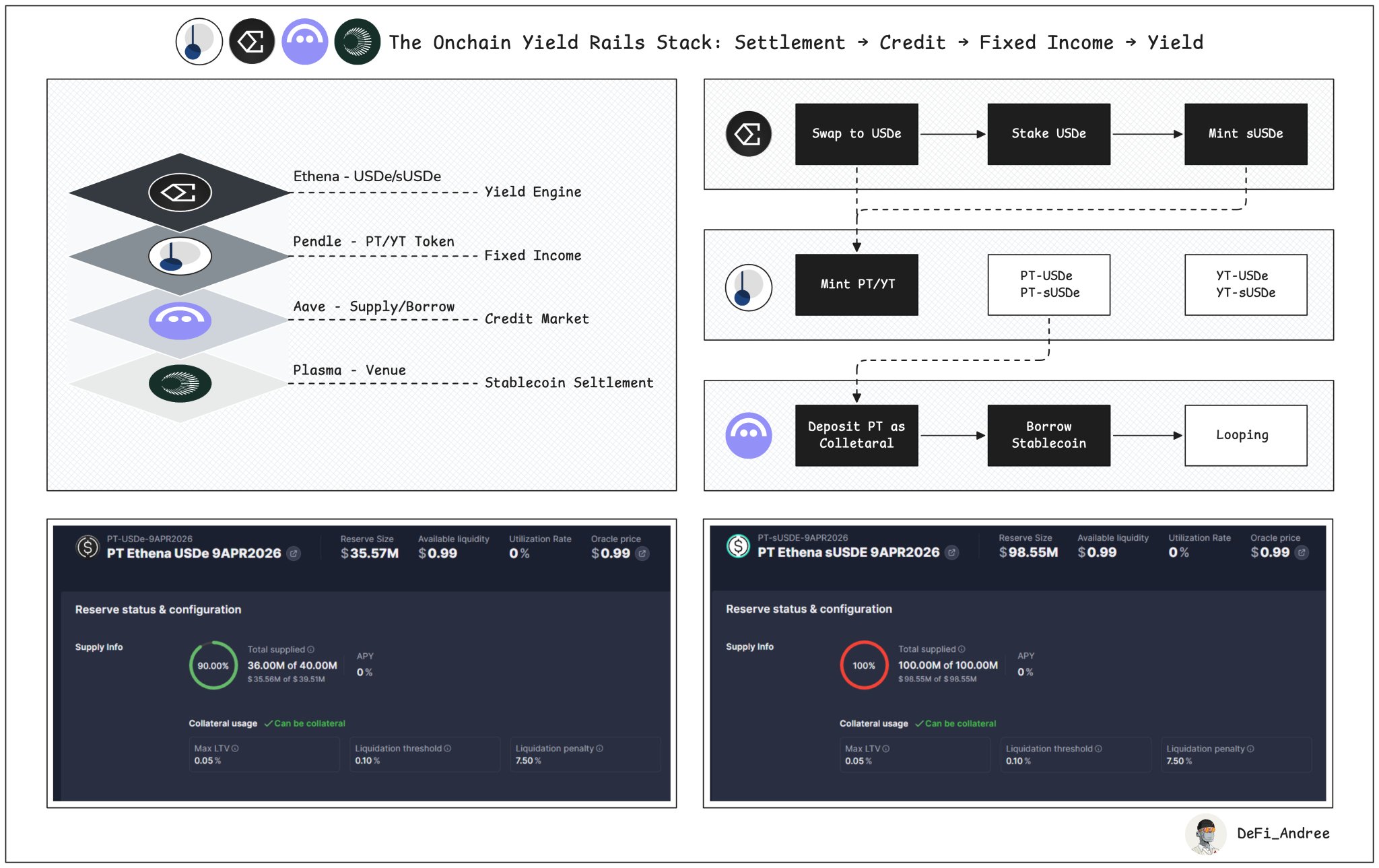

DeFi Andree D7.33K @DeFi_Andree 29 4 9.20K Original >Trend of PENDLE after releaseExtremely Bullish

29 4 9.20K Original >Trend of PENDLE after releaseExtremely Bullish- Trend of PENDLE after releaseBullish

The DeFi Investor 🔎 DeFi_Expert Tokenomics_Expert B161.62K @TheDeFinvestor

The DeFi Investor 🔎 DeFi_Expert Tokenomics_Expert B161.62K @TheDeFinvestor The DeFi Investor 🔎 DeFi_Expert Tokenomics_Expert B161.62K @TheDeFinvestor

The DeFi Investor 🔎 DeFi_Expert Tokenomics_Expert B161.62K @TheDeFinvestor 157 34 9.03K Original >Trend of PENDLE after releaseBullish

157 34 9.03K Original >Trend of PENDLE after releaseBullish- Trend of PENDLE after releaseNeutral

- Trend of PENDLE after releaseBullish

- Trend of PENDLE after releaseNeutral