STBL (STBL)

STBL (STBL)

$0.05377 -5.52% 24H

- 58Social Sentiment Index (SSI)-12.59% (24h)

- #42Market Pulse Ranking (MPR)+32

- 824h Social Mention0% (24h)

- 100%24h KOL Bullish Ratio4 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall58SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (63%)Bullish (37%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of STBL after releaseExtremely Bullish

deathmage.x .edge🦭 DeFi_Expert Researcher B2.27K @phanthanguss

deathmage.x .edge🦭 DeFi_Expert Researcher B2.27K @phanthanguss deathmage.x .edge🦭 DeFi_Expert Researcher B2.27K @phanthanguss

deathmage.x .edge🦭 DeFi_Expert Researcher B2.27K @phanthanguss 1 1 28 Original >Trend of STBL after releaseBullish

1 1 28 Original >Trend of STBL after releaseBullish Henri/MemeMax⚡️ Trader TA_Analyst B6.88K @HenriLee92

Henri/MemeMax⚡️ Trader TA_Analyst B6.88K @HenriLee92

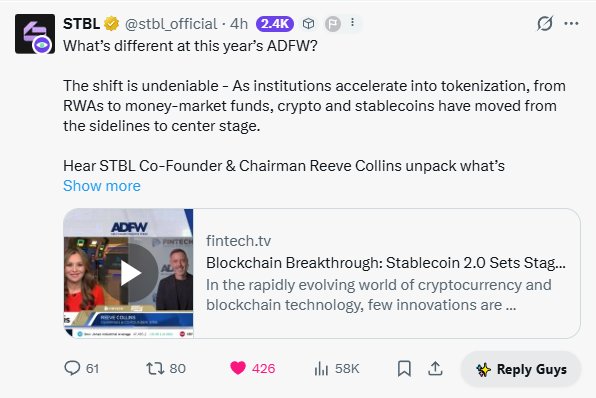

STBL D41.76K @stbl_official31 24 766 Original >Trend of STBL after releaseExtremely Bullish

STBL D41.76K @stbl_official31 24 766 Original >Trend of STBL after releaseExtremely Bullish Ni Researcher DeFi_Expert B40.64K @ni_celeb

Ni Researcher DeFi_Expert B40.64K @ni_celeb Ni Researcher DeFi_Expert B40.64K @ni_celeb

Ni Researcher DeFi_Expert B40.64K @ni_celeb 20 10 383 Original >Trend of STBL after releaseBullish

20 10 383 Original >Trend of STBL after releaseBullish Ni Researcher DeFi_Expert B40.64K @ni_celeb

Ni Researcher DeFi_Expert B40.64K @ni_celeb Ni Researcher DeFi_Expert B40.64K @ni_celeb

Ni Researcher DeFi_Expert B40.64K @ni_celeb 12 4 254 Original >Trend of STBL after releaseExtremely Bullish

12 4 254 Original >Trend of STBL after releaseExtremely Bullish- Trend of STBL after releaseExtremely Bullish

- Trend of STBL after releaseBullish

Ni Researcher DeFi_Expert B40.64K @ni_celeb

Ni Researcher DeFi_Expert B40.64K @ni_celeb Ni Researcher DeFi_Expert B40.64K @ni_celeb

Ni Researcher DeFi_Expert B40.64K @ni_celeb 32 21 1.39K Original >Trend of STBL after releaseExtremely Bullish

32 21 1.39K Original >Trend of STBL after releaseExtremely Bullish Lumen_Deiㅣ∞ KIN .edge🦭 Researcher Tokenomics_Expert A2.31K @letsgoddc746386Eth_Banana edge🦭 D5.83K @RichardRSong

Lumen_Deiㅣ∞ KIN .edge🦭 Researcher Tokenomics_Expert A2.31K @letsgoddc746386Eth_Banana edge🦭 D5.83K @RichardRSong 40 39 316 Original >Trend of STBL after releaseExtremely Bullish

40 39 316 Original >Trend of STBL after releaseExtremely Bullish- Trend of STBL after releaseBullish