Uniswap (UNI)

Uniswap (UNI)

$3.925 +2.21% 24H

- 33Social Sentiment Index (SSI)+3.92% (24h)

- #120Market Pulse Ranking (MPR)-9

- 324h Social Mention-40.00% (24h)

- 66%24h KOL Bullish Ratio2 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall33SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (33%)Bullish (33%)Neutral (34%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

jesse.base.eth Community_Lead Influencer C338.68K @jessepollak

jesse.base.eth Community_Lead Influencer C338.68K @jessepollak liquid 💦 D20.07K @_proxystudio39 8 4.00K Original >Trend of UNI after releaseBullish

liquid 💦 D20.07K @_proxystudio39 8 4.00K Original >Trend of UNI after releaseBullish Uniswap Labs 🦄 Dev DeFi_Expert C1.47M @Uniswap

Uniswap Labs 🦄 Dev DeFi_Expert C1.47M @Uniswap Uniswap Labs 🦄 Dev DeFi_Expert C1.47M @Uniswap6 3 686 Original >Trend of UNI after releaseBullish

Uniswap Labs 🦄 Dev DeFi_Expert C1.47M @Uniswap6 3 686 Original >Trend of UNI after releaseBullish- Trend of UNI after releaseNeutral

- Trend of UNI after releaseExtremely Bullish

- Trend of UNI after releaseExtremely Bearish

- Trend of UNI after releaseBearish

- Trend of UNI after releaseBullish

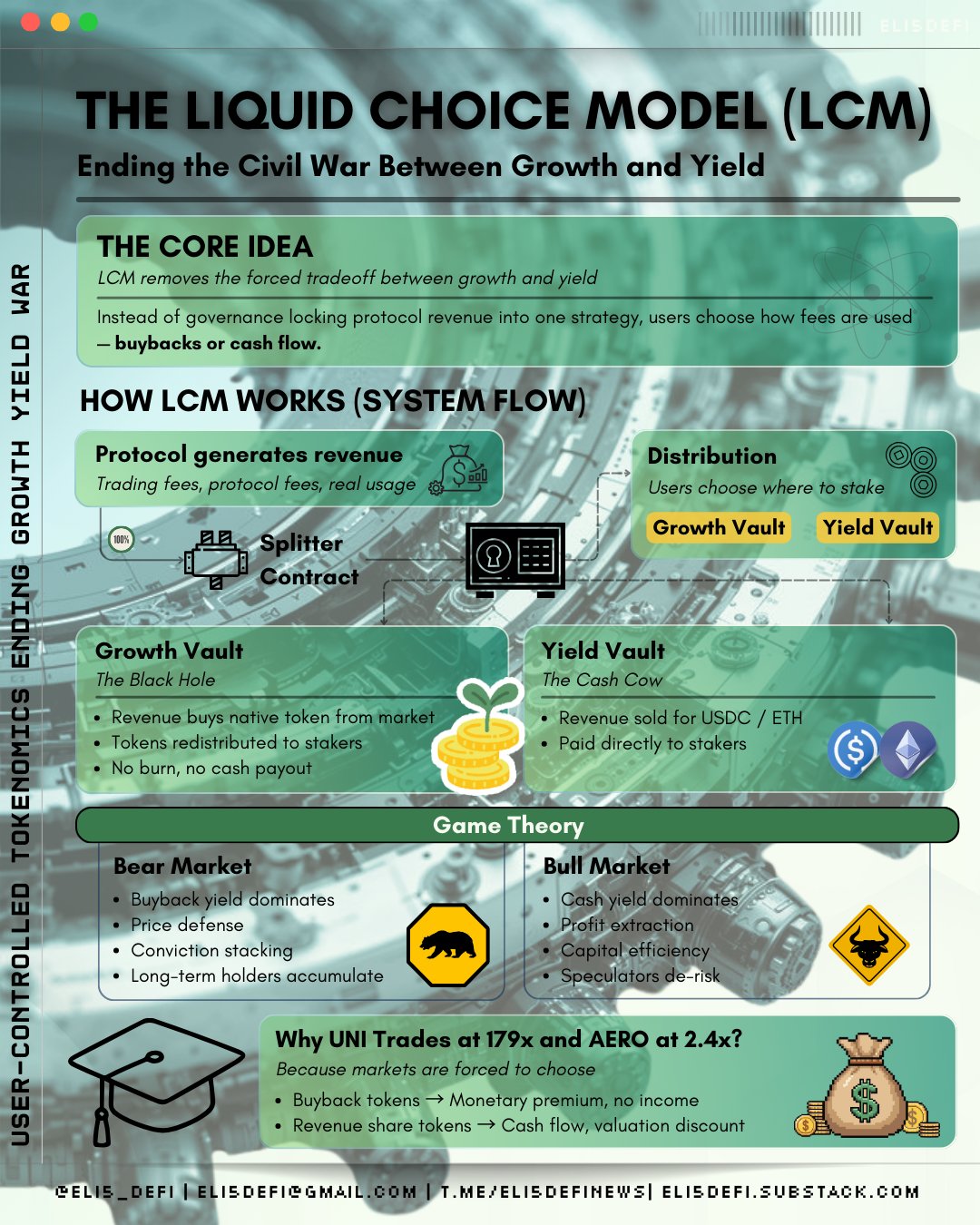

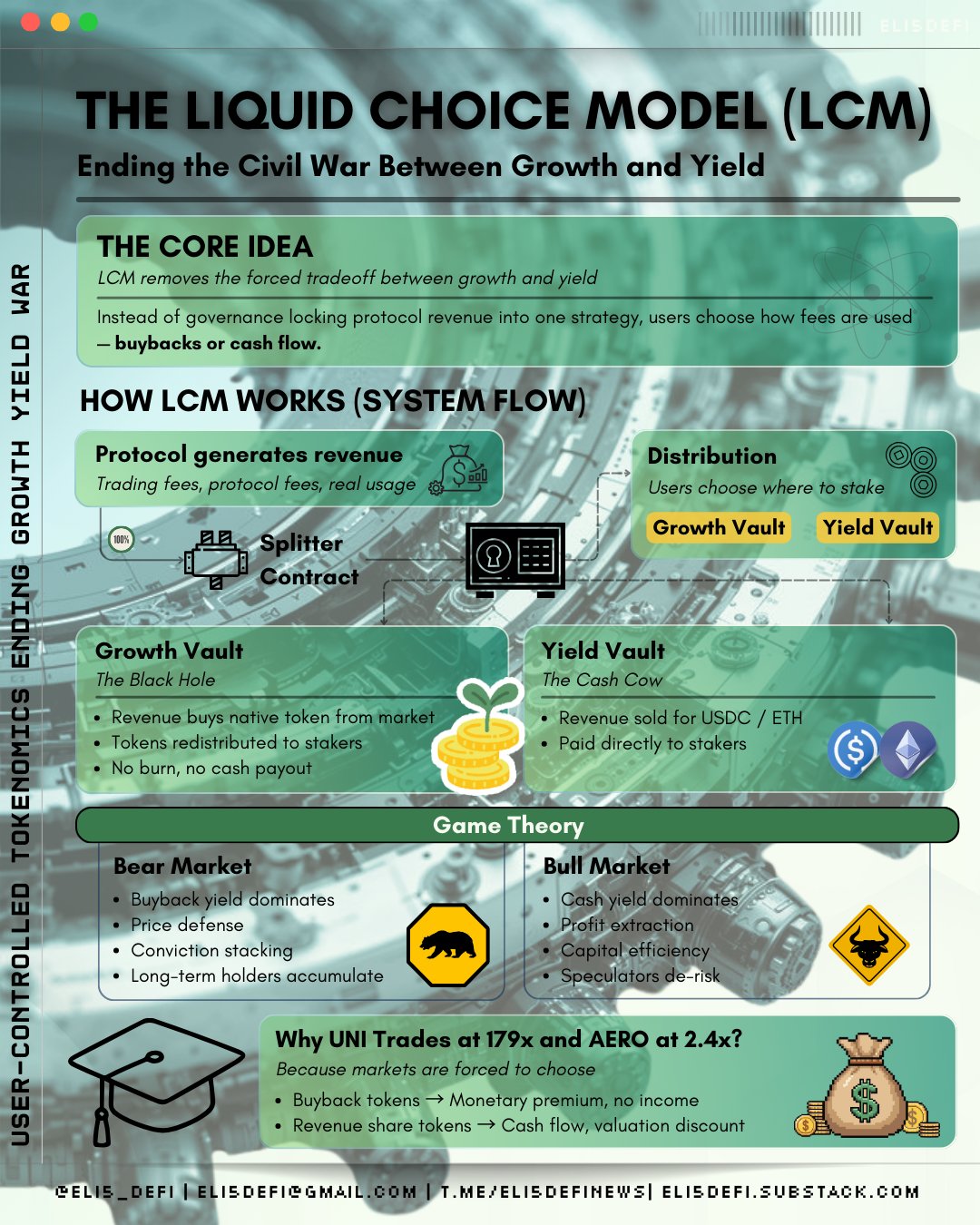

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 53 27 2.24K Original >Trend of UNI after releaseBullish

53 27 2.24K Original >Trend of UNI after releaseBullish Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 53 27 2.24K Original >Trend of UNI after releaseBullish

53 27 2.24K Original >Trend of UNI after releaseBullish- Trend of UNI after releaseBullish