SushiSwap دادههای قیمت لحظهای

قیمت امروز SushiSwap برابر با $ 0.21 (SUSHI/USD) است. با ارزش بازار برابر با $ 63.00M USD. حجم معاملات 24 ساعته $ 89,164.26 USD, تغییر قیمت 24 ساعته به میزان -6.38% و عرضه در گردش برابر با 286.83M SUSHI.

SushiSwap SUSHI تاریخچه قیمت USD

قیمت SushiSwap را برای امروز، 7 روز، 30 روز و 90 روز پیگیری کنید

دوره

تغییر

تغییر (%)

امروز

0

-5.98%

7روزها

--

--

30روزها

--

--

90روزها

0

-56.78%

تجارت SUSHI در سه مرحله

یک حساب کاربری رایگان ایجاد کنید، حساب خود را شارژ کنید، افزودن سپس ارز دیجیتال خود را انتخاب کنید

SushiSwap اطلاعات بازار

$ 0.21 محدوده ۲۴ ساعته $ 0.23

بالاترین رکورد زمانی

$ 99.84

همیشه پایین

$ 0.0099

تغییر ۲۴ ساعته

-6.38%

حجم ۲۴ ساعت

$ 89,164.26

عرضه در گردش

286.83M

SUSHI

مارکت کپ

$ 63.00M

حداکثر عرضه

287.67M

SUSHI

ارزش بازار کاملاً رقیقشده

$ 63.19M

کسب درآمد حتی بدون دانش مالی

Put your idle crypto to work and earn passive income through savings, staking, and more.SushiSwap X Insight

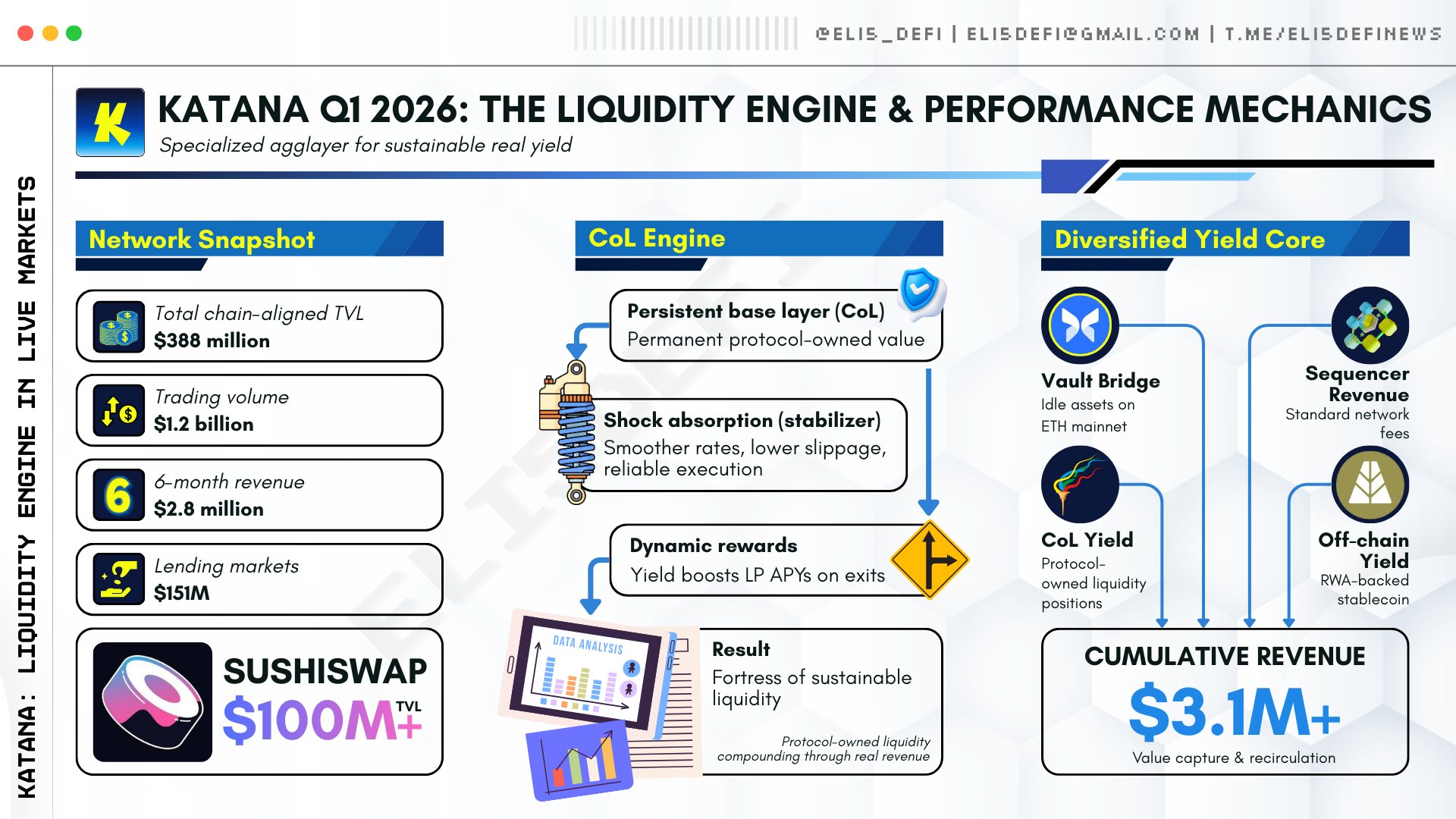

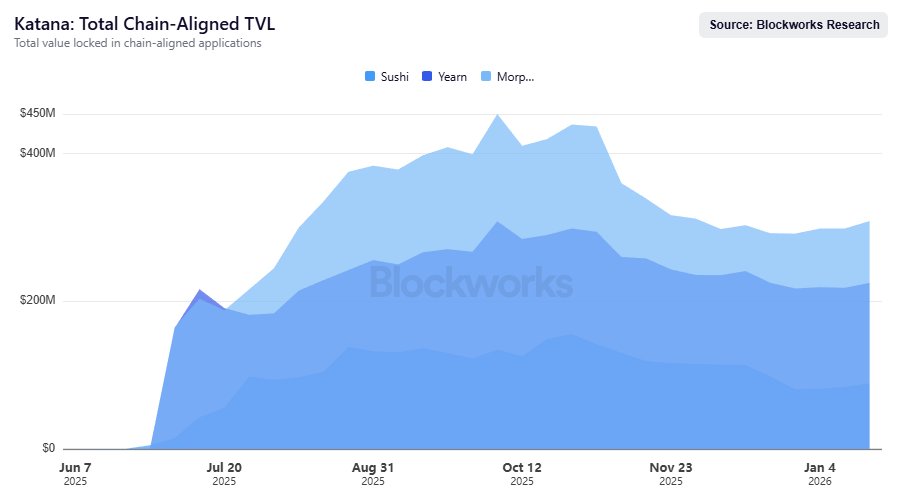

Katana protocol's Q1 performance was strong, with TVL reaching $388 million and cumulative revenue exceeding $3.1 million.

It's only January, Katana is already showing how its liquidity engine behaves under live market conditions.

This is an early Q1 data point.

Under January market conditions, the system is behaving as designed.

▸ ~$388M chain-aligned TVL, top 10 among L2s

▸ ~$1.2B cumulative DEX volume

▸ $3.1M+ total revenue generated and recycled

▸ Capital is actively deployed across lending and DEXs

▸ @SushiSwap anchors spot liquidity with $100M+ TVL

Chain-Owned Liquidity remained deployed as a stabilizing base layer, smoothing borrow rates, reducing slippage, and maintaining execution quality during volatility.

Vault Bridge is the dominant revenue source, deploying idle assets to @ethereum via @Morpho.

Sequencer fees, CoL yield, and off-chain yield via $AUSD add incremental cash flows.

The system captures and recycles value at the protocol level, rather than relying on incentive-driven liquidity.

13 روزها قبل

روند SUSHI پس از انتشار

اطلاعاتی موجود نیست

بسیار صعودی

Katana protocol's Q1 performance was strong, with TVL reaching $388 million and cumulative revenue exceeding $3.1 million.

Katana showed strong performance in Q1, its liquidity engine operated well, and revenue was considerable.

It's only January, Katana is already showing how its liquidity engine behaves under live market conditions.

This is an early Q1 data point.

Under January market conditions, the system is behaving as designed.

▸ ~$388M chain-aligned TVL, top 10 among L2s

▸ ~$1.2B cumulative DEX volume

▸ $3.1M+ total revenue generated and recycled

▸ Capital is actively deployed across lending and DEXs

▸ @SushiSwap anchors spot liquidity with $100M+ TVL

Chain-Owned Liquidity remained deployed as a stabilizing base layer, smoothing borrow rates, reducing slippage, and maintaining execution quality during volatility.

Vault Bridge is the dominant revenue source, deploying idle assets to @ethereum via @Morpho.

Sequencer fees, CoL yield, and off-chain yield via $AUSD add incremental cash flows.

The system captures and recycles value at the protocol level, rather than relying on incentive-driven liquidity.

— Check more details here:

https://t.co/3HNE5ZYTZY

— Disclaimer https://t.co/LK2oZIjb2U

13 روزها قبل

روند SUSHI پس از انتشار

اطلاعاتی موجود نیست

صعودی

Katana showed strong performance in Q1, its liquidity engine operated well, and revenue was considerable.

Katana platform has shown astonishing growth in revenue, TVL, and DEX trading volume within six months of launch.

gm bros

It has already been 6 months since @katana went live!!

And the progress is INSANE for such a short time:

> $3.1M total revenue

> $388M DeFi TVL (#9 L2 by TVL)

> $1.2B DEX volume in Q4 (!!!)

> $151M+ loans on Morph o + $100M+ TVL on SushiSwap

And since it's Katana the TVL is not idle, all TVL is active. VaultBridge alone did $2.8M+ in rev, which is then cycled back into Katana defi to print even more yield

The flywheel is spinning ⚔️

15 روزها قبل

روند SUSHI پس از انتشار

اطلاعاتی موجود نیست

بسیار صعودی

Katana platform has shown astonishing growth in revenue, TVL, and DEX trading volume within six months of launch.

پیشبینی قیمت

چه زمانی برای خرید SUSHI مناسب است؟ آیا اکنون باید SUSHI بخرم یا بفروشم؟

از دیدگاه تجزیه و تحلیل فنی بر اساس تحلیل تکنیکال 4 ساعته SUSHI، سیگنال معاملاتی نگهداری است. بر اساس تحلیل تکنیکال 1 روزه SUSHI، سیگنال معاملاتی نگهداری است.

پیشبینی Beacon

پیشبینی احتمالی قیمت (24 ساعت آینده)crypto.loading

درباره SushiSwap

SushiSwap (SUSHI) is a cryptocurrency launched in 2020and operates on the Ethereum platform. SushiSwap has a current supply of 287,676,365.31480285 with 286,834,102.51212947 in circulation. The last known price of SushiSwap is 0.23953051 USD and is down -2.24 over the last 24 hours. It is currently trading on 965 active market(s) with $14,847,384.58 traded over the last 24 hours. More information can be found at https://sushi.com/.

بیشتر بخوانید

جستجوگر بلاکچین

کاوش بیشتر

کشف BM

لیستینگ جدید

WAN Wanchain

0 0.00%

WAR WAR

0 0.00%

DANKDOGEAI DankDoge AI Agent

0 0.00%

AIX AIXexchange

0 0.00%

WARD Warden Protocol

0 0.00%

ONE Harmony

0 0.00%

IRENON IREN Ondo Tokenized

0 0.00%

AALON American Airlines Group Ondo Tokenized

0 0.00%

MRKON Merck Ondo Tokenized

0 0.00%

XOMON Exxon Mobil Ondo Tokenized

0 0.00%