About the new KAITO IDO you need to know

KAITO recently launched a new IDO project @BitwayOfficial

Compiled the project information; decide whether to join the new;

1| Basic Project Information

BTCFi's L1, originally a side protocol;

Funding totals 5.94M, with a focus on incubation by YZi Labs;

2| Project Valuation

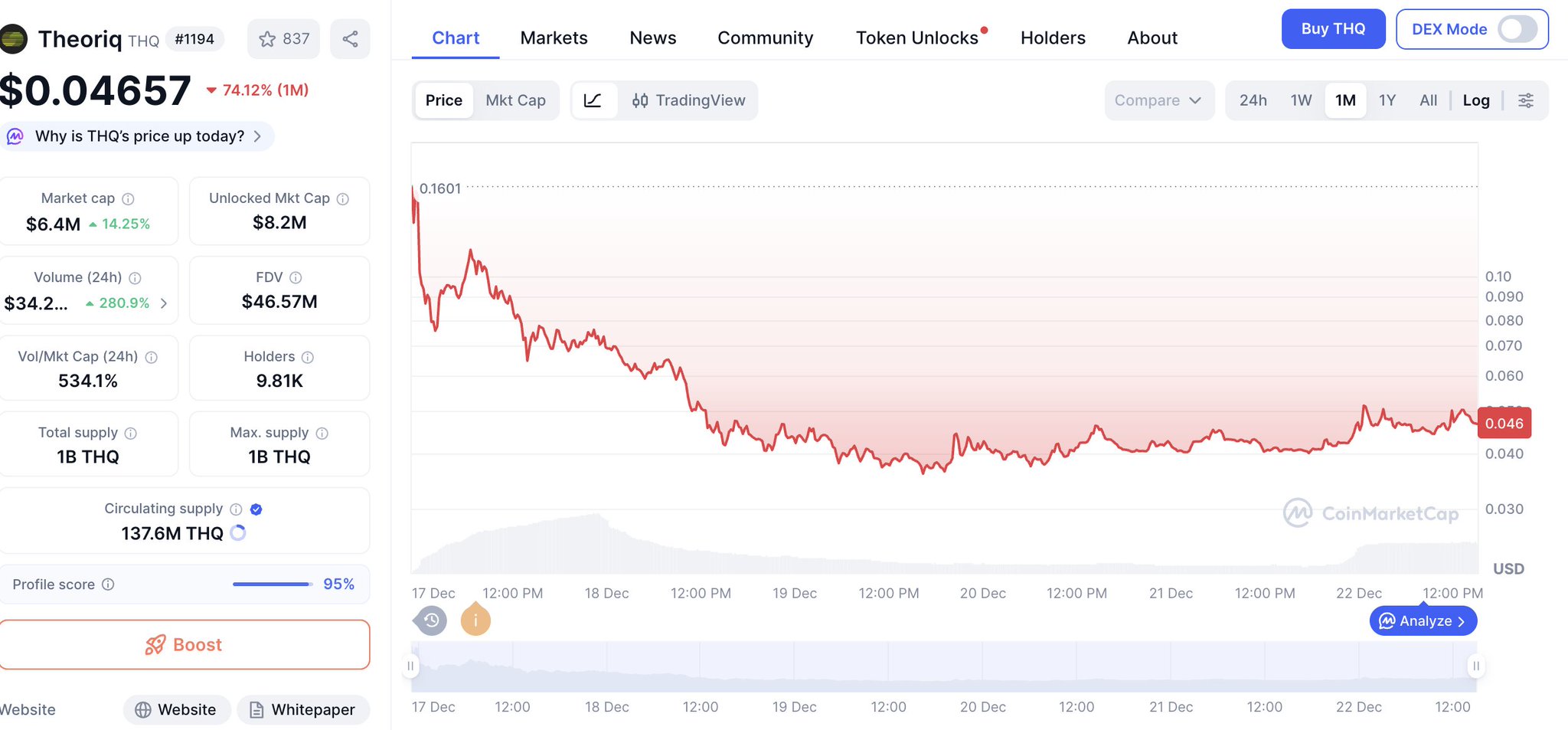

The latest round of directed strategic financing valued the project at $100M;

The recent IDO on Kaito Capital Launchpad sets FDV at $80M, but only 50% is unlocked, with the remainder unlocking over the next three months;

Thus, after TGE, an FDV of 160M would immediately break even;

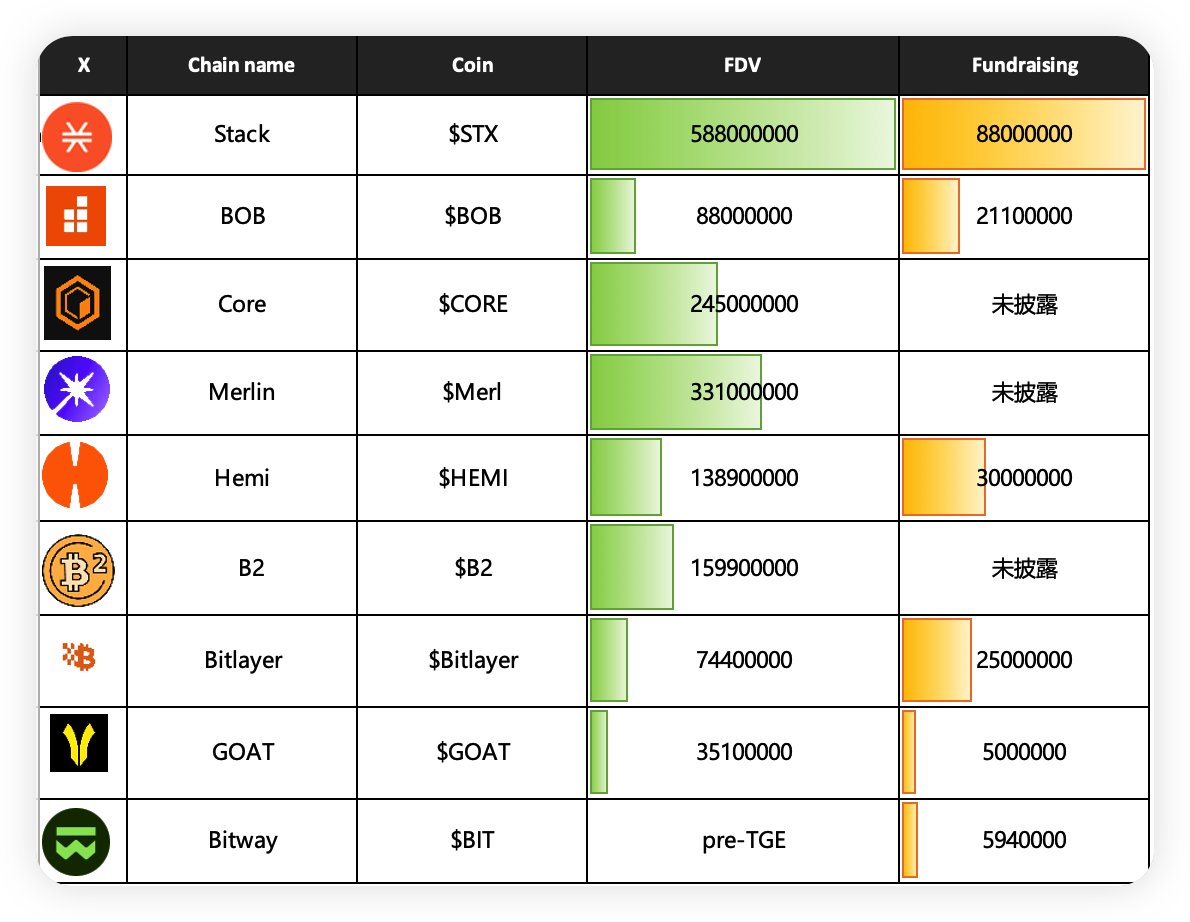

3| Horizontal Comparison

Compiled a simple comparison of BTCFi's public chain projects, focusing mainly on financing

and FDV after TGE (current financing does not represent all)

4| Summary

Invest cautiously; market entry carries risk; make your own decisions;