Cartesi Données sur les prix en temps réel

Le prix de Cartesi aujourd'hui est $ 0.029 (CTSI/USD). Avec une capitalisation boursière de $ 27.08M USD. Volume de trading de $ 4.48M USD sur 24 heures, Un changement de prix de +0.00% sur 24 heures, Et une réserve circulante de 902.79M CTSI.

Cartesi CTSI Historique des prix USD

Suivez le prix de Cartesi aujourd’hui, dans 7 jours, 30 jours et 90 jours

Période

Modifier

Variation (en pourcentage)

Aujourd'hui

0

0.00%

7Jours

--

--

30Jours

--

--

90Jours

--

--

Possédez CTSI dès maintenant

Achetez et vendez CTSI facilement et en toute sécurité sur BitMart.

Cartesi Informations sur le marché

$ 0.019 Fourchette de prix sur 24 heures $ 0.029

Record absolu

$ 0.039

Plus bas niveau jamais atteint

$ 0.019

Variation sur 24 heures

0.00%

Volume sur 24 h

$ 4,475,131.74

Approvisionnement en circulation

0.90B

CTSI

Capitalisation boursière

$ 27.08M

Approvisionnement maximal

1.00B

CTSI

Capitalisation boursière entièrement diluée

$ 30.00M

Gagner

Faites fructifier vos cryptomonnaies et générez des revenus passifs grâce à l'épargne, au staking, et plus encore.Cartesi X Insight

CTSI entered Stage 2, decentralized governance affirmed.

Cartesi has raised the bar for L2s.

At Stage 2 maturity, Cartesi ensures a decentralized and permissionless environment where code is law. This architecture guarantees that users, not founders, remain in control.

Watch @felipeargento discuss this milestone on @CryptoCoinShow ↓ https://t.co/KrIVkPbClX

8 Jours il y a

Tendance de CTSI après le lancement

Pas de données

Haussier

CTSI entered Stage 2, decentralized governance affirmed.

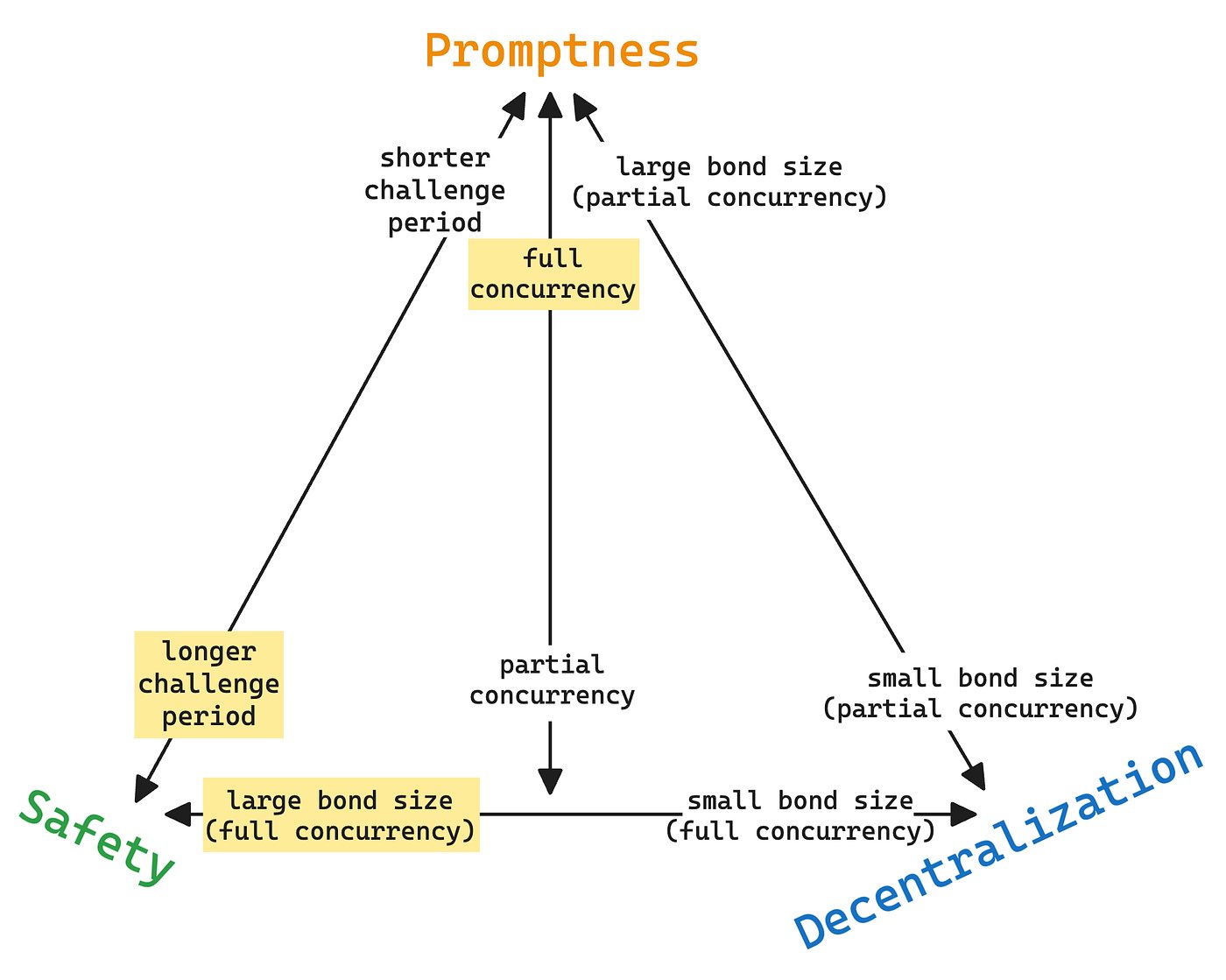

Analyzing ZK/fraud proofs, advocating Layer-2 hybrid architecture to optimize performance.

In a recent thread, @joaopdgarcia a Cartesi developer explained the difference between fraud proofs and ZK proofs in rollups.

He described fraud proofs as a way to “reveal lies” by re-executing disputed steps, and ZK proofs as mathematical statements asserting correctness without re-execution.

That distinction is useful and I quite agree with him .

ZK proofs are impressive as they compress a computation into a tiny proof that anyone can verify quickly.

But this power comes with trade‑offs.

Surveys like the 2025 SoK on zk‑SNARKs point out that scaling these proofs for real‑world, Turing‑complete computations is challenging.

Circuits can become extremely complex, proving requires significant memory and hardware, and only a few actors can generate proofs efficiently.

Studies comparing SNARKs, STARKs, and Bulletproofs confirm that even seemingly simple computations can be orders of magnitude more costly to prove than to execute.

So while ZK proofs promise instant validity, the practical costs, both computational and economic, are non‑trivial.

Fraud proofs, on the other hand, remain surprisingly powerful in practice.

The idea is simple: assume computations are correct unless challenged.

If a dispute arises, only the specific step in question is re‑executed and verified.

Research on optimistic rollups, including recent 2024–2025 studies, shows that fraud proofs not only ensure correctness, but also preserve decentralization, sequencer honesty, and economic security.

Because anyone can verify a dispute cheaply, there’s no natural bottleneck or centralization risk.

They also allow for full Turing‑complete off‑chain computation, something current ZK circuits cannot reliably handle due to expressiveness limits.

The other dimension is hybrid designs, which combine the strengths of both approaches.

By using ZK proofs where computation is tractable and fraud proofs as a fallback for complex or edge‑case logic, hybrid rollups can reduce prover centralization, maintain high throughput, and strengthen security guarantees.

Recent research from 2025 shows that hybrid architectures can balance finality speed, computational expressiveness, and decentralization in ways that pure ZK or pure fraud‑proof systems cannot.

They also provide better transparency for MEV management, since fraud proofs allow visibility during the challenge window, while ZK proofs compress it.

Looking at all the evidence, my take agrees with Joao.

The debate isn’t about choosing one over the other;

it’s about understanding the trade‑offs and designing systems that leverage the strengths of both.

For anyone building Layer‑2 rollups today, this means using fraud proofs for complex logic, applying ZK proofs where proving costs are manageable, and considering hybrid architectures to maximize security, throughput, and decentralization.

Make sure to read the entire thread here 👇

The role of fraud-proofs in a ZK World

Throughout @EFDevcon, the Stage 2 Rollups stand kept the @cartesiproject team busy, walking builders through fraud proofs and zk proofs.

Let’s talk about validation mechanisms in Web3 and why fraud proofs still matter.

71 Jours il y a

Tendance de CTSI après le lancement

Pas de données

Haussier

Analyzing ZK/fraud proofs, advocating Layer-2 hybrid architecture to optimize performance.

Fraud proofs remain a critical verification mechanism in ZK Rollup

The role of fraud-proofs in a ZK World

Throughout @EFDevcon, the Stage 2 Rollups stand kept the @cartesiproject team busy, walking builders through fraud proofs and zk proofs.

Let’s talk about validation mechanisms in Web3 and why fraud proofs still matter.

73 Jours il y a

Tendance de CTSI après le lancement

Pas de données

Neutre

Fraud proofs remain a critical verification mechanism in ZK Rollup

Prévision de prix

Quel est le meilleur moment pour acheter CTSI? Dois-je acheter ou vendre CTSI maintenant ?

Pour déterminer s'il est opportun d'acheter ou de vendre Cartesi (CTSI), il est important de commencer par s'aligner sur sa propre stratégie de trading et son profil de risque. Les investisseurs à long terme et les traders à court terme interprètent souvent les conditions du marché différemment, votre décision doit donc refléter votre approche personnelle. Selon la dernière analyse technique CTSI de 4 heures, le signal de trading actuel est Tenez. Selon la dernière analyse technique CTSI sur 1 jour, le signal actuel est Tenez.

Prédiction de Beacon

Prévision probabiliste des prix (Prochaines 24 heures)crypto.loading

À propos Cartesi

Cartesi (CTSI) is a cryptocurrency launched in 2020and operates on the Ethereum platform. Cartesi has a current supply of 1,000,000,000 with 902,789,769.71116571 in circulation. The last known price of Cartesi is 0.02767016 USD and is up 1.33 over the last 24 hours. It is currently trading on 220 active market(s) with $2,617,492.89 traded over the last 24 hours. More information can be found at https://cartesi.io/.

En savoir plus

Liens officiels

En savoir plus

BM Discovery

Nouvelle annonce

SOFION SoFi Technologies Ondo Tokenized

0 0.00%

ARMON Arm Holdings plc Ondo Tokenized

0 0.00%

IBMON IBM Ondo Tokenized

0 0.00%

ADBEON Adobe Ondo Tokenized

0 0.00%

NKEON Nike Ondo Tokenized

0 0.00%

TCU29 TCU29

0 0.00%

BIGTROUT The Big Trout

0 0.00%

RUNE THORChain

0 0.00%

GSON Goldman Sachs Ondo Tokenized

0 0.00%

SPOTON Spotify Ondo Tokenized

0 0.00%