Kraken acquires BackedFi (xStocks) and takes another look at the tokenized stock market situation:

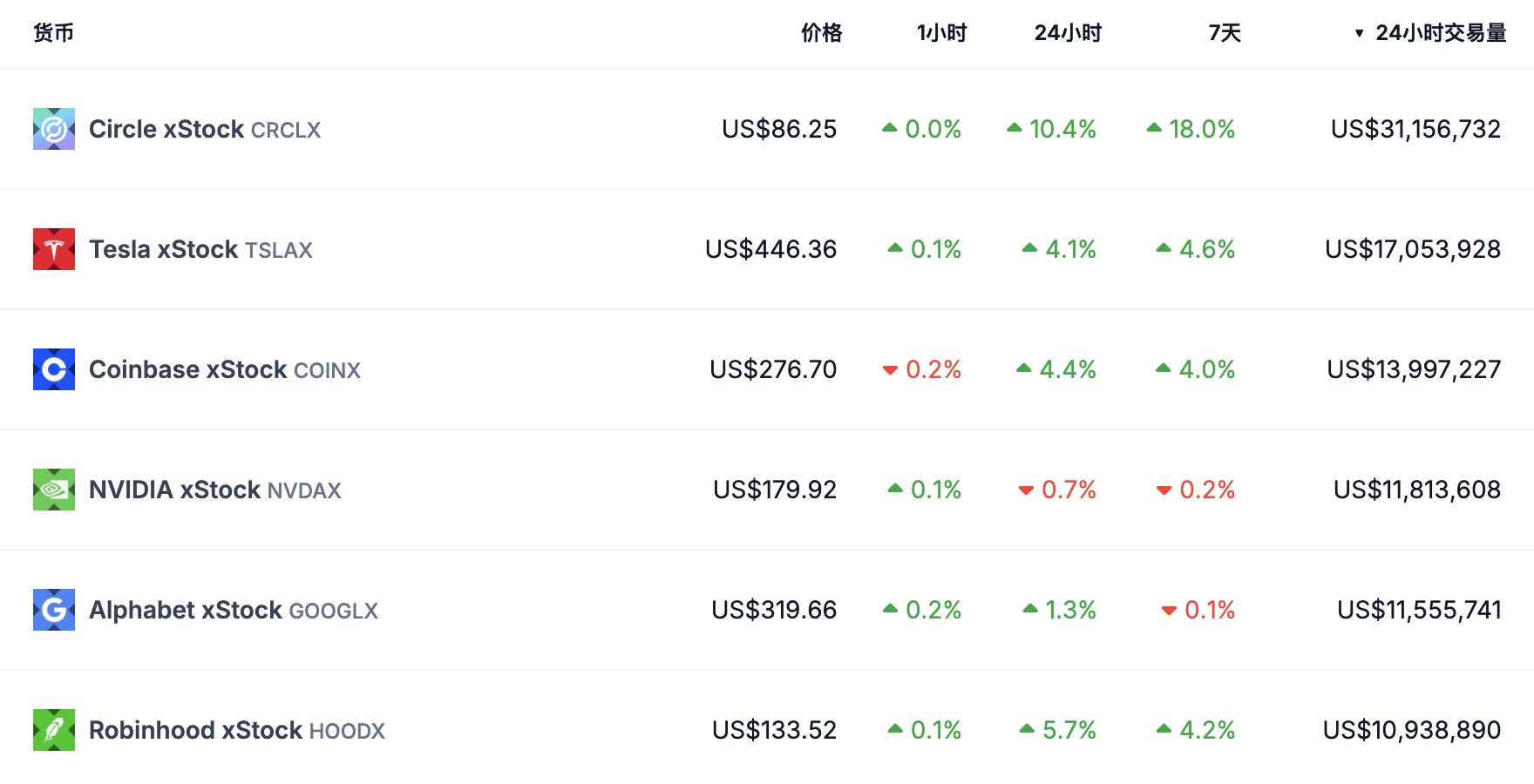

Several popular stocks have daily trading volumes of $10M‑$30M, such as TSLAx, NVDAx, CRCLx. On-chain cumulative trading volume is $400 million, with CEX volume even higher. Recently Binance Wallet has integrated them, so incremental volume should increase. At present, pure trade‑and‑hold appeal is modest, and with Perps entering the space, a new outlet should be sought.

Attention should return to DeFi portfolios.

In the past few months, market expectations for this track were very high, but the current state clearly falls short of expectations. Moreover, Hyperliquid HIP3 has started offering perpetual contracts for US equities, further eroding the attractiveness of simply holding and trading tokenized stocks. Building around DeFi should receive more attention from project teams in the future.

Currently, xStocks can be used as collateral for borrowing on Kamino, achieving an initial DeFi composability. Although the scale is modest, I consider this a good start and experiment. The xStocks solution is fully backed 1:1 by real stocks, with underlying assets verified via Chainlink PoR, permissionless and freely transferable, providing essential groundwork for DeFi integration.

In many other solutions, users cannot move tokens to public blockchains outside the platform, confining them to a trade‑and‑hold niche, which greatly limits those solutions. xStocks’ openness offers an advantage here and could be a breakthrough for the future of tokenized stocks.