Ethena USDe Dữ liệu giá trực tiếp

Giá Ethena USDe hôm nay là $ 0.99 (USDe/USD). Với vốn hóa thị trường là $ 6.55B USD. Khối lượng giao dịch 24 giờ là $ 176.87M USD, Biến động giá trong 24 giờ là +0.00%, Và lượng cung lưu hành là 6.56B USDe.

Ethena USDe USDe Lịch sử giá USD

Theo dõi giá của Ethena USDe hôm nay, 7 ngày, 30 ngày và 90 ngày

Kỳ

Thay đổi

Biến động (%)

Hôm nay

0

0.00%

7ngày

--

--

30ngày

--

--

90ngày

0

0.00%

Sở hữu USDe ngay

Mua và bán USDe dễ dàng và an toàn trên BitMart.

Ethena USDe Thông tin thị trường

$ 0.99 Biến động 24 giờ $ 0.99

Cao nhất từng ghi nhận

$ 0.99

Thấp nhất từng ghi nhận

$ 0.99

Biến động 24 giờ

0.00%

Khối lượng 24 giờ

$ 176,869,448.83

Nguồn cung lưu hành

6.56B

USDe

Vốn hóa thị trường

$ 6.55B

Nguồn cung tối đa

--

Vốn hóa thị trường đã pha loãng hoàn toàn

$ 6.55B

Giao dịch USDe

Ethena USDe X Insight

Ethena (USDE) is accused of being responsible for the market crash on October 10.

Is @ethena the real culprit behind the 10/10 crash?

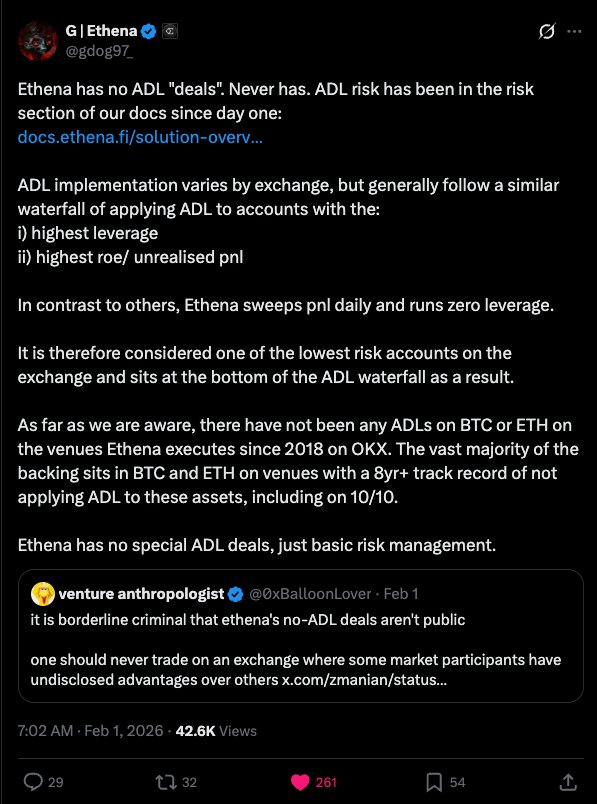

In the aftermath of the sharp market crash on October 10, an intense debate has emerged around the question: “Who should be held responsible?” In this process, Binance and its founder, CZ, have become the primary targets of criticism on Crypto Twitter (CT). At the same time, another project has also been singled out as a potential culprit behind the crash — Ethena.

The core of the argument placing responsibility on Ethena is based on claims put forward by @zmanian (Zaki), a core contributor to Cosmos. His argument can be summarized as follows. Due to the nature of Ethena’s product — which requires maintaining a delta-neutral position — the protocol was structurally compelled to build up a large amount of short open interest in the market. The issue, according to this view, is that these short positions were structured in a way that made them ineligible for Auto-Deleveraging (ADL) on centralized exchanges (CEXs).

As market volatility increased, this allege

1 giờ trước

Xu hướng của USDe sau khi phát hành

Không có dữ liệu nào

Giảm giá

Ethena (USDE) is accused of being responsible for the market crash on October 10.

Ethena launched USDe on multiple exchanges in January, TVL grew, and achieved several important partnerships.

Here's what happened @ethena_labs in January:

• USDe listed on @Official_Upbit and @BithumbOfficial, South Korea's largest exchanges

• @hyenatrade by @BasedOneX reached $1b in total volume, with $500k+ in USDe rewards distributed to traders after opening access to the public

• @etherealdex crossed $75M USDe TVL

• Partnered with @safe to accelerate USDe adoption on multisig wallets

• JupUSD launched on Solana as the latest Ethena Whitelabel stablecoin to go live

• USDe listed on @LBank_Exchange as spot pair and earn product

• USDe expanded to @HTX_Global

• Selected @krakenfx as custody partner for USDe backing assets

• @EchelonMarket announced TGE and airdrop to sENA holders (5% of $ELON total supply)

• USDe now earns institutional clients rewards while in custody at @CeffuGlobal

• Made @coingecko's list of Top 10 Crypto Protocols by 2025 Revenue (#5)

• sUSDe joined Echelon's Fixed Yield product as Day 1 launch partner

• Joined @cantinaxyz and industry leaders in developing Web3SOC, an institution

1 Ngày trước

Xu hướng của USDe sau khi phát hành

Không có dữ liệu nào

Tăng giá

Ethena launched USDe on multiple exchanges in January, TVL grew, and achieved several important partnerships.

The market is under immense pressure due to Binance-related FUD, the 10/10 flash crash, and liquidations.

These days many people have probably seen the news and drama about CZ and Binance flooding the feeds, so I want to summarize it in an easy-to-understand way.

.

The main source of the current FUD wave comes from an event referred to in the industry as

📅 “10/10 Crash” on October 10, 2025

That day the crypto market plummeted sharply within a few hours, many positions were liquidated (automatic loss‑closing), totaling tens of billions of dollars; some coins fell more than 80‑90%. Many compare it to the biggest event since the FTX collapse, but the number of liquidations exceeded those during the Luna and FTX crashes.

.

Those accusing Binance say

👉 They promoted high‑yield products that were too risky

👉 People kept cycling money through multiple rounds, creating fragility in the system

👉 When prices broke key levels, a domino effect wiped out positions across the market and impacted other exchanges

.

In the case of the high‑yield product promotion, the CEO of OKX said that USDE, Ethena’s stablecoin, was promoted for high returns on Binance, attracting inflows, and this was one of the reasons the market collapsed due to a de‑peg at that time.

.

However, this allegation is contested and no definitive conclusion has been reached yet.

.

Now many believe Binance contributed to the system failure

But CZ responded that

• The 10/10 event was caused by external factors such as U.S. economic and political news

• There was no market manipulation or intentional crisis creation

• Binance compensated users beyond the standards of many platforms

.

Besides the 10/10 Crash, there are other rumors such as

📉 Binance or CZ secretly dumping large coins to push prices down

📜 Old lawsuits being revived, involving customer data and past accusations

.

CZ denied all of them, stating that Binance has been continuously monitored by regulators, and most negative news is attacks from competitors.

.

The community is clearly split into two camps: some who lost real money, are angry and distrustful; others view it as a political game within crypto because Binance, being the biggest, bears the brunt.

.

FUD is surging now because CZ’s partner Justin Sun, the founder of the Tron chain, was exposed by someone claiming to be an ex‑girlfriend, accusing him of numerous illegal activities, and inviting the U.S. SEC to request information.

.

The crypto market feels both funny and painful right now; there’s entertainment to follow, but the market keeps falling without pause, lol.

2 ngày trước

Xu hướng của USDe sau khi phát hành

Không có dữ liệu nào

Cực kỳ bi quan

The market is under immense pressure due to Binance-related FUD, the 10/10 flash crash, and liquidations.

Dự đoán giá

Thời điểm phù hợp để mua USDe là khi nào? Liệu tôi nên mua hay bán USDe bây giờ?

Khi quyết định xem đây có phải là thời điểm tốt để mua hoặc bán Ethena USDe (USDe) hay không, điều quan trọng trước tiên là phải phù hợp với chiến lược giao dịch và mức độ chấp nhận rủi ro của riêng bạn. Các nhà đầu tư dài hạn và các nhà giao dịch ngắn hạn thường diễn giải điều kiện thị trường theo các cách khác nhau, vì vậy quyết định của bạn nên phản ánh cách tiếp cận cá nhân. Theo phân tích kỹ thuật 4 giờ mới nhất của USDe, tín hiệu giao dịch hiện tại là Hold. Theo phân tích kỹ thuật 1 ngày mới nhất của USDe, tín hiệu hiện tại là Hold.

Dự đoán Beacon

Dự báo giá xác suất cho (24 giờ tới)crypto.loading

Giới thiệu Ethena USDe

Ethena USDe (USDe) is a cryptocurrency and operates on the Ethereum platform. Ethena USDe has a current supply of 6,563,267,150.89797352. The last known price of Ethena USDe is 0.99871997 USD and is down -0.01 over the last 24 hours. It is currently trading on 293 active market(s) with $145,162,248.63 traded over the last 24 hours. More information can be found at https://www.ethena.fi/.

Đọc thêm

Link chính thức

Trình khám phá chuỗi

Khám phá thêm

BM Discovery

Mới niêm yết

ANYONE ANYONE Protocol

0 0.00%

TRIA Tria

0 0.00%

JNJON Johnson & Johnson Ondo Tokenized

0 0.00%

ORCLON Oracle Ondo Tokenized

0 0.00%

JDON JD.com Ondo Tokenized

0 0.00%

VZON Verizon Ondo Tokenized

0 0.00%

UBERON Uber Ondo Tokenized

0 0.00%

HUNT GreyHunt

0 0.00%

JPGC JPGold Coin

0 0.00%

ZAMA Zama

0 0.00%