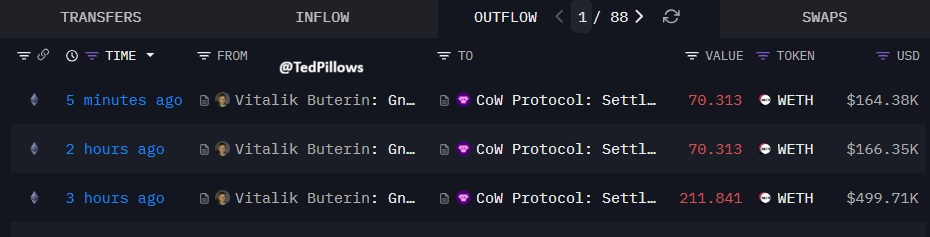

Vitalik is selling coins again... seriously, he can't read the situation... https://t.co/hcAvWglRnF

Ethereum Dữ liệu giá trực tiếp

Ethereum ETH Lịch sử giá USD

Sở hữu ETH ngay

Mua và bán ETH dễ dàng và an toàn trên BitMart.Ethereum X Insight

Vitalik has sold $830,440 in $ETH today.

Read the room, Vitalik. https://t.co/SalHFh8VQv

Yi Li Hua has currently become the largest short on ETH!

Currently holds 498,000 ETH, total value about $1.1 billion, average cost $3,180, cumulative loss $605 million, remaining leveraged loan $743 million.

Multiple borrowing positions have liquidation prices concentrated between $1,685.63‑$1,855.16, core range $1,781‑$1,808.

In the past 4 days, sold a total of 153,500 ETH (average price about $2,294), cashing out about $352 million, repaying $266 million USDT to reduce leverage and lower liquidation risk.

Today transferred another 30,000 ETH to Binance for a sell‑off to cut leverage; the more it sells, the more it falls, entering a vicious cycle. The current liquidation price remains in a high‑risk zone; if liquidation occurs, ETH will face a super black swan!

Likewise, ETH will also reach a super bottom…

Between 75,000‑80,000 it’s normal to need a separate consolidation period before results appear. This drop is so severe that gold has already rebounded first, and BTC should move as well!

It was falling nicely, but upon reaching the critical area around 75,000, Binance started a gradual $1 billion bottom‑support, which should keep it stable for a while! #OKX

ETH is still very weak; it seems unlikely to stop after a big sell‑off. This time the weakness is extreme, but liquidating Huazi (Yi Li Hua) still feels a bit difficult for now, unless BTC breaks $70,000…

Since you’re so concerned about ‘Boss Yi’s’ liquidation price, let me give you a real‑time update:

As of 22:00 on February 3, 2026, Trend Research, under Yi Li Hua, has an ETH borrowing position liquidation range of $1,685.63‑$1,855.16, with the core liquidation price concentrated at $1,781‑$1,808. The main position liquidation prices are as follows:

1. Collateral 145,800 ETH, borrowed $216 million stablecoins, liquidation price $1,791.06

2. Collateral 114,900 ETH, borrowed $172 million stablecoins, liquidation price $1,807.05

3. Collateral 108,700 ETH, borrowed $163 million stablecoins, liquidation price $1,808.10

4. Collateral 79,500 ETH, borrowed $117 million stablecoins, liquidation price $1,781.06

5. Collateral 43,000 ETH, borrowed $66.25 million stablecoins, liquidation price $1,855.16

This range has moved up from $1,558 on January 31, due to recent position reductions and margin top‑up operations.

Nothing is more entertaining than watching Vitalik pivot Ethereum for the 10th time.

yeah this time it will work.

Dự đoán giá

Thời điểm phù hợp để mua ETH là khi nào? Liệu tôi nên mua hay bán ETH bây giờ?

Dự đoán Beacon

Dự báo giá xác suất cho (24 giờ tới)How Much Is Ethereum Worth?

When Was Ethereum Created?

Ethereum (ETH) is a decentralized platform that runs smart contracts, defined as applications that run exactly as programmed without any possibility of downtime, censorship, fraud, or third-party interference. These apps run on a custom built blockchain, an enormously powerful shared global infrastructure that can move value around and represent the ownership of property. This enables developers to create markets, store registries of debts or promises, move funds in accordance with instructions given long in the past (like a will or a futures contract) and many other things that have not been invented yet, all without a middleman or counterparty risk. The project was bootstrapped via an ether presale in August 2014 by fans all around the world. It is developed by the Ethereum Foundation, a Swiss non-profit, with contributions from great minds across the globe.

Khám phá thêm

BM Discovery

Mới niêm yết