Fuel Network Dữ liệu giá trực tiếp

Giá Fuel Network hôm nay là $ 0.0014 (FUEL/USD). Với vốn hóa thị trường là $ 10.10M USD. Khối lượng giao dịch 24 giờ là $ 631.46K USD, Biến động giá trong 24 giờ là +1.43%, Và lượng cung lưu hành là 7.12B FUEL.

Fuel Network FUEL Lịch sử giá USD

Theo dõi giá của Fuel Network hôm nay, 7 ngày, 30 ngày và 90 ngày

Kỳ

Thay đổi

Biến động (%)

Hôm nay

0

0.71%

7ngày

--

--

30ngày

--

--

90ngày

0

-50.00%

Sở hữu FUEL ngay

Mua và bán FUEL dễ dàng và an toàn trên BitMart.

Fuel Network Thông tin thị trường

$ 0.0013 Biến động 24 giờ $ 0.0014

Cao nhất từng ghi nhận

$ 0.087

Thấp nhất từng ghi nhận

$ 0.0013

Biến động 24 giờ

1.43%

Khối lượng 24 giờ

$ 631,461.93

Nguồn cung lưu hành

7.12B

FUEL

Vốn hóa thị trường

$ 10.10M

Nguồn cung tối đa

--

Vốn hóa thị trường đã pha loãng hoàn toàn

$ 14.51M

Giao dịch FUEL

Fuel Network X Insight

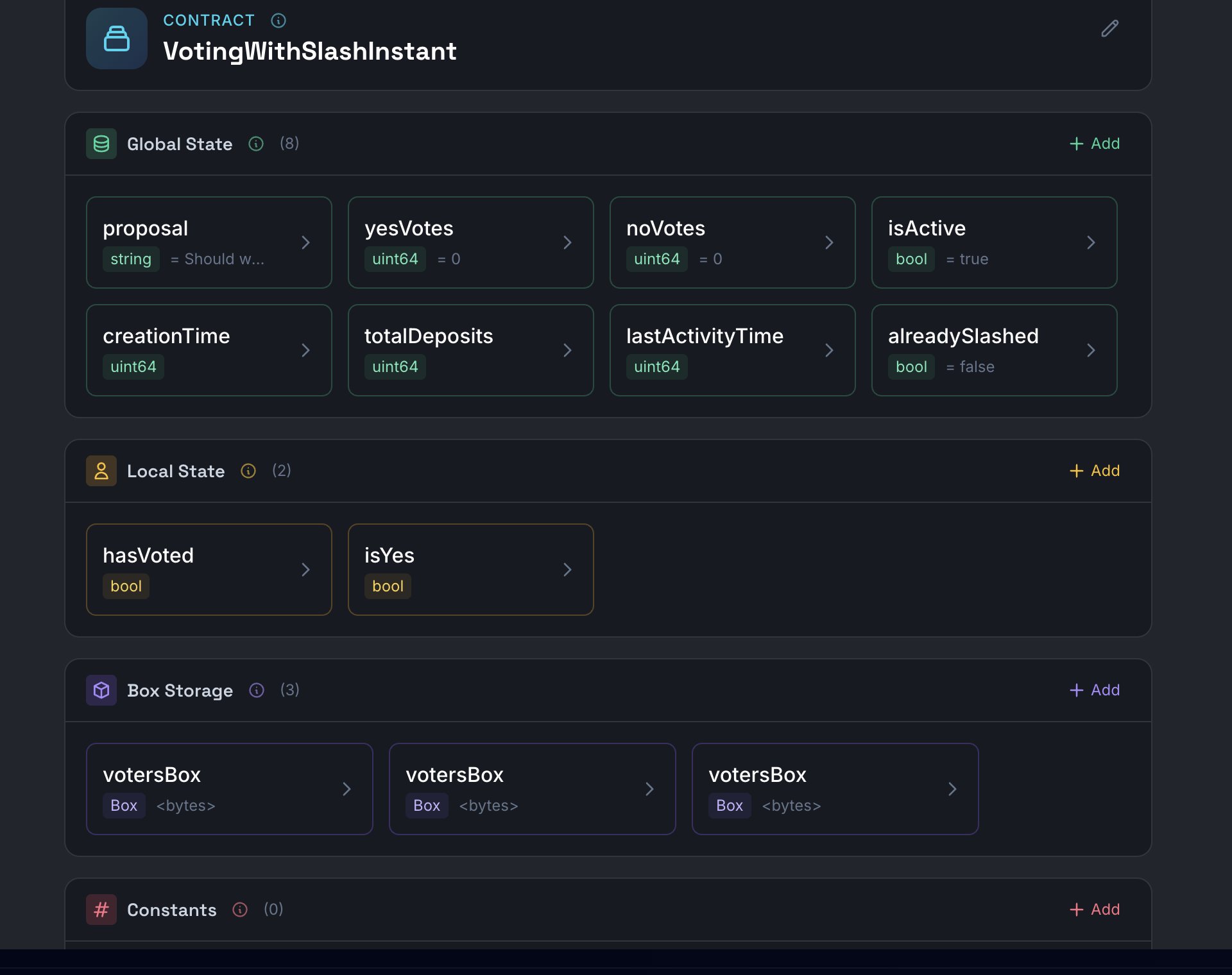

Fuel network voting contract adds a penalty for non‑voters.

today I forked a voting contract and added a 100% slash for non‑voters distributed to voters that participate. it includes a trigger that expires after 30 days that anyone can call

only on https://t.co/24p7jJ9Iog built by @xarmian https://t.co/WE0SmghhPv

15 ngày trước

Xu hướng của FUEL sau khi phát hành

Không có dữ liệu nào

Tăng giá

Fuel network voting contract adds a penalty for non‑voters.

The tweet satirizes the crypto industry's valuation system being detached from users and actual value.

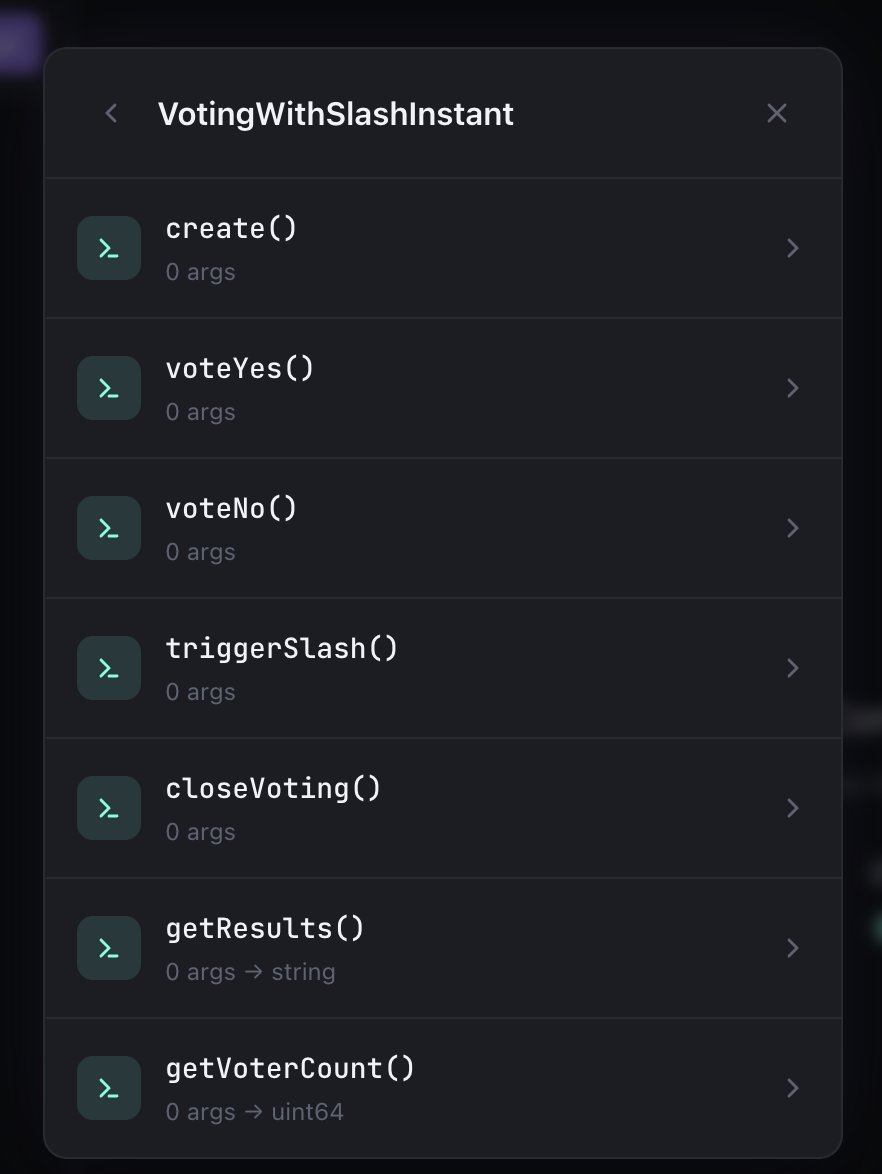

A 1000‑yuan “死了么” that turned a 10 million valuation

Three post‑95s spent 1000 yuan, took less than a month, and built an app.

Now valued at 10 million. A ten‑thousand‑fold increase.

This app is called “死了么”, its functionality is absurdly simple: open it each day and tap to check in, proving you’re still alive. If you miss two consecutive days, the system automatically emails your emergency contacts.

That's it?

Yeah, that's it.

On Jan 8 it topped the Apple paid‑apps chart, costing 8 yuan per download. Founder Mr Guo said the number of paying users has increased 200‑fold in recent days and is still rising.

Capital came knocking. Mr Guo said he plans to sell 10% equity for 1 million. That puts the valuation at 10 million.

The name “死了么” came from a viral internet meme a few years ago.

Someone asked on social media: What app does everyone need and will definitely download?

A highly up‑voted answer: 死了么.

Mr Guo and his team saw the discussion, thought there was a chance. When they tried to register the trademark, they discovered no one had.

So they built it.

Why can something so simple become popular?

China’s single‑person households have already exceeded 120 million in 2024. By 2030 they are expected to reach 150–200 million. These people live in rented apartments in Beijing, Shanghai, Guangzhou, Shenzhen, sharing a very concrete anxiety:

If something happens to me at home, how long will it take for someone to notice? So for 8 yuan you can buy a confirmation that “someone knows I’m still alive.”

“死了么” became popular in less than 24 hours, and a clone appeared.

An app called “活了么” was listed on the Apple Store, with identical functionality, free to download.

Mr Guo’s response was calm: the product’s advantage lies not in technical barriers but in discovering user demand.

In other words, you can copy the features, but you can’t copy my name.

Indeed. Those three characters “死了么” are the most valuable part of the product. If it had been called “Single‑Living Safety Guard”, it would probably still be gathering dust in a corner of the App Store.

Looking back, is a 10 million valuation expensive for an app with no technical threshold and a cost of 1000 yuan?

Then maybe look at how the crypto industry used to value things.

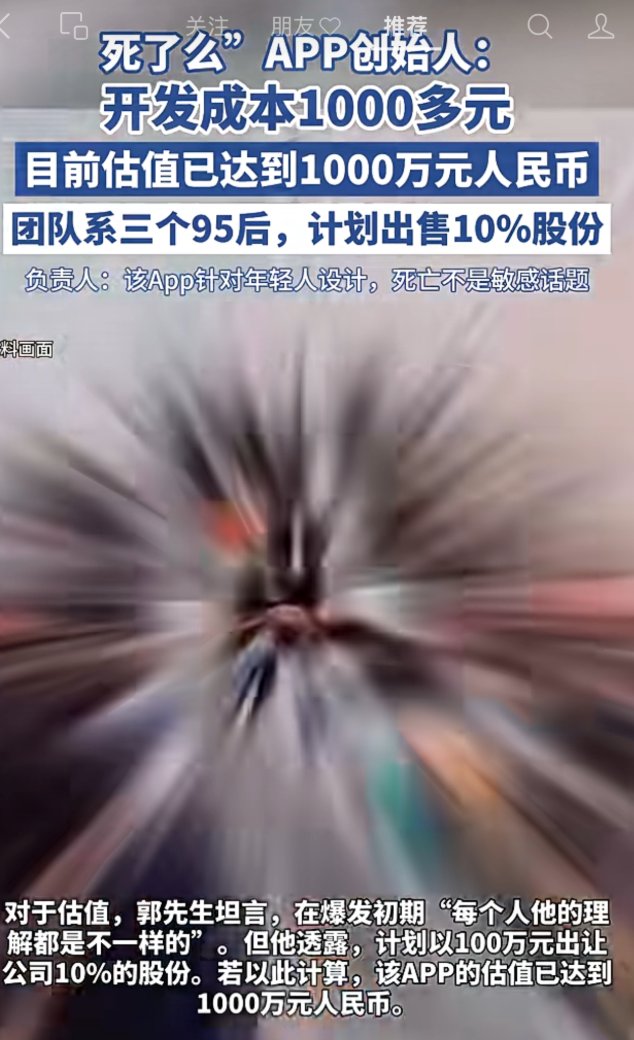

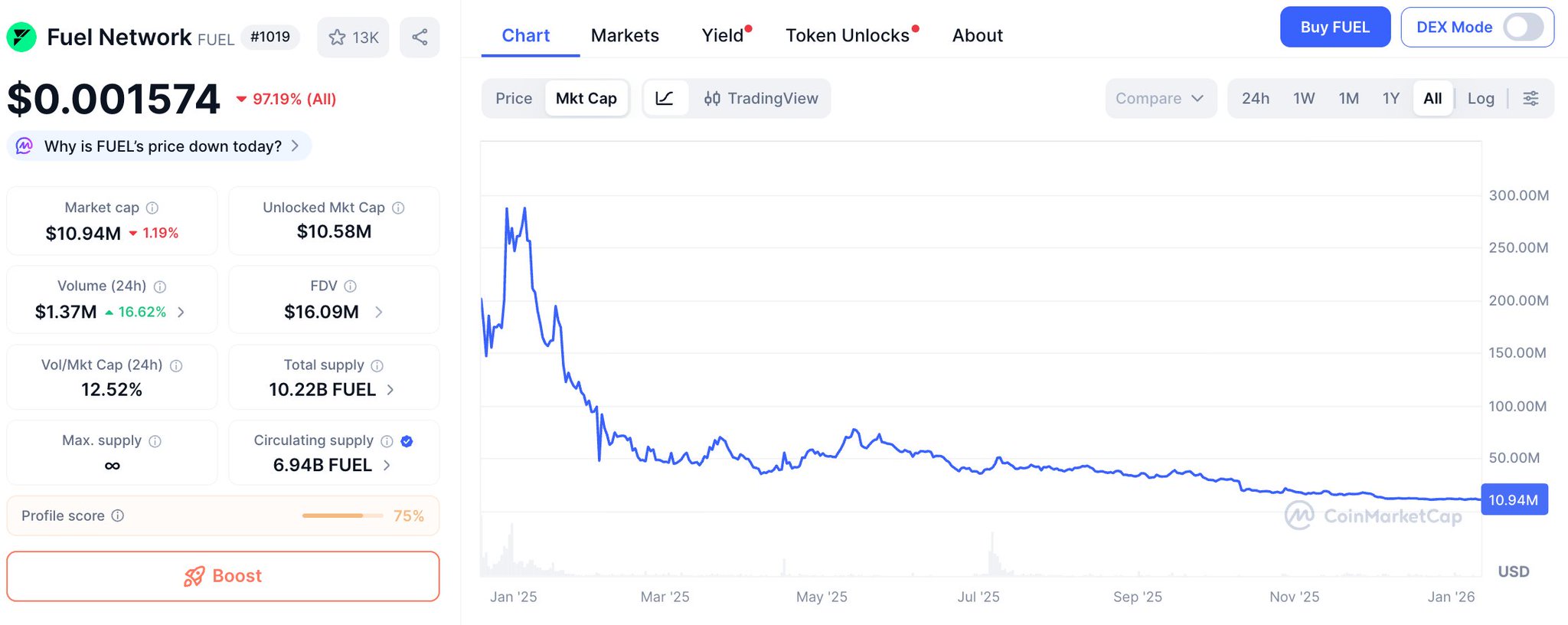

In 2025, there was a crypto project called Fuel Network, building a “modular blockchain execution layer”. VC valued it at 1 billion USD, roughly 7 billion RMB.

That’s a 700‑fold valuation compared to “死了么”.

What does Fuel Network have?

A whitepaper, a roadmap, a bunch of Tier‑1 institutional endorsements, and videos of the founders speaking at major conferences.

But not many actual users.

What is Fuel Network’s market cap now? Around 16 million USD, down 99% from its peak.

I’m not saying every crypto project is a scam.

I’m saying:

In the crypto world, a project can have no users, no revenue, no one actually using it, and still be valued at 1 billion USD.

In the “死了么” world, you have to get people to actually spend 8 yuan to download for it to count.

One values first, then finds users. The other gets users first, then talks valuation.

Which is more reasonable? I don’t know.

Even more absurd is that the “死了么” logic is almost heretical in the crypto world.

If you tell everyone: we have real users, real paying, solving a real need.

Everyone will ask: what’s the narrative? What’s the token economics? What’s the FDV?

You say: no token, just selling an app, 8 yuan each.

People: then why should I invest in you?

This isn’t a joke. That’s how the crypto valuation system works.

Users don’t matter, revenue doesn’t matter, what matters is whether the story is sexy enough, whether the token can list on a major exchange, whether the unlock schedule is long enough for early investors to exit.

If “死了么” issued a token, created a “Single‑Living Chain”, drew a “global loneliness economy” big picture, maybe the valuation could jump tenfold.

But then it might not have real users.

Perhaps “死了么” can become popular precisely because it serves people with that anxiety, but who don’t really need it.

Those who truly need it actually can’t use it.

That’s similar to the crypto industry:

Those who truly need “financial inclusion” are often the ones who can’t use DeFi the most.

In the end, whether 10 million is expensive depends on the metric you use.

Measured by internet standards – a month of development, a three‑person team, no funding, no burn, reaching #1 on the paid chart – 10 million isn’t pricey.

Measured by crypto standards – no token, no narrative, no FDV – just 10 million? That’s too cheap. Should we issue a token?

I think the most satirical point is the split between Web2 and Web3:

In one world, “someone uses it” is a prerequisite for valuation. In the other world, “someone uses it” is an accident for valuation.

When I finished writing this, I actually downloaded “死了么” and checked in.

8 yuan, buying peace of mind.

At least it’s more reliable than most meme coins I’ve bought.

26 ngày trước

Xu hướng của FUEL sau khi phát hành

Không có dữ liệu nào

Cực kỳ bi quan

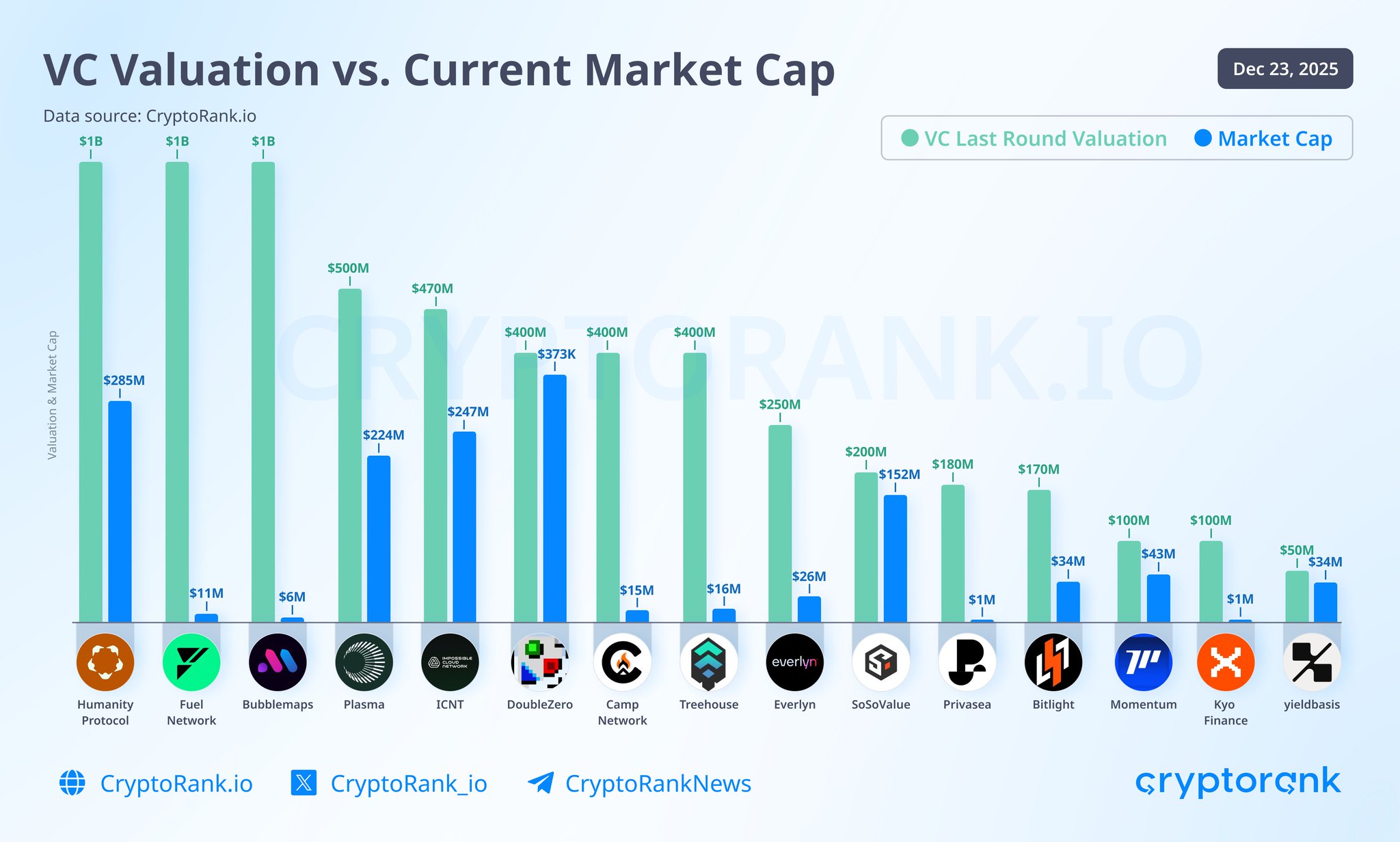

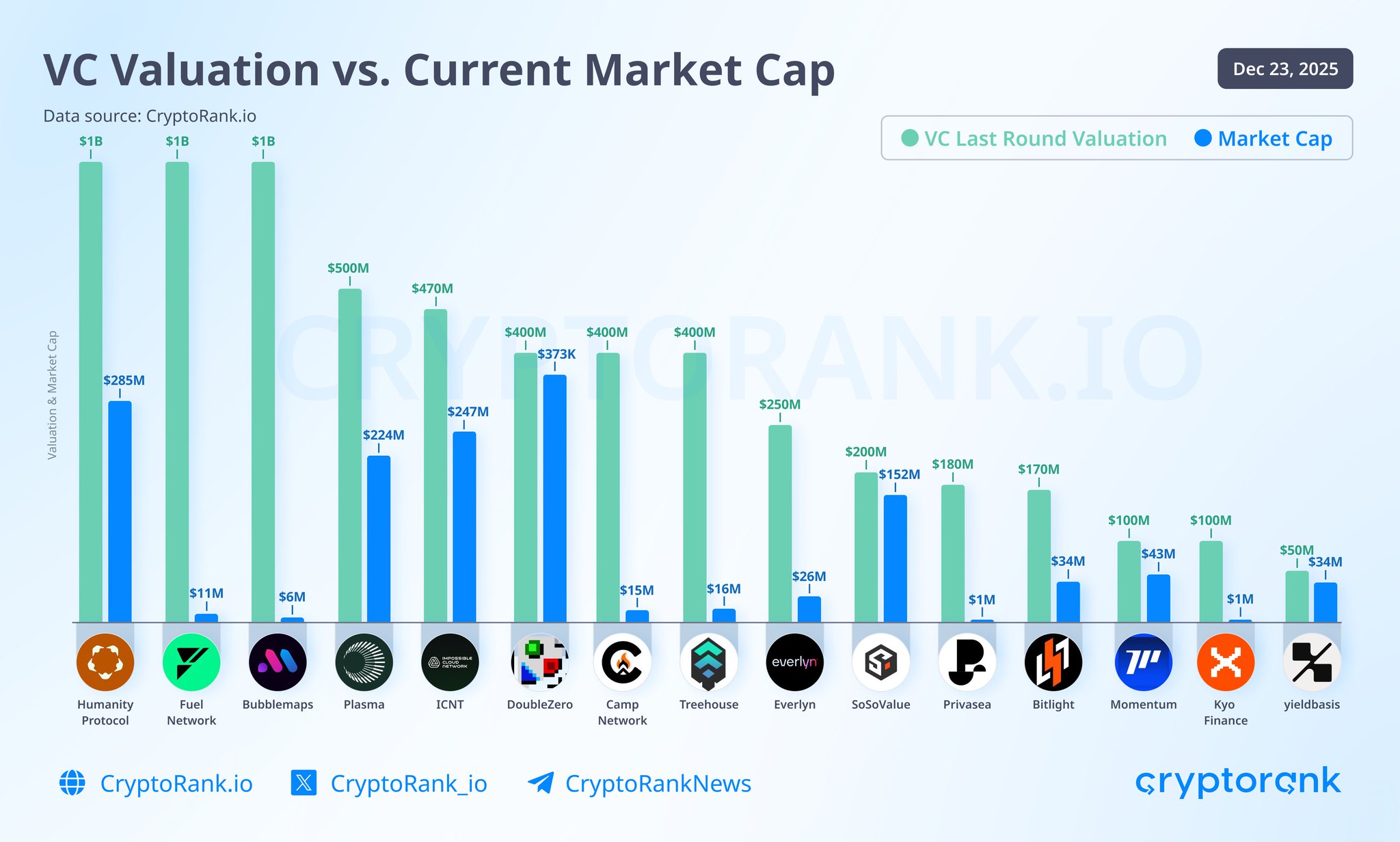

The tweet satirizes the crypto industry's valuation system being detached from users and actual value.

VC-overvalued altcoin projects see their market cap shrink dramatically, and the market is accelerating the clearing of the bubble.

VC valued Fuel @fuel_network at $1 billion, now its market cap is $11 M

VC valued Bubblemaps @bubblemaps at $1 billion, now its market cap is $6 M

It’s so skinny, I don’t know whether to feel sorry for the VCs or for myself who bought the altcoins.

Most crypto narratives have fully shifted from hype to reality, and the market will provide its answer based on real strength.

Against the backdrop of the AI mega‑narrative, the bubble of crypto junk tokens is being cleared rapidly. https://t.co/MdWT8HU2RD https://t.co/lP6y5QfzgF

VC Valuation vs. Current Market Cap

During bull runs and narrative hype, VCs tend to overprice projects and assign aggressive valuations.

However, once sentiment fades or the narrative loses traction, most projects get a reality check and the market resets those euphoric numbers.

That’s why it's important to keep a cool head and weigh risk across multiple outcomes, before investing.

45 ngày trước

Xu hướng của FUEL sau khi phát hành

Không có dữ liệu nào

Giảm giá

VC-overvalued altcoin projects see their market cap shrink dramatically, and the market is accelerating the clearing of the bubble.

Dự đoán giá

Thời điểm phù hợp để mua FUEL là khi nào? Liệu tôi nên mua hay bán FUEL bây giờ?

Khi quyết định xem đây có phải là thời điểm tốt để mua hoặc bán Fuel Network (FUEL) hay không, điều quan trọng trước tiên là phải phù hợp với chiến lược giao dịch và mức độ chấp nhận rủi ro của riêng bạn. Các nhà đầu tư dài hạn và các nhà giao dịch ngắn hạn thường diễn giải điều kiện thị trường theo các cách khác nhau, vì vậy quyết định của bạn nên phản ánh cách tiếp cận cá nhân. Theo phân tích kỹ thuật 4 giờ mới nhất của FUEL, tín hiệu giao dịch hiện tại là Hold. Theo phân tích kỹ thuật 1 ngày mới nhất của FUEL, tín hiệu hiện tại là Hold.

Dự đoán Beacon

Dự báo giá xác suất cho (24 giờ tới)crypto.loading

Giới thiệu Fuel Network

Fuel Network (FUEL) is a cryptocurrency launched in 2024and operates on the Ethereum platform. Fuel Network has a current supply of 10,226,559,043.41852335 with 7,122,381,620.53465385 in circulation. The last known price of Fuel Network is 0.00163988 USD and is up 4.18 over the last 24 hours. It is currently trading on 63 active market(s) with $1,504,213.50 traded over the last 24 hours. More information can be found at https://www.fuel.network/.

Đọc thêm

Link chính thức

Trình khám phá chuỗi

Khám phá thêm

BM Discovery

Mới niêm yết

SOFION SoFi Technologies Ondo Tokenized

0 0.00%

ARMON Arm Holdings plc Ondo Tokenized

0 0.00%

IBMON IBM Ondo Tokenized

0 0.00%

ADBEON Adobe Ondo Tokenized

0 0.00%

NKEON Nike Ondo Tokenized

0 0.00%

TCU29 TCU29

0 0.00%

RUNE THORChain

0 0.00%

GSON Goldman Sachs Ondo Tokenized

0 0.00%

SPOTON Spotify Ondo Tokenized

0 0.00%

INTCON Intel Ondo Tokenized

0 0.00%