$SPK is testing the descending resistance after a long downtrend.

A clean break above this line could signal a trend shift, but rejection here would likely keep the downside pressure intact.

DYOR, NFA

#SPK #SPKUSDT https://t.co/BaH2W8xlFD

$SPK is testing the descending resistance after a long downtrend.

A clean break above this line could signal a trend shift, but rejection here would likely keep the downside pressure intact.

DYOR, NFA

#SPK #SPKUSDT https://t.co/BaH2W8xlFD

⚡️ Spark @sparkdotfi, through the SAEP-09 proposal and Sky ecosystem's 30% emission reduction, creates a perfect combination of throttling + open-source deflation—

I think you can start considering positioning:

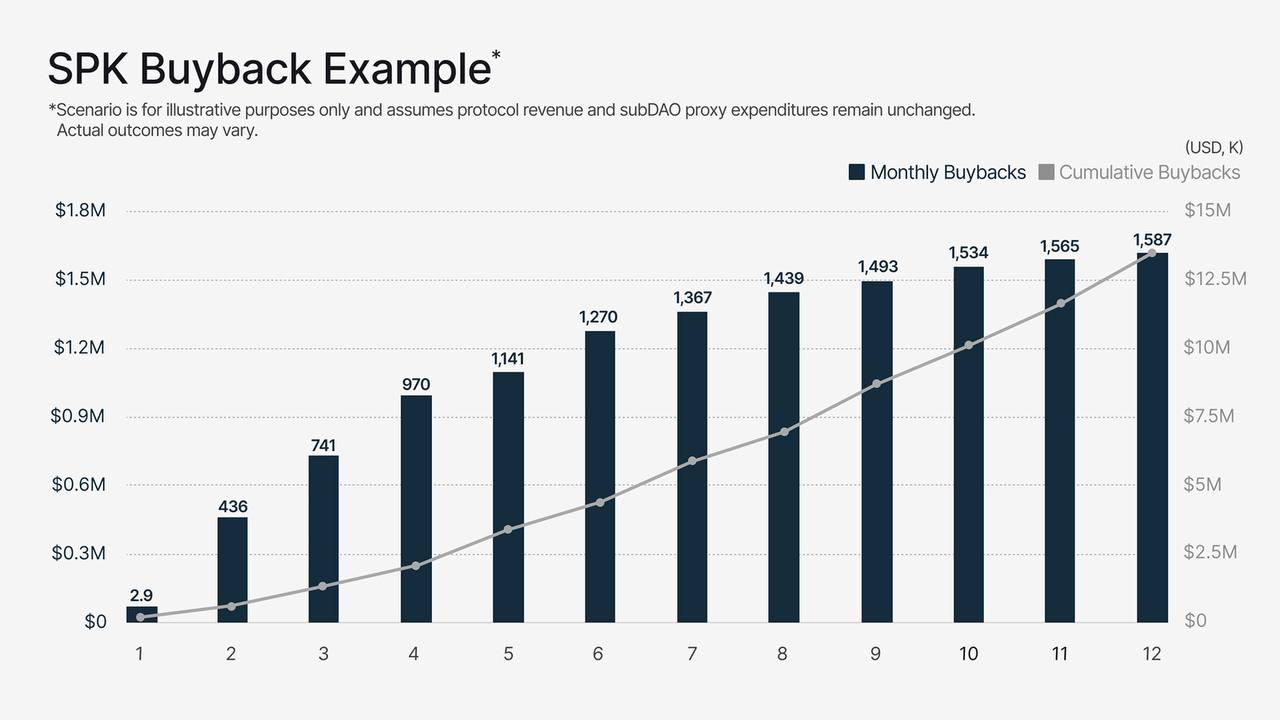

👉 SAEP-09 proposal: release existing capital, expand the buyback inlet.

Unlock and release the capital accumulated in the protocol, by lowering collateral requirements and accelerating capital turnover, more protocol revenue can be directly used for $SPK buybacks.

👉 Sky emission reduction action: remove SPK rewards from SKY staking, cutting off the inflation outlet.

Sky is willing to sacrifice the staking attractiveness of its own token SKY to ensure the success of the SPK buyback proposal.

This shift directly moves SPK from a pure "mining token" model to an income‑driven value accumulation model, demonstrating high coordination and long‑term value orientation among SubDAOs in the MakerDAO ecosystem.

The estimated annual emission reduction/buyback potential reaches $23 million, roughly 45% of the current circulating market cap.

This ratio is rare among DeFi projects, equivalent to a company using 45% of its annual profit for stock buybacks, providing extremely strong price support for the token.

If execution goes smoothly, the buyback should start next month!

SAEP-09 Proposal: Adjusting SubDAO Proxy Parameters has been put up for vote. The proposal outlines adjustments for Spark governance to consider regarding parameters associated with the previously approved SubDAO Proxy reserve plan.

Key Changes:

- Target Runway: 24m to 12m

- Product Backstop: $5M to $1M USDS

- RRC Lookback: 12m to 3m

- Buyback Rate: 10% to 25%

The proposal incorporates the following chart to illustrate how the proposed parameter adjustments would work, assuming protocol activity and subDAO proxy expenditures remain unchanged.

GM frens quick ops note ran a micro tax‑loss harvesting workflow using on‑platform exports after noticing Sky removed $SPK rewards for staking $SKY (buybacks + reward cut = ~40% lower net emissions)

Pulled my live holdings CSV from @SoSoValueCrypto, matched trades to Opportunity Alerts, and scheduled controlled exits + 31d re‑entry ladders offchain

How I did it (10 mins weekly)

1) export portfolio + realized P/L CSV

2) filter tokens flagged by Opportunity Alerts + sudden flow reversals

3) place small loss sells to harvest against prior wins, log tx hashes

4) set staggered buy orders 31+ days later to avoid wash rules

30 days result: caught 3 TLH spots, average re‑entry within ~1.2% of sale, kept core exposure intact

Who else is using SoSoValue exports for TLH or are you more into pure HODL and ignore tax windows?