The collective attack by English‑speaking crypto‑twitter on Binance is a modern version of the “thief crying thief”, where the troublemakers criticize those they have affected.

Among those foreigners who are said to “scold fiercely”,

the loudest and most numerous are none other than:

1. VCs, especially those “well‑known institutions” that can no longer put money into projects

2. KOLs from Dubai, Lisbon, Puerto Rico who post a $8,000 tweet and usually brand themselves as badass traders

3. People whose pockets can't afford Binance’s order‑book Perp DEX tokens or coins, watching their PNL swing between life and death every day

Anyone with a basic understanding of PR can see that this is organized.

At the drop of a hat they chant "You can't hate @cz_binance enough".

At the end of the day, isn’t it just that they won’t list your coin?

Why not list it? Do they lack any sense? They treat Easterners like the Japanese, assuming we have no memory, right?

Binance used to treat these top North‑American institutions and “top” individual Western KOLs as endorsements, just like other leading exchanges, giving certain so‑called “king‑pin” projects almost direct access to listing.

As a result, between 2022‑2024, those Western groups poured hundreds of projects valued at tens to hundreds of billions pre‑TGE into the secondary market.

You haven’t forgotten the familiar names from ’23‑'24, have you?

Blast, Blur, ZK, L0, SAGA, OMNI, RENZO

I could keep extending this list, even though as a project founder I probably shouldn’t be so blunt.

After @cz_binance reinstated spot trading on the strict card and launched Binance Alpha, those top institutions saw their paper returns plunge, yet they still hold a few hundred projects, each with a pre‑TGE valuation of $2‑300 billion, ready to launch.

@binance refusing to list these coins makes it a fraud, a “industry leader that doesn’t think about expanding the cake for the future”, or it expects you to fund the buying‑out and bake a cake for Western institutions?

Know that the entire exchange ecosystem, including Binance, and even the whole Eastern crypto community, have never owned the narrative—except for GameFi. Almost every narrative you can think of was first invented by North‑American players.

And then?

The driver drove the car into a ditch and then blames the exchange that provides liquidity for watering down the gasoline?

Every narrative and sector these “Westerners” promoted after the Luna crash is stamped with “orthodox” and “reconciliation”.

They aren’t truly supporting innovation; they support stories they can control, that benefit them, cost little to produce, yet can be spun into grand “innovation” tales.

The only one among them with genuine grassroots support is @Pumpfun, which they themselves slandered and which was attacked by the western Solana‑ecosystem mouthpiece in June last year—and now, just as then.

Each narrative is a naked betrayal of the true “brothers” in crypto—young people marginalized by the mainstream, exploited across generations, trying to forge a new order.

It isn’t about some “big casino”, and definitely not about “non‑compliance”.

These clichés are the condescending labels from the old guard calling the youth “rebels”.

It is precisely those “Western meat‑eaters” who treat narratives as reality with no empathy for market participants, that have stripped crypto of its allure—no one wants daily sermons about money‑making that feels irrelevant to them.

Thus Eastern youth no longer buy into Western narratives. The boom of Chinese‑language trenches is merely a result, seeded long ago by self‑righteous “Westerners”.

Whether you like it or not, @binance’s existence is the last barrier before Easterners are fully enslaved by Western narrative dominance.

I sincerely suggest @heyibinance court all projects that have found product‑market fit but are being vilified by the “Western mainstream”, including Pump—Western circles have created a “politically correct PMF failure”; why can’t the East gather a “politically marginal PMF success” ensemble?

Blur Datos de precios en tiempo real

El precio de hoy de Blur es de $ 0.020 (BLUR/USD). Con una capitalización de mercado de $ 55.75M USD. Volumen de trading en 24 horas de $ 855.72K USD, Un cambio de precio en 24 horas de -8.68%. Y un suministro circulante de 2.72B BLUR.

Blur BLUR Historial de precios USD

Siga el precio de Blur para hoy, 7 días, 30 días y 90 días

Periodo

Cambiar

Cambio (%)

Hoy

0

-8.95%

7días

--

--

30días

--

--

90días

0

-58.81%

Sea propietario de BLUR ahora

Compra y vende BLUR fácil y seguro en BitMart.

Blur Información de mercado

$ 0.020 Autonomía de 24 horas $ 0.022

Máximo histórico

$ 8.36

El mínimo histórico

$ 0.020

Cambio en 24 h

-8.68%

Volumen en 24 h

$ 855,724.52

Suministros en circulación

2.61B

BLUR

Market Cap

$ 53.74M

Suministro máximo

3.00B

BLUR

Capitalización de mercado totalmente diluida

$ 61.58M

Ganar

Pon a trabajar tus criptomonedas inactivas y obtén ingresos pasivos a través de ahorros, staking y más.Blur X Insight

Calls for Binance to support Asian projects, attacks Western dominance.

https://t.co/OnfdSqqdtO

5 días hace

Tendencia de BLUR tras el lanzamiento

Sin datos

Bajista

Calls for Binance to support Asian projects, attacks Western dominance.

The author asks the community about preferences in the NFT market, mentioning OpenSea, Magic Eden, and showing the logos of Blur and LooksRare.

Opensea

Magic Eden

I’m curious, which marketplace do you use to buy NFTs? https://t.co/19qQVB1xE1

10 días hace

Tendencia de BLUR tras el lanzamiento

Sin datos

Neutral

The author asks the community about preferences in the NFT market, mentioning OpenSea, Magic Eden, and showing the logos of Blur and LooksRare.

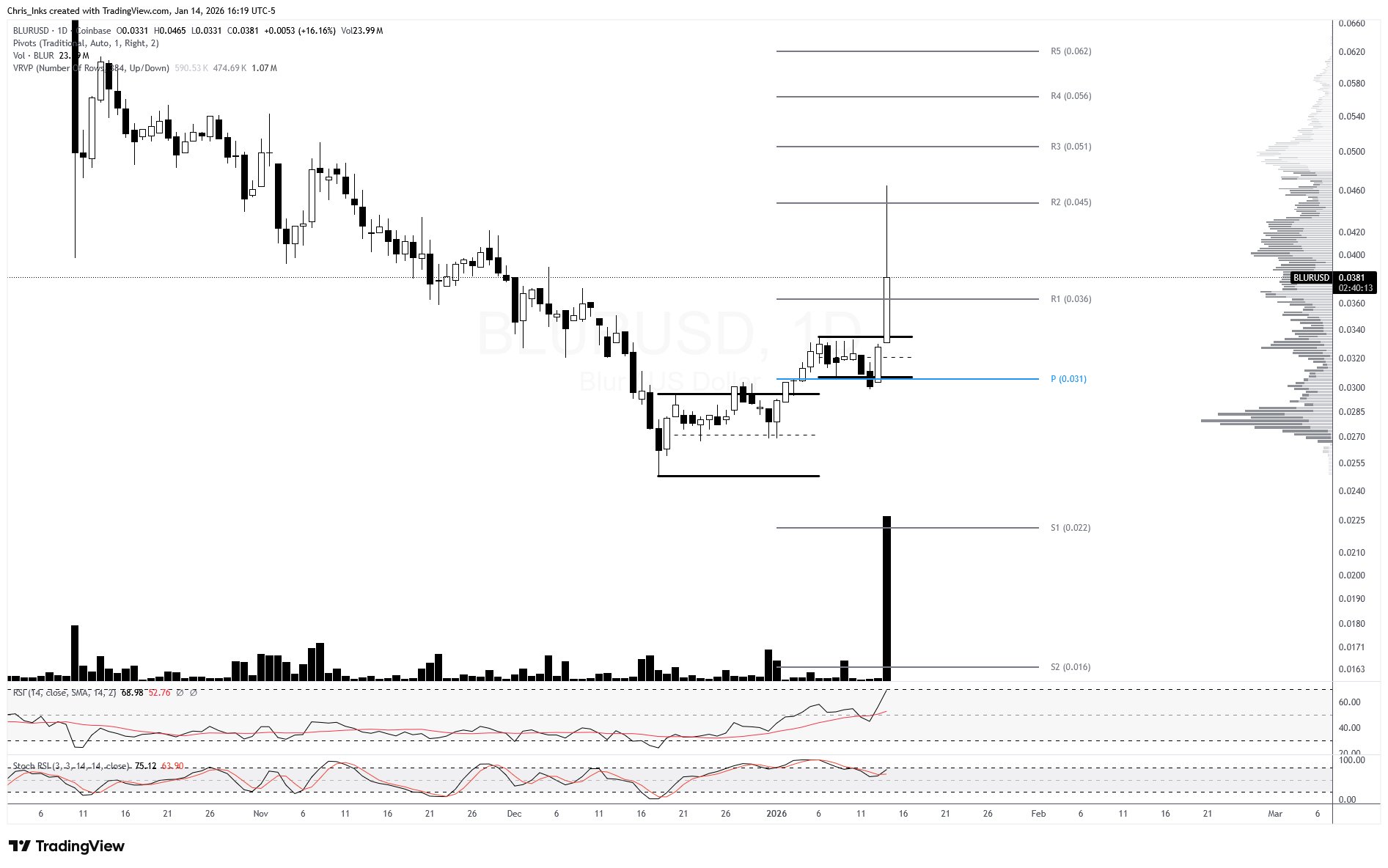

BLUR has shown a strong recent rally, with a structure similar to AXS and positive technical indicators.

$BLUR looking similar to $AXS in terms of structure leading up to, and including, the recent impulsive rally. https://t.co/x4pU2rhL5S

21 días hace

Tendencia de BLUR tras el lanzamiento

Sin datos

Alcista

BLUR has shown a strong recent rally, with a structure similar to AXS and positive technical indicators.

Predicción de precios

¿Cuándo es un buen momento para comprar BLUR? ¿Debería comprar o vender BLUR ahora?

Al decidir si es un buen momento para comprar o vender Blur (BLUR), es importante ajustarse primero a su propia estrategia de trading y perfil de riesgo. Los inversores a largo plazo y los traders a corto plazo suelen interpretar las condiciones del mercado de forma diferente, por lo que su decisión debe reflejar su enfoque personal. Según el último análisis técnico de 4 horas de BLUR, la señal de trading actual es Hold. Según el último análisis técnico de 1 día de BLUR, la señal actual es Hold.

Predicción de Beacon

Pronóstico probabilístico de precios (próximas 24 horas)crypto.loading

Sobre Blur

Blur (BLUR) is a cryptocurrency and operates on the Ethereum platform. Blur has a current supply of 3,000,000,000 with 2,716,045,976.170091 in circulation. The last known price of Blur is 0.02258201 USD and is down -1.44 over the last 24 hours. It is currently trading on 331 active market(s) with $10,861,922.10 traded over the last 24 hours. More information can be found at https://blur.io/.

Leer más

Explorar más

BM Discovery

Nuevo listado

BIGTROUT The Big Trout

0 0.00%

RUNE THORChain

0 0.00%

GSON Goldman Sachs Ondo Tokenized

0 0.00%

SPOTON Spotify Ondo Tokenized

0 0.00%

INTCON Intel Ondo Tokenized

0 0.00%

ABBVON AbbVie Ondo Tokenized

0 0.00%

COSTON Costco Ondo Tokenized

0 0.00%

WAN Wanchain

0 0.00%

WAR WAR

0 0.00%

DANKDOGEAI DankDoge AI Agent

0 0.00%