This is the most important question in our space currently!

What does the token actually do?

Yes distribution and adoption is the growth driver but without value appreciation to the underlying tokens we will lose the chance to create something way more powerful than “just” equity rights.

Tokens are shapeshifters, they can be everything and nothing.

With DeFi we proved already we can create something way more powerful than tradfi/wallstreet.

Let’s fix the tokens now 🫡

Hyperliquid Datos de precios en tiempo real

Hyperliquid HYPE Historial de precios USD

Sea propietario de HYPE ahora

Compra y vende HYPE fácil y seguro en BitMart.Ganar

Pon a trabajar tus criptomonedas inactivas y obtén ingresos pasivos a través de ahorros, staking y más.Hyperliquid X Insight

What does the token actually do?

This has been one of the most fundamental unanswered questions in DeFi since the beginning.

Does the token control governance?

Does it have any claim on the treasury?

Does it receive protocol revenue via buybacks or dividends?

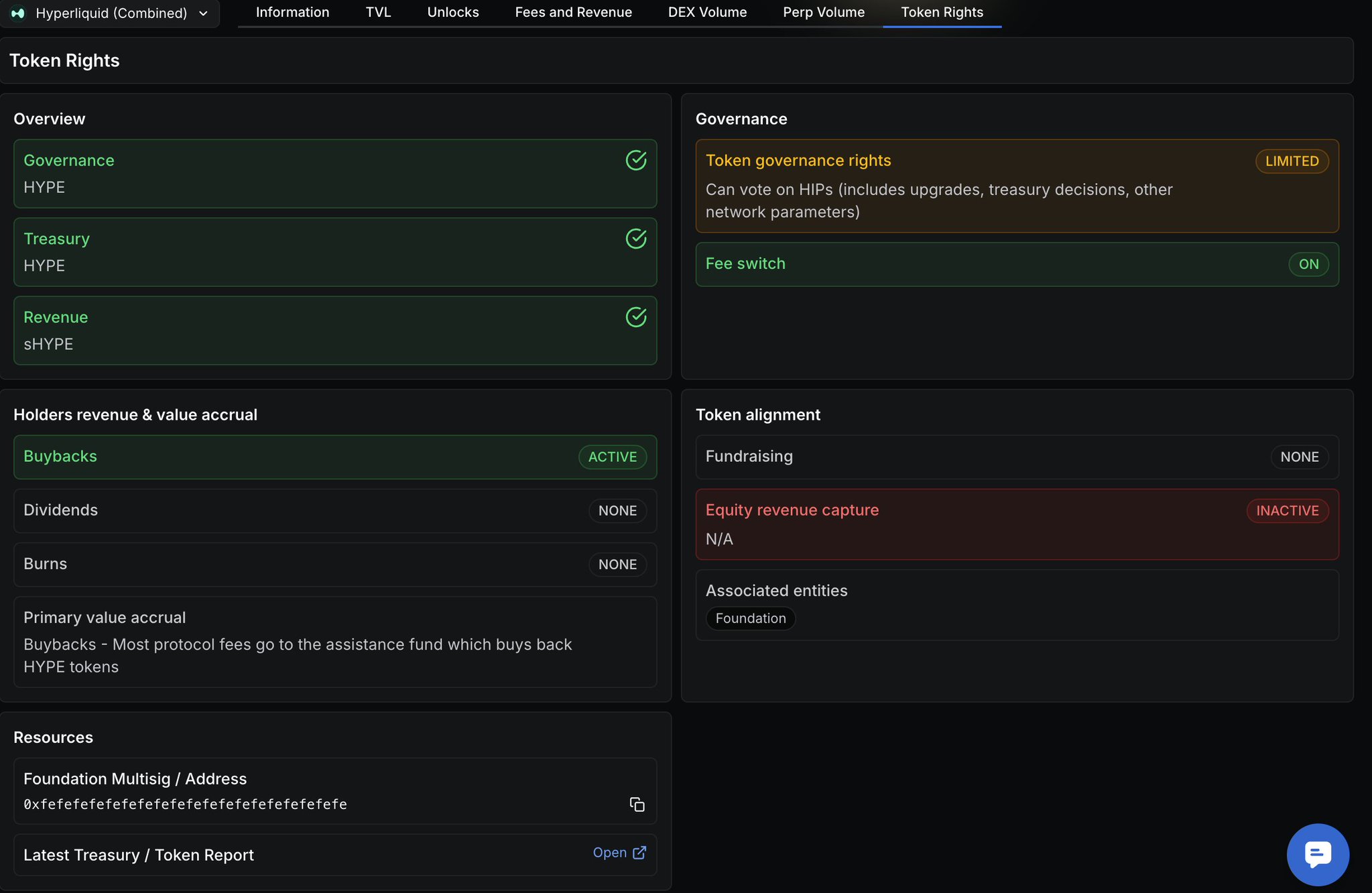

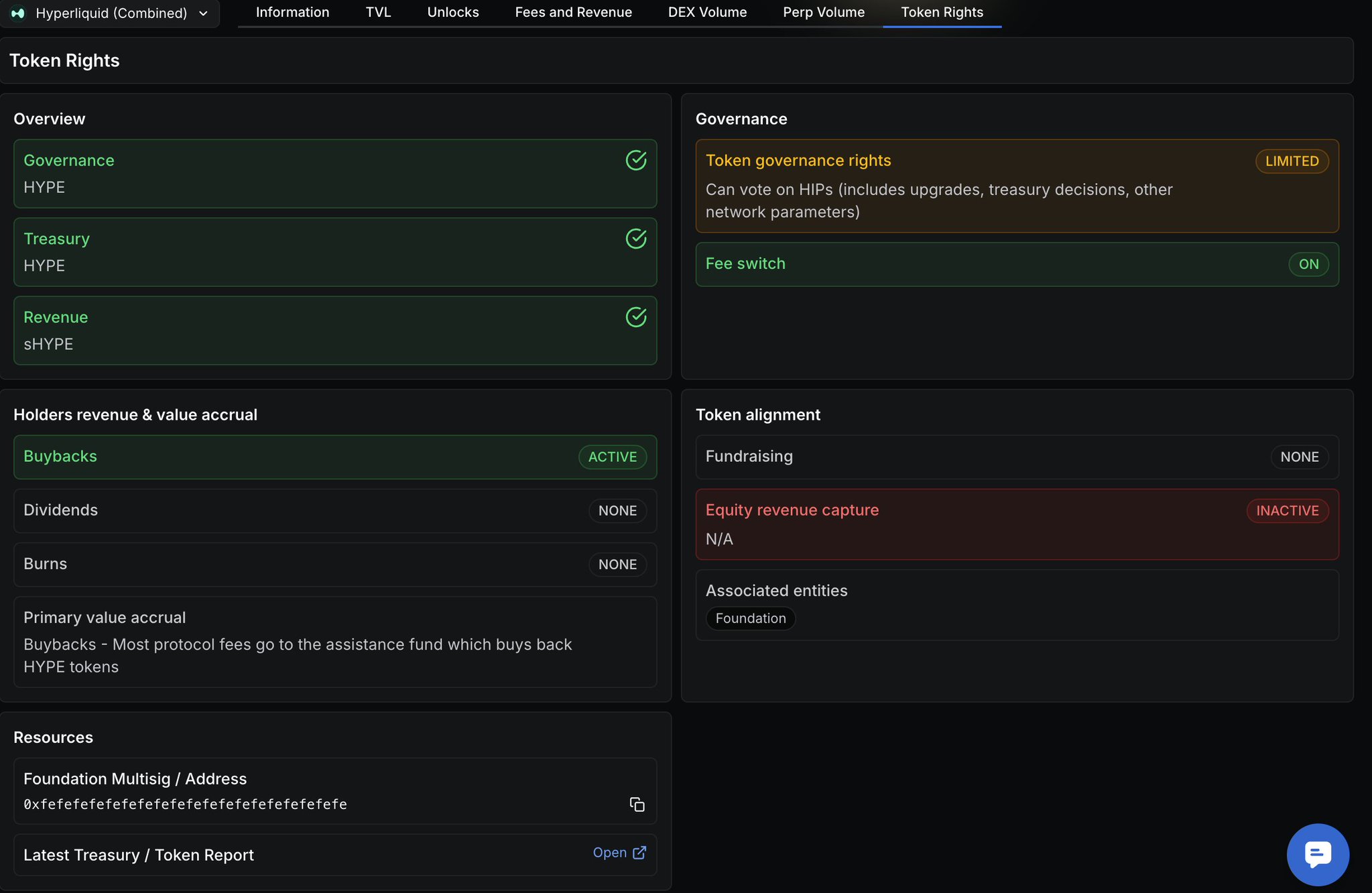

Today, we launched Token Rights on DefiLlama.

Token Rights gives you a clear, standardized view of what a token entitles holders to: revenue, treasury, governance, or none of the above.

We’ve rolled this out across two dozen protocols, including additional context like historical governance discussions around token rights and whether teams raised equity separately from the token.

What does the token actually do?

This has been one of the most fundamental unanswered questions in DeFi since the beginning.

Does the token control governance?

Does it have any claim on the treasury?

Does it receive protocol revenue via buybacks or dividends?

Today, we launched Token Rights on DefiLlama.

Token Rights gives you a clear, standardized view of what a token entitles holders to: revenue, treasury, governance, or none of the above.

We’ve rolled this out across two dozen protocols, including additional context like historical governance discussions around token rights and whether teams raised equity separately from the token.

Born to Click Long… Destined to Get Liquidated😡.

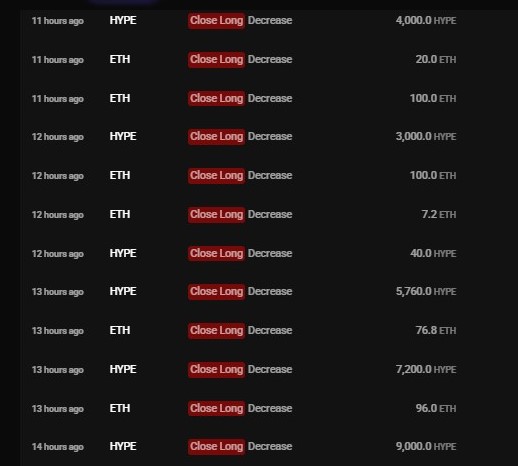

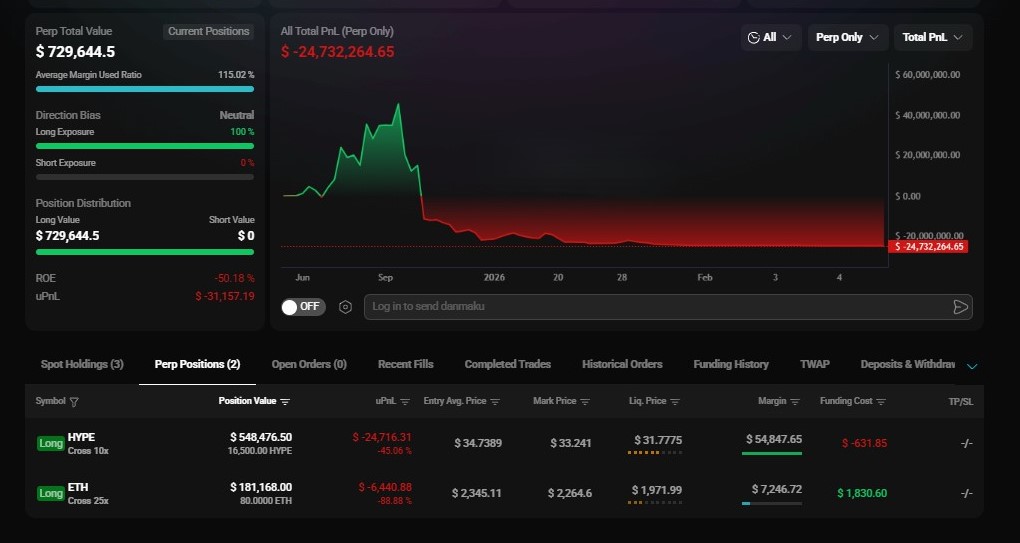

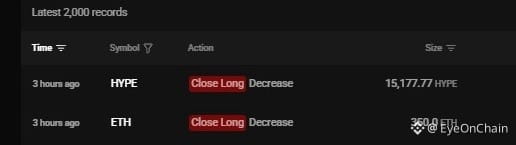

You honestly can’t make this stuff up. @machibigbrother just got clipped another 10 times, like the market has him on speed dial. That $250K USDC he deposited yesterday. It’s been chewed down to about $57.7K.

And yeah… he’s still in.

Right now, his whole book is hanging by a thread. Total perp exposure is sitting around $729K, 100% long, margin usage pushed past 115% —..which already tells you how thin the ice is.

The $HYPE long is the main bleed. About 16,500 HYPE on 10× leverage, position value near $548K. He entered around $34.74, price is hovering closer to $33.24, and the position’s down roughly $24.7K, a nasty -45% ROE. Liquidation is around $31.78, with only $54.8K margin holding the line. Funding’s been quietly draining too.

And on $ETH , smaller but somehow even uglier. Roughly 80 ETH long on 25×, position size about $181K. Entry near $2,345, now trading around $2,265. That’s another -$6.4K, almost -89% ROE, with liquidation down near $1,972. Margin... Just $7.2K.

And the bigger picture is pure pain. All-time perp PnL is sitting around -$24.73M.

At this point, it’s not even about bad trades. It’s about refusing to stop. Machi keeps coming back, keeps levering up, keeps getting wiped .. over and over. let see how long.

Anyways here is his address as usual:

0x020cA66C30beC2c4Fe3861a94E4DB4A498A35872

And the "KING of LIQUIDATION" award goes to 🤫 we mention the name below 👇!

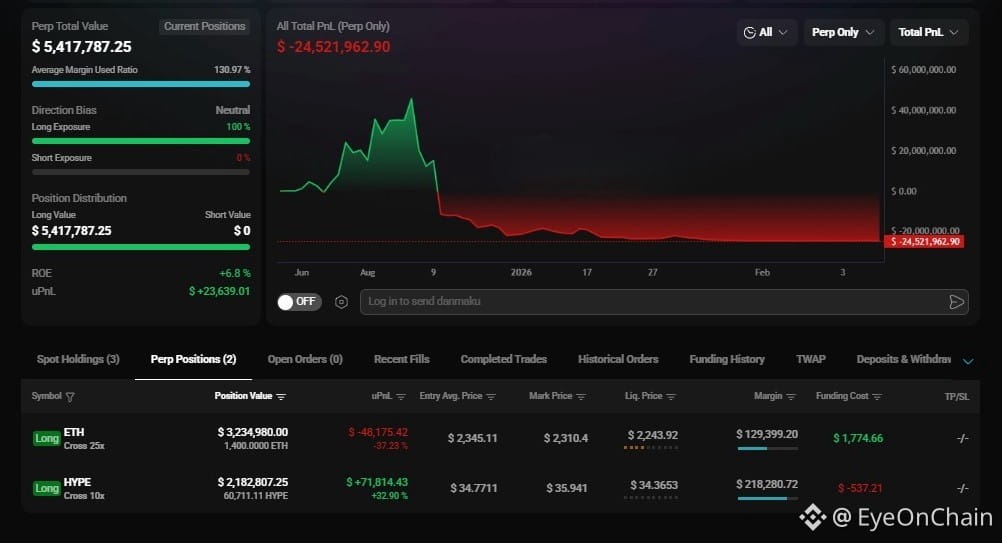

He Got Hit Again… and Somehow Refused to Leave, It happened again. Another partial liquidation, another notch on the belt. just crossed 252 liquidations ... which honestly sounds fake until you realize… no way, it’s really very real, and he’s still trading like nothing happened.

Right now his book is stretched wide open, about $5.4M in perp exposure, all long positions.

The $ETH position is where it hurts. Roughly 1,400 ETH long, sitting near $3.23M in size. He got in around $2,345, price is now closer to $2,310, and the trade’s run in loss currently by about $48K. ROE’s ugly, around -37%, and liquidation is uncomfortably close near $2,244. About $129K in margin holding the line, bleeding a bit more from funding every hour.

Second is $HYPE , the one thing keeping this from completely collapsing. About 60.7K #hype long on 10×, position value near $2.18M. Entry was roughly $34.77, now trading around $35.94, putting him up about $72K,

Predicción de precios

¿Cuándo es un buen momento para comprar HYPE? ¿Debería comprar o vender HYPE ahora?

Predicción de Beacon

Pronóstico probabilístico de precios (próximas 24 horas)Explorar más

BM Discovery

Nuevo listado