By providing liquidity on Polymarket, you can earn USDC rewards and increase your POLY airdrop chances.

If You’re Farming Polymarket Airdrop, Make Sure You Do This! 👇🏻

Adding liquidity has always been something many trading projects look at when it comes to airdrops.

But a lot of people still don’t know you can also add liquidity on Polymarket, and that could help with the $POLY airdrop too.

Fun fact: You can earn USDC rewards while spending $0, as long as you manage your orders well.

I am not fully sure about the exact numbers, but I have heard that if you earn even 1 USDC from adding liquidity, you could already rank higher than thousands of users.

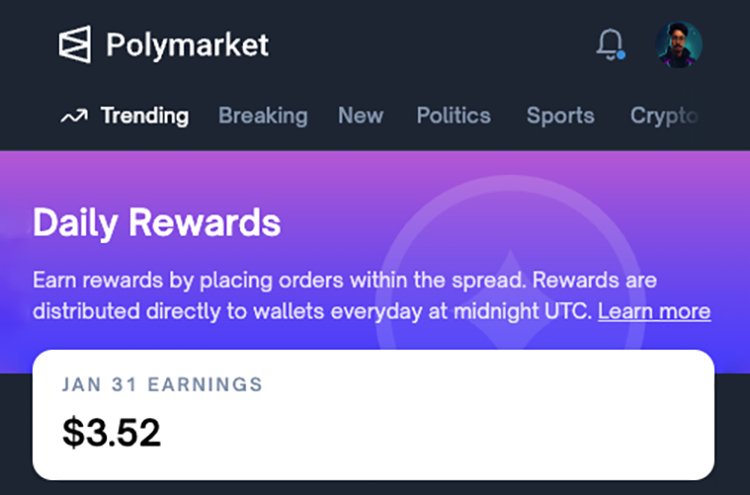

Today I earned 3+ USDC in about 1 to 2 hours with around $150 in orders, then canceled them and got everything back, meaning I spent $0.

------------

✅ So here is a quick guide to add liquidity on Polymarket, earn USDC, and improve your position.

1. Go to Polymarket: https://t.co/V2jpXMSZ50

2. Click your profile picture in the top right

3. Open the “Rewards” section

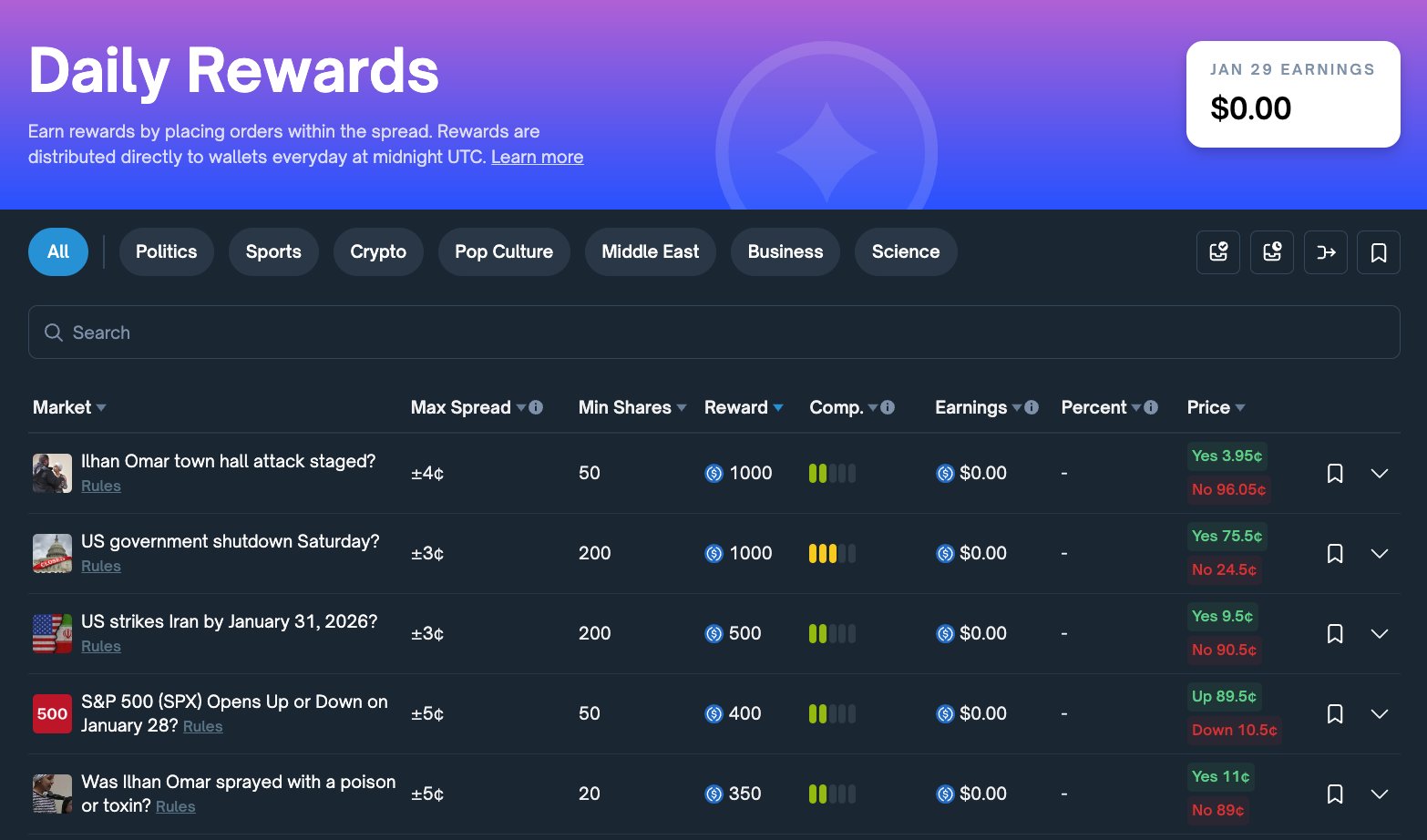

There you will see all the markets where you can add liquidity and earn USDC rewards.

To be clear, you will not see a button like “Add Liquidity” like on most dapps. On Polymarket, placing limit orders is considered providing liquidity.

So just open any market from the “Rewards” section that you understand and place limit orders. That’s it, you’re providing liquidity.

------------

▶️ Things to keep in mind:

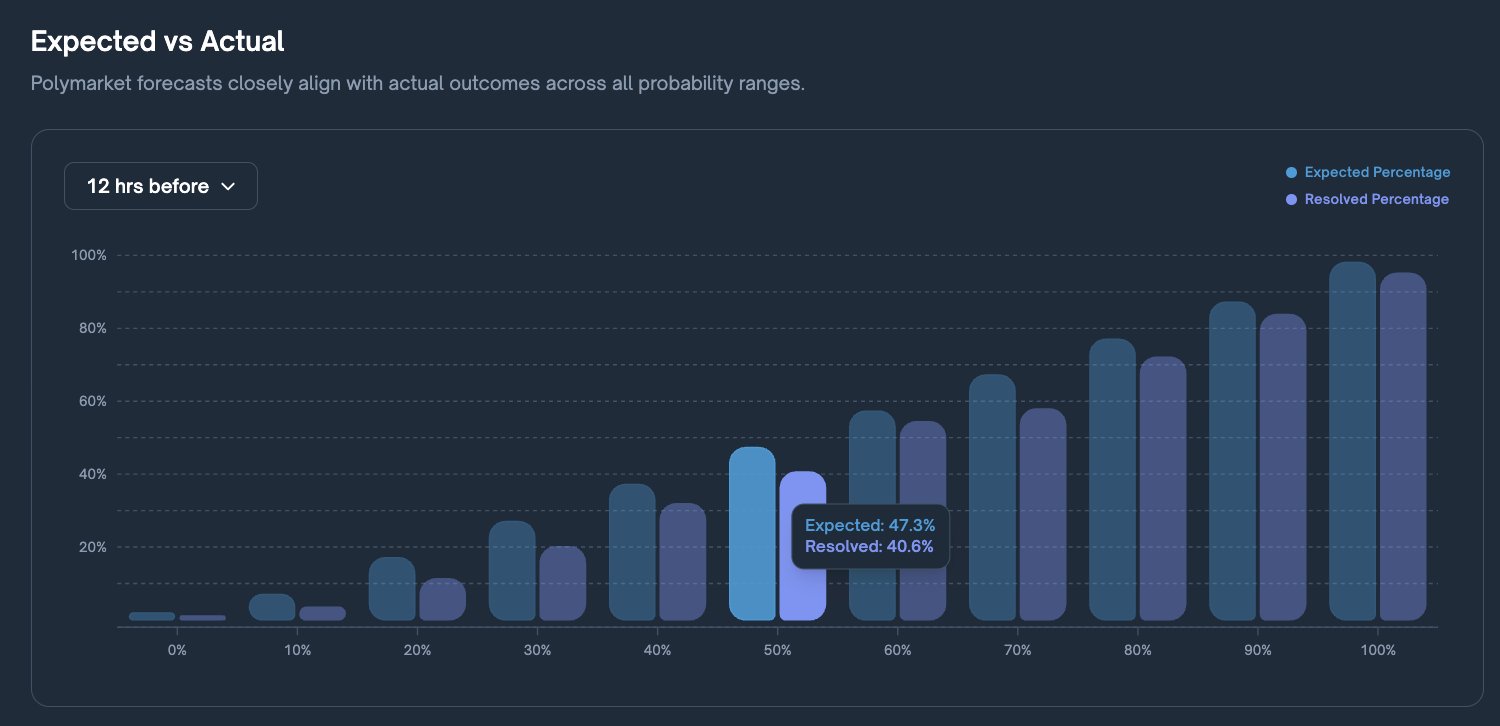

To earn USDC rewards, your limit orders must follow the “Max Spread” and “Min Shares” shown on the rewards page.

If the max spread is ±5 cents, your order must stay within 5 cents of the current market price.

Example: If a share is trading at 90 cents for YES, then NO will be 10 cents. So you can place YES orders between 85 and 89 cents, or NO orders between 5 and 9 cents.

This keeps your limit order within the required range and lets you earn USDC rewards.

If the market price moves, these ranges will change too. Cancel your old orders and place new ones within the updated range.

Also make sure you meet the minimum shares requirement, like 100 shares or whatever is listed. Only then will you qualify for USDC rewards, which is the main goal here.

------------

⚡️ Bonus Tip:

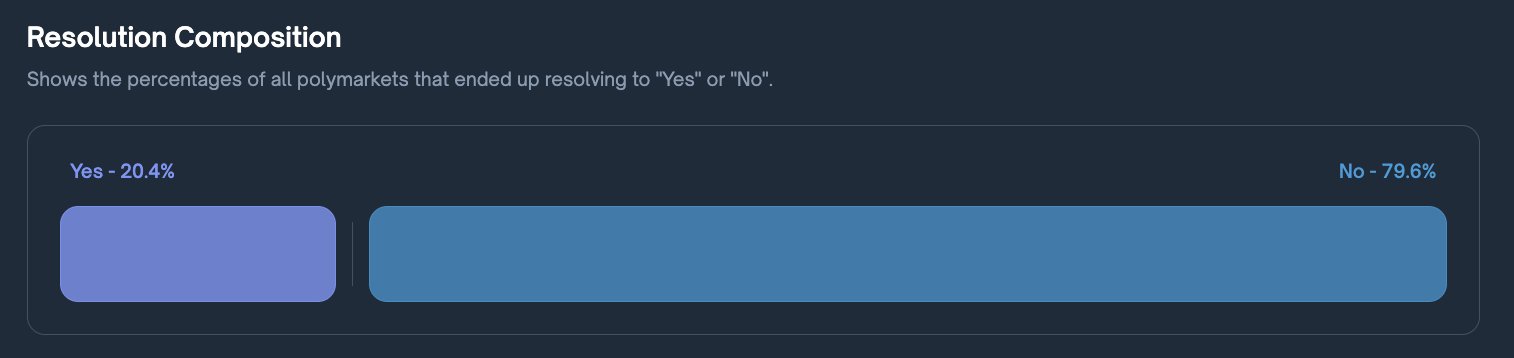

Choose markets with higher rewards. If one market gives 20 USDC and another gives 100 USDC, the 100 USDC one is the one you want to go for.

But higher rewards usually mean tighter spreads, so the risk is also higher. Keep that in mind.

Overall, you can earn a few USDC in a couple of hours using $100 to $200 in orders. Once you earn enough, you can cancel your limit orders and get your funds back, plus the USDC rewards.

------------

Just remember, you can’t place orders and walk away. You need to actively monitor them. If the market price reaches your limit order, it will get filled and you’ll end up buying shares.

So keep watching your orders and adjust or cancel them once you’ve earned enough rewards.

So yeah, hopefully that covers most of the important parts. If anything is still unclear or I missed something, feel free to reply below.