SushiSwap Datos de precios en tiempo real

El precio de hoy de SushiSwap es de $ 0.19 (SUSHI/USD). Con una capitalización de mercado de $ 57.24M USD. Volumen de trading en 24 horas de $ 88,238.25 USD, Un cambio de precio en 24 horas de -14.16%. Y un suministro circulante de 286.83M SUSHI.

SushiSwap SUSHI Historial de precios USD

Siga el precio de SushiSwap para hoy, 7 días, 30 días y 90 días

Periodo

Cambiar

Cambio (%)

Hoy

0

-14.59%

7días

--

--

30días

--

--

90días

0

-60.90%

Sea propietario de SUSHI ahora

Compra y vende SUSHI fácil y seguro en BitMart.

SushiSwap Información de mercado

$ 0.19 Autonomía de 24 horas $ 0.23

Máximo histórico

$ 99.78

El mínimo histórico

$ 0.0099

Cambio en 24 h

-14.16%

Volumen en 24 h

$ 88,238.25

Suministros en circulación

286.83M

SUSHI

Market Cap

$ 57.24M

Suministro máximo

287.67M

SUSHI

Capitalización de mercado totalmente diluida

$ 57.41M

Ganar

Pon a trabajar tus criptomonedas inactivas y obtén ingresos pasivos a través de ahorros, staking y más.SushiSwap X Insight

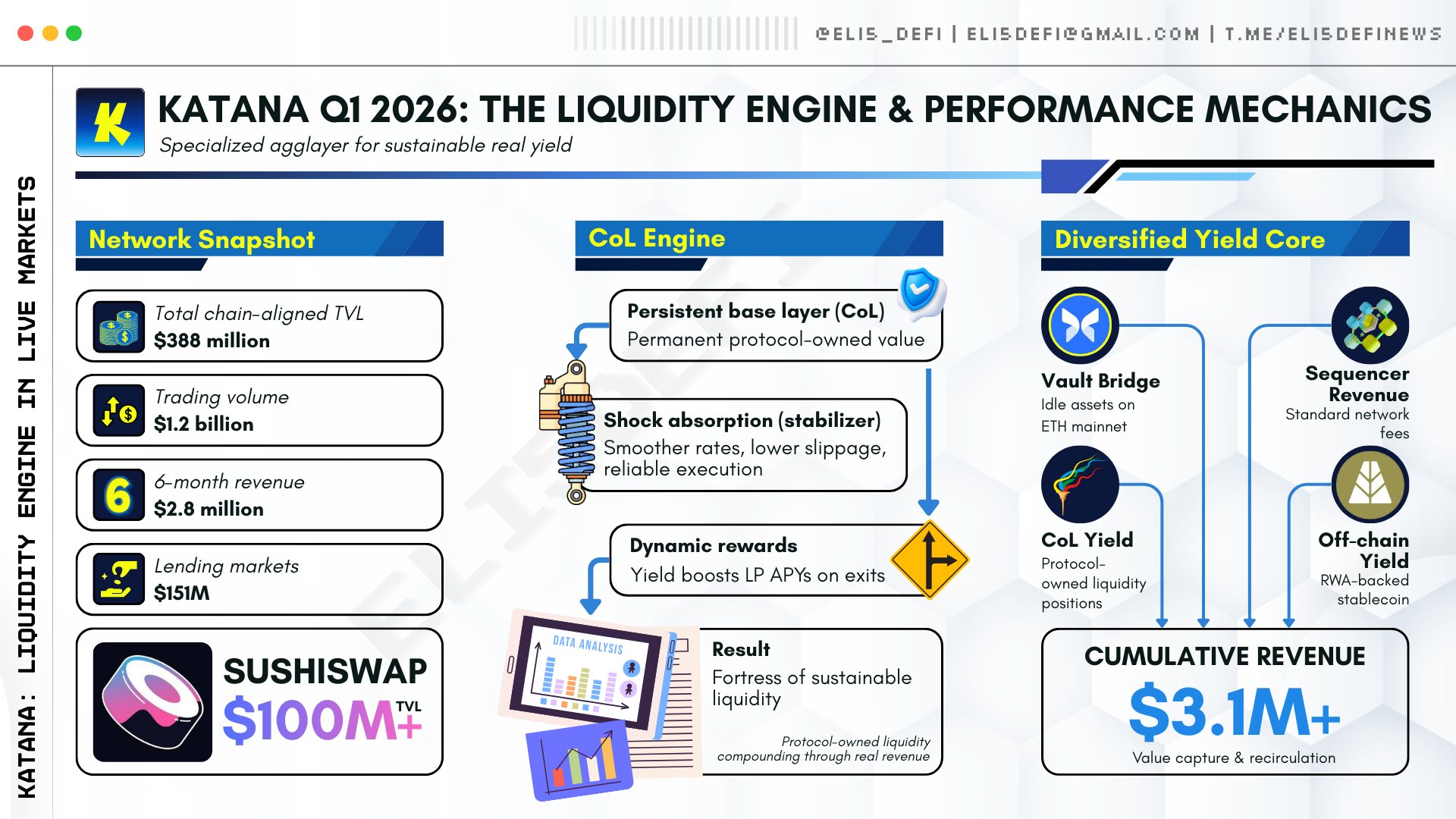

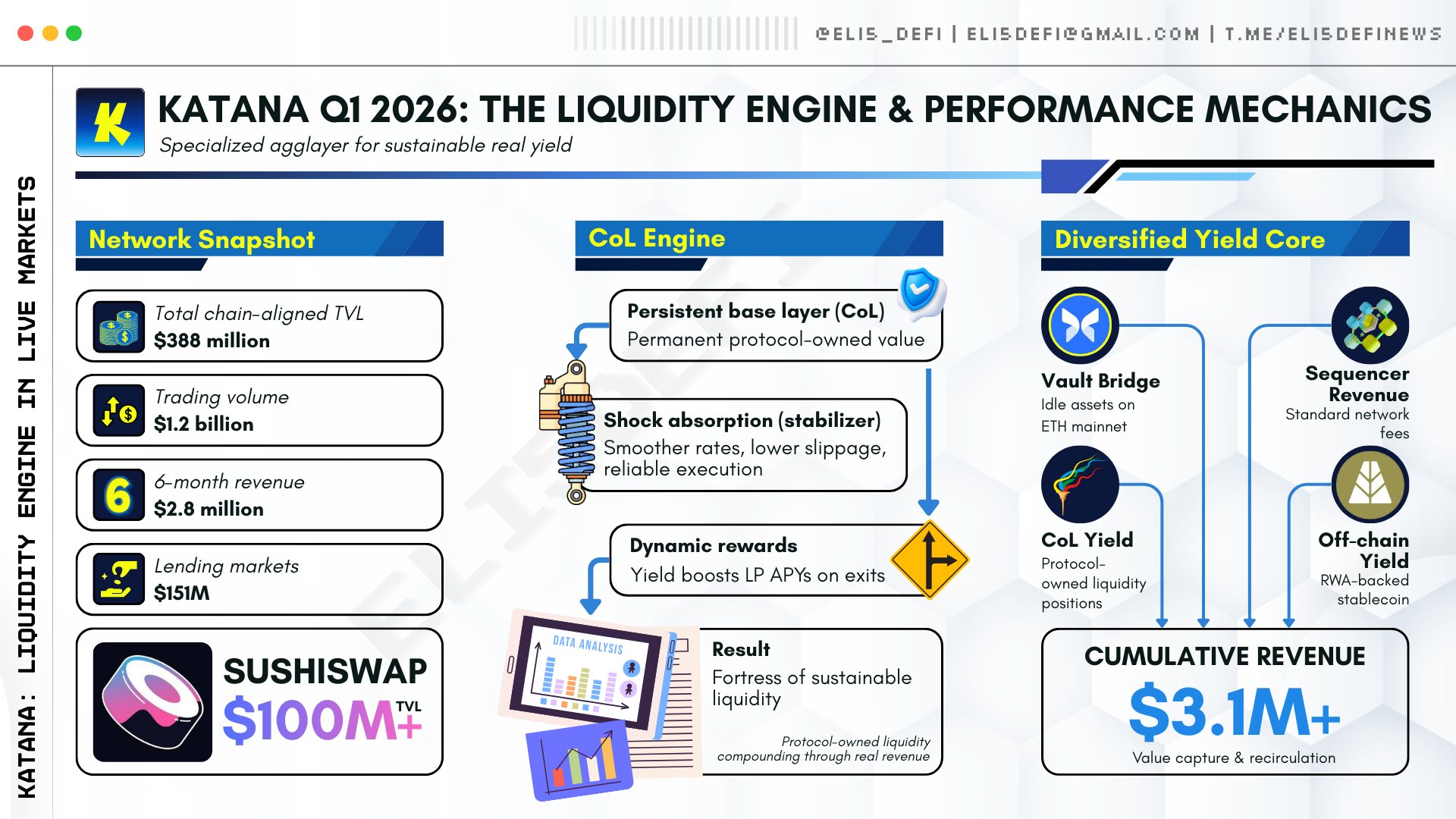

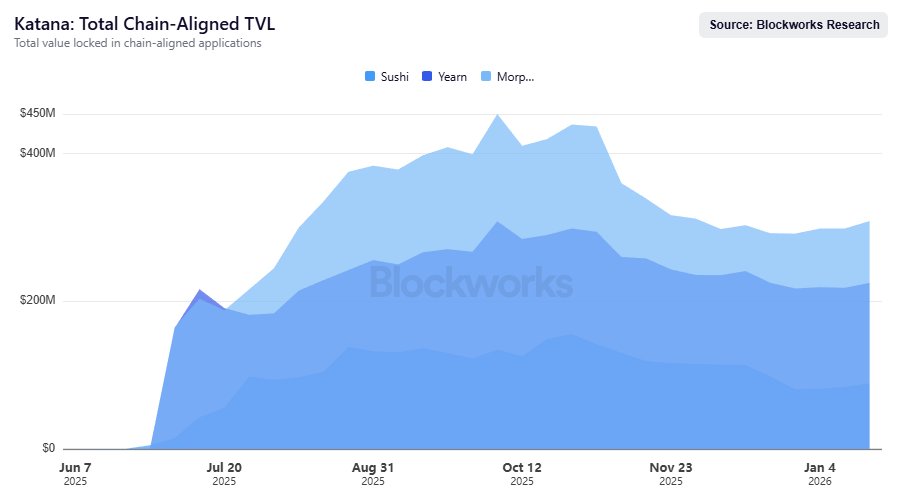

Katana protocol's Q1 performance was strong, with TVL reaching $388 million and cumulative revenue exceeding $3.1 million.

It's only January, Katana is already showing how its liquidity engine behaves under live market conditions.

This is an early Q1 data point.

Under January market conditions, the system is behaving as designed.

▸ ~$388M chain-aligned TVL, top 10 among L2s

▸ ~$1.2B cumulative DEX volume

▸ $3.1M+ total revenue generated and recycled

▸ Capital is actively deployed across lending and DEXs

▸ @SushiSwap anchors spot liquidity with $100M+ TVL

Chain-Owned Liquidity remained deployed as a stabilizing base layer, smoothing borrow rates, reducing slippage, and maintaining execution quality during volatility.

Vault Bridge is the dominant revenue source, deploying idle assets to @ethereum via @Morpho.

Sequencer fees, CoL yield, and off-chain yield via $AUSD add incremental cash flows.

The system captures and recycles value at the protocol level, rather than relying on incentive-driven liquidity.

13 días hace

Tendencia de SUSHI tras el lanzamiento

Sin datos

Extremadamente alcista

Katana protocol's Q1 performance was strong, with TVL reaching $388 million and cumulative revenue exceeding $3.1 million.

Katana showed strong performance in Q1, its liquidity engine operated well, and revenue was considerable.

It's only January, Katana is already showing how its liquidity engine behaves under live market conditions.

This is an early Q1 data point.

Under January market conditions, the system is behaving as designed.

▸ ~$388M chain-aligned TVL, top 10 among L2s

▸ ~$1.2B cumulative DEX volume

▸ $3.1M+ total revenue generated and recycled

▸ Capital is actively deployed across lending and DEXs

▸ @SushiSwap anchors spot liquidity with $100M+ TVL

Chain-Owned Liquidity remained deployed as a stabilizing base layer, smoothing borrow rates, reducing slippage, and maintaining execution quality during volatility.

Vault Bridge is the dominant revenue source, deploying idle assets to @ethereum via @Morpho.

Sequencer fees, CoL yield, and off-chain yield via $AUSD add incremental cash flows.

The system captures and recycles value at the protocol level, rather than relying on incentive-driven liquidity.

— Check more details here:

https://t.co/3HNE5ZYTZY

— Disclaimer https://t.co/LK2oZIjb2U

13 días hace

Tendencia de SUSHI tras el lanzamiento

Sin datos

Alcista

Katana showed strong performance in Q1, its liquidity engine operated well, and revenue was considerable.

Katana platform has shown astonishing growth in revenue, TVL, and DEX trading volume within six months of launch.

gm bros

It has already been 6 months since @katana went live!!

And the progress is INSANE for such a short time:

> $3.1M total revenue

> $388M DeFi TVL (#9 L2 by TVL)

> $1.2B DEX volume in Q4 (!!!)

> $151M+ loans on Morph o + $100M+ TVL on SushiSwap

And since it's Katana the TVL is not idle, all TVL is active. VaultBridge alone did $2.8M+ in rev, which is then cycled back into Katana defi to print even more yield

The flywheel is spinning ⚔️

15 días hace

Tendencia de SUSHI tras el lanzamiento

Sin datos

Extremadamente alcista

Katana platform has shown astonishing growth in revenue, TVL, and DEX trading volume within six months of launch.

Predicción de precios

¿Cuándo es un buen momento para comprar SUSHI? ¿Debería comprar o vender SUSHI ahora?

Al decidir si es un buen momento para comprar o vender SushiSwap (SUSHI), es importante ajustarse primero a su propia estrategia de trading y perfil de riesgo. Los inversores a largo plazo y los traders a corto plazo suelen interpretar las condiciones del mercado de forma diferente, por lo que su decisión debe reflejar su enfoque personal. Según el último análisis técnico de 4 horas de SUSHI, la señal de trading actual es Hold. Según el último análisis técnico de 1 día de SUSHI, la señal actual es Hold.

Predicción de Beacon

Pronóstico probabilístico de precios (próximas 24 horas)crypto.loading

Sobre SushiSwap

SushiSwap (SUSHI) is a cryptocurrency launched in 2020and operates on the Ethereum platform. SushiSwap has a current supply of 287,676,365.31480285 with 286,834,102.51212947 in circulation. The last known price of SushiSwap is 0.23953051 USD and is down -2.24 over the last 24 hours. It is currently trading on 965 active market(s) with $14,847,384.58 traded over the last 24 hours. More information can be found at https://sushi.com/.

Leer más

Enlaces oficiales

Explorador de blockchain

Explorar más

BM Discovery

Nuevo listado

BIGTROUT The Big Trout

0 0.00%

RUNE THORChain

0 0.00%

GSON Goldman Sachs Ondo Tokenized

0 0.00%

SPOTON Spotify Ondo Tokenized

0 0.00%

INTCON Intel Ondo Tokenized

0 0.00%

ABBVON AbbVie Ondo Tokenized

0 0.00%

COSTON Costco Ondo Tokenized

0 0.00%

WAN Wanchain

0 0.00%

WAR WAR

0 0.00%

DANKDOGEAI DankDoge AI Agent

0 0.00%