SushiSwap Live Kursdaten

Der heutige Preis von SushiSwap ist $ 0.21 (SUSHI/USD). Mit einer Marktkapitalisierung von $ 63.01M USD. 24-Stunden-Handelsvolumen von $ 89,260.75 USD, Eine 24-Stunden-Preisänderung von -6.38%, Sowie einer Umlaufmenge von 286.83M SUSHI.

SushiSwap SUSHI Preisverlauf USD

Verfolgen Sie den Preis von SushiSwap für heute, 7 Tage, 30 Tage und 90 Tage

Zeitraum

Ändern

Veränderung (%)

Heute

0

-6.38%

7Tage

--

--

30Tage

--

--

90Tage

0

-56.78%

Besitzen Sie SUSHI jetzt

Kaufen und verkaufen Sie SUSHI einfach und sicher auf BitMart.

SushiSwap Marktinformationen

$ 0.21 24-Std.-Bereich $ 0.23

Allzeithoch

$ 99.86

Allzeittief

$ 0.0099

24-Std.-Veränderung

-6.38%

Menge 24 Std.

$ 89,260.75

Zirkulierendes Angebot

286.83M

SUSHI

Marktobergrenze

$ 63.01M

Nettomenge

287.67M

SUSHI

Vollständig verwässerte Marktobergrenze

$ 63.20M

Verdienen

Setzen Sie Ihre ungenutzten Kryptowährungen ein und erzielen Sie passives Einkommen durch Ersparnisse, Staking und mehr.SushiSwap X Insight

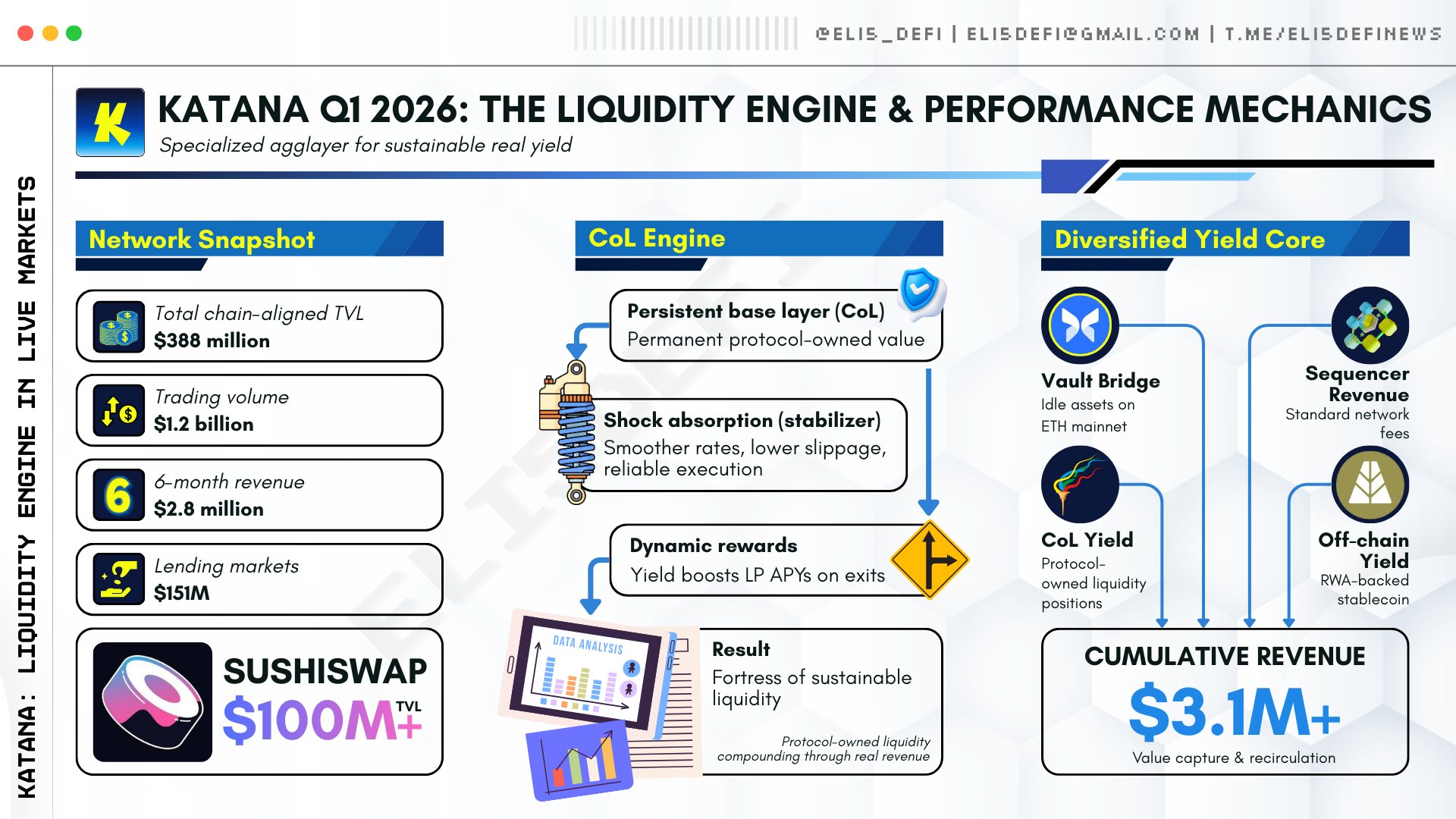

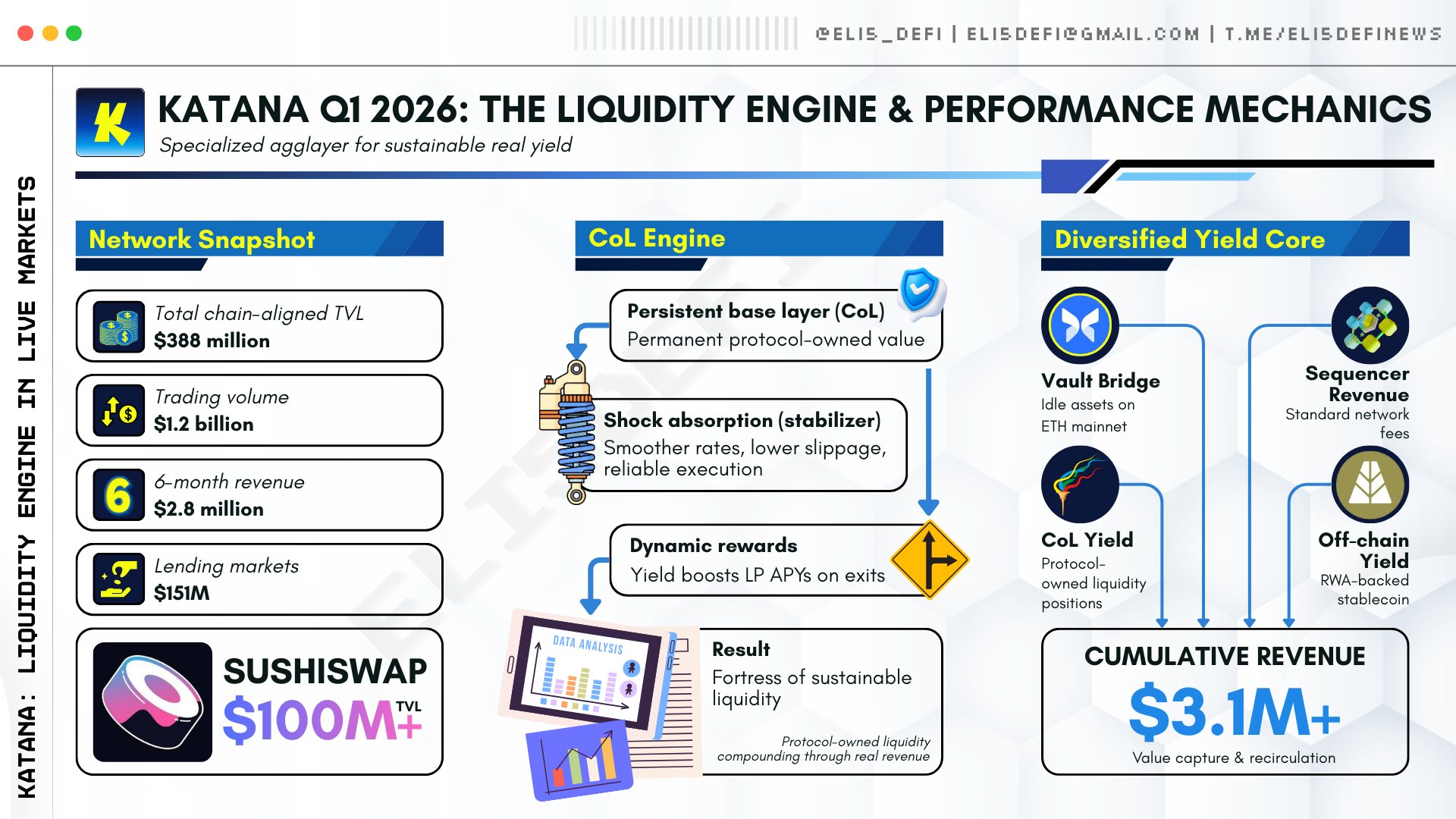

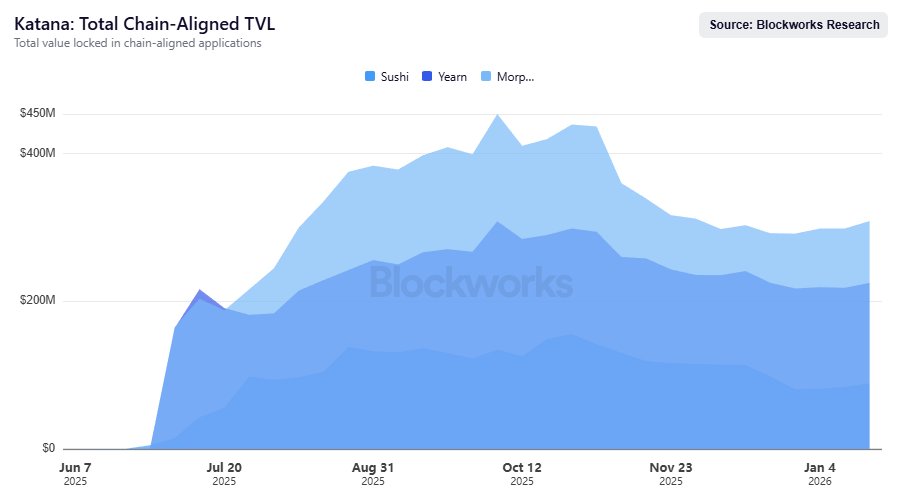

Katana protocol's Q1 performance was strong, with TVL reaching $388 million and cumulative revenue exceeding $3.1 million.

It's only January, Katana is already showing how its liquidity engine behaves under live market conditions.

This is an early Q1 data point.

Under January market conditions, the system is behaving as designed.

▸ ~$388M chain-aligned TVL, top 10 among L2s

▸ ~$1.2B cumulative DEX volume

▸ $3.1M+ total revenue generated and recycled

▸ Capital is actively deployed across lending and DEXs

▸ @SushiSwap anchors spot liquidity with $100M+ TVL

Chain-Owned Liquidity remained deployed as a stabilizing base layer, smoothing borrow rates, reducing slippage, and maintaining execution quality during volatility.

Vault Bridge is the dominant revenue source, deploying idle assets to @ethereum via @Morpho.

Sequencer fees, CoL yield, and off-chain yield via $AUSD add incremental cash flows.

The system captures and recycles value at the protocol level, rather than relying on incentive-driven liquidity.

13 Tage vor

Trend von SUSHI nach Veröffentlichung

Keine Daten

Extrem bullisch

Katana protocol's Q1 performance was strong, with TVL reaching $388 million and cumulative revenue exceeding $3.1 million.

Katana showed strong performance in Q1, its liquidity engine operated well, and revenue was considerable.

It's only January, Katana is already showing how its liquidity engine behaves under live market conditions.

This is an early Q1 data point.

Under January market conditions, the system is behaving as designed.

▸ ~$388M chain-aligned TVL, top 10 among L2s

▸ ~$1.2B cumulative DEX volume

▸ $3.1M+ total revenue generated and recycled

▸ Capital is actively deployed across lending and DEXs

▸ @SushiSwap anchors spot liquidity with $100M+ TVL

Chain-Owned Liquidity remained deployed as a stabilizing base layer, smoothing borrow rates, reducing slippage, and maintaining execution quality during volatility.

Vault Bridge is the dominant revenue source, deploying idle assets to @ethereum via @Morpho.

Sequencer fees, CoL yield, and off-chain yield via $AUSD add incremental cash flows.

The system captures and recycles value at the protocol level, rather than relying on incentive-driven liquidity.

— Check more details here:

https://t.co/3HNE5ZYTZY

— Disclaimer https://t.co/LK2oZIjb2U

13 Tage vor

Trend von SUSHI nach Veröffentlichung

Keine Daten

Bullisch

Katana showed strong performance in Q1, its liquidity engine operated well, and revenue was considerable.

Katana platform has shown astonishing growth in revenue, TVL, and DEX trading volume within six months of launch.

gm bros

It has already been 6 months since @katana went live!!

And the progress is INSANE for such a short time:

> $3.1M total revenue

> $388M DeFi TVL (#9 L2 by TVL)

> $1.2B DEX volume in Q4 (!!!)

> $151M+ loans on Morph o + $100M+ TVL on SushiSwap

And since it's Katana the TVL is not idle, all TVL is active. VaultBridge alone did $2.8M+ in rev, which is then cycled back into Katana defi to print even more yield

The flywheel is spinning ⚔️

15 Tage vor

Trend von SUSHI nach Veröffentlichung

Keine Daten

Extrem bullisch

Katana platform has shown astonishing growth in revenue, TVL, and DEX trading volume within six months of launch.

Preisprognose

Wann ist ein guter Zeitpunkt, um SUSHI zu kaufen? Soll ich SUSHI jetzt kaufen oder verkaufen?

Bei der Entscheidung, ob es ein guter Zeitpunkt ist, SushiSwap (SUSHI) zu kaufen oder zu verkaufen, ist es wichtig, sich zunächst an der eigenen Handelsstrategie und Ihrem Risikoprofil zu orientieren. Langfristig orientierte Anleger und kurzfristig orientierte Trader interpretieren Marktbedingungen oft unterschiedlich, daher sollte Ihre Entscheidung Ihre persönliche Herangehensweise widerspiegeln. Laut der neuesten vierstündigen technischen Analyse von SUSHI lautet das aktuelle Handelssignal Halten. Laut der neuesten eintägigen technischen Analyse von SUSHI lautet das aktuelle Signal Halten.

Beacon Vorhersage

Probabilistische Preisprognose (nächste 24 Stunden)crypto.loading

Über SushiSwap

SushiSwap (SUSHI) is a cryptocurrency launched in 2020and operates on the Ethereum platform. SushiSwap has a current supply of 287,676,365.31480285 with 286,834,102.51212947 in circulation. The last known price of SushiSwap is 0.23953051 USD and is down -2.24 over the last 24 hours. It is currently trading on 965 active market(s) with $14,847,384.58 traded over the last 24 hours. More information can be found at https://sushi.com/.

Mehr lesen