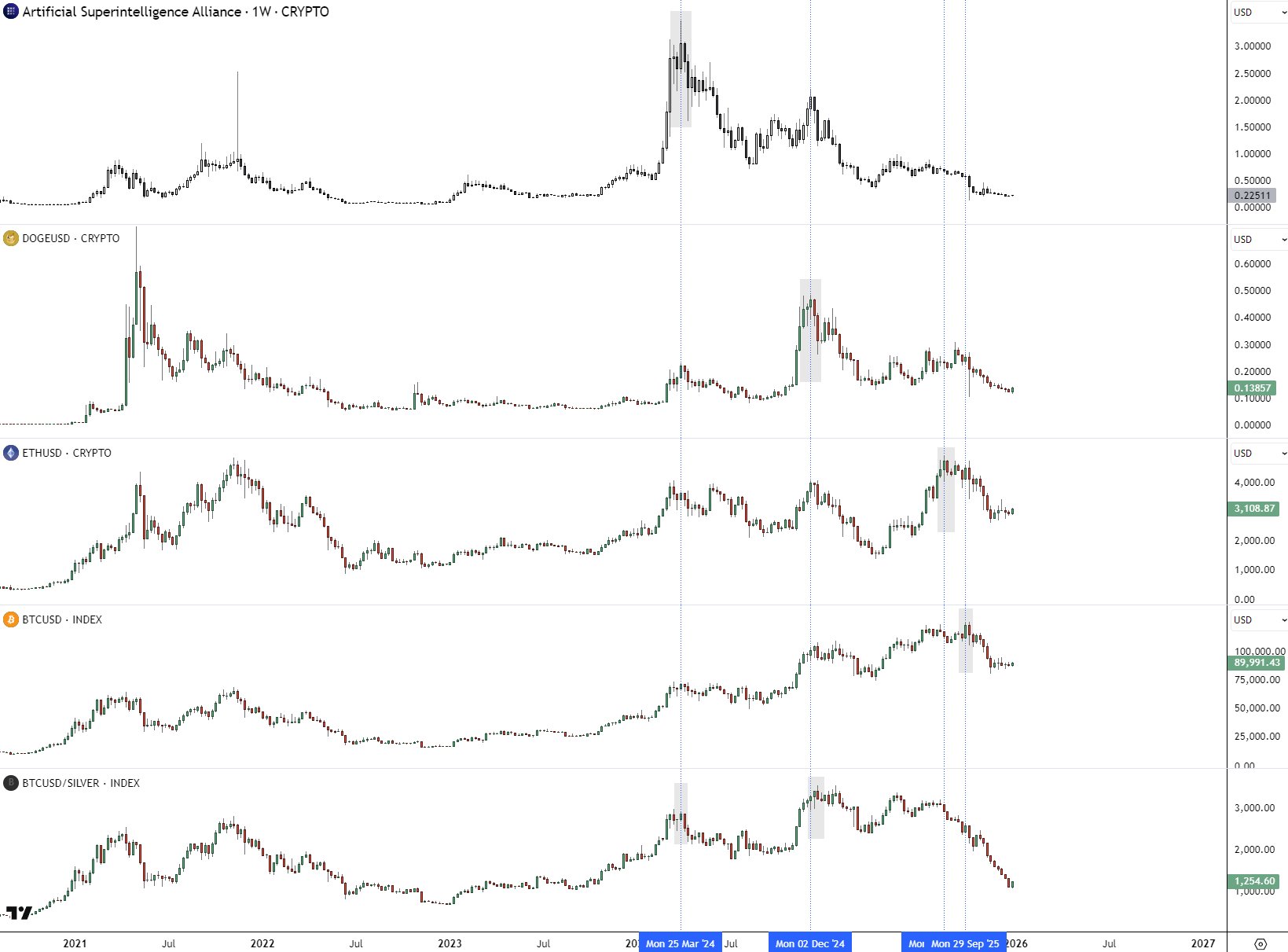

Tweet detailed analysis of the three major decentralized AI projects ASI, QUBIC, and TRAC, bullish on their growth potential.

The Decentralized AI Race.

Forget L1 memecoins, AI compute is where serious capital is moving this cycle.

Could these three break into the $1B club?

→ @ASI_Alliance ( $FET )

→ @_Qubic_ ( $QUBIC )

→ @origin_trail ( $TRAC )

Are these the next 10x of decentralized AI? 👇

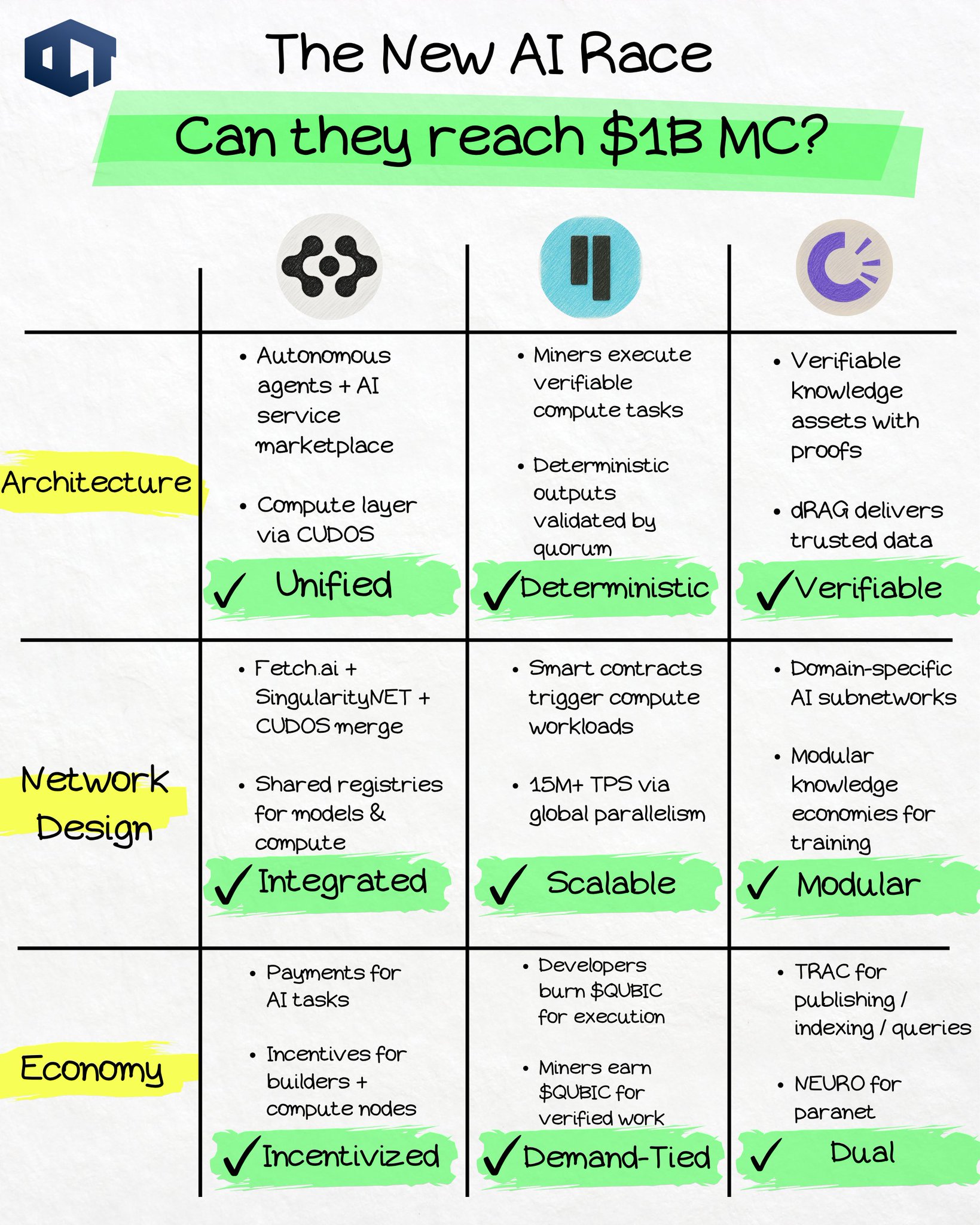

⚪ ASI ( $FET ): The Artificial Superintelligence Alliance

✦ Architecture → Autonomous Agents + Modular AI Chain

ASI is the merger of https://t.co/EBpcX5azxg (FET), SingularityNET (AGIX), and CUDOS, forming a unified AI ecosystem with a shared ASI token.

At its core, ASI combines:

• Autonomous AI Agents from https://t.co/EBpcX5azxg agents that execute tasks, negotiate, trade, or coordinate across chains.

• SingularityNET’s marketplace enabling AI models and services to be published, monetized, and composed.

• CUDOS’ decentralized compute layer bringing GPU/TPU workloads and verifiable compute.

Together, they form a modular network where agents, models, data, and compute plug into a unified AI economy.

The big shift?

Instead of models living in silos, ASI wants AI components to talk to each other, trade value, and scale into something resembling an open AGI substrate.

✦ Utility → Agents, Marketplaces, Compute

ASI focuses on usable AI, not just infrastructure.

• Agentverse → deploy on-chain + off-chain agents that automate trading, logistics, and workflows.

• AI Marketplace → models listed as services, payable via ASI.

• Compute Layer (CUDOS) → offloads heavy inference and training to distributed GPU clusters.

• Data Layer → Ocean-inspired, but not merged ASI integrates verifiable data markets for training inputs.

What makes ASI interesting is the interoperability:

Agents can call models, models can request compute, compute can pull verifiable data all within one token economy.

It’s the closest thing crypto has to an “AI operating system.”

✦ Economy → $ASI Migration + Shared Incentives

The ASI migration unified: FET + AGIX + CUDOS → ASI under a ~2.63B supply.

Token roles include:

• Payment for agent execution

• Rewards for compute providers

• Governance over model registries

• Incentives for marketplace usage

• Staking for network security

The design aligns all contributors agents, model creators, compute providers, and data suppliers into one incentive loop.

👉 My take: ASI is the “everything layer” for decentralized AI agents, models, compute, and data under one roof. It has the cleanest narrative and widest scope, but delivering on the AGI vision will be its challenge.

🟢 Qubic ( $QUBIC ): Turning Mining Into AI Compute

✦ Architecture → Useful Proof-of-Work + AI Quorum

Where ASI focuses on agents and marketplaces, Qubic focuses on raw compute.

Its innovation is Useful Proof-of-Work (UPoW) instead of hashing, miners perform verifiable computational tasks like:

• AI inference

• Model evaluations

• Encryption tasks

• Scientific computations

Every computation is validated by a global quorum a decentralized verification layer ensuring correctness without trusting miners.

This makes Qubic one of the only networks where the act of mining directly produces AI work.

✦ Utility → Deterministic Compute + AI Execution

Qubic is effectively a deterministic AI mainframe.

• Smart contracts trigger off-chain compute tasks

• Miners solve them and return proofs

• Network reaches quorum and finalizes results

This allows:

✔ AI agents

✔ LLM inference

✔ Game logic

✔ Scientific simulations

✔ Real-world compute outsourcing

2025 milestones include:

• Monero mining via Qubic (demonstrating UPoW flexibility)

• TOKEN2049 demo of deterministic AI compute

• 15.52M TPS benchmark verified by CertiK

Qubic isn’t trying to be an L1 it’s trying to be an AI supercomputer powered by miners, which makes its economic model fascinating.

✦ Economy → $QUBIC Utility + Burn-for-Compute

Qubic’s model is extremely simple:

• Miners earn $QUBIC for completing tasks

• Users and applications burn $QUBIC to access compute

• Burning ties network demand directly to token scarcity

This makes $QUBIC one of the few AI tokens with real resource backing compute is the commodity, token burns are the pricing mechanism.

👉 My take: Qubic is the highest-risk, highest-upside play if UPoW becomes a standard, Qubic becomes the decentralized compute engine. If not, it stays experimental.

🔵 OriginTrail (TRAC): The Verifiable Internet for AI

✦ Architecture → Decentralized Knowledge Graph (DKG) + dRAG

Where ASI deals with agents and Qubic handles compute, TRAC solves a different AI problem:

AI hallucinations.

OriginTrail’s DKG structures data into verifiable knowledge assets:

• Provenance

• Authenticity

• Blockchain-backed proofs

• Cross-chain indexing

Then, dRAG (decentralized Retrieval Augmented Generation) lets AI models pull information from trusted sources before answering.

In plain language:

➡️ “Don’t guess check the facts first.”

TRAC is building a verifiable memory layer for AI.

✦ Utility → Paranets + Knowledge Economies

OriginTrail introduced Paranets domain-specific subnetworks for sectors like:

• Supply chains

• Pharma

• Real-world assets

• Scientific knowledge

• AI training datasets

Each paranet is run by its own community, with its own incentives, validators, and governance but all plug into the global DKG.

This modular structure allows the DKG to scale horizontally while keeping data specialized and trusted.

✦ Economy → $TRAC + $NEURO Dual Token

OriginTrail uses two tokens:

• $TRAC → indexing, publishing, querying, and securing knowledge assets

• $NEURO → paranet rewards, governance, and emissions

Demand grows as:

• Enterprises publish more data

• Paranets expand

• AI applications integrate dRAG

• More knowledge markets go live

👉 My take: TRAC is the “truth layer” for AI the one that ensures AI systems aren’t confident liars.

🔚 Conclusion: The AI Edge

Each project attacks a different weakness in AI:

• ASI → Autonomous agents, compute marketplace, model economy

• Qubic → Deterministic compute powered by UPoW

• TRAC → Verifiable knowledge and hallucination prevention

Together, they form a full stack:

Knowledge → Compute → Agents.

📊 Final Rankings

AI Infrastructure

$ASI > $QUBIC > $TRAC

ASI spans agents, models, compute, R&D, and governance. Qubic excels in compute. TRAC is specialized around data verifiability.

Scalability & Execution Model

$QUBIC > $ASI > $TRAC

UPoW enables parallel deterministic compute. ASI’s agent + compute modules scale well. TRAC scales via paranets but depends on adoption.

Real-World Utility

$TRAC > $ASI > $QUBIC

TRAC already secures supply chains & enterprise datasets. ASI integrates consumer and enterprise AI apps. Qubic’s utility depends on developer adoption.

💡 My Takeaway

If you want broad AI infrastructure exposure → ASI

If you want compute as a commodity → Qubic

If you want verifiable AI that doesn’t hallucinate → TRAC

Each plays a role in the coming autonomous AI economy.