🧵 AUDD is building both liquidity and rails: XDC/Curve + Hedera/Acacia 🇦🇺

$AUDD’s expansion isn’t a who wins story, it’s a two‑layer build:

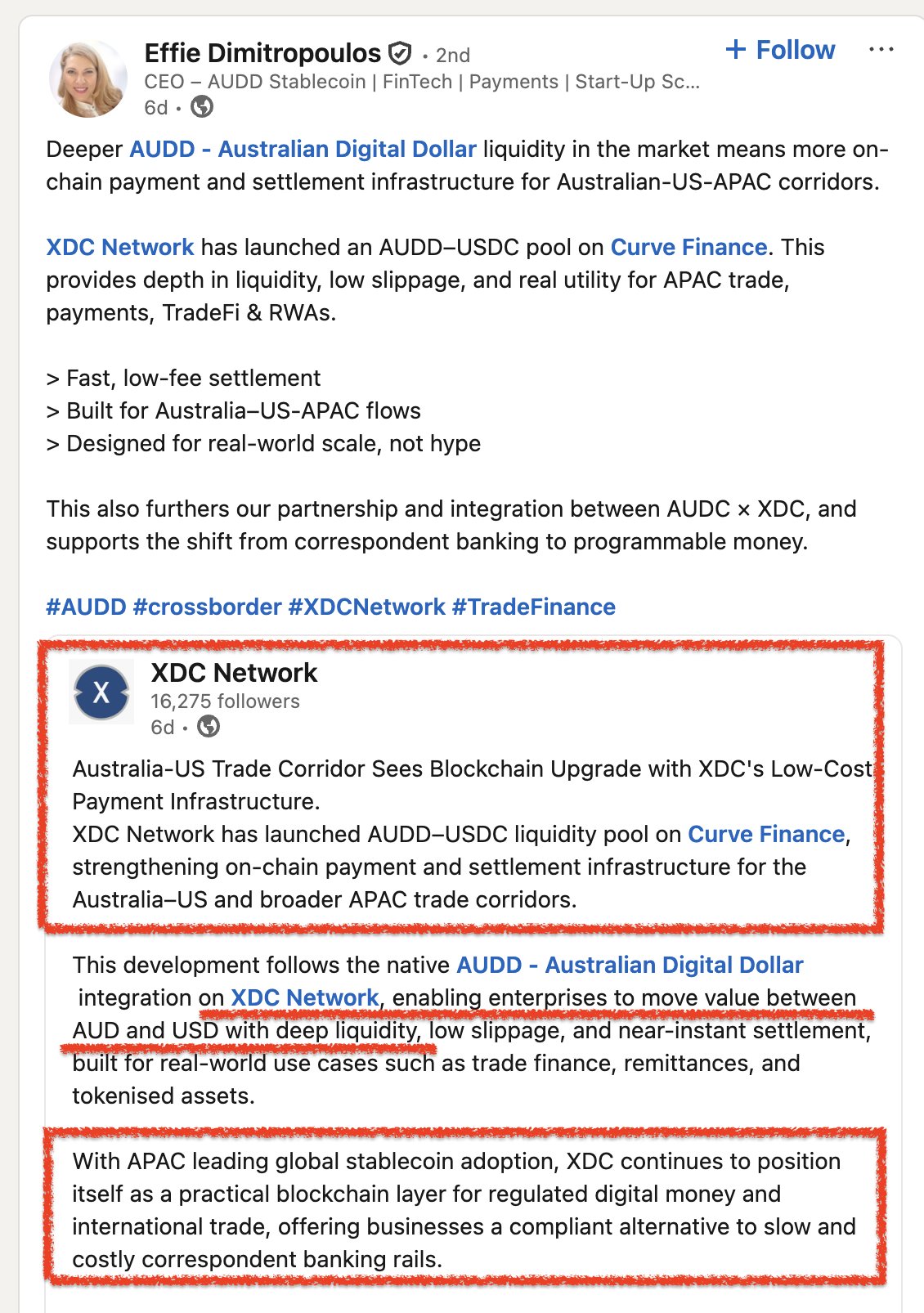

✅ Liquidity where it trades/routes (XDC + Curve)

✅ Rails where it settles/integrates (Hedera + wholesale pilots)

Quick context: AUDD (Australian Digital Dollar) is an AUD‑denominated stablecoin. The point isn’t speculation, it’s payments + settlement.

The pain point is real: AU↔US business transfers can mean multi‑day settlement + meaningful fees. That’s exactly why firms look for digital payment alternatives.

This is where XDC x AUDD fits: modernizing payment infrastructure for Australia–US / broader APAC trade corridors with a focus on efficiency (TradeFi/RWA vibes).

And the Curve piece matters: a deep AUDD–USDC pool isn’t just DeFi. It’s practical plumbing:

• better on‑chain FX (AUD↔USD)

• lower slippage

• easier routing for real flows

In other words: liquidity is utility. You can’t use a stablecoin at scale if it’s hard/expensive to swap, hedge, or move between stable assets.

Now the other layer: Hedera. AUDD launched as a native Hedera deployment with the usual pitch institutions care about: fast finality + predictable low fees + stablecoin tooling.

This is why the “XDC vs Hedera” framing misses it:

• XDC/Curve helps AUDD move (liquidity + routing)

• Hedera helps AUDD settle (rails + predictable cost structure)

The macro signal in Australia is wholesale digital money experimentation (Project Acacia / tokenized settlement trials). That’s where rails narratives get tested beyond marketing.

Project Acacia (RBA + DFCRC) is Australia’s sandbox for wholesale digital money + tokenized settlement — aimed at banks/institutions, not retail payments.

They’re testing multiple settlement assets (stablecoins / deposit tokens / pilot wCBDC) across a multi‑DLT setup — with Hedera named as one of the platforms.

The clean thesis: AUDD wants to be the programmable AUD layer for trade/payment use cases and that requires both:

• liquid markets (Curve‑style venues)

• settlement‑grade rails (institutional lanes)

Final take: This is what progress looks — not tribal chains — multi‑chain money.

AUDD where it trades. AUDD where it settles.

👉 https://t.co/S19MugRI6a